Date: 2026-03-05 Page is: DBtxt003.php L07-08-TPB-PETER-BURGESS

| #8 |

PETER BURGESS

A LIFETIME OF EXPERIENTIAL LEARNING |

| HOME / #8 | BRIEFS | Last ... L07-07-FLOW-ACTORS | SN-08-TPB-PETER-BURGESS | Next ... L07-01-SEES-OVERVIEW |

| . |

|

|

|

|

|

|

|

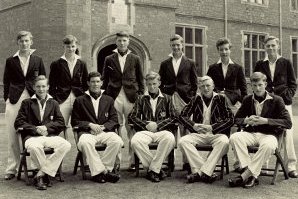

Blundell's

1st XV Rugby |

Cambridge

Sidney Sussex |

Accountancy

CB&Co |

Corporate

CFO |

Consultancy

WB, UN and others |

Post Career

TrueValueMetrics |

| . |

| Childhood Homes | ||

Paternal grandparents' home

Wakefield, Yorkshire

Wakefield, Yorkshire

|

My home (0 to 5)

Surbiton, Surrey

Surbiton, Surrey

|

My home (5 to university)

Okehamption, Devon

Okehamption, Devon

|

| . |

| Blundell's School (founded 1604) | ||

|

|

|

| . |

| Sidney Sussex College (founded 1597), Cambridge University | ||

|

|

|

| . |

|

Very Brief Overview

I graduated from Cambridge University in 1961 after studying engineering and economics and in 1965 qualified as a Chartered Accountant after training with Cooper Brothers & Co. in London. This was a good foundation for corporate profit improvement because I had some understanding of both factories, products and finance. In my late 20s, I had experience in budget management and financial controllership and in my early 30s I was appointed as VP manufacturing for a US company employng around 1,300 workers. In the 1970s I became the CFO of an international fishing company and quickly learned the importance of nature in the world's socio-enviro-economic system. After this corporate experience, I became an independent consultant I did many assignments for the World Bank, the United Nations and private clients working in more than 50 countries. I have worked on every phrase of the 'project cycle' ... project planning, appraisal, financial negotiation, supervision, monitoring and evaluation ... combining financial analysis, economics, and technical knowledge to optimize for multiple benefits. Fast forward to post career I am now working to figure out how conventional financial accountancy should be enhanced in order for business leaders and everyone else to make better decisions so that the chronic malaise and unsustainability of the modern socio-enviro-economic system may be mitigated! |

| . |

|

My background

I grew up in Okehampton, a small town in the South-West of England. We moved to Okehampton in 1945 at the end of the war, from Surbiton, a suburb of London, close enough to have experienced the 'blitz' and 'doodle-bugs'. My father was a schoolmaster, and he was a believer in the value of education, both academic and physical. My parents skimped and saved and at 13 I went to Blundell's School, a good boarding school in England, and then, in 1958, to Cambridge University. Blundell's School was founded in 1604 by Peter Blundell, a wealthy textile merchant in Tiverton, Devon. Peter Blundell also endowed scholarships at Sidney Sussex College, Cambridge, and Balliol College, Oxford. My time at Blundell's was busy ... rugby, cricket, athletics, tennis and academic study ... probably in that order. I was fortunate that I was at Blundell's when it expected very high academic standards while also encouraging high performance in sports. I was a year younger than Richard Sharp who became one of the best English rugby players of our generation, and was part of the school rugby team. I was also a part of a group of students that gained more places at Oxford and Cambridge than at any time before in the history of the school. Sidney Sussex is one of the smaller colleges at Cambridge, less well known, with an interesting history and very comfortable in its skin. While I was at Sidney, we reached the finals of the inter-college rugby tournament despite our small size, losing to St. Johns. We also carried out an 'archeological dig' in the college garden. Oliver Cromwell had been a student at Sidney, and it was rumored that he was buried at the College. Academicaly, I did what might now be called a “double major” in engineering and economics. I completed the Mechanical Sciences Tripos followed by the Economics Tripos Part II ... essentially five years of academic work in three years. My combination of engineering and economics has been a strong foundation for most of my thinking during the past 50+ years. Cambridge engineering had a lot of metrics and calculation that spread over every aspect of the engineering world. This was in an era before computerized calculations, but manual calculation is possible, and we had sliderules. I maintain I learned very well the fundamentals of the calculations. Part of the course requirement was time in a practical engineering environment, which I satisfied by working in the apprentice programme at the Royal Ordnance Factory in Chorley, Lancashire. I still remember the challenge of making a 1x1x1 inch cube in steel that would push fit into a 1x1 inch square hole in a 1 inch thick steel plate ... using hand tools! My respect for craftsmanship is undiminished 50 years later. I got into economics in part because I did not want to specialize in a specific engineering field. Economics gave me the opportunity to do study that related to almost everything. Not surprisingly, my economics education had a Keynesian slant at the hands of Joan Robinson and a fine tutor, Andy Roy. It was also influenced by my membership in the Cambridge Canada Club which organized annual charter flights fron the UK to New York every summer. I took advantage of these flights in the summer of 1960 and 1961 and in the process learned something of the world outside the UK, not to mention getting a very different perspective on economics and possibilities. My travel to Canada and the United States in the summers of 1960 and 1961 while still a student had a big influence on my subsequent career path. Early on, I also had some opportunity to travel in Europe. The combination of some exposure to Europe as well as North America complemented my otherwise very 'British' upbringing. Immediately after college, I worked in heavy engineering with Davy United Engineering Company. Subsequently I got a professional training in accountancy as an Articled Clerk with Cooper Brothers in London ... that joined with Lybrand Ross Bros and Montgomery to form the international accounting firm of Coopers and Lybrand and then PriceWaterhouseCoopers. I became a Chartered Accountant in 1965. The first major phase of my career has been work in the corporate sector. I worked in heavy engineering construction in the steel industry, the pulp and paper industry and civil engineering, consumer products, high-tech systems and food and fisheries. Most of my work has been to do with management and ways to plan and implement profit improvement initiatives. By the mid 1970s I was the Chief Financial Officer for a US based international fishing company operating around the world in 26 separate jurisdictions. I was part of an international team in a complex industry that was well managed and solved problems creatively. The second major phase of my career was working as an independent consultant. In 1978 I started a consulting firm to specialize in international business and development and have done assignments in more than 50 countries for the World Bank, the UN and its specialized agencies and private organizations. The assignments have always had a focus on data, analysis and planning for various parts of the economy including sector planning, national planning, refugee planning, famine and drought emergency planning, national reconstruction planning, aid coordination, information technology planning and implementation, privatization, management training, etc. I have had the opportunity to do planning and analysis work at the national level, the sector level and for regions and communities. My work has been done largely in collaboration with local local staff, consultants and professional firms. The third phase of my career ... where I am now ... is to look at our global society and economy with the benefit of experience and try to get answers to some basis questions and to manage the opportunities better:

I concluded a long time ago that the capacity of the international community to achieve relief and development progress required a new development paradigm. This resulted in a book manuscript under the title Turning Development Upside Down which was not published but rewritten under the title Revolutionary Change for Relief and Development and again rewritten with a different focus under the title Iraq, A New Direction. I also published a paper titled Hundreds of Issues that Impact Relief and Development Progress. These were all published using Lulu.com by my company Tr-Ac-Net Inc. through its Transparency and Accountability Network. While so much is wrong, there is also a lot that is right and amazing. There are two things that are particularly positive:

So while I am pleased ... up to a point ... with the work I have done during my career, the results of my work so far have been inconsequential. None of the systemic paradigm changes that are needed have been made. From this perspective I have been totally ineffective, but I continue to try. I am particularly encouraged because many of the issues that I have wanted to be part of the conversation are now being talked about, and I am also encouraged that some of the critical technology to make certain changes possible are now available. The problem is that the links between what is talked about and what needs to be done are still tenuous at best ... or not existing. There is still more talk about the issues, than talk about the solutions to the issues. There is a huge amount of academic work, rather less practical work. |

| . |

|

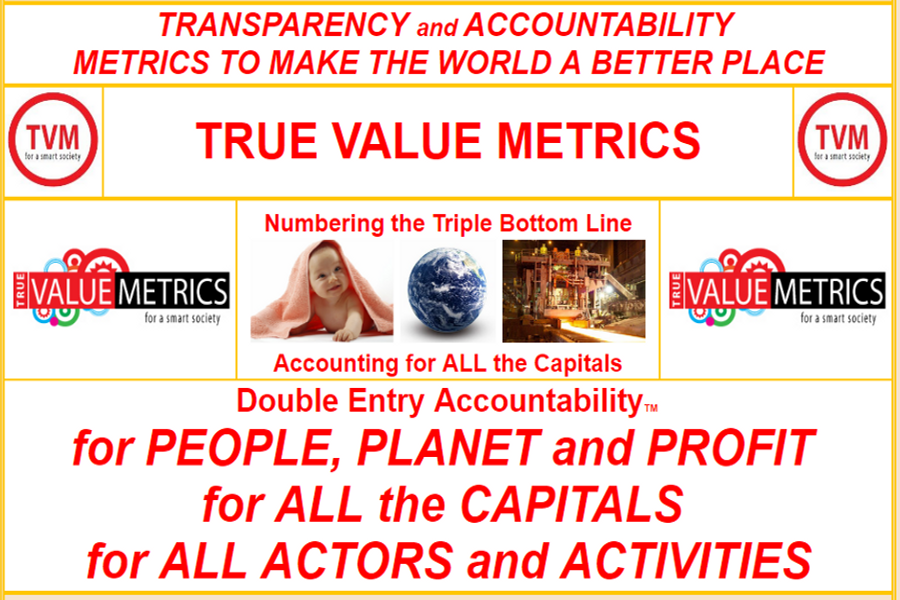

Origins of True Value Metrics (TVM)

The idea for TrueValueMetrics (TVM) emerged slowly over a long period of time, especially during the period when I had left the corporate world and was starting to consult with the World Bank and others in the development community. Clearly, better accounting was required in these areas, in the sense that the bookkeeping needed to be strengthened to enable better accountability. While conventional accounting is a strong management tool in relation to money transactions and profit performance, the projects of the World Bank and others in the field do not have the goal of maximizing profits, but to enable 'development' in all its many dimensions. Conventional financial accountancy does not have the tools for this. I started to think how accountancy could be enhanced in order to be more effective in this arena. I always used accounting and financial reports to the greatest extent possible in all my consulting work for the World Bank, the UN and others ... and while they told only part of the story, they were a useful foundation of facts about the money dimension of development. This experience set me thinking about how accountancy could be enhanced to serve as a management framework for all the dimensions of development. I developed a database system for development analysis (DBSDA) using FoxPro that facilitated preparation of UNDP's Development Cooperation Report (DCR). This work terminated when Microsoft acquired FoxPro and the UNDP terminated its work with the DCR. Several years later I formulated Multi Dimension Impact Accounting (MDIA) to address the challenge of more substantive accounting for the Triple Bottom Line (People, Planet, Proft). Around 1988, I had the opportunity to make a presentation in the Office of the Adminstrator of UNDP (the United Nations Development Programme) in New York. The theme of the presentation was 'Responsibility Accounting', a concept that had been very effective throughout my corporate career and, in my view, very applicable for development work, but sadly missing. After the meeting one of my friends told me that I had blown it because I had talked at some length about 'responsibility' and 'accountability' and 'management' ... three ideas that just did not exist in the culture of the UN system. Some time later, perhaps around 2003 I had another opportunity to make a presentation to the Office of the Secretary General in the United Nations. One of my firends worked closed with Kofi Annan, the Secretary General and he arranged the meeting. I thought it would be a good idea to team up with an African colleague who was very interested in more effective development, and while it was a good idea ... it did not turn out well. There were similar issues to the UNDP meeting, but this time at a much higher level. The conference room was full of senior level staff who were quite satisfied with the status quo. Several favored attack over defense. While I had considerable experience with this sort of push-back, my African friend did not. We were demolished! In my experience, conventional financial accountancy is the foundation for very powerful management information systems that enable profit performance optimization. I have believed for a long time that the management framework that is central to management accountancy can be enhanced so as to be just as powerful for more than just money transactions and financial wealth. This is what the various manuscripts for TrueValueMetrics (TVM), Multi Dimension Impact Accountancy (MDIA) and other variants have set out to do. These manuscripts have been revised many times over a long time ... and never yet finished in a form good enough for publication. They continue to be developed to be both effective and low cost. |

| . |

| HOME / #8 | Last ... L07-07-FLOW-ACTORS | SiteNav L0700-SN-08-TPB-PETER-BURGESS | Next ... L07-01-SEES-OVERVIEW |