OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

GEOPOLITICS / ECONOMIC GLOBALIZATION

WHAT IS THE POSITION OF CHINA? Macron has left Europe dangerously exposed if China invades Taiwan ... Read this exclusive extract from our Economic Intelligence newsletter and sign up at the bottom of the article to get it every Tuesday Original article: https://www.telegraph.co.uk/business/2023/04/18/macron-has-left-europe-exposed-if-china-invades-taiwan/ Peter Burgess COMMENTARY Peter Burgess | ||

|

Macron has left Europe dangerously exposed if China invades Taiwan

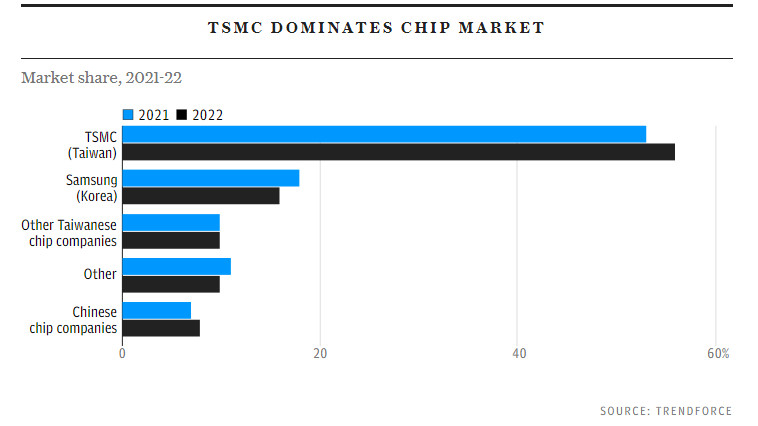

Read this exclusive extract from our Economic Intelligence newsletter and sign up at the bottom of the article to get it every Tuesday Written by Ambrose Evans-Pritchard 18 April 2023 • 3:25pm FILE - French President Emmanuel Macron, left, shakes hands with Chinese President Xi Jinping after meeting the press at the Great Hall of the People in Beijing, on April 6, 2023. In the weeks since Chinese leader Xi Jinping won a third five-year term as president, setting him on course to remain in power for life, leaders and diplomats from around the world have beaten a path to his door. None more so than those from Europe. (AP Photo/Ng Han Guan, Pool, File) French President Emmanuel Macron received criticism for his recent trip to China CREDIT: Ng Han Guan/AP If China invaded Taiwan and succeeded in capturing the world’s semiconductor hub without destroying it in the process, the stolen manufacturing prize would be almost completely useless. It would not help Xi Jinping’s Communist regime break out of the tightening chip blockade imposed by the United States and the global democratic alliance, and would certainly not help China achieve superpower supremacy in artificial intelligence, 5G telecommunications, or smart weaponry. What it would do is to bring large parts of the global economy to a shuddering halt within two months as existing inventories are depleted. It would be the technological equivalent of a sudden stop in global oil supply from Saudi Arabia, Kuwait, and Russia all at the same time, and chip-dependent Europe would find itself stripped bare with no strategic agency whatsoever. If Emmanuel Macron thinks that Taiwan is not the EU’s problem, or that Europe could somehow negotiate a separate post-invasion deal with Xi Jinping to keep chips flowing, he might do well to read Chip War: The Fight For The World’s Most Critical Technology by economic historian Chris Miller. Taiwan accounts for 63pc of the global foundry market. It manufactures 37pc of all logic chips, and 92pc of the most advanced semiconductor chips under 10 nanometers (nm), which are what matter for the global tech race. The lion’s share of this is produced by Taiwan Semiconductor Manufacturing Company (TSMC) in four giant foundries - or Gigafabs - on the west coast of the island. These happen to run straight down the earthquake line of the Chelungpu Fault, one of the most dangerous tectonic strips on the planet.

However, Taiwan is only a cog in the global supply chain for chips, albeit a sophisticated one. TSMC rose to its current extraordinary position precisely because it found a particular niche in the US ecosystem. It essentially makes chips designed by others, using equipment made by others, and relying on a constant flow of critical materials from other countries. TSMC was founded in 1987 by Morris Chang, a well-born US refugee from the Chinese revolution who cut his teeth at Texas Instruments. His insight was to spot early that it was no longer necessary to manufacture chips where they were designed, and that there would be a huge global market for pure ‘fabs’ that did nothing else other than make chips for others – above all for Silicon Valley. This created a symbiotic dependency on the US that continues to this day. When Washington imposed sanctions on China’s Huawei, it quietly followed suit, even though a fifth of TSMC’s global sales were by then in China. TSMC is still allowed to make chips for Huawei’s 4G mobile network – nobody cares about that – but not for 5G and beyond, which will set the global digital infrastructure of the 21st Century. TSMC is a textbook study in successful industrial policy. The Taiwanese state bet the farm on the venture. It took a 48pc equity stake, strong-armed the country’s richest families into buying blocks of shares, educated vast numbers of technical graduates, and turbo-charged exports through a suppressed currency. But at the end of the day, Silicon Valley is still the global brain of advanced circuitry. It dominates chip design. The US retains ultimate control over the key choke points, either directly or through allies that depend on the US security umbrella. “Nearly every chip in the world uses software from at least one of three US-based companies, Cadence, Synopsys, and Mentor,” said Prof Miller. Just one company in the Netherlands, ASML, makes the extreme ultraviolet lithography machines (costing $150m each) that are needed to make advanced processors below 7 nanometers (nm). This in turn relies on irreplaceable DUV light sources produced by its Cymer subsidiary in San Diego. China makes its own chips, of course, but it is a generation behind, and the gap is not closing despite three failed “Manhattan Projects”. It still imports $430bn a year of micro-processors, more than its combined imports of oil and grain. Xi Jinping’s grand plan for hi-tech mastery – Made in China 2025 – was supposed to raise chip self-sufficiency to 70pc by mid-decade. It is not going to happen. China is still stuck at 16pc. It is nowhere close to the 3nm to 5nm miniaturisation needed to keep up with US weapons systems. Taiwan has a near monopoly on this.

Robert O’Brien, Donald Trump’s former national security adviser, said Washington will not allow China to become the “Opec of silicon chips” overnight by seizing TSMC. “The US and its allies are never going to let those factories fall into Chinese hands,' he said, evoking Churchill’s decision to sink the French fleet at Mers-el-Kébir in 1940. But Mr O’Brien has misunderstood the nature of the threat. “Nobody can control TSMC by force. You will render the TSMC factory inoperable,” said Mark Liu, the company’s chief executive. “Because this is such sophisticated manufacturing, it depends on real-time connection with the outside world, with Europe, with Japan, with the US, from materials to chemicals, to spare parts, to engineering software, and diagnosis,” he told CNN last year. The nightmare is not that China gains chip supremacy at a stroke, it is that nobody gets Taiwan’s chips, sending prices through the roof and causing a heart attack for the whole global economy. We had a mild taste of this during the pandemic. The closure of Taiwan would be orders of magnitude more serious. “Chips are absolutely critical to human existence. Everything digital runs on a semiconductor chip; it’s in all of our devices,” said Pat Gelsinger, head of Intel. The US has subcontracted so much of its chip manufacturing to cheaper ‘fabs’ in East Asia that its own output has dropped to 12pc of world share. But it still has Micron and Texas Instruments. Above all it has Intel, aiming to challenge TSMC at the 3mn frontier, and investing in two cutting edge fabs in Ohio with the help of Joe Biden’s $52bn Chips Act. TSMC itself has been strong-armed by Washington into building two foundries in Arizona to make ultra-advanced chips at a cost of $40bn, even though cost of production is 50pc higher. It would take several years for the US to cover the shortfall if Taiwan were knocked out, but at least it is preparing and has the tech ecosystem to pull it off. Europe is more vulnerable. Its global share of semiconductor production has shrivelled to 8pc. Its share of advanced chips has dropped to zero. The EU has announced a €43bn Chips Act to reestablish digital ‘sovereignty’ and regain its lost capability at the cutting edge. The plan is to quadruple European chip output this decade, but only €3.3bn of EU funding exists so far, and this comes from cannibalising Digital Europe and EU science. Troops prepare for the arrival of Chinese President Xi Jinping (unseen) at the People's Liberation Army (PLA) Hong Kong Garrison in one of events marking the 20th anniversary of the city's handover from British to Chinese rule, in Hong Kong, China June 30, 2017. REUTERS/Damir Sagolj Xi Jinping has revamped the Chinese army during his time as president CREDIT: DAMIR SAGOLJ/REUTERS “We calculate that they would need €500bn,” says Kurt Sievers, from the Dutch chip-maker NXP. As matters stand, Europe has no plausible way of ensuring its own chip supply in a prolonged crisis. China is unlikely to launch a full-scale invasion of Taiwan after observing Putin’s humiliation in Ukraine, even if “use of force” is openly advocated in Beijing’s Defence White Paper. The latest Chinese manoeuvres around the island instead simulated a partial maritime and air blockade. This form of coercion could be a more insidious way of forcing Taiwan to step up advanced chip supply to China, and forcing the rest of the world to acquiesce in exchange for continued supply. Whether China feels tempted to prosecute such a strategy depends on whether it thinks the West will hold together or splinter into competing interests. Emmanuel Macron has just signalled all too clearly that it would splinter, and he purported to speak in the name of Europe, to the ecstatic delight of China’s wolf warrior press. He has therefore made it more likely that China will escalate. Norbert Röttgen from the German Bundestag said Mr Macron's free-lance amateurism has been a “PR coup for Xi and a foreign policy disaster for Europe.” There are many reasons to bridle at what Mr Macron has done. He appeared to cast the US as the primary driver of escalating tensions in East Asia; he more or less offered Taiwan’s democracy on a plate; and he indulged in theatrical anti-Americanism even as America rescues Europe from a catastrophe on its own doorstep. Above all, he seems not to have learned the lesson of failed deterrence against Putin’s regime. Either Mr Macron refuses to acknowledge that the autocracies are waging war against liberal democratic civilisation, or he thinks he can negotiate a separate opt-out for some notion in his head called Europe. I am not sure which is worse. This article is an extract from The Telegraph’s Economic Intelligence newsletter. Sign up here to get exclusive insight from two of the UK’s leading economic commentators – Ambrose Evans-Pritchard and Jeremy Warner – delivered direct to your inbox every Tuesday.

| The text being discussed is available at | https://www.telegraph.co.uk/business/2023/04/18/macron-has-left-europe-exposed-if-china-invades-taiwan/ and |