Date: 2026-03-03 Page is: DBtxt003.php txt00025542

ECONOMICS

ANALYSIS OF NEO-KEYNESIANISM

The Economic Consequences of Neo-Keynesianism by Jamie Merchant

ANALYSIS OF NEO-KEYNESIANISM

The Economic Consequences of Neo-Keynesianism by Jamie Merchant

Original article: https://brooklynrail.org/2023/07/field-notes/The-Economic-Consequences-of-Neo-Keynesianism

Peter Burgess COMMENTARY

Peter Burgess

By Jamie Merchant

After nearly four decades of free-market ideology, industrial policy has returned to America in the form of an octogenarian president who barely knows what year it is.

In the words of the Biden administration, the time has come for a “modern American industrial strategy.”1 So-called Bidenomics, encompassing the American Rescue Plan, the Infrastructure, Investment, and Jobs Act, the CHIPS and Science Act, and the comically-named Inflation Reduction Act (IRA), indicates a shift in the government’s willingness to intervene directly in the national economy. While huge government subsidies for corporations and tax incentives to attract foreign investment are nothing new, the government’s rationale—using its fiscal power to shape the economy’s productive and technological structure—is genuinely new. Such economic statecraft would have been denounced as heresy by most politicians and pundits a mere five years ago. Instead, liberals are beside themselves. Robert Kuttner of The American Prospect celebrated the death of neoliberalism:

We now have the first post-neoliberal administration in power in Washington. The Biden administration has explicitly disavowed all aspects of neoliberalism, including the assumptions about free trade and the alleged efficiency of outsourcing, the lack of support for trade unions, and the bipartisan contempt for industrial policy … Biden managed to get through Congress the most expansive technology and industrial policies since World War II.2With his willingness to nudge private investment in certain directions, the somnolent commander-in-chief appears to be embarking on a bold new course for the American experiment. Or perhaps Bidenomics is less a departure from American precedent than a revival of it, a retrieval of the Hamiltonian tradition of the national developmental state reaching back to the founding of the country: “Biden’s economic team is betting on something Hamilton knew: Long-term investment in the real economy is essential, but private investors might not provide it. That’s where government can—and should—step in,” opines Alex Yablon at Vox.3 With the Vox stamp of approval, industrial policy has officially entered the realm of conventional Beltway opinion.

Whether industrial policy is a radical new experiment or a tradition as American as mass shootings, liberals are not the only ones excited about it. Its assumption that the government has a key role to play in actively guiding investment in a more productive, competitive direction can now be found across the political spectrum—for instance, in the fake working-class politics of Florida Senator Marco Rubio’s report, American Investment in the Twenty-First Century. Rubio is a key figure of “national conservatism,” an ideology that embellishes the standard defense of plutocracy with a superficial rejection of the same free-market dogma people like Rubio were credulously preaching just a few years ago. Evidently, after three decades even the children of the Reagan Revolution are discarding the usual pablum about the wisdom of markets in favor of yesterday’s heresy: more government guidance of the economy.

Criticism of the new orthodoxy has been scarce, but not completely absent. In a blog for the New Left Review, the sociologist Dylan Riley threw cold water on the whole prospect of Bidenomics. Taking the March bailout of Silicon Valley Bank as a point of departure, Riley claimed that “the SVB collapse is a beautiful, almost paradigmatic, demonstration of the fundamental structural problem of contemporary capitalism: a hyper-competitive system, clogged with excess capacity and savings, with no obvious outlets to soak them up,” and that “the current vogue for ‘industrial policy’ will do nothing to address this underlying issue.” Consequently, socialists have no business supporting Bidenomics or any other industrial policy for that matter: instead, “the commanding heights of the economy…must be seized all at once.”4

Despite helpfully solving the problem of socialist strategy, Riley’s polemic provoked a flurry of rote Keynesian responses criticizing his ultraleft politics and emphasizing the role of demand as a policy variable. Writing for New York magazine, Eric Levitz pointed to the high rate of US profits, as measured by the US Bureau of Economic Analysis, as evidence against Riley’s contention that overcapacity is suppressing them. “More broadly, overcapacity cannot exist in anything but a relative sense,” he added, “the world does not have more productive capacity than is required to satisfy all the wants and needs of its 7.8 billion people.” The problem, Levitz suggested, is one of “inadequate demand.”5 Similarly, the economist J.W. Mason criticized the theoretical basis of Riley’s overproduction story, claiming that it—unjustifiably—takes demand as a static variable, just as, conversely, mainstream economics usually takes supply as a given factor, unalterable by human activity. Besides, political realities should trump political purism. Rather than dismissing Bidenomics from the standpoint of some idealized socialist movement, progressive activists should welcome it as the flawed but long-awaited arrival of post-neoliberal governance, which for better or worse will form the terrain of political conflict in the years to come. And in the end, isn’t any climate policy better than none?6

Considering the content of the IRA, that's actually debatable. The IRA— billed by its cheerleaders as “the most important climate action in U.S. history”—provides billions in tax credits to generate domestic consumer demand for US-made electric vehicles, along with a host of other measures to incentivize emission reductions and clean energy manufacturing. It also hands out truly massive subsidies to the oil and gas industries, locking in continued windfall profits for oil oligarchs—“courageous visionaries,” in the words of US Energy Secretary Jennifer Granholm—and environmental degradation at the public’s expense for decades to come.7 At the moment, it is unclear if the legislation’s decarbonization measures will even balance out the historic pipeline permit it just handed to the fossil fuel industry not just to continue, but to escalate its campaign to doom human civilization. Beyond the IRA, the speed with which the Biden administration has approved new drilling projects has left even Trump’s cretinous lackeys of industry in the dust.8

That’s not all, though. A key feature of the IRA is its brazen protectionism for US electric automobile manufacturing, which predictably set off alarm bells in Brussels and Seoul, whose exports the Act is explicitly meant to shut out. As a plainly mercantilist policy with the goal of raising US growth at the expense of its competitors, the IRA is already triggering an international arms race toward general mercantilism, with the European Union rushing to implement its own protectionist subsidies. The South Korean government, already acting against its own economic interests to accommodate the US’s trade war against China, was shocked by the US’s apparent willingness to economically decimate a critical ally in its anti-China coalition.9 It has since enacted a new round of subsidies for its domestic industries and is currently considering even bigger ones. Japan is following suit.10 With the IRA’s beggar-thy-neighbor consequences, the US is happily forming a circular firing squad with its supposed “allies,” with signs afoot that a global race to the bottom in protectionism is already underway. This makes the prospects for global cooperation on the climate crisis even bleaker than they already were.11

Liberals hail Bidenomics as a vindication of Keynesian politics. Finally, it seems, the government is getting serious about its national economic role. Many of the same people applaud Washington’s new anti-China consensus and the US ruling class’s campaign to subjugate a country of 1.4 billion people to its whims. Perhaps Keynes himself would have agreed. But it is more likely that the internationalist author of The Economic Consequences of the Peace, who excoriated Allied leaders after the First World War for their narrow self-interest and myopic nationalism, would have been appalled by these policies. Keynes, who “though an Englishman, [felt] himself a European,” vehemently opposed the Paris peace treaty, seeing clearly that the Allied prostration of Germany would lead to a cataclysm that would make the Great War pale in comparison.12 He understood that whatever short-term advantages it gave to France and Britain would be far outweighed by the negative longer-term consequences it baked in for human civilization, which would not be long in coming. What would he have made of the world’s premier superpower blowing up the very international order it designed and oversaw for the better part of a century in a frantic attempt to suppress a country with a population some fifteen times larger than Germany’s, all for a few tenths of a percentage point of GDP?

Crucibles

In fact, the self-defeating qualities of US policy reflect the larger global environment that seemed to make Bidenomics necessary in the first place. This is particularly evident with regard to climate sustainability commitments. Governments across the world are discarding the laissez-faire, free trade rulebook of yesteryear, actively manipulating their economies, and doubling down on fossil fuels in a bid to raise their international competitiveness. In this context, pledges to achieve carbon neutrality count for little.

A brief survey of the global situation makes this abundantly clear. In Mexico, President Andrés Manuel López Obrador shuns investment from US and Canadian clean energy companies, effectively discarding the US-Mexico-Canada trade agreement and opting instead to champion Mexico’s state-run oil firm (Pemex) and Federal Electricity Commission. AMLO’s government pursues a policy of energy sovereignty—not unlike the US’s own preoccupation with energy security—that invests in petroleum and coal with little room for renewables.13 To the south, Brazilian President Lula da Silva has committed Brazil to serious progress on the development of clean energy resources following the environmentally catastrophic regime of his cartoonish predecessor, Jair Bolsonaro. At the same time, he has vowed not just to halt the planned sell-off of state-owned firms but to strengthen the government’s control over them, including the Brazilian oil giant Petrobras and the country’s central bank, in a bid to lower fuel prices and “reindustrialize” the economy.14 Lula’s government plans to disconnect the price of fuel from world dollar markets, to “Brazilianize” the price of gasoline, and to invest in more oil refineries and natural gas as part of an integrated energy policy.15

In the European Union, French President Emmanuel Macron has declared his own intention to embrace more government planning in the energy sector to make France more “energy independent,” and is the most outspoken voice for an EU-wide industrial policy to counter the US’s IRA, which could throttle continental industry.16 To his east, the German government has implemented price caps on its natural gas and electricity supply funded by a tax on profits in the green energy sector— i.e., taxing renewables to subsidize carbon fuel consumption, especially for its all-important export sectors.17 The intervention undermines the country’s commitment to achieving carbon neutrality, not to mention the sanctity of market forces, but German industry needs cheap fuel to remain competitive.

To the west, across the battlefields of Ukraine and the vast expanse of the Kyzylkum and Karakum Deserts, India, the world’s third largest carbon emitter behind the United States and China, has flatly refused to endorse a net-zero carbon emissions target. Narendra Modi’s government has consistently ranked the development of the economy as the higher priority. This can hardly be a surprise: India’s private capitalist sector has nearly become moribund, staying alive mainly through continuous lavish funding from government subsidies as investment and productivity have cratered over the last decade.18 In East Asia, Japan is the only G7 country currently planning a major rollout of coal power, which already accounts for 32 percent of the country’s energy supply, over the next decade.19 And lastly, the Chinese government has pledged that the country will be carbon neutral by 2060, and China is the world's largest producer and exporter of wind and solar energy. Yet, as part of the government’s efforts to power a national economic recovery following the pandemic, the country is currently burning more coal than the rest of the world combined.

The global trend is plain to see. Virtually everywhere, redoubled consumption of fossil fuels is undercutting the possibility, already remote, for countries to meet their long-term commitments to carbon neutrality. Everywhere too, governments are directly intervening in their national economies through price controls, trade restrictions, industrial subsidies, and targeted investments to transform their productive infrastructure, measures that would have been unthinkable not so long ago, when official doctrine held that markets knew best and governments should just get out of their way. It would appear that neoliberalism is dead and buried, replaced by the very thing it was supposed to have definitively ended: state-directed economic development.

What accounts for this stunning reversal? In one plausible explanation, a crisis of legitimacy has unfolded through a series of destabilizing political and economic shocks in the G7 countries over the last fifteen years, forcing the policy elite to learn from their mistakes. The devastating aftermath of the 2008 global financial crisis, and the lack of any real recovery from it, provided the soil from which so-called populist challenges sprang forth from the right and the left over the ensuing decade, shaking the political establishment from its complacent stupor. Trump was the exclamation point of this sequence. After stumbling into office following his surprise electoral victory, the Trump administration proved far too erratic and unpredictable for the traditional wards of the American state, particularly its foreign affairs, national security, and monetary policy wings, all of whom feuded with Trump throughout his tenure. The bumptious but entertaining blowhard was not only an insult to their self-regard as a benign meritocracy; he also personified the de-legitimation of the entire political system, exposing it as a playground for a ruling class of oligarchs and sociopaths like himself. During the pandemic, the national George Floyd uprising of 2020 and the invasion of the Capitol building by a QAnon mob in January of 2021 sealed the deal. For the federal government’s career administrators this was an intolerable outcome that could not be allowed to happen again.

But it was Trump’s government that provided the proof of concept for what would become Bidenomics. It started with an incompetent trade war launched against China in the spring of 2018 and pursued through 2019. With the arrival of COVID-19, emergency measures like fast-tracking vaccine research, relief packages with direct aid to families, and (largest of all, of course) a firehose of central bank funding for distressed businesses beyond the central bank’s usual remit demonstrated that debates over a larger fiscal role for the government were moot, because it had already become a reality. At the same time, over a decade of near-zero interest rates and persistently low inflation suggested the government had more room to maneuver than previously believed. With the accession of the Biden administration, US executive leadership decided the time had come to turn the page on failed economic policies prescribed by an obsolete ideology, and experiment with bigger, bolder roles for federal spending to address its festering legitimation crisis at the source.20

These events shook the paternalistic clique that runs the government to its core, giving it a newfound sense of the precarity of its grip on power. But this account leaves the most important questions unanswered. Why, first, did the world economy never really recover from the events of 2008–2009? One could say that the rich countries sabotaged themselves through a self-defeating obsession with austerity following the meltdown, and that growth would have reached a healthy clip had the return to statism come sooner. But this doesn’t explain why the country that did follow that path, China, also experienced a pronounced growth slowdown over the same decade.21 In any case such explanations are ultimately pointless, because “policymakers” don’t decide what to do based on the better argument; they do what they usually do until it either causes or can’t resolve a crisis, at which point they begin to improvise. They simply were not going to do anything differently until it was painfully clear that the old, neoliberal playbook had not worked.

More fundamentally, this nationally-focused narrative doesn’t adequately explain the advent of the new Cold War, which has accompanied the return of industrial policy from the start. While politicians are always looking for scapegoats for their failures, the US demonization of China and its economic warfare against that country are on a different level than this. They reflect a strategic decision to undercut that country’s further development in order to preserve American preeminence, a decision reflecting the assumption that the global economy cannot accommodate both American growth and Chinese development. Prosecuting economic—and, probably soon, military—warfare against China is not incidental to Trumponomics and Bidenomics; it is not a hawkish foreign policy attached to the domestic economics, which could be pried away from it by conscientious reformers. Rather, it is integral to the economic program, baked into it by the correct judgement on the part of US leaders that in the current, decelerating global economic environment, national growth must come at the expense of other nations.

Lastly, the national crisis narrative cannot explain the most remarkable, improbable fact of all: faced with an escalating, comprehensive domestic crisis, the US government has opted not to renovate the international order it has led since 1945, its own bespoke system of market-led trade that it designed in its own image, but to demolish it, ending nearly eighty years of liberal internationalism buttressed by the universal expansion of markets, free trade, and open capital flows. In the form of Bidenomics, the US response to the crisis of neoliberalism has abolished the very basis for its claim to world leadership since the end of the Second World War, which was to stand for something larger than itself—to represent the center of a cosmopolitan political order sponsored by the American state. The worldwide return of industrial policy marks the end of that project, and the definitive end of an entire era of US-led world capitalism. To understand this stunning historical outcome, and what it portends, we need to look beyond a narrowly national explanation to the dynamics of the capitalist system as a whole.

Decalescence

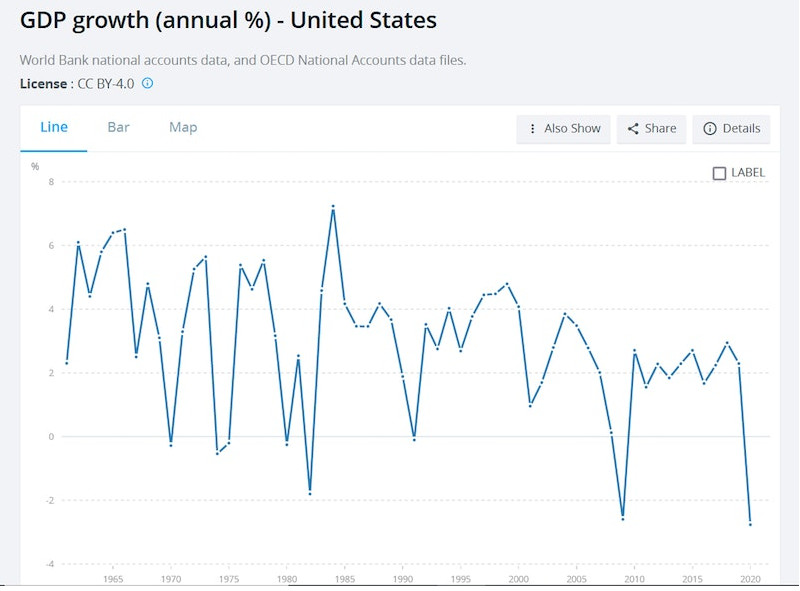

GDP growth rates, crude as they are, offer an initial clue. First consider US growth rates from 1961–2020 as measured by the OECD and World Bank:

As is evident, growth is cyclical, passing through the ups and downs of periodic business cycles, through which a clear downward trend works itself out. With each turn of the cycle, over time the peaks get lower, and the troughs deeper, to the point that from the decade spanning 2010 to 2020 the US could barely manage a roughly 2 percent rate of growth.

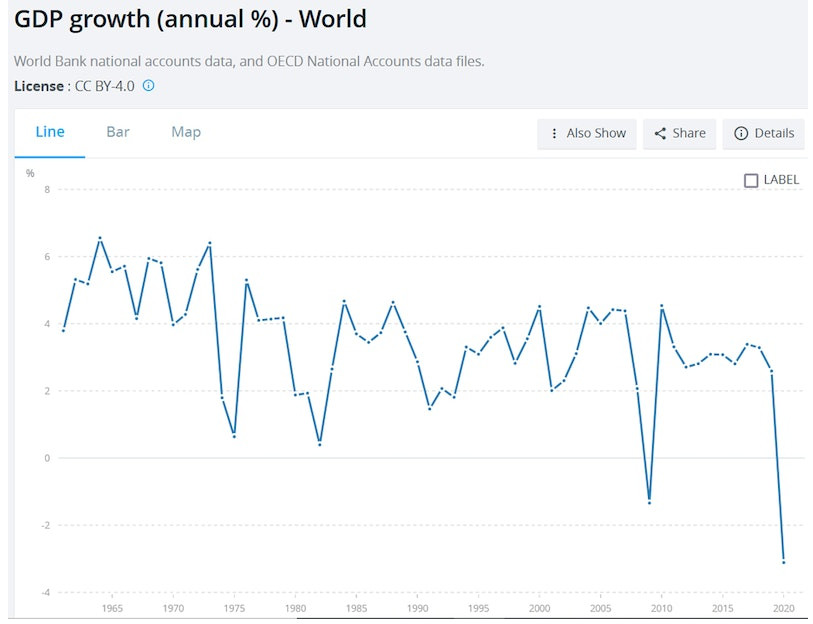

Now consider the world economy over the same period. World GDP growth mostly mirrors the US trajectory. Although higher in absolute terms, its ups and downs reflect the fluctuations of a single world business cycle whose peaks and troughs, as for the U.S., both trend steadily lower over time. The decline traverses the “golden age” of post-war capitalism, its demise, the emergence of globalization, the end of the first Cold War, the rise of China, everything up to the eve of the coronavirus outbreak of 2020.

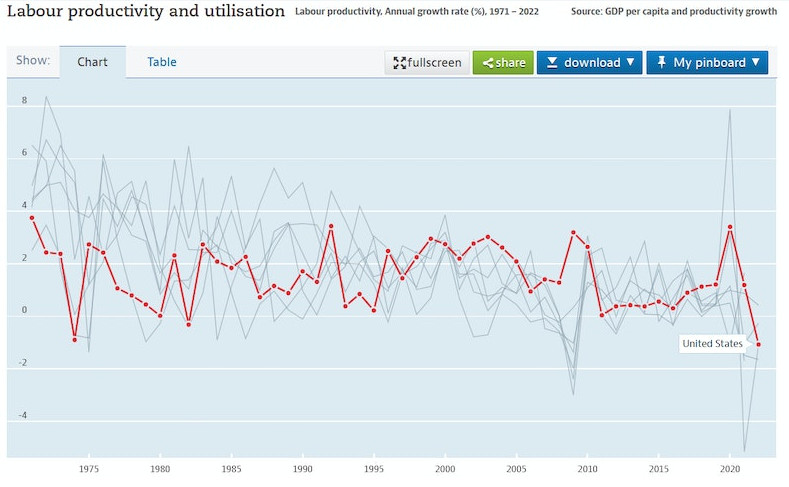

Labor productivity rates for the G7 economies, derived from OECD data, show a clear compression over time, converging on the same, narrow range fluctuating between 0 and 2 percent from 2008 to 2020, or outright flatlining for much of that period, as in the U.S (highlighted). Among other things, declining productivity means wages and salaries can only increase by cutting into corporate profits, so for profits to remain high workers' incomes must be assiduously suppressed. For some hopeful commentators, the post-pandemic recovery seemed to hold out hope for a long-awaited productivity revolution in the making, reflected in a modest bump in the data for 2021. Alas, this turned out to be a false dawn, as the advanced economies quickly reverted to trend. As the Conference Board observes, stagnating productivity is likely to persist for the foreseeable future.22

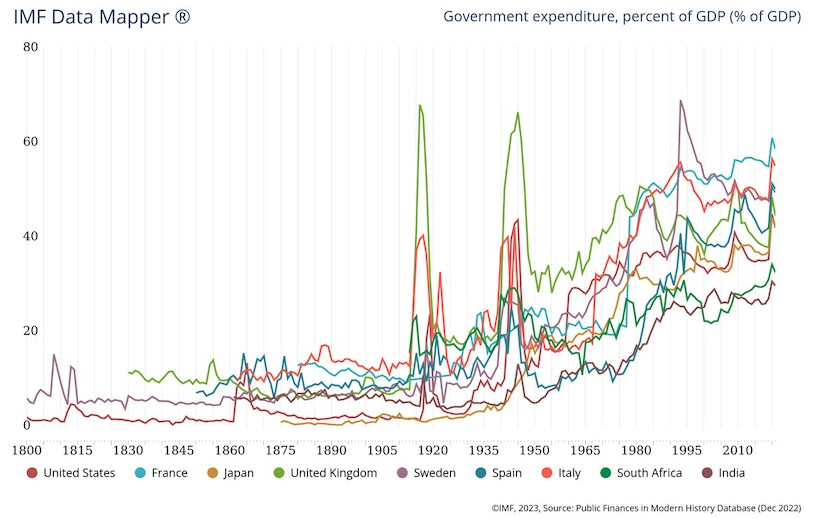

Finally, maybe most strikingly, this global decline has been accompanied since the 1940s by steadily rising rates of government expenditure as a percentage of GDP, with government spending in both advanced and less developed economies accounting for somewhere between 40 and 60 percent of GDP. Rising levels of state spending accompany ever more anemic levels of growth and output. Again, this continued uninterrupted from the middle of the twentieth century all the way to now. Against this trend, the recent rediscovery of industrial policy is a mere blip.

Economic statistics should be taken critically as the shaky constructions they are, but they do tell you something. Industrial policy has made its worldwide comeback within an equally worldwide exhaustion of the global economic system, the slow-motion expiration of the US-based configuration of capitalism inaugurated at the close of the Second World War. On the surface, Bidenomics seems to represent a decisive break with neoliberal dogma, and so it is in some respects; but more fundamentally, it is smoothly continuous with the deeper trend, starting in the 1940s, of fading growth prospects and rising state involvement in the private economy. If anything, it is an intensification of this trend. Its official adoption represents the belated recognition by “policymakers” that still greater state action is needed to sustain the already meager growth rates of the national economy, crushed beneath the dead weight of an expiring system.

Transitions

US decline is not due to China, or any other one country, but to the fading vitality of the greater international economy made in its own image, and to which its fate, as the core of that system, is irrevocably chained. This secular decline is behind the legitimation crisis that has engulfed all of the advanced economies over the last decade and a half, as well as the stalling growth afflicting the so-called emerging economies. It is the background for the abandonment of economic liberalism and the revalidation of state-guided development in the eyes of political establishments worldwide.

In a world in which growth is scarce and ideas scarcer, industrial policy has made a comeback not as a pathway to some egalitarian, post-carbon social democracy, much less some long-awaited government revelation that people should matter more than profits. Rather, it returns as a strategy that capitalist countries are forced to adopt to defeat one another on the shifting stage of global competition. Its return to fashion in official discourse signals a distinctive feature of that competition in the current moment: a constantly expanding footprint of national states in both domestic and international corporate economies. As economic growth dries up, states are compelled to abandon the usual platitudes about free trade, openly calling for the kinds of aggressively nationalist, beggar-thy-neighbor policies that the capitalist world was supposed to have left behind. The different national forms this takes—Bidenomics in the US, Germany’s Industrial Strategy 2030, China’s Made in China 2025, India’s MII (Make in India) initiative, and so on —are all particular instances of a single, structural transformation of the world economy into a fragmented state-capitalist hellscape. As with all great ideological shifts in the political establishment, the official hype for industrial policy is mostly an after-the-fact recognition of a process that is already well underway.

Dylan Riley and Robert Brenner have coined a concept that at least tries to grasp this transformation, which they label “political capitalism.” Initially outlined in “Escalating Plunder,” an essay published by Brenner in the summer of 2020 in New Left Review and later re-upped in Brenner and Riley’s “Seven Theses on American Politics,” political capitalism is allegedly a “new regime of accumulation” in which profits no longer come from investment in businesses but from peddling influence in the political process.23 Business elites enrich themselves by pushing for easy money policies on the part of the government, which politicians are happy to oblige as a way to secure their own power. It amounts to “the politically driven upward redistribution of wealth to sustain central elements of a partially transformed dominant capitalist class, as the response to a seemingly inexorable process of economic deterioration,” a process supposedly induced by worsening industrial overcapacity at the global level. Exactly how this happens is not clarified, as the concept is derived through an exclusive focus on the US. In fact, despite referring to it as a “new regime of accumulation,” in neither of these essays do Riley or Brenner turn more than a perfunctory glance at the global situation, and how the US fits into it, content instead with vague references to falling returns from chronic overcapacity.24

To briefly sketch Brenner’s now classic theory, as originally laid out in The Economics of Global Turbulence: overcapacity is driven by a problem of continuing entry with insufficient exit in world export markets. Faced with the entry of more technically advanced, lower cost competitors from Germany and Japan in their markets, legacy producers in the US with high fixed capital costs in plant and machinery chose not to divest from those assets to efficiently reallocate their capital, but to recommit to them by shifting the burden of competition onto labor and raw material costs to compensate for now out-of-date productive equipment. Eventually, the new competitors themselves faced heightened competition from newer entrants into their fields, clogging world export markets with even more extraneous industrial capacity than before. The process repeats, resulting in permanently falling industrial profits driven by always excessive competition between industrial producers.

As astute critics pointed out from the start, what Brenner offered was not so much a theory as a historical description of market failure.25 His narrative encompasses the world economy, but as an aggregate of individual, competing units, with no prior analysis of the dynamics of the capitalist system itself, nor an account of how the changing nature of competition expresses those dynamics. Instead, once overcapacity set in, stagnation was assured; it is ultimately a static conceptualization of the world system. Not only does this leave out an explanation for why world markets have apparently failed to clear for decades on end, but more importantly, it reduces politics to an equally static story about predatory state elites, since capitalist social relations are supposedly no longer a defining feature of the economy. With only vague allusions to the economic forces behind all this, political capitalism is basically indistinguishable from banal libertarian whining about “crony capitalism,” which is based on a similar claim that government corruption erodes the basis for the capitalist economy to function. Both views elide the system’s dependence on profits extracted from the exploitation of labor, which, pace Brenner, is still the basic foundation of the economic system.

Profits in particular have become a topic of some confusion among leftwing commentators responding to the overcapacity story. For example, Tim Barker and Eric Levitz both point to official government data on the profits of American businesses, which since the 1980s have shown a cyclical pattern and have even risen slightly, to question Brenner’s claim that systemwide profitability is stagnating.26 With Brenner and Riley offering only a parochial focus on the US, with no real economic analysis, this is the obvious and inevitable objection. But the rate of profit for the capitalist system as a whole is a global magnitude, which affects each producer and each nation unevenly, based on their relative position in the world economic hierarchy. As expressions of this hierarchy, national rates of profit reflect the relative success of state strategies to secure continued profitability for its affiliated corporations both domestically and abroad, largely at the expense of their competitors.

Such as it was, the neoliberal profits recovery in the US was accompanied by an epochal expansion of credit, a consequence of the country’s transformation into a global debtor following the deep depression and spiking interest rates of the early 1980s. These attracted a huge amount of the world’s money to its financial centers and marked the beginning of a dramatic expansion of government debt to its current level of 130 percent of GDP, climbing steadily since 1980, and the continuing growth of nonfinancial corporate debt, currently at 85 percent of GDP. 27 By borrowing to fund endless tax giveaways, corporate subsidies, runaway military spending, and a general credit boom for businesses and consumers, the US secured the conditions for consistent profitability through the constant expansion of debt. As a direct consequence of the skyrocketing interest rates unleashed by Fed Chairman Paul Volcker, lower income countries in Latin America, Africa, and Asia were laid waste by the Third World Debt Crisis of the early 1980s, a cataclysmic event from which many of them never really recovered. These countries were and continue to be starved of billions of dollars of potential investment as much of the world’s wealth is absorbed by the enormous market for US government debt. Now the cycle is poised to repeat itself as a result of the Federal Reserve's frantic attempt to get inflation under control by jacking up interest rates to their highest levels in decades, with a world debt crisis once again poised to pulverize a wide swathe of low-income countries across the Global South.28

At the dawn of the neoliberal era, much of the world had to be wrecked as a condition for the US to begin its transition to a credit-based national recovery. But while credit can facilitate profitability it is not the source of it. Along with exciting new techniques for tax avoidance opened up by globalization, not to mention the government’s open support for the corporate assault on organized labor that began in the early 1980s, US profit growth over the last several decades also expressed the globalization of production, with US multinationals leveraging their position as global monopsonies to enforce competition between subcontract manufacturers exploiting workers in international production chains. The symbiosis between these producers, mainly located in East Asia, and the credit-fueled US consumer market was the flywheel of global growth throughout the neoliberal period. But as this growth engine sputters out, and with US mercantilism now openly aiming to steal investment away from other countries, credit-based profit growth in the US increasingly means condemning the majority of humanity to economic purgatory, as the self-designated leader of the “international community” (again) absorbs the world’s money to fund its national growth strategy. While the U.S. is currently importing more capital from the rest of the world than ever before, levels of global FDI (Foreign Direct Investment) are now below the level they were at in 1995.29

As the US case amply demonstrates, governments intervene constantly to maintain a profitable environment for investment, but by doing so they gradually sap the vitality of the total economic system. This will, in turn, prompt national governments to pursue even more radical and desperate experiments to revive national growth, further exacerbating the global trend toward disintegration. Both Brenner and his critics lack any sense of this process, much less its political ramifications. But they also share a certain conceptual affinity. As the term suggests, political capitalism is supposed to describe how politics and economics have fused together, with political rent-seeking now responsible for whatever economic activity there is. Yet in their deeper, unexplained assumption that governments cannot do anything to alter their economic fate as handed to them by the problem of overcapacity, Brenner and Riley subscribe to a crude form of economic determinism. As a concept, political capitalism is based on this prior, hard separation of the state from the economy, which is the determining factor.30 Ironically, the authors share this conceptual dichotomy with progressive economists and the very “neo-Kautskyites” Riley denounces, who, believing that national governments can shake off global constraints through industrial policy, emphasize the other side of the same dichotomy. Both positions obscure a deeper understanding of the conditions that bring about the kind of dramatic renovations of state ideology exemplified by the return of industrial policy, as well as its likely consequences. These conditions are the forces and relations of world capitalist production. Their evolution does not mechanically determine politics, but, in tandem with the latter re-shapes the relations between state and economy in ways that alter the nature of both.

As a global mode of production based on class domination, capitalism depends on the extraction of surplus value from a subordinated class, the world working class, which is the pool from which profits, interest, rent, dividends, and other forms of this surplus are taken. As one of its most basic features, corporations in different countries mechanize their operations to raise their profit rate by increasing labor productivity. As these techniques become generalized, the relative advantage for their early adopters dries up, and a new productivity norm becomes the rate at which businesses must produce to remain competitive. The drive for a new breakthrough in productivity begins. Enormous amounts of profit are produced and realized during this process while deleting workers from it—that is, by getting rid of the real source of profit, labor power. As a result, even as individual corporations rake in more money through investing in machinery, the average rate of profit for all producers declines. The longer this goes on, the lower profitability becomes, reducing the level of investment and further intensifying the pressures of competition.

Economists—like business-people—see market competition as the driver of corporate technological innovation, but the competitive pressures of markets—especially the world market—are as much the consequence as they are a cause of the drive for greater productivity, which tends to outpace what markets can absorb. As the scale of production expands and labor power shrinks as a share of total expenditure by private business, total profits worldwide will also tend to shrink relative to the total invested capital. The resulting fall in industrial profitability is a well-documented empirical trend. In his book Capital Wars, for example, the financial analyst Michael Howell records an overall decline in the returns on industrial capital from 1984–2019 for Germany, the US, and China, with the rate of return in all three countries nearly converging by 2019. Likewise, according to the World Bank, growth rates for industrial 'value added' in the three countries have slowly converged on a common downward path since the early 1990s.31 Value added is the net output of a sector, or total output (sales) minus intermediate inputs (purchased components, energy, raw materials, services), so it serves as an indirect indicator of profitability. Industrial profitability is not important to track for its own sake, but because it is a key indicator of the sector with the historically highest rates of labor productivity. Even if it is not evident to commentators like Levitz, for whom “it is not clear why that sector’s peculiar trajectory is of overriding importance,” it is perfectly clear to the US government, which is hell bent on reviving this sector even if it means sabotaging its own “allies” and considerably raising the chances for world war.32 Despite delirious proclamations celebrating the advent of a post-industrial economy during the heyday of neoliberalism, capital-intensive manufacturing for world markets is still the main engine of capitalist growth. The less profitable it becomes, the less private investment it will attract, requiring more drastic measures on the part of governments to reignite growth in their sputtering, low-productivity economies.

In the long run, declining average rates of profit are the other side of the growing scale of capital investment, of the capitalist pursuit of ever greater productivity. This conflict between productivity and profitability plays out internationally in the competitive arena of the world market, where corporations and their national governments experience it as a problem of foreign competitors. Corporations experience this trend as heightening competitive pressure to remain profitable; governments face it in the increasing difficulty of raising the national rate of growth. The longer this dynamic goes on, the more the global pool of surplus value to be globally divided up shrinks, and the more the world economy is in effect as a zero-sum environment, with growth for some only coming at the expense of others.

Likewise, the thickening concentration of regional production networks, the scale of investment needed to produce at the global technological frontier, and the resulting scarcity of manufacturing profitability are the forces behind the widely observed phenomenon of premature deindustrialization. For the most part, so-called emerging markets are bypassing the second, industrial phase of the traditional cycle of development, in which the transition from a mainly agrarian to an industrial economy raises national incomes and living standards before transitioning to a mostly service-based economy. Given the level of mechanization and capital intensity required at the global standard of production, growth in industrial output no longer correlates with significant employment growth, but does contribute to global pressure on overall profitability. Even traditionally labor-intensive segments of global production networks, such as certain sectors of subcontract manufacturing, are increasingly organized by centralizing monopolies, blocking new entry into potentially more labor-intensive development strategies.33 These deep, tectonic trends effectively mean the end of development, as a comatose system consigns most of the world's population to workless misery. The return of industrial policy and the onset of premature deindustrialization are two sides of the same historical dynamic: falling worldwide profitability, the thickening concentration of capital, and an expanding population of surplus humans that governments are frightened of but which national economies are unable to absorb. In this context, pursuing “industrial policy,” as the US is doing, simply means destroying one’s competitors, even if it means starting World War III. At least these measures will be accompanied by reassuring homilies about the sanctity of the rules-based international order.

Mask off

For Bidenomics’s official goal, which is to intervene in the domestic economy to raise its productive capacity, the decline in American industrial competitiveness means it can only achieve that goal by kneecapping its more advanced competitors. As Edward Luce of the Financial Times recognizes, the domestic side of Bidenomics is a byproduct of its main point, which is to throttle China's further development.34 In fact, the latter is a condition for the former: in a global system characterized by increasingly capital- and technology-intensive production standards that left the U.S. behind long ago, making manufacturing in the U.S. profitable at scale, i.e. “re-shoring” it, is only possible by leveraging export restrictions and trade sanctions that basically blackmail manufacturers to avoid further engagement with China. The cooperation of the Dutch company ASML, for example, which manufactures key components for semiconductors, was most likely secured by threatening to withhold the software it relies on, which is made by a US-based company.35 The larger geoeconomic war against China is backed by some of the biggest corporate interests in the country. It is, for example, strongly supported by much of Silicon Valley, whose manufacturers and services are in danger of being outcompeted by China’s rapidly developing hi-tech sectors.

But US policy is also squarely aimed at undercutting Europe, where the constraints of the EU’s governmental process make a similar “European IRA” exceedingly difficult, if not impossible. Unlike in the US, where senators can closely collaborate with executive officials to crank out legislation acceptable to big business, and thus passable, the European Parliament and the European Commission must juggle the disparate interests of dozens of different countries with internal divisions of their own. EU leaders, reflecting the EU’s constitution, are also still hobbled by a dogged attachment to “market solutions” even at this late date, compounding the difficulty. Of course, the Biden administration was well aware of all of this when it rammed through the IRA. Presidential Senior Advisor Brian Deese's remark that “We should welcome [similar] actions by most countries if they’re structured fairly and scaled appropriately” is either naive or, more likely, just disingenuous.36

Nevertheless, the US was compelled to respond to European outrage at its turn to open neo-mercantilism. Forced to make concessions to hold together its shaky alliance against Russia and China, the Biden administration quietly implemented two regulatory changes, by executive action, to the legislation in December 2022 and March 2023. These changes make it possible for US citizens to access tax credit subsidies for electric vehicles that are not made in the US; under the new rule, if the vehicle is leased rather than purchased, imported cars receive the benefit of the subsidies. This would effectively bypass the “made in America” requirements of the bill for car manufacturing, arguably its most important provision. With leases accounting for over a third of the US market in new electrical vehicles and rising, one of the key employment generators of the IRA may already be dead on arrival.37 All this reveals how America's geopolitical and economic objectives, as currently understood, are hopelessly in conflict with one another.

In an international setting like this, calls for a “global race to the top” in clean energy development may be honest, if naive; what they are not is realistic. Liberal commentators have bent over backwards to rationalize the US’s descent into solipsistic economic nationalism, insisting that it will actually work out great for the world. Supposedly the IRA will lower costs for key decarbonization technologies, making them available for everyone. But apart from the advertisements offered by officials and their apologists, what this means in reality is this: the US aims to monopolize the production of these and other key technologies for a US-dominated trade bloc of wealthy countries that it leads against its official enemies, principally China. By upgrading its domestic manufacturing capacity through protectionism and—more importantly—geoeconomic warfare, clean energy technologies may eventually be cheaper for other countries to import, but it will be the US, of course, who will be making and supplying them.

In any case, the notion of a cooperative world effort to decarbonize that excludes the world’s leading producer by far of clean energy resources is bound to be a self-defeating exercise. China already accounts for the vast majority of the world's investments in clean energy technology and the cost efficiencies that have accrued from them, but US foreign policy is bent on locking China out of global markets for these and other advanced products, literally at all costs. In the near to mid-term this will drive up prices for these products for everyone by forcing producers to make them outside of the global productivity frontier in the China-centered value chains of East Asia. Far from helping it, the destabilizing effects of US foreign policy will impede the project of decarbonization by dramatically raising its cost.

In a recent speech, US National Security Advisor Jake Sullivan tried to put forward a coherent rationale for US policy by outlining a “new Washington Consensus.” In the new order, the US will invest in emerging economies through trade deals and international organizations like the World Bank, all while maintaining its customary, undisputed supremacy. Unlike the previous Washington Consensus, when liberalized trade was supposed to be the engine of global development, or the consensus before that, which thought all countries would pass through industrialization on their way to becoming “modernized” economies, we’re assured that this time will be different; this time, global development will really happen. Again, the official self-presentation needs to be distinguished from reality. For low-income countries to have any real opportunities for development, they would need not just foreign capital, but also to have export access to the lucrative markets of North America, Europe, and Japan; it is precisely such access that these countries, above all the US, are moving to close off. The general turn to protectionism in the rich countries will instead consign developing economies to the role of suppliers of raw materials and basic commodities, their traditional, subordinate position in the world hierarchy, forestalling progressive development. Far from alleviating global inequality, this will profoundly exacerbate it.

For example, take the “Green Steel Deal,” which unites the EU and US in a commercial agreement to incentivize reduced-carbon steelmaking. It is supposedly open to global participation so long as countries produce steel “fairly,” as defined by US trade law. However, under current law, most steel is “unfairly” traded, due to the presence of “non-market” forces in steel-producing countries, i.e. the same kind of state-support the US itself is of course pursuing on behalf of its own steel industry.38 Leaving aside China, even if key countries like India or Indonesia produce steel with similar forms of state involvement, their access to the US market will be penalized, making their exports uncompetitive. There is thus no incentive for these countries to join such an agreement, which makes it a non-starter. Through its intensifying protectionism and hypocritical trade laws, the US is still firmly set to “kick away the ladder” for lower and middle income countries, making the New Washington Consensus a mere empty phrase.

Meanwhile, developments on the domestic front could eventually unravel the entire project to reorient the economy around industrial policy. As investors are no doubt aware, the business environment the IRA tries to create is nowhere near politically secure. Domestically, the Democrats’ strategy was to locate most new manufacturing in Republican-controlled states, creating jobs and, so the thinking goes, solidifying the support of Republicans. Demonstrating all the cunning and strategic savvy the Democrats are known for, the legislation has had no such effect, with Republican legislators and governors just as implacably opposed to everything they try to do as ever. The most likely result will be for new factory jobs to make Republican governors and congressional representatives more popular, emboldening their extremism and encouraging them to be even more obstructionist. By not only failing to contest Trumpism but in fact doubling down on its basic principles, the leaders of the Democratic Party have locked in a general mood of paranoid nationalism, sure to benefit an increasingly hysterical conspiracist right that will thrive in it. Meanwhile, Joe Biden’s approval ratings continue to plumb new lows, setting up a rematch with Trump he could very well lose in 2024—an all-around stellar performance by the Dems.

The situation labor confronts is no more favorable. Most new factories are set to come online in Right-to-Work states, where traditional workplace organizing is much more difficult than in states less hostile to trade unions. But perhaps more to the point, the cost of building modern manufacturing complexes for advanced components like semiconductors is so high that a critical producer like the Taiwan Semiconductor Manufacturing Corporation, which has been contracted to build the IRA’s flagship factory in Arizona, has flatly refused to countenance a unionized workforce. Organizing in these conditions is not impossible, but it will be a seriously uphill battle made even tougher by a government desperate to secure new investments, whatever it takes.

America pursues a “green industrial policy” set to pump more greenhouse gasses into the atmosphere than ever before while making global decarbonization more difficult; it demands that its chief competitors join its international alliance while enacting an economic policy aimed at decimating them; it expects developing countries to join the same alliance, while punishing them for pursuing the kinds of industrial policies it itself is pursuing; and it has placed all its bets for renewing domestic growth and stability on a strategy that virtually guarantees worsening stagnation and global instability. Almost a year after the passage of the 'Inflation Reduction Act,' inflation remains persistent, US manufacturing is in a slump, and 2023 is turning into a banner year for corporate bankruptcies.39 The incoherence of US governance is not just the result of its leaders’ incompetence, though there is plenty of that, but a consequence of the exhaustion of its own international economic system and the impossibility of overcoming this through economic nationalism, however extreme. As the outcome of a dysfunctional process of elite improvisation, such an 'industrial policy' has no rational basis, and cannot be rationally justified. It represents a step in the mutation of contemporary societies into a new stage of state capitalism induced by the long-term decay of the capitalist system itself.

Gonzo economic nationalism will do nothing to alleviate this crisis, and in fact will only make it worse at every level. Self-destructive economic policies ensure the continued deterioration of profit growth worldwide, which in turn means depressed investment and employment growth, which then prompts further, more desperate national experiments. But the failure of capitalism is, in the end, a failure to enforce the regime of class domination it is based upon. As in all previous episodes of world capitalist breakdown, the state must now be enlisted on the behalf of the ruling class to re-impose discipline on the global workforce, to establish a new basis for growth in the class relationship at the heart of the capitalist system. In the end, the breakdown of capitalism is an expression of a breakdown in this relationship, the increasing difficulty of globally reproducing it. If the left's first wave of post-neoliberal strategy pursued electoral tactics to seize a foothold in the state, perhaps the second will see national states as but one vector in a much greater field of global forces, in which new possibilities for class formation will emerge through the disintegration of laboring life as we know it.

- Mark Muro, “Biden’s big bet on place-based industrial policy,” www.brookings.edu, March 6, 2023.

- “What Comes After Neoliberalism?,” The American Prospect, www.prospect.org, March 28, 2023.

- Alex Yablon, “The origins of Biden’s most important policy, explained,” Vox, www.vox.com, April 5, 2023.

- “Drowning in Deposits,” New Left Review, www.newleftreview.org, April 4, 2023.

- Eric Levitz, “Blaming ‘Capitalism’ Is Not an Alternative to Solving Problems,” New York Magazine, www.nymag.com, April 10, 2023.

- J.W. Mason, “Yes, Socialists Should Support Industrial Policy and a Green New Deal,” Jacobin, www.jacobin.com, April 6, 2023.

- Kate Aronoff, “Why Is the Fossil Fuel Industry Praising the Inflation Reduction Act?,” The New Republic, www.newrepublic.com, March 10, 2023; Paul Blackburn, The Hill, “The Inflation Reduction Act may save the fossil fuel industries,” www.thehill.com, August 8, 2022.

- The Center for Biological Diversity, “Biden Administration Oil, Gas Drilling Approvals Outpace Trump’s,” Press Release, www.biologicaldiversity.org, January 24, 2023.

- Jaemin Lee, “How a Biden Legislative Achievement Jeopardized Relations With South Korea,” The Diplomat, www.thediplomat.com, January 6, 2023.

- Ibid.

- David Kamin and Rebecca Kysar, “The Perils of the New Industrial Policy,” Foreign Affairs, www.foreignaffairs.com, May/June 2023.

- John Maynard Keynes, The Economic Consequences of the Peace (Seattle: Loki, 2019) p. 9.

- David Agren, “US and Canada launch trade dispute with Mexico over clean energy,” Financial Times, www.ft.com, July 20, 2022.

- Brian Harris and Michael Pooler, “Investors fret over Lula’s approach to Brazil’s state-controlled companies,” Financial Times, www.ft.com, January 6, 2023.

- Reuters, “Brazil's Lula says he would strengthen, rather than privatize, key state enterprises,” www.reuters.com, February 17, 2022; Arthur Deakin, “4 Ways Lula Will Transform Brazil’s Energy Sector,” www.americasmi.com, November 2, 2022.

- William Horobin and Francois De Beaupuy, “Macron Says France Must Regain Control of Some Energy Firms,” Bloomberg, www.bloomberg.com, March 17, 2022.

- Arne Delfs, Kamil Kowalcze and Vanessa Dezem, “Germany Plans €54 Billion Package to Contain Energy Surge,” Bloomberg, www.bloomberg.com, November 22, 2022.

- R. Nagaraj, “India Derailed: A Falling Investment Rate and Deindustrialisation,” The India Forum, www.theindiaforum.in, February 21, 2023.

- Aaron Sheldrick, “Japan's climate change efforts hindered by biased business lobby: study,” www.reuters.com, August 5, 2020.

- Ted Fertik and Tim Sahay, “Bidenomics and Climate Action: The Case of the Inflation Reduction Act,” Youtube, www.youtube.com, February 11, 2023; Yakov Feygin and Nils Gilman, “The Designer Economy,” Noema, www.noemamag.com, January 19, 2023.

- World Bank, “GDP growth (annual %) – China,” http://data.worldbank.org.

- The Conference Board, “Stagnant Productivity Growth Returns to the Post-Pandemic Economy,” Press Release, www.conference-board.org, April 29, 2022.

- Robert Brenner, “Escalating Plunder,” New Left Review, www.newleftreview.org, May/June 2020; Dylan Riley & Robert Brenner, “Seven Theses on American Politics,” New Left Review, www.newleftreview.org, November/December 2022.

- At the end of “Escalating Plunder,” Brenner promises a sequel examining the global scene that to the best of my knowledge never appeared.

- Michael A. Lebowitz, “In Brenner Everything Is Reversed,” Following Marx: Method, Critique, and Crisis, (Chicago: Haymarket, 2009,) ch. 15; Simon Clarke, “Capitalist Competition and the Tendency to Overproduction: Comments on Bob Brenner’s ‘Uneven Development and the Long Downturn,’” New Left Review 229, 1998.

- Tim Barker, “Basic Questions about Brenner and the Profit Rate,” www.substack.com, December 21, 2022; Levitz, “Blaming ‘Capitalism.’”

- IMF, “General Government Debt: Percent of GDP,” www.imf.org; “Nonfinancial corporate debt, loans and debt securities,” www.imf.org. While U.S. state debt only began to rise precipitously after 1980, debt levels for U.S. non-financial corporations have been rising continuously since 1950.

- Indrajit Samarajiva, “Sri Lanka Collapsed First, but It Won’t Be the Last,” New York Times, www.nytimes.com, August 15, 2022; Lynn Parramore, “Another Debt Crisis in the Global South?,” www.ineteconomics.org, April 17, 2023.

- Board of Governors of the Federal Reserve System (US), “Rest of the World; Net Lending (+) or Borrowing (-) (Capital Account), Transactions,” http://fred.stlouisfed.org; Johannes Fritz, Simon Evenett, “FDI is in big trouble: Insights from the 27th Global Trade Alert report,” VoxEU, Centre for Economic Policy Research, cepr.org, June 3, 2021.

- In this respect, Brenner’s more recent output represents a methodological regression compared to his earlier, path-breaking work on agrarian capitalism. In that body of work, static social structures and teleological determinism were rejected as explanatory methods in favor of an emphatic emphasis on the historical impact of class struggle. Now, class struggle is de-emphasized in favor of a static explanation based on deterministic principles. Brenner’s exclusion of the concept of value, supposedly the main strength of so-called political Marxism, is responsible for this regression. Without the global scope of the competitive and class relations signified by value, analysis tends to isolate individual aspects of one fundamental crisis – such as a particular national form it takes – without penetrating down to the deeper dynamics of world production that mold them. The inevitable result is the reification of effects as causes, parts as wholes, and a general dismissal of the possibility of actual historical change – i.e., the mission statement of bourgeois economics.

- World Bank, “Industry (including construction), value added (annual % growth) - United States, Germany, China,” http://data.worldbank.org.

- Levitz, “Blaming ‘Capitalism.’”

- Ashok Kumar, Monopsony Capitalism: Power and Production in the Twilight of the Sweatshop Age (Cambridge: Cambridge UP, 2020); Phillip Neel, “The Broken Circle: Premature Deindustrialization, Chinese Capital Exports, and the Stumbling Development of New Territorial Industrial Complexes.”

- Edward Luce, “The New Washington Consensus,” Financial Times, www.ft.com, April 19, 2023.

- Scott Foster, “Sanctions move China to replace chips supply chain,” Asia Times, www.asiatimes.com, January 27, 2023.

- The White House, “Remarks on Executing a Modern American Industrial Strategy by NEC Director Brian Deese,” www.whitehouse.gov, October 13, 2022.

- Chad P Brown, “Industrial policy for electric vehicle supply chains and the US-EU fight over the Inflation Reduction Act,” Peterson Institute for International Economics, www.https://www.piie.com/.

- Simon Lester, “Prospects for a Green Steel Deal,” International Economic Law and Policy Blog, http://ielp.worldtradelaw.net, March 24, 2022.

- Lydia Depillia, “After Pandemic Rebound, U.S. Manufacturing Droops,” New York Times, www.nytimes.com, May 2, 2023; Sean Longoria, Annie Sabater, “April adds 54 more US corporate bankruptcies; 2023 filings highest since 2010,” S&P Global Market Intelligence, www.spglobal.com, May 4, 2023.