Date: 2026-03-05 Page is: DBtxt003.php L0700-II-CIRCULAR-ECONOMY

|

INTERESTING IDEAS

CIRCULAR ECONOMY |

| HOME | SiteNav | Alpha | Chrono | Briefs | SEES | capitals | activities | actors | place | products | SI | SS | metrics | TPB |

| . |

| TO DO ... update images to be more relevant to the subject matter | ||

|

|

|

|

CIRCULAR ECONOMY / Textiles Reuse

| Open L0700-II-Circular-Economy-Textiles-Reuse |

|

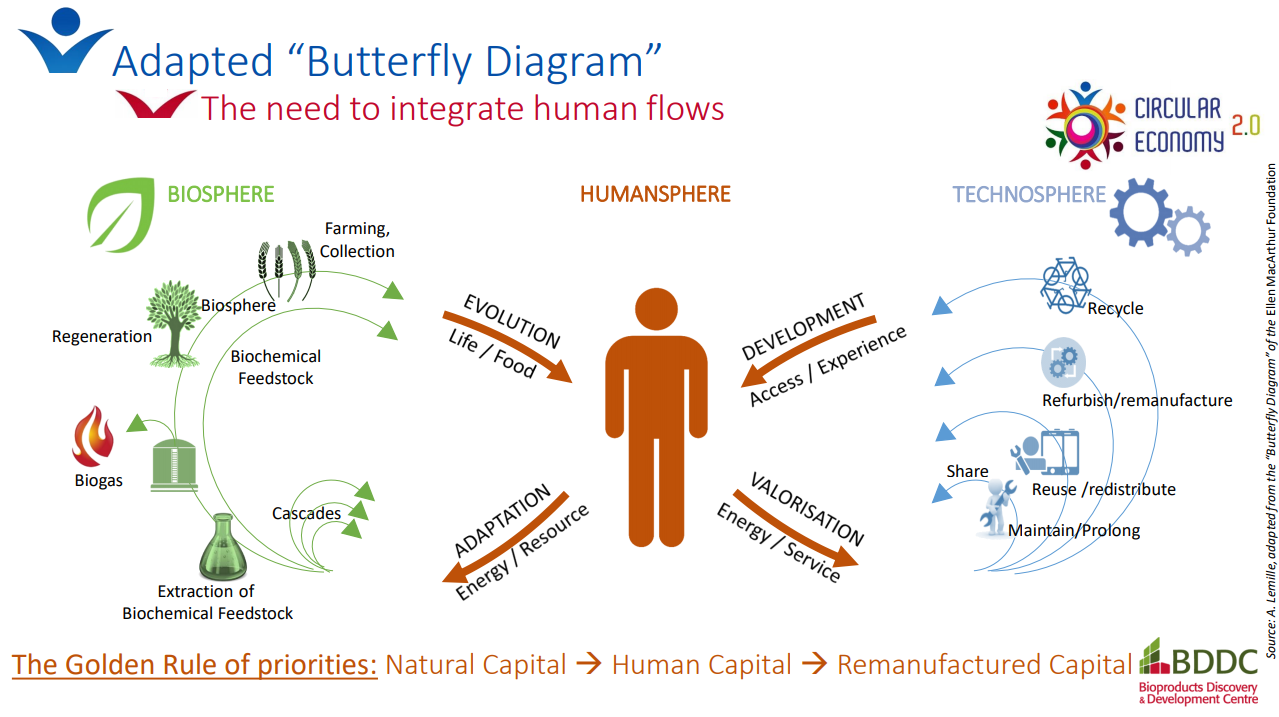

CIRCULAR ECONOMY / Alexandre-Lemille

| Open L0700-II-Circular-Economy-Alexandre-Lemille |

|

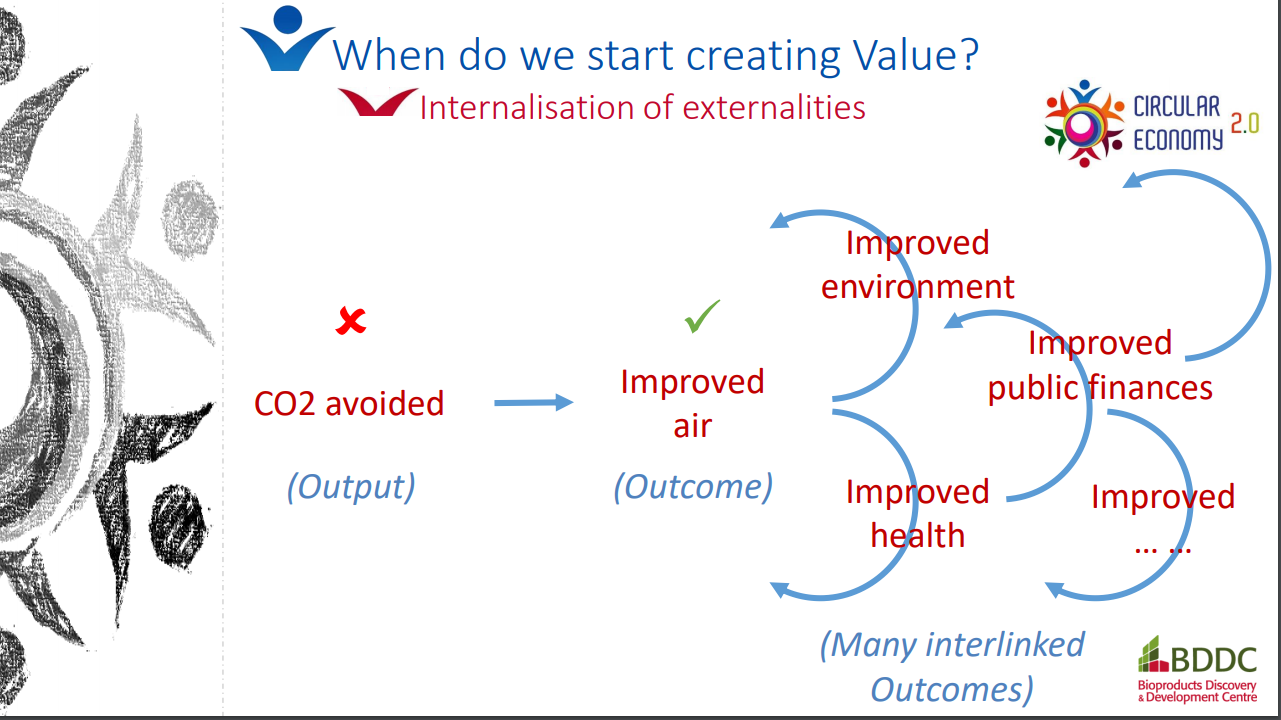

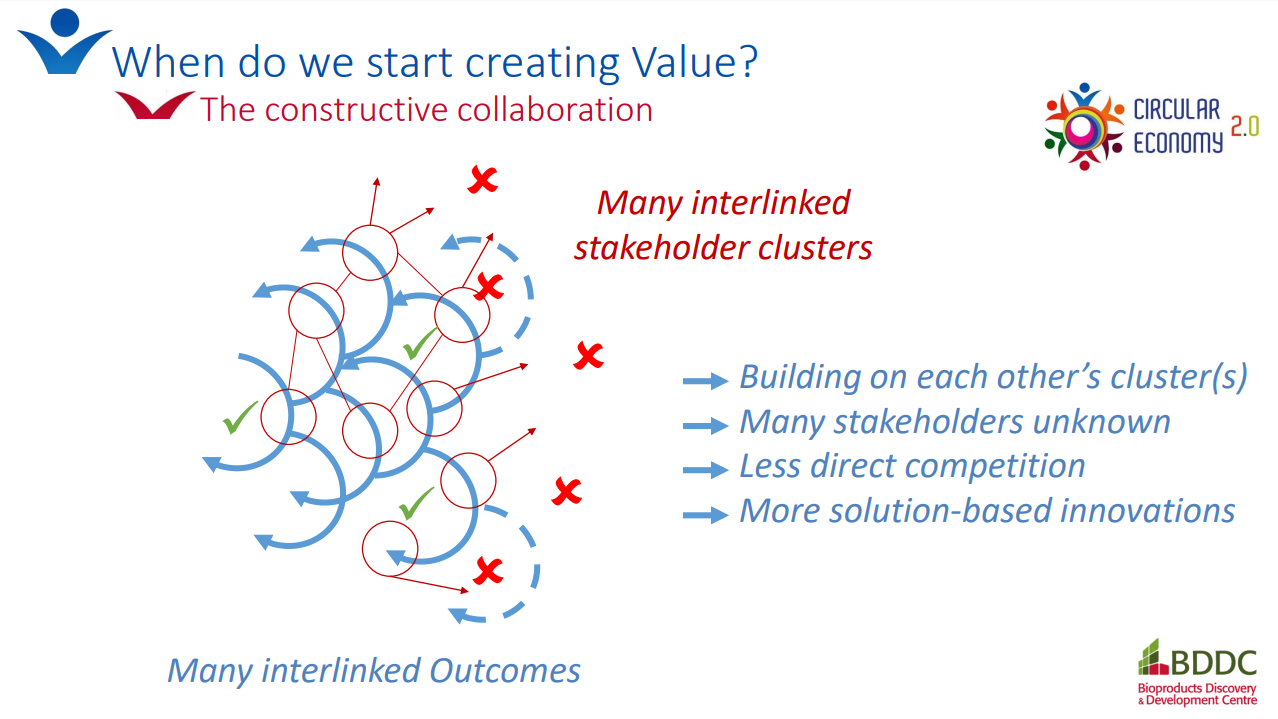

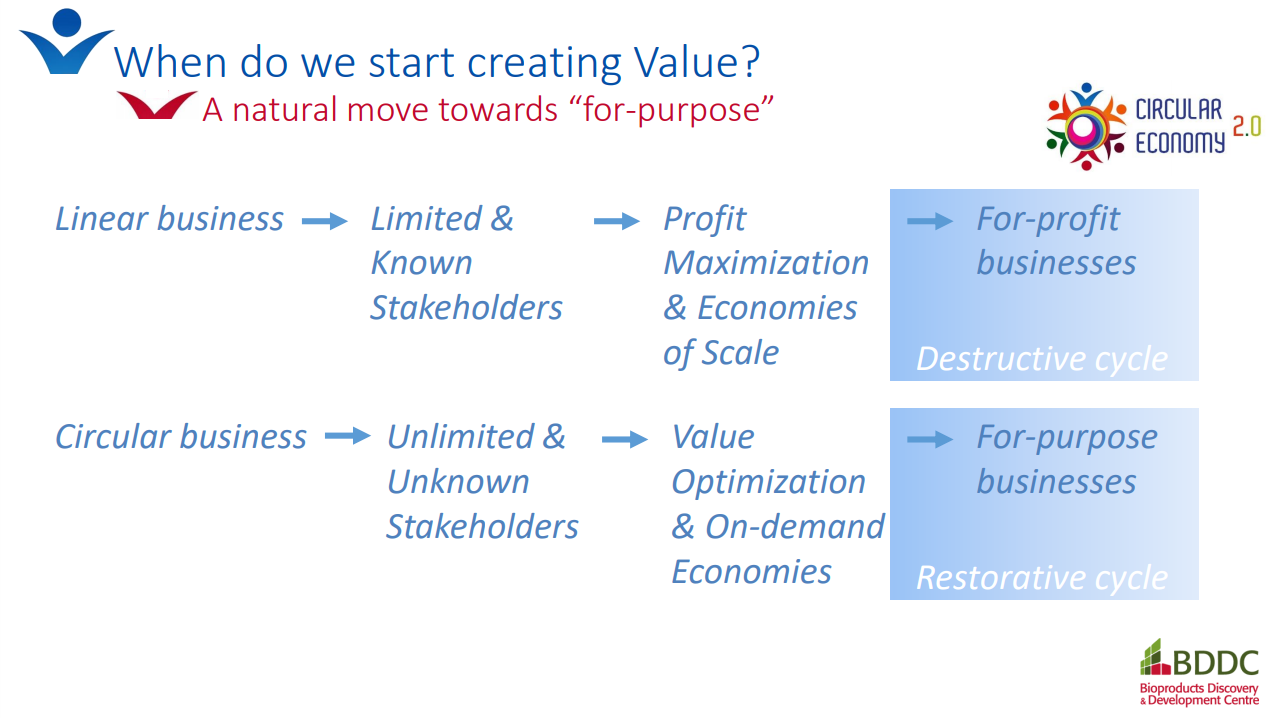

TVM ... Accounting, Analysis and Reporting for the The Circular Economy

(1) All the Capitals: The first principle is that the accounting, analysis and reporting should reflect impact on ALL the capitals ... that is on Human Capital, on Natural Capital and Created Capital where Created Capital reflects all of the systems and structures that have been built using human creativity and initiative. These include Financial Capital, Physical Capital and Intangible Capital like Knowledge, Institutional Structures, Legal systems, Security, etc. (2) Money is the unit of account for Financial Capital, and is for all transactions using money as a medium of exchange. (3) A set of TVIA units of account are used to account for transactions that impact all the other capitals. (4) The idea of circularity can be used to improve the PERFORMANCE of PROCESS. (5) PROGRESS is measured by comparing STATE in the past with the current STATE. (6) TVIA units of account are compatible for a variety of different reporting units: ... ORGANIZATIONS (Complex Groups) ... ORGANIZATIONS (SMEs) ... ORGANIZATIONS (NGOSs and not for profits) ... ORGANIZATIONS (Governments / Governmental Agencies) ... INVESTMENT PORTFOLIOS ... PLACES ... INDIVIDUAL PEOPLE and FAMILIES ... PRODUCTS ... PROCESSES ... PROJECTS / PROGRAMS | |

|

Progress towards getting advantage from the Circular Economy

Some of the ideas of the Circular Economy has been talked about for many years. There has been more adoption of the ideas of the Circular Economy in the past few years than in the more distant past, but the adoption is still slow and most major companies still operate on the basis that profit and investor wealth is more important than impact on society and impact on the environment.

TPB note: Without metrics along the lines of TVIA it is difficult for decision makers to make the right decisions and for there to be accountability. Without metrics there can be a lot of talk without much real progress. |

|

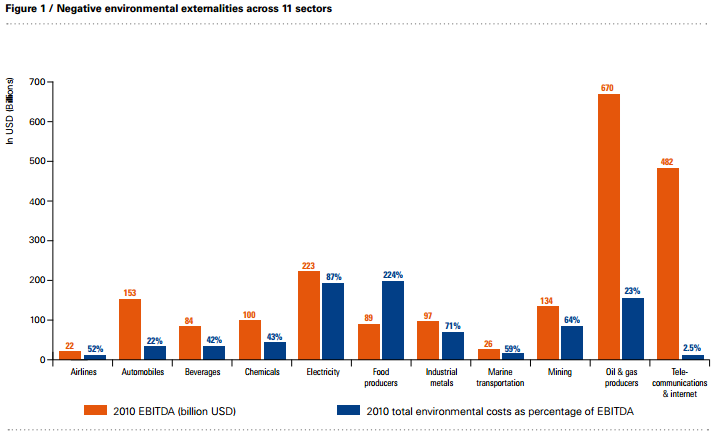

Connecting corporate and societal value creation

From a Report by KPMG in 2014 | |

| |

|

A New Vision of Value

Value creation is the goal of all companies, but corporate value creation is not always aligned with value creation for society as a whole. 'http://truevaluemetrics.org/DBpdfs/impact-accounting/KPMG-A-New-Vision-of-Value-2014.pdf' | Open PDF ... KPMG-A-New-Vision-of-Value-2014 |

|

UPS Report - The Growth of the Circular Economy

| |

|

Trends: The circular economy is becoming more widely understood and commonplace in business. Almost unanimously, survey respondents felt they clearly understood the concept, while more than half could provide examples of the circular economy in play.

'http://truevaluemetrics.org/DBpdfs/Circular-Economy/UPS-GreenBiz-Growth-of-the-Circular-Economy-Whitepaper.pdf' |

Open file 12958

Open PDF ... UPS-GreenBiz-Growth-of-the-Circular-Economy-Whitepaper Open PDF ... UPS-GreenBiz-Growth-of-the-Circular-Economy-Infographic |

|

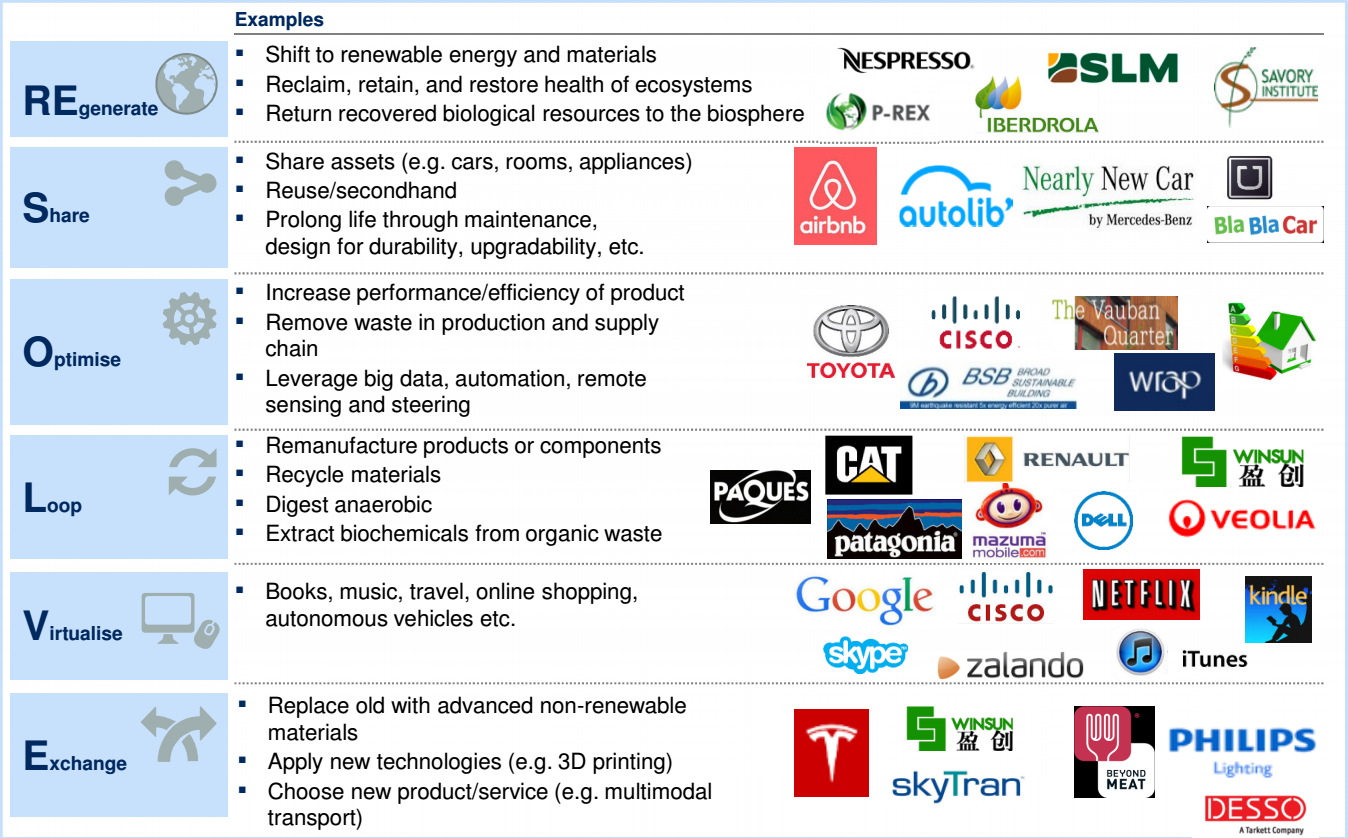

Accenture-Waste-Wealth-Exec-Sum

Waste to Wealth A book by Peter Lacy and Jakob Rutqvist Published by Palgrave Macmillan '../../DBpdfs/Circular-Economy/Accenture-Waste-Wealth-Exec-Sum.pdf' | Open PDF ... Accenture-Waste-Wealth-Exec-Sum.pdf |

|

360-Environmental-Perchards-A-discussion-of-the-UK-PRN-PERN-system-for-packaging-waste-and-possible-alternatives-161018

'../../DBpdfs/Circular-Economy/360-Environmental-Perchards-A-discussion-of-the-UK-PRN-PERN-system-for-packaging-waste-and-possible-alternatives-161018' | Open PDF ... 360-Environmental-Perchards-A-discussion-of-the-UK-PRN-PERN-system-for-packaging-waste-and-possible-alternatives-161018 |

|

ESA-Rethinking-Waste-Crime-170502

'../../DBpdfs/Circular-Economy/ESA-Rethinking-Waste-Crime-170502.pdf' | Open PDF ... ESA-Rethinking-Waste-Crime-170502 |

|

ESA-Planning-for-a-Circular-Economy-170411

'../../DBpdfs/Circular-Economy/ESA-Planning-for-a-Circular-Economy-170411.pdf' | Open PDF ... ESA-Planning-for-a-Circular-Economy-170411 |

|

ESA-Aiming-for-zero-harm-in-the-waste-and-recycling-industry-2015-161105

'../../DBpdfs/Circular-Economy/ESA-Aiming-for-zero-harm-in-the-waste-and-recycling-industry-2015-161105.pdf' | Open PDF ... ESA-Aiming-for-zero-harm-in-the-waste-and-recycling-industry-2015-161105 |

|

ESA-The-Role-of-Extended-Producer-Responsibility-in-Tackling-Litter-in-the-UK-161011

'../../DBpdfs/Circular-Economy/ESA-The-Role-of-Extended-Producer-Responsibility-in-Tackling-Litter-in-the-UK-161011.pdf' | Open PDF ... ESA-The-Role-of-Extended-Producer-Responsibility-in-Tackling-Litter-in-the-UK-161011 |

|

ESA-Delivering-a-strong-and-competitive-UK-resource-economy-160801

'../../DBpdfs/Circular-Economy/ESA-Delivering-a-strong-and-competitive-UK-resource-economy-160801.pdf' | Open PDF ... ESA-Delivering-a-strong-and-competitive-UK-resource-economy-160801 |

|

ESA-Delivering-Sustainable-Growth-160510

| Open PDF ... ESA-Delivering-Sustainable-Growth-160510 |

|

ESA / The Environmental Services Association

'../../DBpdfs/Circular-Economy/ESA.pdf' | Open PDF ... ESA |

|

Waste / Recycling in the UK ... The Environmental Services Association (ESA),

POLITICS ... ESA calls for planning system to be aligned with circular economy ... a lot of work to be done | Open file 13109 |

|

ESA-UK-Circular-Economy-Report

'../../DBpdfs/Circular-Economy/ESA-UK-Circular-Economy-Report.pdf' | Open PDF ... ESA-UK-Circular-Economy-Report |

|

EU

'../../DBpdfs/Circular-Economy/EU.pdf' | Open PDF ... EU |

|

Kingfisher

'../../DBpdfs/Circular-Economy/Kingfisher.pdf' | Open PDF ... Kingfisher |

|

Norden-Successful-Nordic-Business-Models

'../../DBpdfs/Circular-Economy/Norden-Successful-Nordic-Business-Models.pdf' | Open PDF ... Norden-Successful-Nordic-Business-Models |

|

Unleashing-the-power-of-circular-economy

'../../DBpdfs/Circular-Economy/Unleashing-the-power-of-circular-economy.pdf' | Open PDF ... Unleashing-the-power-of-circular-economy |

|

UPS-GreenBiz-Growth-of-the-Circular-Economy-Infographic

'../../DBpdfs/Circular-Economy/UPS-GreenBiz-Growth-of-the-Circular-Economy-Infographic.pdf' | Open PDF ... UPS-GreenBiz-Growth-of-the-Circular-Economy-Infographic |

|

UPS-GreenBiz-Growth-of-the-Circular-Economy-Whitepaper

'../../DBpdfs/Circular-Economy/UPS-GreenBiz-Growth-of-the-Circular-Economy-Whitepaper.pdf' | Open PDF ... UPS-GreenBiz-Growth-of-the-Circular-Economy-Whitepaper |

|

US-Chamber-of-Commerce-Circular-Economy-Webinar-August-2015

'../../DBpdfs/Circular-Economy/US-Chamber-of-Commerce-Circular-Economy-Webinar-August-2015.pdf' | Open PDF ... US-Chamber-of-Commerce-Circular-Economy-Webinar-August-2015 |

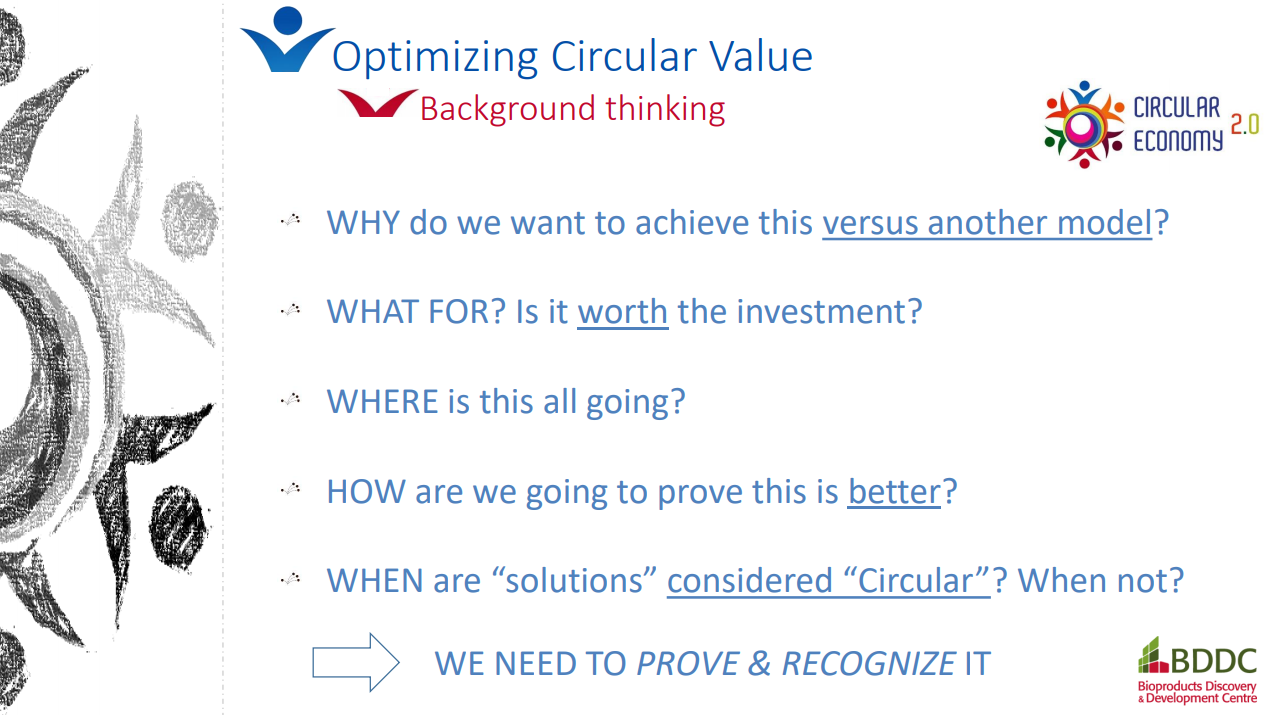

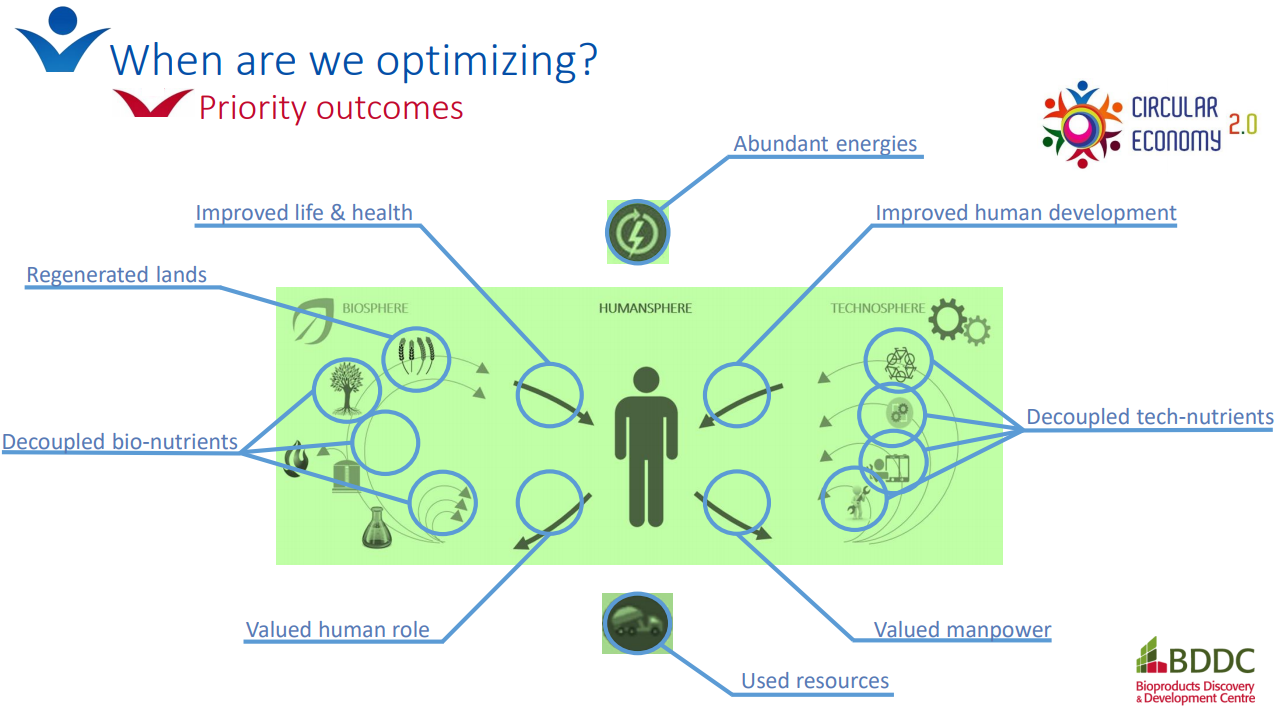

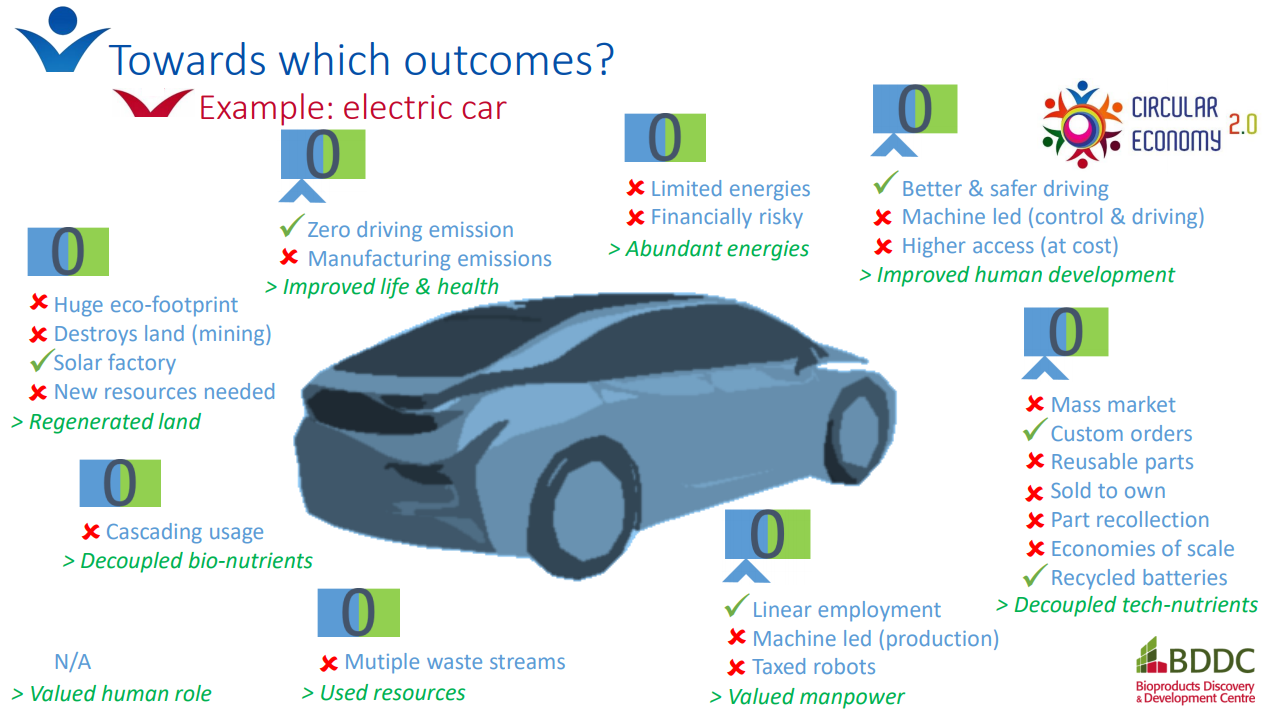

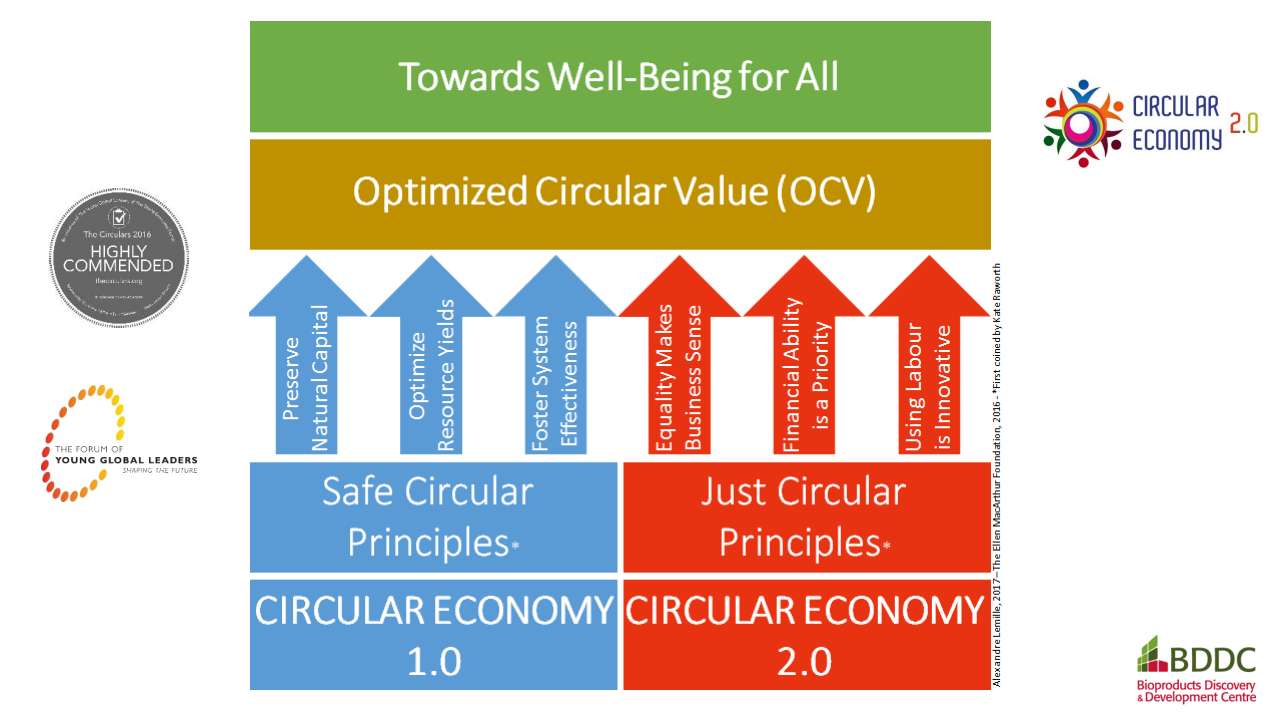

| OPTIMIZING CIRCULAR VALUE | |

| Open L0700-II-Circular-Economy-Alexandre-Lemille |

| |

|

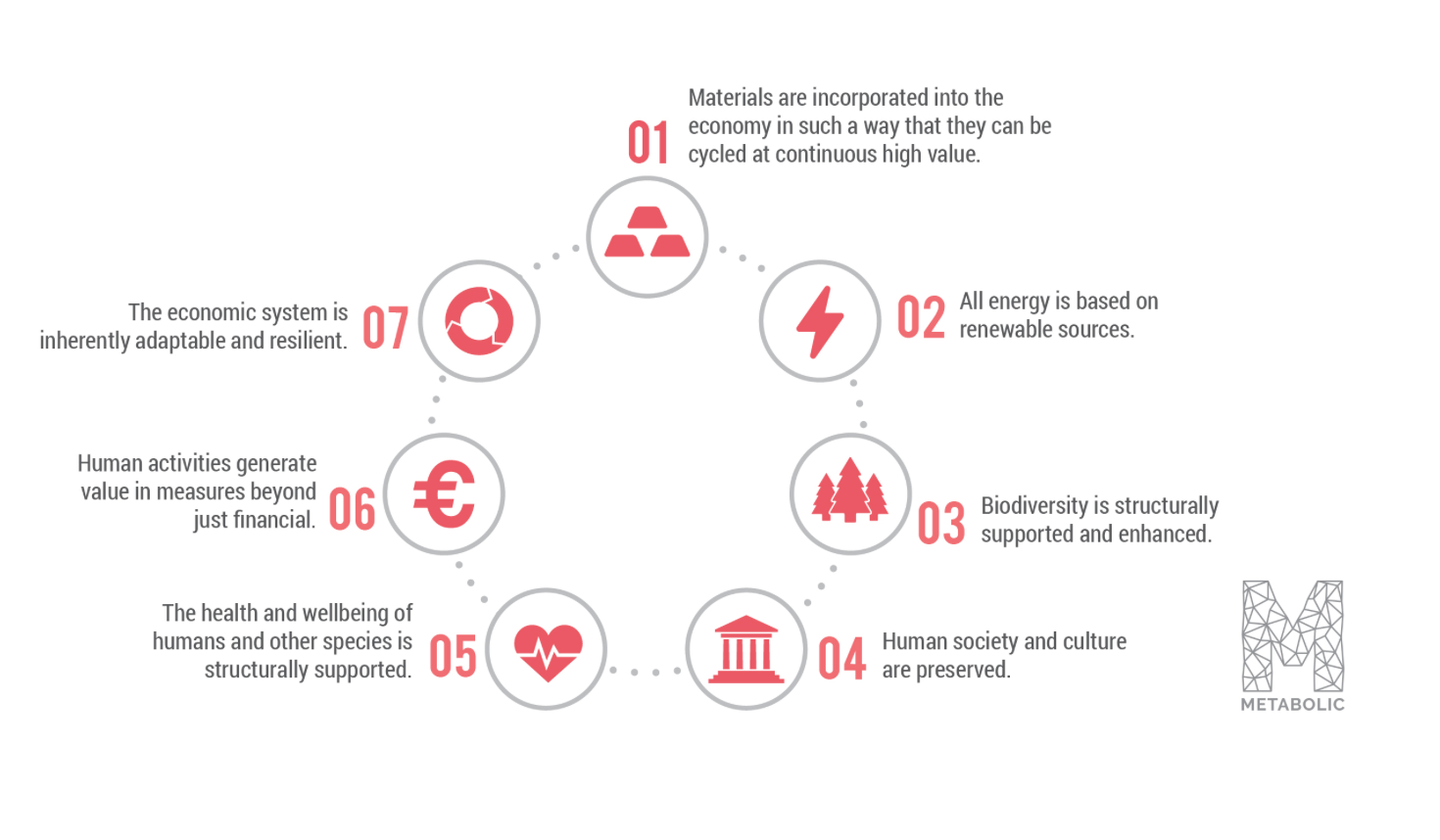

The 7 Pillars of the Circular Economy

According to this Metabolic construct: 1. Materials are cycled at continuous high value. 2. All energy is based on renewable sources. 3. Biodiversity is supported and enhanced through all human activities. 4. Human society and culture are preserved. 5. The health and wellbeing of humans and other species is supported. 6. Human activities generate value in measures beyond just financial. 7. The economic system is inherently adaptable and resilient. TVIA Note: These 7 pillars are not inconsistent with the thinking that has informed the design of the TVIA system. It should be noted that while many of the processes in the socio-enviro-economic system have the potential for circularity, the passage of time is linear, and progress is all about things being better as time passes. | Open file 12869 |

|

518 515 |

735 447 |

1390 1190 |

1348 838 |

571 530 |

1023 1705 |

735 447 |

1221 512 |

800 470 |

|

Ellen-MacArthur-Foundation

Advocating powerfully for the Circular Economy |

| More about the Elen MacArthur Foundation and their Circularity Initiative | Open L0500-Ellen-MacArthur-Foundation |

|

Ellen-MacArthur-Foundation-FinanCE-2016

The fast-changing global context is our starting point. In a world increasingly dominated by new technologies and shifts in demographics and the global economy, new challenges arise. One is how to cope with the legacy of a linear economy, in which products are consumed and largely get turned into waste, diminishing the stock of non-renewable natural resources. A more circular economy that creates economic value is also an answer to the resource challenge, both because it is a more effective system that the linear economy and mitigates its risks whilst creating positive capital-building opportunities. PART I In the first part of the report we describe the context, provide a systematic framework in which money is one of the enablers of the transition to a circular economy, and lay out our ambition as a financial sector in contributing to this transition. PART II In the second part of the report we focus on three important components of the financial perspective of the transition to a more circular economy: - First are the changes we see in business models that accompany circular ways of working. The report analyses various case studies of circular economy businesses to determine the concrete financial impacts of going circular. - Second is a deep dive into the financial considerations of circular economy businesses, covering risks and opportunities and the detailed consequences for revenue and cost structures, cash flows, balance sheets and financing requirements. - Third are the macroeconomic consequences of circular economy business models being more widely adopted. This extends the assessment of the circular economy approach beyond the commercial considerations of individual businesses. Macroeconomic analysis is an important consideration for potential investors deciding where to invest. PART III In the third [second] part of the report we focus on three important components of the financial perspective of Finally, we look beyond this report. This first step, to understand the financial implications of circular economy business models, is only the first the working group will take. The next phase, to assess the impact and consequences for financial institutions themselves, is crucial: actions speak louder than words. 'http://truevaluemetrics.org/DBpdfs/Circular-Economy/Ellen-MacArthur-Foundation-FinanCE-2016.pdf' | Open PDF ... Ellen-MacArthur-Foundation-FinanCE-2016 |

|

Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol1

A 98 page report ... In the face of sharp volatility increases across the global economy and proliferating signs of resource depletion, the call for a new economic model is getting louder. In the quest for a substantial improvement in resource performance across the economy, businesses have started to explore ways to reuse products or their components and restore more of their precious material, energy and labour inputs. The time is right, many argue, to take this concept of a ‘circular economy’ one step further, to analyse its promise for businesses and economies, and to prepare the ground for its adoption. '../../DBpdfs/Circular-Economy/Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol1.pdf' | Open PDF ... Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol1 |

|

Ellen-MacArthur-Foundation - Circular Economy 100 (CE100)

Ellen-MacArthur-Foundation-The-Circular-Economy-9-Dec-2015 TOWARDS A CIRCULAR ECONOMY: BUSINESS RATIONALE FOR AN ACCELERATED TRANSITION 'http://truevaluemetrics.org/DBpdfs/ORGS/EllenMacArthurFoundation/Ellen-MacArthur-Foundation-The-Circular-Economy-9-Dec-2015.pdf' | Open PDF ... Ellen-MacArthur-Foundation-The-Circular-Economy-9-Dec-2015 |

|

Ellen-MacArthur-Foundation

https://www.ellenmacarthurfoundation.org/circular-economy/overview/concept | Open external LINK |

| |

|

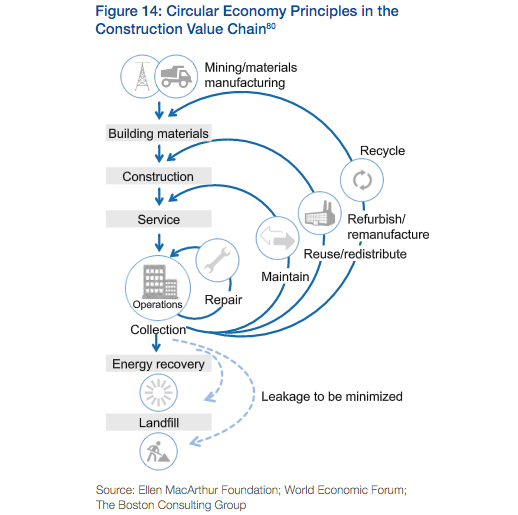

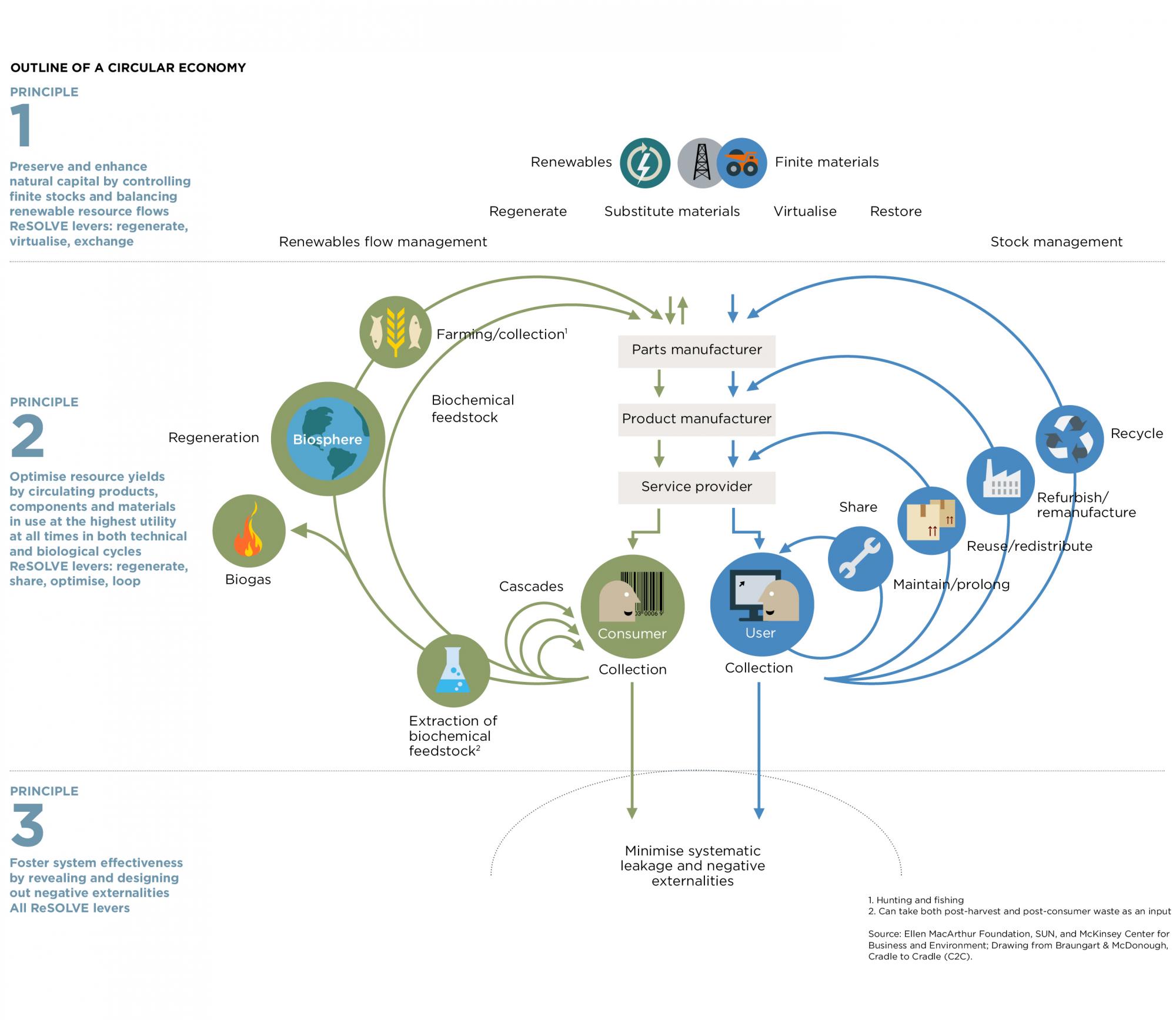

Heading to come

Principle 1: Preserve and enhance natural capital by controlling finite stocks and balancing renewable resource flows. This starts by dematerialising utility – delivering utility virtually, whenever optimal. When resources are needed, the circular system selects them wisely and chooses technologies and processes that use renewable or better-performing resources, where possible. A circular economy also enhances natural capital by encouraging flows of nutrients within the system and creating the conditions for the regeneration of, for example, soil. Principle 2: Optimise resource yields by circulating products, components, and materials at the highest utility at all times in both technical and biological cycles. This means designing for remanufacturing, refurbishing, and recycling to keep technical components and materials circulating in and contributing to the economy. Circular systems use tighter, inner loops (e.g. maintenance, rather than recycling) whenever possible, thereby preserving more embedded energy and other value. These systems also maximise the number of consecutive cycles and/or the time spent in each cycle, by extending product life and optimising reuse. Sharing in turn increases product utilisation. Circular systems also encourage biological nutrients to re-enter the biosphere safely for decomposition to become valuable feedstock for a new cycle. In the biological cycle, products are designed by intention to be consumed or metabolised by the economy and regenerate new resource value. For biological materials, the essence of value creation lies in the opportunity to extract additional value from products and materials by cascading them through other applications. As in any linear system, pursuing yield gains across all these levers is useful and requires continued system improvements. But unlike a linear system, a circular one would not compromise effectiveness Principle 3: Foster system effectiveness by revealing and designing out negative externalities. This includes reducing damage to systems and areas such as food, mobility, shelter, education, health, and entertainment, and managing externalities, such as land use, air, water and noise pollution, and the release of toxic substances. https://www.ellenmacarthurfoundation.org/circular-economy/interactive-diagram | Open external LINK |

|

https://www.ellenmacarthurfoundation.org/circular-economy/overview/concept | Open external LINK |

| |

|

Ellen-MacArthur-Circularity-Indicators-Project-Overview-May-2015

'http://truevaluemetrics.org/DBpdfs/Circular-Ecconomy/Ellen-MacArthur-Circularity-Indicators-Project-Overview-May-2015.pdf' | Open external LINK Ellen-MacArthur-Circularity-Indicators-Project-Overview-May-2015 |

|

Ellen-MacArthur-Foundation-Circularity-Indicators-Methodology-May-2015

'http://truevaluemetrics.org/DBpdfs/Circular-Ecconomy/Ellen-MacArthur-Foundation-Circularity-Indicators-Methodology-May-2015.pdf' | Open external LINK Ellen-MacArthur-Foundation-Circularity-Indicators-Methodology-May-2015 |

|

Ellen-MacArthur-Circularity-Indicators-Non-Technical-Case-Studies-May-2015.pdf

'http://truevaluemetrics.org/DBpdfs/Circular-Ecconomy/Ellen-MacArthur-Circularity-Indicators-Non-Technical-Case-Studies-May-2015.pdf' | Open external LINK Ellen-MacArthur-Circularity-Indicators-Non-Technical-Case-Studies-May-2015 |

|

Ellen-MacArthur-Foundation-Circularity-Gap-report-2019

'http://truevaluemetrics.org/DBpdfs/Circular-Ecconomy/Ellen-MacArthur-Foundation-Circulity-Gap-report-2019' | Open PDF ... Ellen-MacArthur-Foundation-Circularity-Gap-report-2019 |

|

|

| . |

| HOME | SiteNav | Alpha | Chrono | Briefs | SEES | capitals | activities | actors | place | products | SI | SS | metrics | TPB |