Date: 2026-03-04 Page is: DBtxt003.php txt00026928

US ECONOMY

A CNN ECONOMIC ANALYSIS

What’s really happening in America’s economy

(Trump and Biden spin aside)

A CNN ECONOMIC ANALYSIS

What’s really happening in America’s economy

(Trump and Biden spin aside)

Despite the robust labor market, there are warning signs in the US economy right now.

Nam Y. Huh/AP

Original article: https://www.cnn.com/2024/05/24/business/us-economy-whats-happening

Peter Burgess COMMENTARY

'What’s really happening in America’s economy?' is a good question which rarely gets a good answer.

My view is that it is impossible to answer this question in a meaningful way at the aggregate national level which is the normal approach and presentation ... rather it is essential to look at the specific impact on all the different groups that make up the national aggregate.

To illustrate this, maybe I should look at my own personal situation. I was born in the UK in early 1940 which translates to me being 84 years old as I write this. Relatively few people born in 1940 are still alive, Statisticaly I should have died about 5 years ago which simply goes to show that single point statistics should be looked at with some scepticism and more effort put into understanding the make-up of the numbers.

In my early 20s I became 'well paid' in the UK with an annual salary of around 700 pounds .. which at the prevailing UK/US exchange rate was the equivalent of around $1,680 a year. By the time I was 25 years old my salary in the UK was around 2,000 pounds, equivalent to around $4,800n a year. When I migrated to North America in 1967 my first job paid me a little more than $10,000 a year which quickly increased to around $15,600. This was a fortune compared to what would have been possible in the UK and Europe. Bluntly put ... I was an economic migrant!

Unfortunately, the US economy has not been managed well over the past 60 years and the current state of the economy is something of a shambles. There are many reasons for this including individual greed which drives corporate greed, the oil shock of the 1970s, the failed idea 'trickle down' economics, the military industrial complex and forever wars, dysfunctional right wing politics ... unaffordable education ... time wasting technologies ... and the list goes on.

However, within this big mess, there are some amazing possibilities.

I got interested in technology when I was quite young ... maybe 7 or 8. I am still interested in technology almost 80 years later! Around 1900 my maternal grandfather subscribed to Harmsworth Popular Science and I grew up with access to several years worth of this magazine and 'Strand' magazines in big bound volumes. I had no interest in 'comics' but devoured the content of these serious magazines pretty aggressively.

By the time I got to be an adult, I had had the opportunity to integrate my informal childhood learning into my formal education at the University of Cambridge where I studied engineering and economics. Post Cambridge, I engaged in an industrial management training program in heacy engineering, and then joined a formal training program with Cooper Brothers & Co. to qualify as a Chartered Accountant. Over time, CB&Co morphed into Coopers and Lybrand and later into PriceWaterHouseCoopers (PWC). While I was at Cambridge, I spent two summers travelling and working in North America. The travel arrangements were made by the Cambridge Canada Club who chartered two Boeing 707s to carry us to New York from London at the end of May and return us early in September. We ere not allowed to work in the USA, but could work in Canada. In 1960 I worked in Montreal and in 1961 in Toronto. In addition I got to travel extensively in 1960 crossing Canada from Montreal to Vancouver and back by car then going South to Miami in Florida and back to New York. In 1961 my travel took me by car to almost every steel plant in North America ... an amazing exercise prior to my subsequent involvement in a British industrial management training program.

When I completed my 'articles' and qualified as a Chartered Accountant, I remained with CB&Co for a relatively short time in London before migrating to North America and settling in Vancouver. My new wife and I flew from London to Montreal before taking the train to Vancouver. It was February and it was Canada ... but it was a wonderful experience. The train got stuck in the Rockies for about 2 days but eventually we arrived at our destination.

Less than a week later I was employed by H.A.Simons International (HAS) ... a pulp and paper industry consulting company ... and all set for a lifetime of interesting assignments. I was recruited as a 'field accountant' to do the management accounting related to the construction of pulp and paper mills where HAS was engaged as design consultants and construction project managers.

MORE TO COME

Peter Burgess

The US economy is giving off weird vibes right now.

Analysis by Elisabeth Buchwald, CNN

New York CNN

Published 2:14 PM EDT, Fri May 24, 2024

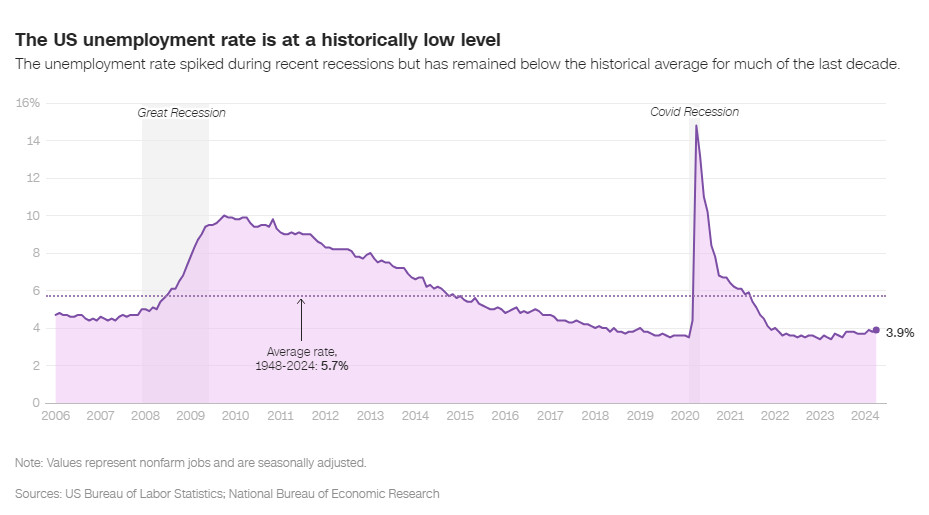

There are millions of job openings and the unemployment rate is low. In fact, it hasn’t been this low for such a long stretch of time in decades. You’d think that would mean the economy is coasting, since periods of low unemployment are generally associated with higher rates of economic prosperity.

But there’s a slew of red flags right now — like a large and growing share of people, particularly Gen Zers, taking on such high levels of credit card debt to cover their spending that lenders have stopped loaning more money to them.

That seems to be the case with a lot of recent economic data: No piece of good news comes without other evidence that give economists pause. “I wouldn’t give the economy a clean bill of health,” said Gregory Daco, chief economist at EY. “It looks robust, but there are pockets of concern.”

But while the state of the economy has economists weighing their words, presidential candidates see it in more binary terms. For instance, President Joe Biden tells voters the economy is booming and has hardly ever been doing better — even though, as he frequently says, there’s still work to be done. Yet from former President Donald Trump’s vantage point, “the economy is crashing” and is in total disarray, he said at a recent campaign rally in Wisconsin.

Here’s what’s really going on.

The good

If you’re already optimistic about the economy’s current state, you’re going to feel even better by parsing through some of the latest labor market data.

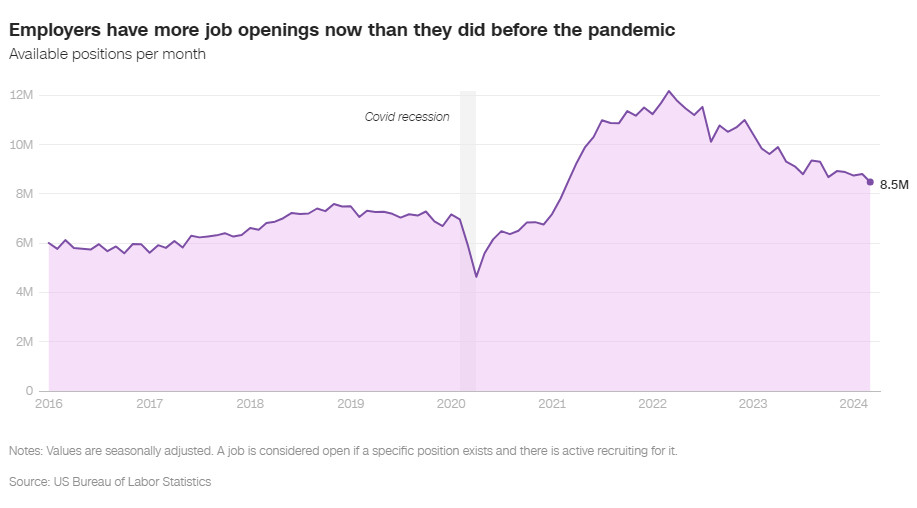

Currently, there are 8.5 million job openings. That exceeds the number of pre-pandemic job openings by 1.5 million. Meanwhile, there are 6.5 million unemployed people. That means there’s more than one job per job seeker. In the decade preceding the pandemic, that ratio was 0.6 on average, signifying there were more job seekers than the number of job openings.

Americans’ average hourly earnings are 22% higher than before the pandemic, according to Bureau of Labor Statistics data. Though wage increases have been slowing, they’re rising at a faster rate than prices.

That’s good news for consumers, since it means their income is stretching further.

The bad

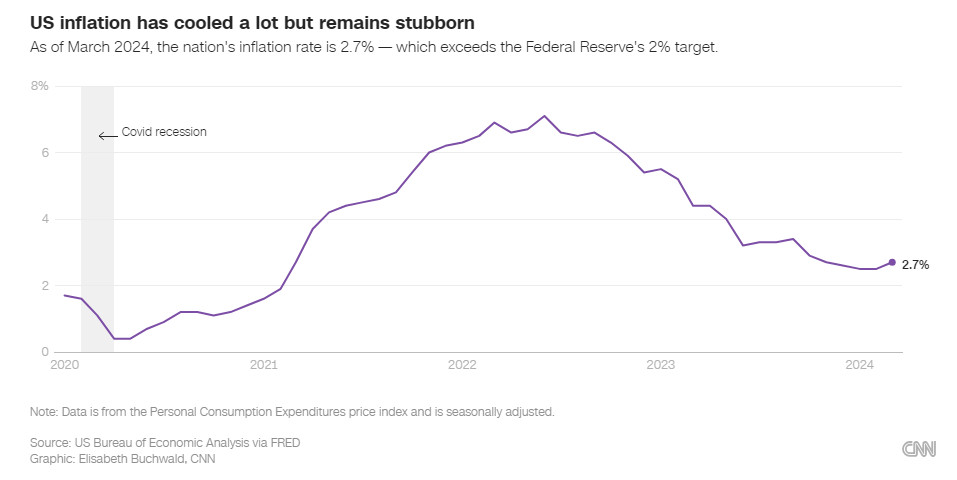

Though inflation has cooled significantly from its peak in the summer of 2022, further progress toward the Federal Reserve’s 2% target is looking like it’ll be a lengthy process.

That trajectory has taken many Fed officials by surprise, including Gov. Christopher Waller who thought the economy would be in a good position for cutting interest rates by now. “However, the first three months of 2024 threw cold water on that outlook, as data on both inflation and economic activity came in much hotter than anticipated,” Waller said in a speech Tuesday.

But he said April Consumer Price Index data, which showed headline inflation levels cooled slightly, was “welcome relief.”

“If I were still a professor and had to assign a grade to this inflation report, it would be a C+— far from failing but not stellar either,” he added.

But at the same time, consumers believe that inflation will move higher in the year ahead, according to two surveys Fed officials monitor closely.

Since inflation expectations can effectively control the pace of price hikes, businesses take those expectations into account when pricing goods and services. That can lead to higher prices.

However, an early reading on retail spending for April came in much weaker than expected as consumers reined in their spending. That’s good in the sense that it doesn’t give retailers the ability to pass along higher prices to consumers if they aren’t willing to accept them, which had previously been the case. But given consumer spending is one of the biggest drivers of the economy, a pullback can have adverse effects, too.

“It certainly bears watching, but part of the weakness probably was ‘payback’ for strength in prior months,” David Alcaly, lead macroeconomic strategist at Lazard, told CNN.

Daco said he sees the retail sales report as a sign that consumers are “a little more cautious, but are not retrenching.” However, if spending starts to slow a lot more, that could negatively impact the economy, he said.

The ugly

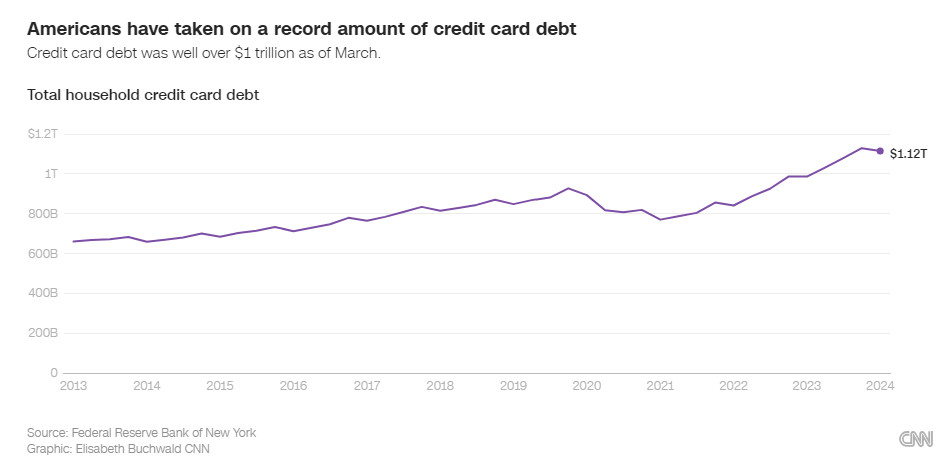

The biggest flashing red light in the economy right now is the level of debt people are racking up.

One reason consumer spending has held up so well in the face of higher-than-desirable inflation combined with the highest interest rates in over two decades is that consumers aren’t necessarily spending within their means.

The savings many accumulated during the pandemic have all but evaporated, leading to a lot more credit card purchases that aren’t being paid back on time.

That, combined with the gradually cooling labor market — which is reducing workers’ leverage — is causing some households to accumulate more debt and fall into serious delinquency, meaning 90+ days late on a payment.

Recent New York Fed data showed the percentage of credit card balances in serious delinquency climbed to its highest level since 2012.

“The rising levels of consumer debt and delinquency rates, if continued, are not just individual problems; they could have macroeconomic effects requiring attention from economic policymakers,” Sung Won Sohn, a Loyola Marymount University economics and finance professor and chief economist of SS Economics, wrote in a recent note. “As more income is directed toward debt repayment, consumers have less disposable income for other purchases.”The rising delinquencies will likely force banks and other lenders to lend less money to borrowers deemed riskier or cause lenders to charge even higher interest rates, he said. Ultimately, these combined effects “can contribute to a broader economic slowdown — or even a recession.”

MORE FROM CNN

Opinion

Why Americans are so frustrated with the economy right now

Job openings fall to new 3-year low, as the US economy ...

Consumers haven’t felt this bad about the economy since November

CNN BUSINESS VIDEOS

FST rich man One-on-one with Africa’s richest man

FST oil africa Inside Africa’s largest oil refinery

FST bold swimwear Andrea Iyamah’s bold swimwear fuses African heritage with modern flair

FST james masterclass Why Veekee James is spilling trade secrets to aspiring fashion designers