|

#2

|

ABOUT THE TVM INITIATIVE

MOVING THE NEEDLE ON MAJOR ISSUES

|

|

|

Numbering the Triple Bottom Line

Accounting for ALL the Capitals

|

|

TRANSPARENCY

and

ACCOUNTABILITY

METRICS TO MAKE THE WORLD A BETTER PLACE

|

- TVM uses the core concepts of conventional accountancy:

- Enhancing them to include social and environmental impacts;

- While continuing to account for economic efficiency.

|

|

Peter Drucker famously said you manage what you measure ...

|

|

This is undoubtedly true ... in the corporate world, the components that go into making profit are measured intensely in order to improve profit performance ... and it works!

Unfortunately, we don't do anything like the same amount of measuring in order to improve society and avoid degrading the environment ... and we don't have any easy way of talking about social performance and environmental performance in the same way that we are able to talk about corporate performance and investment portfolio performance.

This has to change

|

|

TVM argues that you had better measure the right things

|

TPB note: Management accountancy and electronic data processing (EDP) enabled the optimization of profit performance during my adult lifetime and legitimized by fashionable universities like Harvard (the Business School) and Chicago University (Milton Friedman). This resulted in financialization of the system which, in turn, enabled the most virulent inequality in all of history. The system needs to be brought back in balance with social, environmental and economic issues all managed in a coherent, comprehensive and optimized manner.

|

Socio-Enviro-Economic Trends

Decades of Social and Economic Progress & Environmental Degradation

|

|

What has been happening ... What needs to happen in the immediate future

|

|

THE WHOLE SYSTEM

|

THE ACTUAL PAST

|

A NO CHANGE FUTURE

|

A BETTER FUTURE

|

|

|

|

|

|

More and more DEPLETION and DEGRADATION of NATURAL CAPITAL is UNSUSTAINABLE

|

|

DATA AND FACTS MUST DRIVE DECISIONS

|

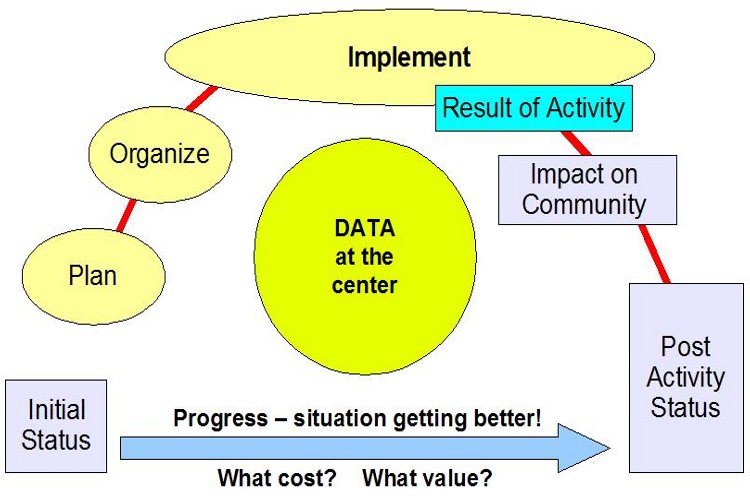

Data at the Center

|

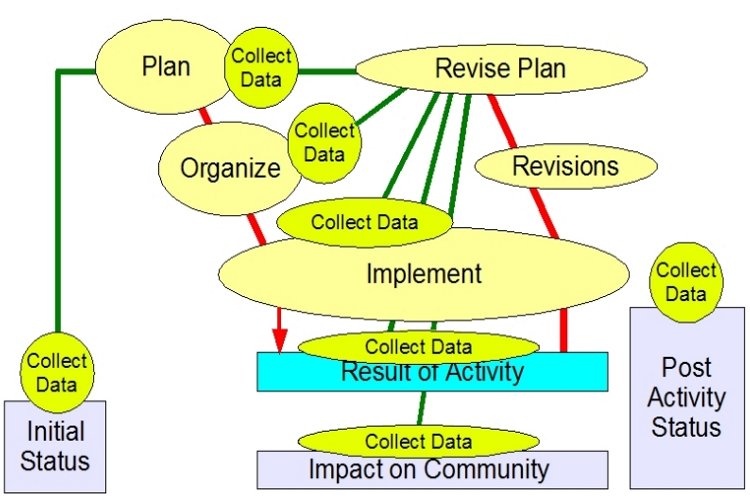

Data Everywhere

|

|

These schematics were drawn around 1995 early in the days of electronic data collection. What was expensive then, has now become relatively low cost. However, the challenge remains to make use of data in a meaningful way so that better decision get made.

|

|

ACCOUNTING'S CENTRAL CORE CONCEPT

|

Conventional financial accounting has 'double entry' as its central core concept. The profit and loss of every activity is recorded in the income and expenditure accounts, and the impact of the activity is recorded in the balance sheet accounts. The income and expenditure accounts are used to summarise the profit or loss and the balance sheet accounts show the state of the reporting entity.

The concept of 'double entry' in accounting and accountability is very old, going back at least 400 years when it was described by an Italian Luca de Pacioli. This form of financial accountancy has been an essential enabling factor in the progress of the industrial revolution for the last 200 years, making it possible for engineers and innovators to obtain financing from bankers and wealthy investors.

Since the end of WWII the size of the world's population and the level of industrial activity has grown substantially. The result of this has been substantial depletion and degradation of the natural environment. Conventional financial accountancy does not take this into consideration, and now makes this form of accountancy no longer fit for purpose. In addition, the use of money and price as the central metric for basic transactions means that this form of accountancy does not take into account almost everything that is important for society and quality of life. The purpose of TrueValueMetrics (TVM) is to address these issues.

|

|

TRIPLE BOTTOM LINE

|

The idea of a 'Triple Bottom Line' was popularised in the 1990s when it was written about by John Elkington, but was not taken up by big investors and the mainstream of the business world. The Triple Bottom Line (TBL) is not just about profit performance, but also about impact on society (people) and the natural world (planet). This is sometimes referred to as the 3Ps.

TVM applies the same basic construct used in double entry accounting to not only to activities that have an impact on economic capital, but also to their impact on social capital and on natural or environmental capital. Double entry accounting has, at its core, the unerstandng that a result ... a profit of loss ... is made up of a combination of revenues and of costs which together result in the profit or loss result.

So far, this concept does not appear to be being widely used as the foundation for various forms of ESG and 'sustainability' accounting and reporting, though there is accelerating progress in an increasing number of cpmpanies to compile much of the core information needed better to understand the multiple non-cinancial impacts of most economic activities. So far, however, there is no widely accepted way to report on the social and environmental dimensions of progress with anything like to same rigor and oversight that there is for economic (financial) performance. This is, of course, the foundational reason for TVM.

|

|

COST, PRICE and VALUE

|

The corporate organization is very familiar with cost and price. Good corporate managers understand the behavior of costs and the behavior of prices, and they manage to optimize the 'delta' of price being bigger than cost. This has been the essence of for-profit business for a very long time.

For customers, there is more interest in the delta between value and price. They understand the behavior of value and price and act accordingly. In a competitive market situation, the customer has leverage, but this has been weakened in the modern economy by corporate organizations consolidating, becoming oligopolies and almost eliminating competitive pressures on prices and profits.

|

|

MULTI-VALUE NUMBERING

|

TVM's use of multi-value numbering has similarities with the multi-currency accounting logic within conventional financial accountancy. The socio-enviro-economic system is complex and multiple units of measure (units of account) are needed in order to measure and report progress and performance logically and with reasonable clarity.

TVM does not 'monetize' the elements that make up social and environmental (natural) capital. Money is not a suitable unit of measure because it varies over time and in ways that are not related to what needs to be measured.

In the multi-currency world there are exchange rates between different currencies. The same idea applies in the case of the numbering associated with social capital, the numbering associated with natural capital and the numbering (money) associated with economic capital.

|

FINANCIAL ACCOUNTING

IS INCREDIBLY POWERFUL

|

FINANCIAL ACCOUNTING IS USED MAINLY IN THE CORPORATE WORLD

TO OPTIMIZE FOR PROFIT PERFORMANCE AND STOCKHOLDER VALUE

which has created huge economic wealth but also enabling inequality and environmental damage

|

TRUEVALUEMETRICS (TVM)

IS BETTER FOR THE WORLD

|

|

TRUEVALUEMETRICS (TVM) OPTIMIZES FOR SOCIAL IMPACT, ENVIRONMENTAL IMPACT AND ECONOMIC IMPACT AND ALSO ENABLES RADICAL ACCOUNTABILITY FOR ALL ACTIVITIES AND ACTORS

|

|