Date: 2026-01-22 Page is: DBtxt003.php L0700-CC-ACCTGforACTIVITIES

|

CORE CONCEPTS

ACCOUNTING FOR ACTIVITIES Not only the financial impacts, but ALL the impacts |

|

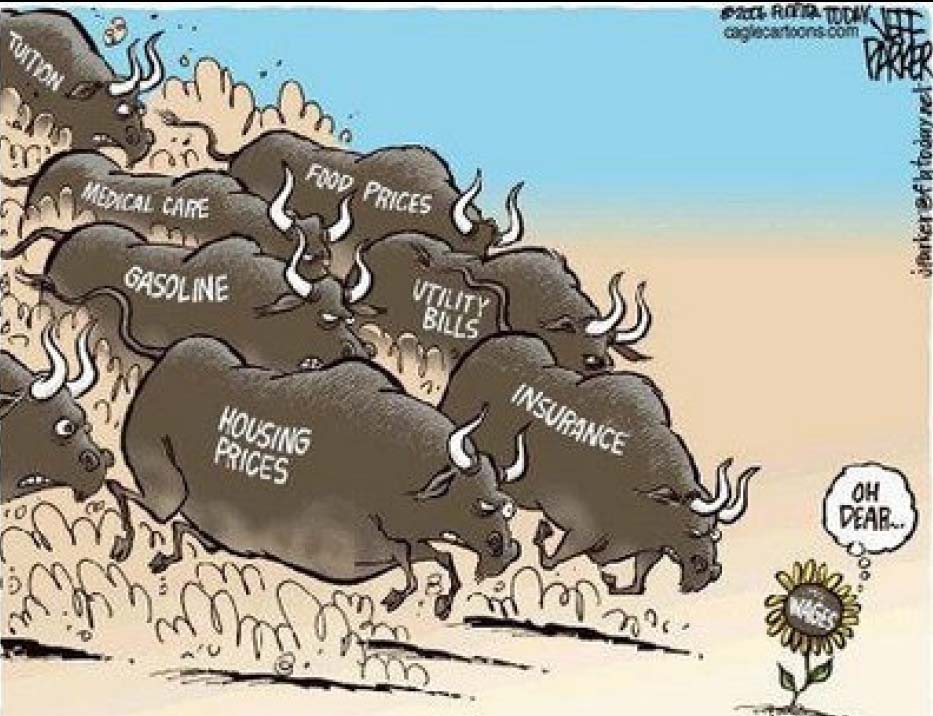

ALL THESE RELATE TO MONEY WEALTH & MONETIZED VALUE

Money / Profit growth / GDP growth / Stock Prices / Cost push inflation / Wages chasing prices

|

| . |

|

INTRODUCTION / AMERICAN EXCEPTIONALISM

President Ronald Reagan is often credited with having crystallized the idea of American exceptionalism. Others have different views of American exceptionalism. The growth of financial wealth in the United States over the past 200 years has been enormous, but really just what one would have expected with

The policy options chosen by American leadership over the past 40 years or more, have been questionable. There has been massive growth in financial capital, but social capital improvement has been negligible and natural capital severely degraded both at the global level and locally. | |

| https://en.wikipedia.org/wiki/American_exceptionalism | Open Wikipedia page |

| . |

|

FINANCIAL IMPACTS

Financial accounting has been around for a very long time. Paper accounting records exist that are 800 years old. The modern field was established by the Italian mathematician Luca Pacioli in 1494. It is the language of business. The double entry concept together with the classification of accounts between the balance sheet and the operating accounts or profit and loss accounts make for more accuracy in the accounting. Financial accounting is very powerful and is the foundation for all management information systems. In conventional financial accounting the focus is on the reporting entity, with everything that is outside the 'reporting boundary, being ignored. In the modern world these 'externalities' are becoming more and more important. While there is more and more conversation about making modern accounting more responsive to reporting externalities, no effective system for doing it has yet been articulated. OTHER ECONOMIC IMPACTS Conventional accounting does more than merely compute the increase in financial capital, but has also established clear conventions about how other assets should be accounted for in the accounts and reports. Physical assets like buildings. machinery and equipment, vehicles, etc are accounted for at cost when they are purchased, and then there are charges for depreciation through the life of the asset so that at the end of the asset life the net asset value in the accounts stands at zero. Other assets such as IP ... intellectual property ... may be purchased for money and included in the accounts at the amount paid. All these assets have the common feature that the purchase transaction has been made in money. | |

| . | |

| . |

|

IMPACTS ON SOCIAL CAPITAL

While conventional accounting may be the language of business, it is time for there to be an equally rigorous language to describe the progress and performance of society ... social capital at the individual level (human capital) and social capital in various forms of groupings (relationship capital). The transactions around social capital are not usually made in money, but thought there may be no money price, that does not mean that the transactions has no value. Economics has not given us a measure for important things that do not transact with money. TVM is introducing a Unit of Account to measure transactions that have an impact on Social Capital. | |

| . | |

| . |

|

IMPACTS ON NATURAL CAPITAL

Similarly for Natural Capital. It is time for there to be a rigorous language to describe the progress and performance of every aspect of natural capital ... the depletion of resources, the degradation of the environment. the loss of biodiversity and the destabilization of all sorts of ecosystems. The impact on natural capital has been totally ignored in the computation of corporate profits and the valuation of companies ... but that is in the process of changing. TVM is introducing a Unit of Account to measure transactions that have an impact on Natural Capital. | |

| . | Open PDF |