Date: 2026-02-19 Page is: DBtxt003.php L0900-MBF-NYSE-SandP500-Chart-1950-2016

US ECONOMY

STOCK MARKET ... NYSE

S&P 500

STOCK MARKET ... NYSE

S&P 500

Peter Burgess COMMENTARY

In my view financial 'Markets' have an outsize role in modern economic analysis, a result of what I refer to as the 'financialization' of the modern world. I do not subscribe to the idea that if it is profitable it must be good, nor do I subscribe to the idea that it is only profit and return to owners that matters in respect of business decision making.

Clearly environmental and social issues should be taken into consideration as well. There is progress in this regard, and it is accelerating (2022) but there is still a long way to go before such measures have the same power as the profit measure.

When it comes to stock market valuation, I would like to see not only the profit and the profit trend, but also something about the return on capital employed and its trend. It is disturbing to me how many companies are choosing to use 'stock buy-backs' as a way to improve the reported return on investment, a financial measure, while the actual physical plant in use has no measure. To my mind, this is an unacceptable gaming of the system and hides important realities. This is of particular importance as more and more of the modern economy is founded on 'digital systems' that have very different cost profiles over time than heavy machinery and physical infrastructure.

If this were to be coupled with a more thoughtful way of computing corporate taxation, there could be a sea-change in the behavior of investors. My thinking is that the difference between return on investment and the return on capital employed should be taken into consideration in some way.

Peter Burgess

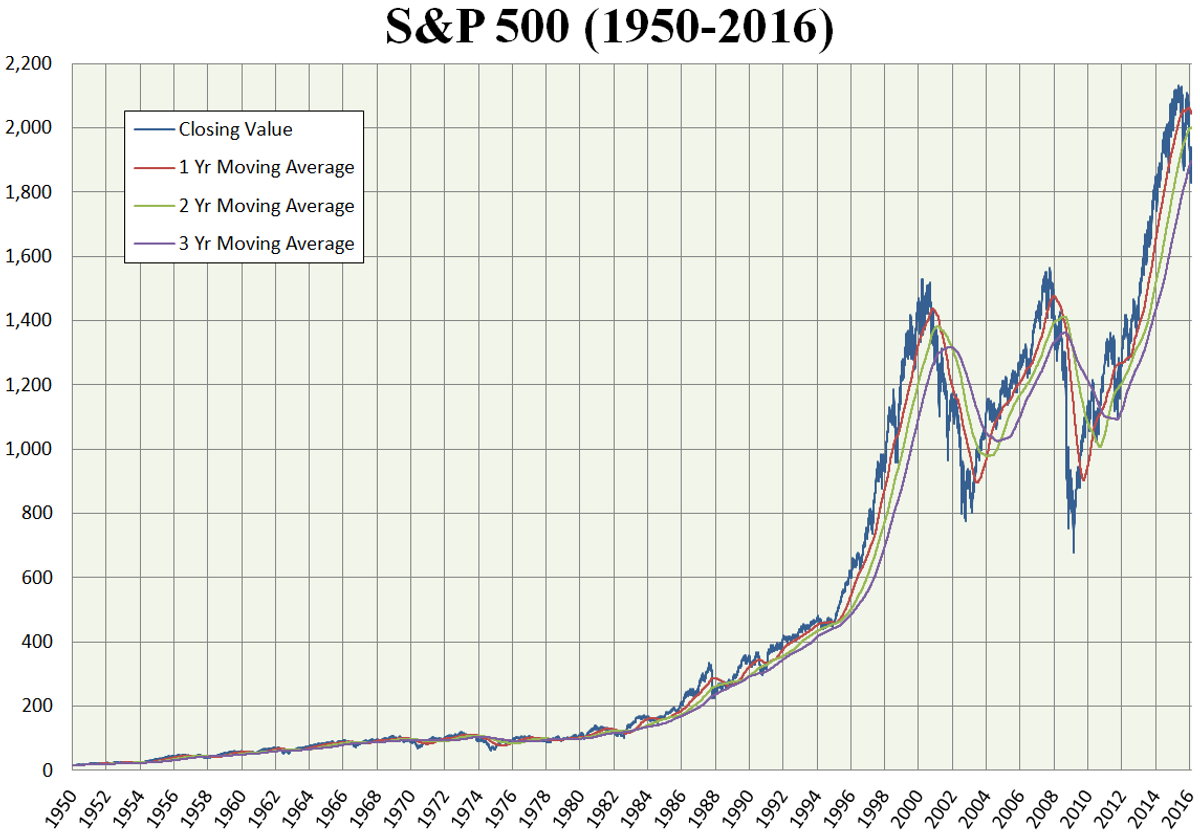

- Stock markets have gone up. When stock market indices like the Dow, S&P 500 and other indeces go up, the general public, journalists and politicians consider it to be good

- The increase was relatively modest from the end of WWII until the 1970s and 80s. From the early 90s to the present time the market price increases have been spectacular.

- But why?

- From the end of WWII to around 1980 the benefits of prouctivity were shared between investors and workers in a reasonably equitable manner. After 1980 the share of profits enabled by massive improvements in productivity were allocated almost totally to owners and very little to workers.

- Almost everything was done in this period to enable profit and wealth accumulation by owners, and at the same time, in the USA, there was a serious weakening of workers' rights to collective bargaining and decent wages. This was accompanied by many examples of disruption where profit was realized at the expense of those that were made redundant.

- A measure of economic profitability ... but nothing else