Date: 2026-01-17 Page is: DBtxt003.php txt00022394

ENERGY

FINANCIALIZATION

Trade secrets: oil majors keep quiet on a key profit driver ...

Shell, Total and BP have singled out their trading divisions

for praise but won’t say how much money they make

FINANCIALIZATION

Trade secrets: oil majors keep quiet on a key profit driver ...

Shell, Total and BP have singled out their trading divisions

for praise but won’t say how much money they make

© FT montage/Bloomberg

Burgess COMMENTARY

The behavior of 'big business' has been irresponsible for most of my adult lifetime. On balance it can be considered that big business has done more good than bad over the past 50 years, but compared to what could have been done, their performance has been poor ... perhaps even very bad.

While there has been a substantial growth in rules and regulations promulgated by government, the effectiveness of most of these rules and regulations leave much to be desired.

As the size of companies increase, and as the complexity increases as well, the rules and regulations related to public information about the entities becomes more and more ineffective.

In a good number of cases, companies or industries have laws that actually ban the collection of information about certain companies' activities. For example, I believe it is illegal in some states to take photographs near company facilities even though it is apparent that their effluent is polluting local streams.

A common tactic is to combine good and bad to generate a 'net' result. Progress to 'net-zero' is one such example. In many cases the compuation of net-zero has one component that is bad for sure and another component that is good maybe. This may look good when combined on paper, but when it is assessed in reality it is awful.

Though not specific to pollution and climate change, the use of GDP as a metric of economic performance is utterly stupid. Essential, GDP measures all activity without differentiating at all between activity that is delivering bad and activity that is delivering good. Bad and good are added together ... which is nonsensical, but has been done this way for decades. Kuznets ... and I think Keynes as well ... wanted the metric to be cleaned up many decades ago, but it has never been done. In my own modest way I tried to get this matter addressed by the Congessional Budget Office back in the 1980s but had little impact. It was pointed out that a consistent way of preparing a metric was important, and change would therefore be difficult and not recommended !!!!!!!!!

It is perhaps worth noting that in financial reporting profit is a useful piece of information. However, to put the profit in perspective there is also information about revenue and costs which together result in profit. Furthermore, the change in assets and liabilities during a reporting period also reflects profit and provides more information about performance.

Nearly every activity is done to produce 'good' but in the process usually also produces more or less 'bad'. A better world results when activities are creating more good faster than bad ... but it is almost always happening together in some way.

The following article raises another issue ... how can performance be understood in a meaningful way when there are many different activities being conducted within one big complex organization.I have been concerned about the 'financialization' of the business sector because it enables profits to be created within an organization while the net value add for the broader socio-enviro-economic system is zero or negative. This has been 'taught' at prestigious elite academic institutions like the Harvard Business School and Wharton at the University of Pennsyvania without putting it in the broader context of the whole system.

There is a role for market mechanisms but when market profits are the sole goal, they have no tangible real purpose.

Peter Burgess

More commentary by Peter Burgess (January 2023)

The above remarks were written early in 2022 before the full impact of Putin's invasion of Ukraine further added to the profits of energy companies.

One thing that has become very clear in the last few years is that the modern global economic system is very profitable and that this profitability has been achieved at the expense of resilience and flexibility.

China is part of most international supply chains, and Covid has had a substantial impact on all sorts of production in China, much of which is essential for production further along the supply chains. Many companies now rely on parts from China, and without them they cannot produce.

Russia is a major supplier of energy (oil and gas) to many countries and especially countries in Europe. Germany is the most dependent on Russian energy and they are having to take exceptional measures to handle the almost total supply disruption from Russia associated with Russia's invasion of Ukraine.

Almost everything that is consumed in the modern world has a huge component of 'embedded energy'. If the price of energy goes up, then the cost of production for almost everything goes up as well. In order for companies to maintain profits, they are obliged to put prices up for their consumers. Most people understand this and generally accept this as a reasonable business behavior.

It is becoming more and more apparent that there are many businesses that are taking advantage of the many supply chain disruptions to go way beyond simply trying to maintain profit margins, but are actively working on improving profit margins ... taking advantage of a variety of supply chain disruptions as well as actively creating margin improvement opportunities. There have been reports of critical suppliers of, for example, poultry and eggs who have destroyed their birds to aggravate shortages. There are a growing number of examples where packaging is being reworked to make the package look much the same, but in fact the new package only contains a lesser amount of product. The package price may stay the same, but the unit cost of the product inside the package has gone up.

The political process especially in the United States does not help very much. Meaningful regulation of business has been very difficult in the US for a very long time, going back to the Reagan administration. Reagan set the stage for the 'financialization' of the US economy that has been very good for 'owners' but not so good for everyone else. Worse, there has been little clear understanding of what this means for the critical changes that are needed in order to have a better country and a better world.

Reagan engaged in misinformation and did it well as the 'great communicator' ... but the idea of political misinformation has reached a whole new level in the decades since.

But it is worse than this. There are several generations of Americans who have gone through a lot of education without learning very much, and especially, the ability to sort through the many strands of information that now flow in digital form all day and every day on mobile devices that are never turned off.

It is not going to be easy to change the current state of knowledge and how essential change can become possible.

As I see it, one of the available tools is to make it possible for there to be substantially more transparency about the operations of all the big corporate entities and for them to be taxed much more aggresively when (1) their profits are very high related to capital employed; (2) their profits are very high while their social impacts are low or negative; and (3) their profits are high and their environmental impact will require governmental and international remediation.

A big proportion of the US population has been brain-washed for decades that Federal Taxes in the USA are very high. I did 'grunt' work on tax returns during my accountancy training in London during the 1960s. Ar the time high income individuals were taxed at a marginal tax rate of over 90% and corporate excess profits taxes were in the same range. The US has had low taxation for decades and the lack of 'public investment' explains much of the annoyance a lot of people have for their government at the present time.

Maybe change is coming ... the need for change is clear ... and just maybe President Biden and his administration during the past two years may have actually started the change that is so much needed.

Peter Burgess

BP, Shell and Total have singled out their trading divisions for praise but won’t say how much money they make

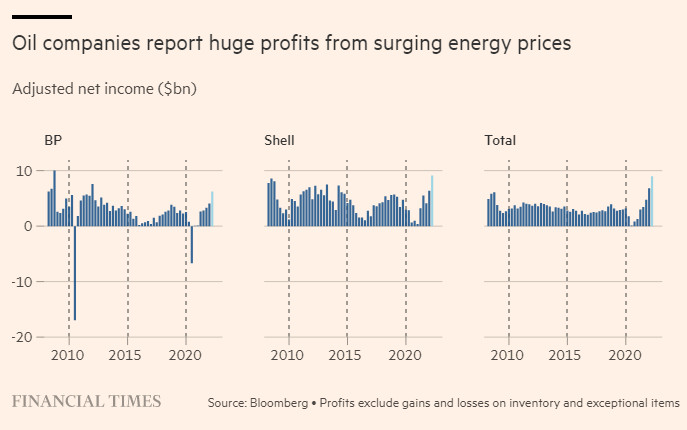

As Europe’s biggest energy companies reported record profits for the first three months of the year, each singled out different parts of their business for praise. But there was one constant: trading.

BP’s highest quarterly earnings since 2008 were driven by “exceptional oil and gas trading”. TotalEnergies noted the “outperformance” of its oil trading activities and the “very good performance” of its gas and electricity dealers. At Shell, “higher trading and optimisation margins for gas and power, due to exceptional market environment”, resulted in the highest quarterly profit on record.

But beyond these qualitative statements none of the three provided any further breakdown of the financial performance of their various trading units or their contribution to overall group profits.

The companies say the traders are integrated into different parts of the business, making it difficult to strip out their performance. BP’s oil trading profits, for example, are attributed to the customers and products division, where the unit that refines and trades oil reported earnings before interest, taxes, depreciation and amortisation of $2.03bn.

The trading teams, however, are not only placing the company’s production with customers. They also buy and sell third-party volumes of oil, gas and other commodities for profit, making them significant revenue generators in their own right.

“BP, Shell and Total have an edge and it is unique to these three companies,” said Oswald Clint at Bernstein, adding that the US oil majors and other international oil companies had struggled to replicate that kind of trading capability.

The last time BP published a breakdown of trading revenue in its annual results was in 2005, when its profits from oil, gas and power dealing reached $2.97bn.

By comparing the delta between the revenues BP would have generated from selling its own production with the reported earnings for its different divisions, Clint calculates BP could have made as much as $1.2bn from gas trading and $400mn from oil trading in the first quarter.

Such returns can make traders among an oil company’s best paid staff. BP’s lead oil trader for West Africa was paid a $3.75mn bonus after his team of four traders made a profit of $72mn in 2016, according to court filings from a current employment tribunal.

Shell, the world’s largest trader of liquefied natural gas, produced 8mn tonnes of the fuel in the first three months of this year but sold 18.3mn tonnes. Prices for LNG cargoes have soared as European efforts to reduce dependence on piped gas from Russia have increased competition.

Chief financial officer Sinead Gorman was reluctant to disclose exactly how much its LNG traders had made. “Our trading results were quite strong in liquefied natural gas, as one would expect with the market,” she said after its earnings were published last week.

Shell’s chief financial officer Sinead Gorman © Shell

“We’ve also seen very strong trading results with respect to our refining and products,” she said, adding that the $500mn in earnings generated by renewables and energy solutions was supported by “the strong ability of our trading portfolio being able to bring gas into Europe where it is needed most.”

Despite the common perception that commodity traders profit by taking bets on price, the companies generally insist they do not take speculative positions.

“It’s certainly not luck, because if we rely on luck to run the business that means we can have bad luck as well,” BP chief executive Bernard Looney told the Financial Times. “The trading business’s first job is to make sure that molecules flow around the world and one of the things that’s been hugely challenging for the energy system today is the redirection of energy flows.”

Upheaval resulting from the war in Ukraine and the growing isolation of Russia, the world’s biggest energy exporter, has stoked unprecedented volatility in commodity markets that has highlighted the need for the companies that keep commodities flowing, Looney said. “The role for a company like BP has never been clearer.”

It is not just the oil majors that are making bumper profits from trading. Glencore said last month its trading business was set for another strong year as it cashes in on the wild price swings and supply disruptions caused by the invasion of Ukraine.

Based on its performance in the first three months of the year, the FTSE 100 company expects earnings from its marketing unit to be “comfortably” above the top end of its guidance range of $2.2bn-$3.2bn.

If achieved, that would make it the third straight year the unit, a big trader of industrial metals and coal as well as oil, has exceeded its forecast profits.

Glencore’s performance suggests the big privately owned commodity traders — a group that includes Vitol, Trafigura, Mercuria and Gunvor — are also likely to score big profits this year. Speaking at the FT Commodities Global Summit in March, Trafigura executive chair Jeremy Weir said 2022 had “the potential to be a significant year again”.

Some of the privately owned traders provide greater transparency on their trading activities than either Shell or BP. These details come in the reports they publish for holders of their bonds, which are publicly listed. Gunvor’s recently published annual update weighed in at 84 pages.

But trading is not without risk. As the middlemen of the global economy, linking the suppliers of raw materials — often in developing countries — with consumers, their activities have drawn scrutiny from international prosecutors. Vitol and Gunvor have both settled oil trading corruption cases in the past two years, while Trafigura is facing a probe in Brazil and Glencore is under investigation in the UK, US and Brazil.

In March, more than two weeks into the war in Ukraine, Shell chief executive Ben van Beurden had to apologise after Shell traders acquired a heavily discounted cargo of Russian crude to supply one of its refineries. Like most of its peers, the company has now said it will not trade any more Russian products and will not renew long-term supply contracts once they expire.

Commodity analysts are predicting continued volatility as changing geopolitics reshape trade flows, and the energy system shifts to include more renewable power. In that new world, getting trading right and learning how to communicate that success to investors will be increasingly important, particularly as BP, Shell and Total build out their renewables businesses, said Bernstein’s Clint.

“It’s unique, it’s an edge and it deserves to be better valued,” he said. “The big question I have is, can they translate those skills, built up over the last two decades trading molecules, into trading electrons?”