OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

TAXATION

TIME TO UP CORPORATE TAXES Global Tax Reform May Add $250 Billion a Year to Public Coffers

Original article: https://www.bloomberg.com/news/articles/2023-01-18/global-tax-reform-may-add-250-billion-a-year-to-public-coffers Peter Burgess COMMENTARY Peter Burgess | ||

Global Tax Reform May Add $250 Billion a Year to Public Coffers

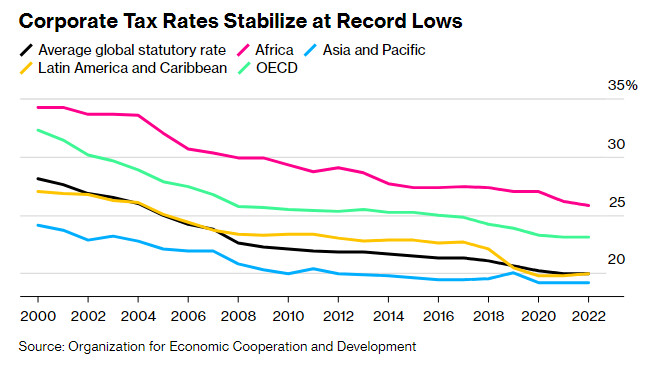

January 18, 2023 at 9:00 AM EST The world’s governments stand to increase their collective tax revenues by about $250 billion a year by enacting a deal to rewrite the rules for multinational corporations, according to new estimates from the OECD. The Paris-based organization, which oversaw talks on the 2021 agreement between around 135 countries, said it is revising up calculations of potential fiscal gains based on data showing more profits of the biggest global companies would be captured. Corporate Tax Rates Stabilize at Record Lows Source: Organization for Economic Cooperation and Development The release of the analysis keeps pressure on governments to deliver on the two-part reform after technical difficulties and political inertia delayed implementation by at least a year to 2024 at the earliest. The OECD also repeated its warning that failure would lead to controversial digital taxes and retaliatory trade disputes reducing global economic output by as much as 1%. The biggest revenue increase would come under what is known as Pillar Two, which creates an effective minimum corporate rate of 15% — a mechanism intended to stop a race to the bottom between governments, and to annul the advantage of parking profits in tax havens. Due to a recent increase in low-taxed profits of global mega-firms, the OECD now expects the minimum rate would generate an additional $220 billion a year in government revenues, compared to a 2020 estimate of $150 billion. Global Firms Record Big Share of Profits in Places With Few Workers Source: Organization for Economic Cooperation and Development Note: Investment hubs are defined as jurisdictions with a total inward Foreign Direct Investment above 150% GDP Pillar Two is also the closest to coming into effect, notably in the European Union, where countries agreed in December on a directive for harmonized implementation starting at the end of this year. The other part of the overhaul, known as Pillar One, is designed to share taxing rights more fairly between jurisdictions after many European governments complained that US tech firms are generating huge revenues in their countries while paying little tax. If implemented, the OECD now estimates the new rules would reallocate taxing rights on $200 billion of profits instead of $125 billion in its previous assessment. The net boost to annual global tax revenues under Pillar One would be much smaller, at around $13 billion to $36 billion. Negotiations on technical details are also moving more slowly, with the aim of agreeing a multilateral convention that countries could begin signing from mid-2023. The OECD gave more detail on which companies would be impacted by the reallocation of their profits for tax purposes:

| The text being discussed is available at | https://www.bloomberg.com/news/articles/2023-01-18/global-tax-reform-may-add-250-billion-a-year-to-public-coffers and |