Date: 2026-03-06 Page is: DBtxt003.php txt00022904

INVESTMENT / INSURANCE

ALLIANZ

Allianz has massive failure of investment strategy in the USA

ALLIANZ

Allianz has massive failure of investment strategy in the USA

The logo of Allianz is seen on a building in Paris, France, April 30, 2020. REUTERS/Charles Platiau/File Photo

Original article:

Peter Burgess COMMENTARY

Peter Burgess

Reporting by Alexander Huebner; Writing by Tom Sims; editing by Rachel More, Maria Sheahan, Sabine Wollrab

August 12, 2022 at 6:29 AM EDT

FRANKFURT, Aug 12 (Reuters) - Germany's financial watchdog BaFin has called on Allianz (ALVG.DE) to improve its internal controls following fraud at its U.S. funds unit, a person with knowledge of the matter said on Friday, the latest development in a scandal that has dogged the company for two years.

The regulator sent Allianz a letter with concrete demands for controls improvements some weeks ago, said the person, speaking on condition of anonymity.

In May, Allianz agreed to pay more than $6 billion and its U.S. asset management unit pleaded guilty to criminal securities fraud over the collapse of a group of investment funds early in the COVID-19 pandemic.

WirtschaftsWoche first reported about the letter earlier Friday.

Allianz declined to comment to Reuters but told WirtschaftsWoche it always meets the highest risk management and compliance standards.

Reuters reported last year that BaFin was looking into the demise of the funds after U.S. regulators opened their own probes.

Last week, Allianz disclosed it spent around 140 million euros on restructuring to wind down the U.S. funds unit at the centre of the fraud, an expense that added to a worse-than-expected 23% fall in quarterly profit.

Reporting by Alexander Huebner; Writing by Tom Sims; editing by Rachel More, Maria Sheahan, Sabine Wollrab

Our Standards: The Thomson Reuters Trust Principles.

The logo of insurer Allianz SE is seen on the company building in Puteaux at the financial and business district of La Defense near Paris

https://www.reuters.com/business/finance/allianz-pay-6-bln-over-structured-alpha-fraud-fund-manager-charged-2022-05-17/

Allianz to pay $6 bln in U.S. fraud case, fund managers charged

Written by Tom Sims, Alexander Hübner and Jonathan Stempel

May 17, 2022, 5:38 PM EDT

NEW YORK/MUNICH, May 17 (Reuters) - Germany's Allianz SE (ALVG.DE) agreed to pay more than $6 billion and its U.S. asset management unit pleaded guilty to criminal securities fraud over the collapse of a group of investment funds early in the COVID-19 pandemic.

Allianz's settlements with the U.S. Department of Justice and U.S. Securities and Exchange Commission are among the largest in corporate history, and dwarf earlier settlements obtained under President Joe Biden's administration.

Gregoire Tournant, the former chief investment officer who created and oversaw the now-defunct Structured Alpha funds, was also indicted for fraud, conspiracy and obstruction, while two other former portfolio managers entered related guilty pleas.

Once with more than $11 billion of assets under management, the Structured Alpha funds lost more than $7 billion as COVID-19 roiled markets in February and March 2020.

Allianz Global Investors US LLC was accused of misleading pension funds for teachers, bus drivers, engineers, religious groups and others by understating the funds' risks, and having 'significant gaps' in its oversight. read more

Investors were told the funds employed options that included hedges to protect against market crashes, but prosecutors said the fund managers repeatedly failed to buy those hedges.

Prosecutors said the managers also inflated fund results to boost their pay through performance fees, with Tournant, 55, collecting $13 million in 2019 and becoming his unit's highest or second-highest-paid employee from 2015 to 2019.

Investigators said the misrepresentations began in 2014, and helped Allianz generate more than $400 million of net profit.

At a news conference, U.S. Attorney Damian Williams in Manhattan said more than 100,000 investors were harmed, and that while American prosecutors rarely bring criminal charges against companies it was 'the right thing to do.'

Investors 'were promised a relatively safe investment with strict risk controls designed to weather a sudden storm, like a massive collapse in the stock market,' he said. 'Those promises were lies.... Today is the day for accountability.'

BLAMING COVID

Also known for its insurance operations, Allianz is among Germany's most recognizable brands and an Olympic sponsor.

Its namesake arena near its Munich headquarters, meanwhile, houses Bayern Munich, one of world's best-known soccer teams.

The settlement calls for Allianz to pay a $2.33 billion criminal fine, make $3.24 billion of restitution and forfeit $463 million, court papers show.

Williams said the fine was significantly reduced because of Allianz's compensation to investors.

Even so, the payout is close to twice the $3.3 billion in corporate penalties that the Justice Department collected for all of 2021.

An Allianz lawyer entered the guilty plea at a hearing before U.S. District Judge Loretta Preska in Manhattan.

Allianz also accepted a $675 million civil fine from by the SEC, one of that regulator's largest penalties since Enron Corp and WorldCom Inc imploded two decades ago.

Shares of Allianz closed up 1.7% in Germany, with the payout broadly matching reserves that the company previously set aside.

Tournant, of Basalt, Colorado, surrendered to authorities on Tuesday morning.

The U.S.-French citizen appeared briefly in Denver federal court, and was released after agreeing to post a $20 million bond. An arraignment was set for June 2 in New York.

Tournant's lawyers, Seth Levine and Daniel Alonso, said the investor losses were 'regrettable' but did not result from a crime.

'Greg Tournant has been unfairly targeted [in a] meritless and ill-considered attempt by the government to criminalize the impact of the unprecedented, COVID-induced market dislocation,' the lawyers said in a joint statement.

The other two portfolio managers - Stephen Bond-Nelson, 51, of Berkeley Heights, New Jersey; and Trevor Taylor, 49, of Miami - agreed to plead guilty to fraud and conspiracy, and cooperate with prosecutors. Their lawyers declined immediate comment.

VOYA PARTNERSHIP

Allianz's guilty plea carries a 10-year ban on Allianz Global Investors' providing advisory services to U.S.-registered investment funds.

As a result, Allianz plans to move about $120 billion of investor assets to Voya Financial Inc (VOYA.N) in exchange for a stake of up to 24% in Voya's investment management unit. It expects a final agreement in the coming weeks.

Regulators said the misconduct included when Tournant and Bond-Nelson altered more than 75 risk reports before sending them to investors.

The SEC said projected losses in one market crash scenario were changed to 4.15% from the actual 42.15%, simply by removing the '2.'

Allianz's alleged oversight lapses included a failure to ensure Tournant was hedging, though prosecutors said only people in his group knew of the misconduct before March 2020.

'No compliance system is perfect, but the controls at AGI didn't even stand a chance,' Williams said.

Bond-Nelson, at Tournant's direction, also lied to Allianz's in-house lawyers after the company learned about the altered reports and the SEC probe, prosecutors added.

'Unfortunately, we've seen a recent string of cases in which derivatives and complex products have harmed investors across market sectors,' SEC Chair Gary Gensler said in a statement.

Investors have also filed more than two dozen lawsuits against Allianz over the Structured Alpha funds.

Reporting by Jonathan Stempel in New York and Tom Sims and Alexander Huebner in Munich Additional reporting by Luc Cohen in New York Editing by Chizu Nomiyama, Tomasz Janowski and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles.

Tom Sims ... Thomson Reuters

Covers German finance with a focus on big banks, insurance companies, regulation and financial crime, previous experience at the Wall Street Journal and New York Times in Europe and Asia.

The seal of the United States Department of Justice is seen on the building exterior of the United States Attorney's Office of the Southern District of New York in Manhattan, New York City

https://www.reuters.com/business/finance/germanys-allianz-its-us-funds-troubles-2022-05-17/

Germany's Allianz and its U.S. funds troubles

Reporting by Tom Sims ... Editing by Tomasz Janowski

May 17, 2022, 9:28 AM EDT

FRANKFURT, May 17 (Reuters) - Germany's Allianz (ALVG.DE) has agreed to pay about $6 billion and its U.S. asset management unit will plead guilty to fraud after a group of its multibillion investment funds collapsed amid market turmoil triggered by the coronavirus pandemic in 2020. read more

Here is timeline of key events in the saga, based on court documents, corporate disclosures, archived websites, public statements, and minutes of investor meetings:

2005

Allianz's U.S. asset management arm establishes the so-called Structured Alpha funds under manager Greg Tournant.

2007

Arkansas' pension fund for retired teachers - which would later be the first to sue Allianz over its investments in the funds - owns $19.4 million in Allianz stock, its fourth-largest holding in a foreign company.

2008

The Arkansas' pension fund makes an initial investment in Allianz's Structured Alpha funds.

2013-2016

Arkansas decides to build up its investment in the Allianz funds. The funds also attracted pension funds that served labourers in Alaska and subway workers in New York.

2016

Marketing material describes the funds as 'a tested & proven solution' and 'consistently above target'. They are marketed as 'a confident strategy with an insurance spirit'.

2019

Arkansas' Structured Alpha holdings reach a market value of $1.6 billion at the end of 2019, a significant portion of the $18.3 billion fund.

2020

January - Global stock markets plunge amid fears of the spreading coronavirus.

Feb. 3 - Mohamed El-Erian, Chief Economic Advisor at Allianz, warns CNBC viewers not 'to buy the dip' because the coronavirus crisis was without precedent.

March 13 - The investment consultant Aon warns Structured Alpha investors in a 'flash report' that it put the Structured Alpha funds on review.

March 25 - Allianz announces the liquidation of two hard-hit funds. Investors are also told chief fund manager Tournant had been ill for weeks, according to lawsuits.

March 27 - Allianz says it remains committed to the fund franchise and 'the remaining funds are now well positioned', but Aon issues another report recommending a 'sell'.

March 31 - One of the funds held by Arkansas loses 78% in the first quarter, compared to a 22% drop of its benchmark.

April 6 - The Arkansas fund's board votes to exit the Allianz funds and park the proceeds with BlackRock.

June 30 - The Arkansas fund's board votes to sue Allianz.

July 20 - Arkansas' suit is filed with the U.S. Southern District of New York claiming $774 million in losses.

July 21 Allianz publishes a paper saying that 'losses were not the result of any failure in the portfolio's investment strategy or risk management processes'. It has since been removed from the web.

Aug. 4 - Allianz discloses that the SEC is investigating.

September - Numerous other investors had by this point filed suits similar to Arkansas', and more followed.

2021

May - The U.S. Department of Justice approaches Allianz for information on the funds.

Aug. 1 Allianz publicly discloses the DOJ investigation and says it could take a financial hit. read more

Aug. 2 - Allianz shares drop 7.8%. read more

Aug. 7 Oliver Baete, Allianz chief executive officer describes a 'horrible week' and concedes 'not everything was perfect in the fund management.' read more

Sept. 10 - Reuters reports that the DOJ was looking at possible misconduct by fund managers and misrepresentation of risk to investors. read more

2022

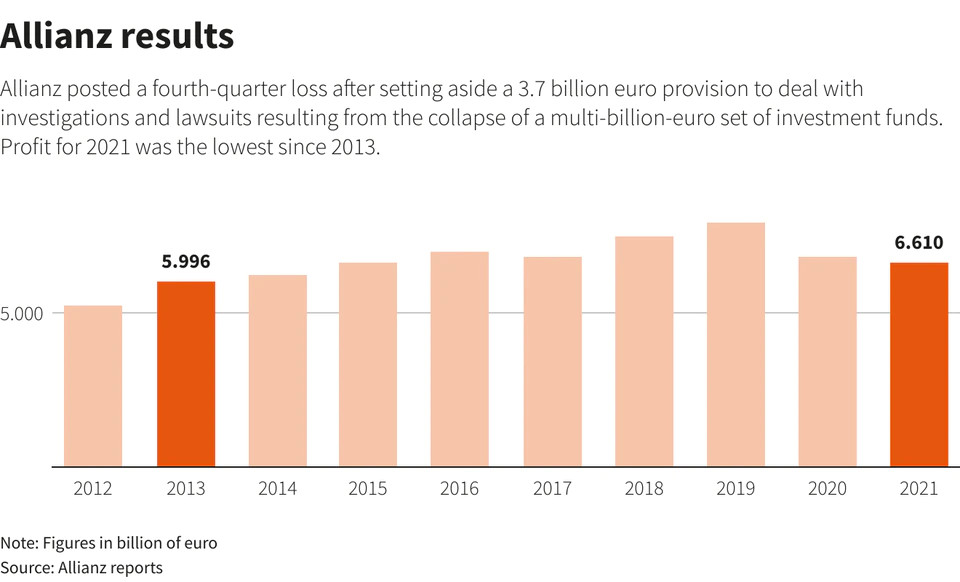

Feb. 17 - Allianz says it will set aside 3.7 billion euros ($3.90 billion) to deal with investigations and lawsuits. Reports 2021 profit was the lowest since 2013. read more

Feb. 18 - Allianz announces bonus cuts for its CEO and board, and a settlement with a 'vast majority' of investors. read more

Feb. 28 - A number of big investors file to end their lawsuits. read more

March 3 - Arkansas drops its lawsuit after settling for $642 million, according to a court document and board meeting minutes. read more

March 4 - Allianz's annual report discloses that Allianz Chief Executive Oliver Baete earned 9% more in 2021 despite a cut in his bonus for the funds saga.

May 11 - Allianz sets aside another 1.9 billion euros to settle litigation and any fines from U.S. regulators. nL5N2X327P]

MAY 17 - The DOJ announces Allianz has agreed to pay about $6 billion and its U.S. asset management unit will plead guilty to fraud. read more

($1 = 0.9496 euros)

Reporting by Tom Sims Editing by Tomasz Janowski

Our Standards: The Thomson Reuters Trust Principles.

The Allianz Global Investor headquarters in Frankfurt ... Allianz Global Investors logo is pictured at the company's headquarters in Frankfurt, Germany August 16, 2021. REUTERS/Tilman Blasshofer

Apologetic CEO says Allianz to cut bonuses after trading debacle

Reporting by Tom Sims and Alexander Hübner ... Editing by Jason Neely and Mark Potter

February 18, 2022, 2:21 PM EST

FRANKFURT, Feb 18 (Reuters) - Allianz announced on Friday big bonus cuts for its CEO and board, and a settlement with a 'vast majority' of investors, as it braces for the outcome of U.S. regulatory investigations into a multibillion-dollar trading debacle at its funds arm.

The collapse of a $15 billion set of investment funds during the pandemic market turmoil in early 2020 has cast a shadow over Germany's most valuable financial firm and one of the world's largest asset managers.

A 3.7 billion euro ($4.2 billion) provision announced on Thursday to deal with a slew of investor lawsuits goes some way to resolving the issue, but investigations by the U.S. Department of Justice and Securities and Exchange Commission are ongoing. The provision was the largest ever for Allianz (ALVG.DE), which said further costs were likely.

The issue has worried Allianz's top shareholders and harmed its reputation with pension funds that provide a source of business for one of Germany's best known brands.

Speaking at a news conference, a contrite CEO Oliver Baete apologised for investor losses and promised a 'significant impact' on compensation for himself and all board members for the past year.

'We want to demonstrate we are taking this matter extremely seriously and we regret really the losses,' he said, declining to quantify the cut.

Baete's pay package in 2020 totalled 6.39 million euros, and the entire board's was 32 million euros.

Baete also said the German insurer and asset manager had settled U.S. lawsuits with the 'vast majority of investors,' without giving details of the agreement.

But the fallout continues, and some investors remain cautious.

Reiner Kloecker, a fund manager with Union Investment, one of Allianz's largest shareholders, said the provision was a step in the right direction, but warned significant additional losses would mean 'management's credibility would suffer again.'

The issue centres around Allianz funds that used complex options strategies to generate returns but racked up massive losses when the spread of COVID-19 triggered wild stock market swings in February and March 2020.

Allianz, with 2.6 trillion euros of assets under management, said on Thursday the provision plunged it to a fourth quarter loss. Its 2021 profit was the lowest since 2013. read more

Allianz results ... Reuters Graphics

Investors in the so-called Structured Alpha set of funds have claimed some $6 billion in damages from the losses in cases filed in the United States.

The set of funds catered in particular to normally conservative U.S. pension funds, from those for labourers in Alaska to teachers in Arkansas to subway workers in New York.

After the pandemic sent markets into a tailspin early in 2020, the Allianz funds plummeted in value, in some cases by 80% or more. Investors in their lawsuits alleged Allianz strayed from its stated strategy.

Baete declined to specify which investors had settled.

Allianz shares were down 3.7% at 1445 GMT.

Ingo Speich, head of sustainability and corporate governance at Deka, a top Allianz investor who once called the issue a 'massive setback' for the company, expressed some relief.

He said the amount and timing of the provision were a positive for Allianz and investors.

($1 = 0.8794 euros)

Reporting by Tom Sims Editing by Jason Neely and Mark Potter

Our Standards: The Thomson Reuters Trust Principles.

Tom Sims ... Thomson Reuters

Covers German finance with a focus on big banks, insurance companies, regulation and financial crime, previous experience at the Wall Street Journal and New York Times in Europe and Asia.