Date: 2026-03-04 Page is: DBtxt003.php txt00024853

FOOD AND AGRICULTURE

AGRIFOOD ATLAS (2017)

Facts and figures about the corporations that control what we eat.

AGRIFOOD ATLAS (2017)

Facts and figures about the corporations that control what we eat.

Open PDF: Agribusiness-agrifood-atlas.pdf

Peter Burgess COMMENTARY

The manner in which the world is being 'managed' at the moment (2023) is appalling. The prevailing dysfunction has been a long time in getting to this catastrophic state ... at least forty years going back to Margaret Thatcher and Ronald Reagan.

The rapid pace of modern technological development goes back to the Second World War and post war reinvestment in Europe and Japan. For several years ... until the mid 1960s progress of productivity, growth of business profits and growth of wages all followed more or less the same trajectory. This changed with the OPEC oil shock of the 1970s when the cost of energy derived from petroleum went from a basis of around $3,00 a barrel to $13.00 (in 1973) and $39.00 by the end of the decade. This changed the underlying cost structure of virtually everything and every business that was a user of energy created a cost crisis that was also a profit crisis.

Presidents Nixon, Ford and Carter could do little or nothing to address the 'cost push' inflation that resulted from the actions of the OPEC cartel. By the time Reagan was elected the business community had started to address the US and European cost crisis by starting to outsource production from the high wage cost areas of Europe and North America to the much lower wage cost areas of the world mainly in Asia.

President Nixon and Secretary of State Kissinger started a process that would eventually enable China to become part of the global trading economy. In many ways this was a huge success, especially for China and many other countries with low wages around the world. The impact on high wage countries was more problematic, especially in the United States.

Prior to the OPEC oil shock, the big difference between the European economy and the US economy was the underlying energy efficiency. In Europe industry paid a high price for energy because of the prevailing tax regime while in the USA industry consumed a lot of much lower priced energy much more inefficiently. With the new OPEC global pricing regime, the energy inefficiencies of the US industry could not be addressed except by a massive amount of outsourcing of production to low wage countries mainly in the Far East. This started slowly but during the Reagan administration it became widespread and the industrial production base much of it in the mid-West of the United States was gutted.

US wages have flatlined now (2023) for more than 40 years!

But the socio-enviro-economic situation is a whole lot worse than just this and some of this is described in the AGRIFOOD ATLAS paper referenced here. I have been concerned for a long time about the role that 'financialization' has been having on the way the socio-enviro-economic system works.

If the ultimate goal of life is for 'me' to accumulate the most wealth, then going to a business school like the Harvard Business School (HBS) and learning about financialization maybe is the best way to start. If the goal is for the people of the world to improve their quality of life, something better than financialization is needed ... and that is what TrueValueMetrics (TVM) is all about.

HBS style financialization is actually a good starting point for the sort of management metrics that are needed. The framing of progress and performance that is used for money profit and economic performance needs to be applies as well for social progress and performance and environmental progress and performance.

All the 'bits' needed for better management metrics like TVM exist but they are not routinely integrated into a single coherent comprehensive reporting package. The regulations and the institutional framework are constraining rather than encouraging better metrics. I have never heard a good explanation why ESG (Environment, Society and Governance) has become popular (albeit ineffective) while TBL (Triple Bottom Line / People. Profit, Planet) has almost completely disappeared. My conclusion is that people who only have an interest in the value (price) of an investment remain the dominant actors in anything to do with business decision making ... and continue to be enabled by many high profile academics and intellectuals.

Over the past many decades there has been an unhealthy consolidation of companies so that they have become bigger and bigger and more and more profitable. Whether or not these very big conglomerates are good for society and the environment is not at all clear since the utility and relevance of the reporting seems to decline as the reporting entity gets bigger and more diverse.

For example: The issues that are associated with toothpaste and those associated with detergent are not the same, They may be well understood inside the company that produces and markets both of these products, but a consumer has little or no access to any of these potentially interesting issues. I remember, for example, that Colgate toothpaste was manufactured in New Jersey but not any more. It is imported from 'I don't know where' and looks the same ... almost ... but is it the same?

Almost every product has a back story that consumers probably need to know about ... but this never happens in the modern retail eco-system. Sadly, marketing is much more about carefully selected misinformation than it is useful information that has true value for the potential consumer. Consumers need much better and easier information about all products.

Peter Burgess

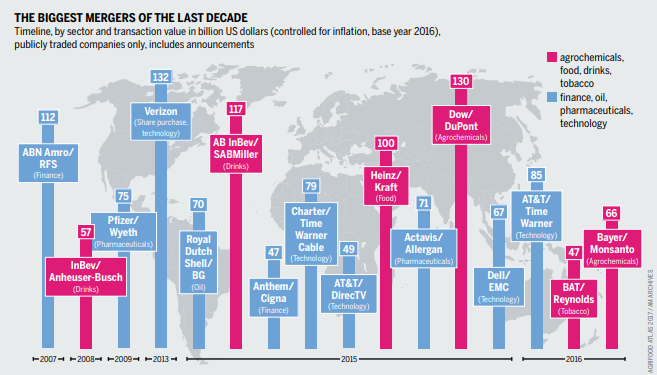

Takeovers and mergers like Monsanto by Bayer, Kraft with Heinz and Dow with DuPont are just the tip of the iceberg. A spate of corporate marriages is concentrating control at each link in the value chain, from field to fork. The biggest players are growing the fastest and are pushing through their own interests and approaches.

|

CONTENTS OF THE PDF REPORT

This report is well researched and written ... but the results are effectively zero! | |

|

(1) HISTORY ... SUPERSIZE ME

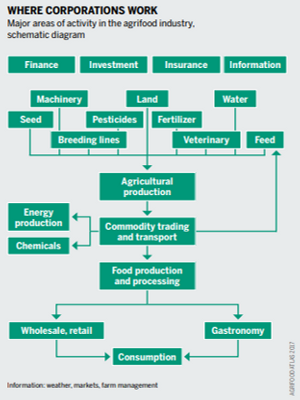

Whether protectionism or deregulation – the agrifood industry keeps growing. Mergers are making firms bigger all the way along the value chain. (2) MERGERS ... ONE GROUP TO RULE THEM ALL A single private equity firm, 3G Capital from Brazil, controls some of the world’s biggest food and beverage corporations. The company’s aggressive takeover strategy is just the tip of the iceberg. (3) PLANTATIONS ... MODERN-DAY LANDOWNERS New corporations have emerged that buy or lease vast areas of farmland in developing countries. They grow monocultures to feed the industrialized agriculture. (4) AGRICULTURAL TECHNOLOGY ... DIGITAL MANOEUVRES – WHEN TRACTORS GO ONLINE Precision farming promises to revolutionize farm management. But it will only benefit large landholdings and capital-intensive agro enterprises. (5) FERTILIZERS ... CHEMICALS FOR THE SOIL Synthetic fertilizers increase agriculture’s productivity, but do not improve soil quality. Manufacturers want to sell more – despite the high energy and environmental costs. (6) SEED AND PESTICIDES ... FROM SEVEN TO FOUR – GROWING BY SHRINKING Mergers galore: Bayer wants to buy Monsanto and become the world’s largest producer of seeds and agrochemicals. All top rivaling companies are pairing up. (7) ANIMAL GENETICS ... IN THE BEGINNING WAS THE PATENT Genetically modified livestock are prone to disease and are difficult to market. But many labs are developing methods to further industrialize animal production. (8) CROP GENETICS ... JUGGLING GENES In the coming years, seed companies plan to use genome editing to produce crops with new characteristics – and market them without having to state that they are “genetically modified”. (9) COMMODITIES ... AGRICULTURAL TRADERS’ SECOND HARVEST Four Western corporations dominate the global trade of agricultural products. Now a Chinese firm has joined them. (10) MANUFACTURERS ... BRANDS DOMINATING MARKETS Fifty manufacturers account for 50 percent of global food sales in the industry. The big companies are growing fastest and are rapidly increasing their market share. (11) RETAILING ... EXPANDING AISLES Food shoppers in the developed world let the cash registers ring at the likes of Wal-Mart, Lidl, Carrefour and Tesco. The supermarket revolution is now expanding throughout the developing world. (12) FEEDING THE WORLD ... CHEMICAL SPRAYS, BUT HUNGER STAYS Industry says it can feed the world. But total food production is not the issue; access to food is. The key solution is to fight poverty. (13) MEAT ... HERD INSTINCT They are largely unknown to the public, but they dominate the world’s meat supplies. Much of the beef, pork and chicken we eat is controlled by just a handful of big firms. (14) ALTERNATIVES ... LOOKING FOR A NEW WAY Agroecology is a successful concept which promotes farming methods that are attuned to local ecosystems. It is already used for growing rice worldwide. (15) CAPITAL MARKETS ... INVESTORS CARE ABOUT GROWTH – NOT ABOUT THE GROWERS Speculators are increasingly placing their bets on agriculture. Capital flows into stock exchanges are exacerbating price fluctuations in agricultural commodities – to the benefit of funds and banks. (16) WORKING CONDITIONS ... PILE IT HIGH, SELL IT CHEAP Labels on supermarket packaging trumpet all kinds of concerns for people and nature. But most have little impact on the miserable conditions endured by farm and plantation workers. (17) WORLD TRADE ... IN CONTROL, NOT UNDER CONTROL International trade deals reflect the interests of the industry. Agrifood corporations want to keep a grip on the steering wheel. (18) EU LOBBYING ... BIG BUSINESS IN BRUSSELS The crowds of industry lobbyists trying to infl uence European Union policy often find they are pushing at an open door. They combine legitimate lobbying with underhand methods such as hiring government insiders and publishing quasi-scientific studies. The EU must recognize such tactics for what they are. (19) CHINA ... PUBLIC AND PRIVATE COMPANIES ARE REACHING OUT The world’s new economic powerhouse is located in China. Its land investments in Africa and Latin America have attracted headlines, but Southeast Asia is where it is making its influence most felt. (20) RULES ... MARKET POWER AND HUMAN RIGHTS Again and again, corporations fail to respect human rights. Voluntary measures are not enough: we need binding rules. (21) RESISTANCE PROTESTS, BOYCOTTS AND RESISTANCE In many countries, people are resisting agrarian and trade policies that boost the power of the multinationals. Individual companies also come in for criticism. (22) AUTHORS AND SOURCES FOR DATA AND GRAPHICS |

Agriculture and food is a complex system, with the complexity optimized for the profit performance of the 'owners' of the industry. |