Bridgewater Exits Ray Dalio Era With Hedge Fund Overhaul, Bets on AI and Job Cuts

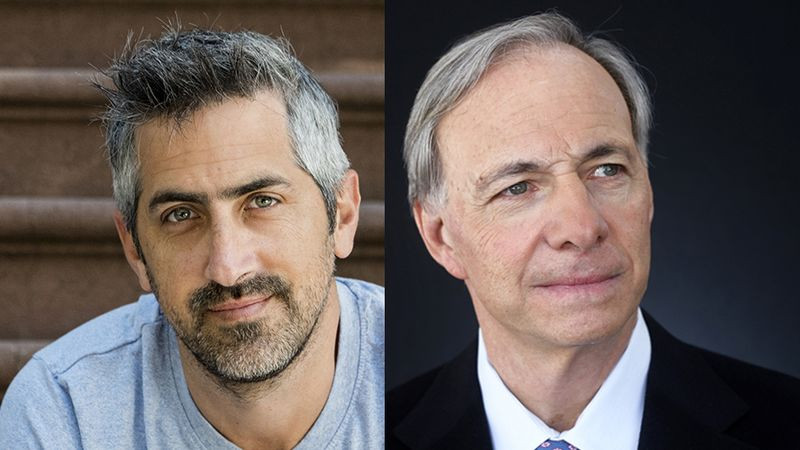

Written by Erik Schatzker @ErikSchatzker

March 1, 2023 at 10:02 AM EST ... Updated on March 1, 2023 at 11:25 AM EST

Bridgewater Associates was bound to be different once billionaire founder Ray Dalio no longer commanded the world’s largest hedge fund. Very different, it turns out.

- Flagship hedge fund strategy will be capped to boost returns

- Firm to cut 100 jobs, freeing up resources for new initiatives

- The Takeaways From Bridgewater’s Post-Dalio Overhaul

The overhaul began even before Dalio handed off control five months ago, with not-so-subtle tweaks to the infamously odd culture he nurtured. Now, the management team he left in charge, led by Chief Executive Officer Nir Bar Dea, is adopting an ambitious strategy to boost returns, increase profitability and develop new sources of revenue — in what amounts to the biggest shakeup in four decades.

Bridgewater is capping the size of its flagship funds, plowing more money and talent into artificial intelligence and machine learning, expanding in Asia and in equities and doubling down on sustainability. To pare costs and free up resources, it’s also embarking on a firm-wide reorganization over the next two weeks, eliminating about 100 jobs in a workforce of roughly 1,300.

“Just doing what we’ve been doing isn’t good enough,” Bar Dea, 41, said in an interview. “Evolve or die. That’s what’s happening here.”

This new direction for the $138 billion firm is partly the product of a leadership transition that began in 2020, when several years of underperformance and losses in the first year of the pandemic drove Bridgewater to establish an oversight committee for its investment decisions. Since then, the flagship Pure Alpha strategy has rebounded with a net annualized return of 10%, though many of its peers in so-called macro investing have fared far better.

The shifts also reflect an evolving landscape in the hedge fund industry, including the rise of multi-strategy behemoths such as Citadel and Millennium Management, the boom in sustainable finance and the emergence of technologies such as generative AI and quantum computing.

Capping Flagship

For years, the Westport, Connecticut-based firm defied the conventional wisdom that individual hedge fund strategies had natural size constraints. Pure Alpha and its long-only counterpart All Weather kept hoovering up assets, and by 2011 Bridgewater was managing a then-unprecedented $100 billion.

But as interest rates flattened, so did Bridgewater’s performance.

Now, in a reversal, the firm is restricting access to Pure Alpha with the hope that it can generate a higher risk-adjusted return, or Sharpe ratio, on a smaller pool of money. The strategy will be capped at 20% to 30% below its maximum size, which peaked at about $100 billion over the past decade.

“Our values as a firm are pervasive excellence and always trying to outperform,” Bar Dea said. “We want to make sure our flagship product is set up to deliver that.”

Bridgewater is betting that by limiting Pure Alpha’s capacity it can capture some of those opportunities in other strategies and redeploy resources for new initiatives. Of course, there’s no guarantee it’ll succeed; hedge fund history is strewn with foiled ambitions.

‘Stay Relevant’

An entrepreneur and former officer in the Israeli military, Bar Dea joined Bridgewater in 2015 as a relative unknown in the investing world. Yet he quickly climbed the ranks to become co-CEO in January 2022. Together with colleagues such as Co-Chief Investment Officer Greg Jensen, Bar Dea longed to modernize the firm and recast its quirky culture. But Dalio, 73, kept postponing plans to cede power to a younger generation.

Bar Dea described some of those exit negotiations with Dalio as “really hard.”

“The only way to stay relevant is by innovating,” he said. “We’ve been doing that a little bit slower over the past few years.”

Now, change is accelerating. Earlier this month, Karen Karniol-Tambour, 37, joined Jensen, 48, and Bob Prince, 64, as one of three co-CIOs. And as part of the broader overhaul, Mark Bertolini is stepping down as Bar Dea’s co-CEO to become an independent director on Bridgewater’s board.

With Dalio in a back-seat role as mentor to Bar Dea and his investment chiefs, the firm’s new leadership is pushing ahead in four areas:

- Developing more funds with exposure to Asia and doubling its Singapore staff from about 15 employees to diversify operations and reinforce ties to longtime clients in the region.

- Adding products that use individual stocks to express Bridgewater’s view on macro trends such as the direction of interest rates or the price of commodities.

- Expanding in sustainability to make bets on equities specifically and to feature strategies that can produce excess return, or alpha.

- Creating a new team under Jensen’s direction that’ll engineer investment tools powered by artificial intelligence and machine learning.

Bridgewater aims to attract billions of dollars in assets for each of those initiatives over time, reducing its dependence on Pure Alpha and All Weather. Dalio sits on the board that approved the new strategy.

“At some point, you acquire a critical mass that allows you to build other things to help clients,” Co-CIO Prince said in the interview. “Alpha is in demand.”

‘Serious Swings’

During his 47 years atop Bridgewater, Dalio not only built a hedge fund manager of unrivaled size; he pioneered a systematic approach to investing that codified knowledge and understanding into rules. He also instilled an unusual culture of “radical transparency,” which he detailed in his 2017 bestselling book Principles.

Bar Dea’s contribution is what he calls a “flywheel” — a virtuous circle of new talent with new ideas that demand new goals and a nimble strategy. He knows his challenge is figuring out how to make Bridgewater thrive for another half-century despite technological revolutions that are certain to roil the industry.

“These are serious swings we’re taking,” Bar Dea said. “We’re not dabbling.”

(Adds details on strategy cap in ninth paragraph and on Dalio’s role in 16th and 21st)

Key Takeaways: Details of Bridgewater’s Post-Dalio Overhaul

Read more: Dalio gives up control of Bridgewater in final succession step

Read more: Ray Dalio says he’s ready to give away Bridgewater’s secrets

WealthScore Meter

__Placeholder Value__

Assess your financial health with

Bloomberg's new personal finance tool

Launch

Have a confidential tip for our reporters?

Get in touch

Before it's here, it's on the

Bloomberg Terminal

Learn more

Terms of Service Do Not Sell or Share My Personal Information Trademarks Privacy Policy ©2023 Bloomberg L.P. All Rights Reserved

Careers Made in NYC Advertise Ad Choices Help

Register to read more.Get Started

| The text being discussed is available at

https://www.bloomberg.com/news/articles/2023-03-01/bridgewater-exits-dalio-era-with-hedge-fund-overhaul-bets-on-ai-sustainability

and

| |