OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

THE US ECONOMY ... BANKING A PROBLEM

PAUL KRUGMAN It’s hard to know how this bank mess will play out. But there are clues.

Illustration by Sam Whitney/The New York Times; photograph by Tanarch/Getty Images Original article: Paul Krugman Opinion ... March 21st, 2023 Peter Burgess COMMENTARY Peter Burgess | ||

|

It’s hard to know how this bank mess will play out. But there are clues.

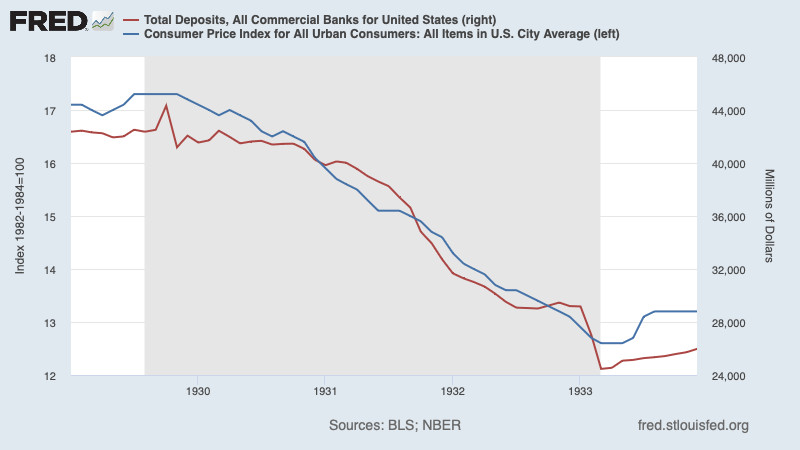

By Paul Krugman ... Opinion Columnist MARCH 21, 2023 I’m on vacation and trying to spend a few weeks not thinking about the usual stuff. But it turns out that I can’t stay completely out of the debate over the sudden wave of banking crises and their effect on the economic outlook. So as everyone knows, Silicon Valley Bank — not a huge institution, but an integral part of the tech industry’s financial ecosystem — has been taken over by the Federal Deposit Insurance Corporation after facing a classic bank run. Signature Bank soon followed; First Republic Bank is under severe pressure. Swiss authorities have arranged a takeover of Credit Suisse, a major bank, by its rival UBS. And everyone is wondering what other land mines may be about to go off. There will and should be many inquests into how and why these banks managed to get into so much trouble. In the case of S.V.B. it appears that regulators had known for some time that the bank was a problem case, but for some reason didn’t or couldn’t rein it in. But the more pressing question is forward-looking. How much does the banking mess change economic conditions? How much should it change economic policy? Some commentators — mainly, as far as I can tell, cryptocurrency enthusiasts — are issuing apocalyptic warnings about hyperinflation and the imminent collapse of the dollar. But that’s almost certainly the opposite of the truth. When depositors pull their money out of banks, the effect is disinflationary, even deflationary. That’s certainly what happened in the early years of the Great Depression:

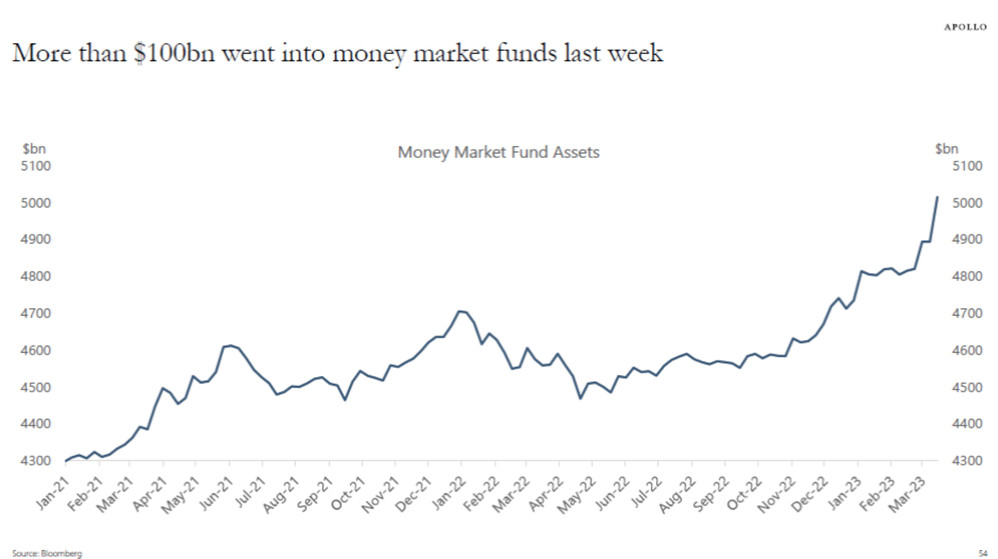

A lesson from the mother of banking crises: Bank runs are deflationary.FRED The savings-and-loan crisis of the 1980s wasn’t a Depression-level event, largely because depositors were generally insured, so they were made whole (at taxpayers’ immense expense) despite huge industry losses. Even so, the crisis may have curbed business lending, especially in the commercial real estate industry, contributing to the 1990-91 recession. And the financial crisis of 2008 — which was functionally a bank run even though the crisis centered on “shadow banks” rather than traditional depository institutions — was also disinflationary and helped bring on the worst economic slump since the Great Depression. So how does the current mess compare? It will definitely impose a drag on the economy. But how big a drag? And how much should it change policy, in particular the interest rate decisions of the Federal Reserve? The answer is simple: Nobody knows. Here’s what we do know: Depositors don’t seem to be demanding cash and putting it under their mattresses. They are, however, moving funds out of small and medium-size banks, to some extent into big banks, and to some extent into money market funds: Out of the banks, into the funds.Apollo Global Management Both types of institution are likely to do less business lending than the smaller banks now under pressure. Big banks are more tightly regulated than smaller banks, required to have more capital (the excess of assets over liabilities) and more liquidity (a higher proportion of their assets devoted to investments that can readily be converted into cash). Money market funds also face quite stringent liquidity requirements. Add in the likelihood that even banks that haven’t experienced a run on their deposits will become much more cautious, and we’re probably looking at a serious reduction in credit. In effect, banking turmoil will act a lot like a rate hike by the Fed.

But how big an effective rate hike? I’m seeing smart, well-informed people produce numbers that are all over the place. Goldman Sachs says we’ll see the equivalent of a rate hike of 0.25 to 0.5 percentage points; Torsten Slok of Apollo Global Management says 1.5 percentage points. I have no idea who’s right. However, the direction of the shock seems clear. I wrote a couple of weeks ago that the Fed is creeping its way through a dense data fog, trying to steer between the Scylla of inflation if it tightens too little and the Charybdis of recession if it tightens too much (or maybe it’s the other way around; input from Homer scholars is welcome). Well, the fog has gotten even thicker. But clearly the risk of recession has gone up and the risk of inflation has gone down. So it makes sense for the Fed to steer somewhat to the left. What this probably means in practice is that the Fed should pause its rate hikes until there’s more clarity about both the inflation picture and the effects of the banking mess — and it should be clear that that’s what it is doing. There doesn’t seem to be much danger that the Fed will lose its inflation-fighting credibility if it takes time to get its bearings. Inflation expectations are looking very well anchored:

Crypto bros aside, people aren’t expecting runaway inflation.Federal Reserve of New York Should the Fed go further and actually cut rates? Even though I’m generally a monetary dove, I wouldn’t call for an actual cut, at least just yet. Among other things, that might convey a sense of panic. And even though the wave of bank problems has shocked almost everyone, panic doesn’t seem like the right response. On the other hand, for the Fed to continue with rate hikes right now might send the opposite signal: a sense of cluelessness. This seems like a time to say, “Don’t just do something — stand there.” For what it’s worth — and these may be famous last words — I’m actually somewhat reassured by the way policymakers have been responding to the current wave of banking problems. Some of us remember bitter debates in 2008-09 about how to stabilize the financial system: The troubled institutions were complex and opaque, and nobody in power seemed willing to seize them so that they could be rescued without also bailing out shareholders. This time we’re talking about conventional banks that can be and have been seized by the F.D.I.C., protecting depositors without letting shareholders off the hook. The upshot is that so far, at least, this doesn’t look like a full-blown financial crisis. Stay tuned, though. The newsletter will be taking a quick break, returning on March 31. Quick Hits

| The text being discussed is available at | and |