OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

INFLATION

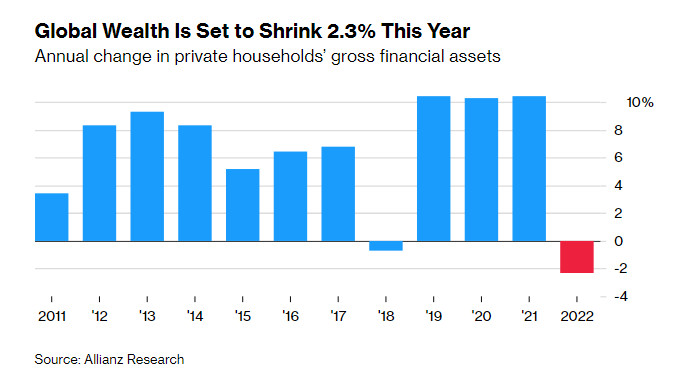

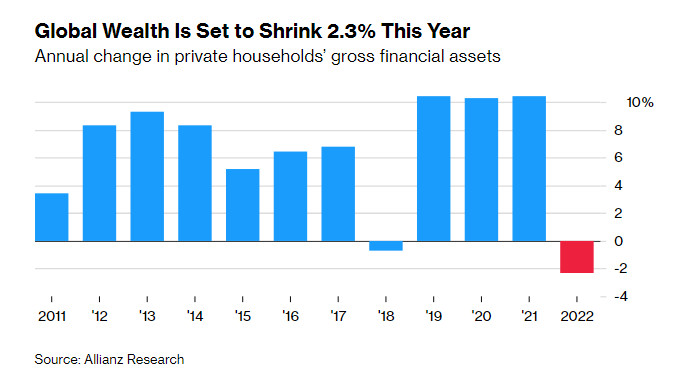

WEALTH SHRINKS Global Wealth to Shrink by More Than 2% This Year, Allianz Says

Source: Allianz Research Original article: https://www.bloomberg.com/news/articles/2022-10-12/global-weath-to-shrink-by-more-than-2-this-year-allianz-says Peter Burgess COMMENTARY This is a 'headline' with little or no underlying analysis. I thought I might learn something, but in reality it was a waste of time. This is much of what now qualifies as 'news'. Frankly, I really do expect a lot better from Bloomberg. Those with investments are seeing a decline in value because stock markets are valuing stocks much more pessimistically than last year. Those with little or no financial investments and little in terms of cash cushion are in economic trouble because of higher prices for what they need to buy ... food, energy, transport, etc. Those who own physical assets like a house or a vehicle are probably seeing a higher valuation for this real asset ... but it has little immediate current economic value because they need to live, and if they sell it to get cash, replacing it will likely cost more ... maybe substantially more. Bottom line ... people without wealth need higher wages to pay for the goods and services they need that have gone up in price. People who run businesses should be called out where they are making profits substantially in excess of what they were making prior to the Covid pandemic. Top of the 'call out' list are energy companies as well as a variety of companies which have oligopolistic pricing power. I should note that getting to know how much specific business units make by way of profit, whether it is a small business or a really big business with hundreds of locations and thousands of products, is an almost impossible undertaking. This is not by accident. Most people will be shocked at the profit margins that are being earned by many actors in the business community at this time in history ... while at the same time, there are many businesses that are struggling. I should also add that I would like to see changes in corporate tax rules so that there is some sort of excess profits tax along the lines of what existed in the UK during and folloing WWII. I would like to see this imposed 'by product line' or even 'by product' in the mega-corporations that now dominate the economic landscape. Peter Burgess | ||

|

Global Wealth to Shrink by More Than 2% This Year, Allianz Says

Written by Carolynn Look @carolynnlook October 12, 2022 at 5:42 AM EDT Global household wealth is on track for its first significant contraction since the great financial crisis of 2008, according to a report by Allianz. After three years of record gains in the value of household financial assets, 2022 is likely to result in a nominal drop of more than 2%, researchers said in a global wealth report published Wednesday. They called this year a “turning point” for global wealth, amid scant signs that a meaningful reversal will follow. “Monetary tightening is squeezing economies and markets -- household wealth will feel the pinch,” Allianz said the report. “In real terms, households will lose a tenth of their wealth.” Global Wealth Is Set to Shrink 2.3% This Year Annual change in private households’ gross financial assets

Source: Allianz Research Russia’s war on Ukraine has choked the post-pandemic economic recovery and caused food and energy prices to soar, forcing central banks across the globe to raise borrowing costs. Most stock markets are very likely to end the year “in the red,” Allianz said, adding that it’s unclear whether recent interest in equities as an asset class will prevail in some parts of the world amid the subdued return prospects. “In contrast to the Great Financial Crisis, which was followed by a relatively swift turnaround -- not least in asset markets -- this time around the mid-term outlook, too, is rather bleak: The average growth of financial assets is expected to be at 4.6% until 2025, compared with 10.4% in the preceding three years,” according to the report. READ MORE...

| The text being discussed is available at | https://www.bloomberg.com/news/articles/2022-10-12/global-weath-to-shrink-by-more-than-2-this-year-allianz-says and |