|

INFLATION

THE INFLATION OF 2022

TPB Viewpoint: The inflation of 2022 is different from that of the 1970s.

Why is this not being discussed?

Peter Burgess COMMENTARY

I find it very annoying that journalists who ought to now better portray the history of inflation as if it starts in 1980.

I studied economics at Cambridge in the late 1950s early 1960s and lived through the inflation of the 1970s relatively early in my career. Anyone who was involved in business in the 1970s had an understanding of how bad inflation can be, especially when it is 'cost-push' inflation. Specifically, I was involved with the running of a manufacturing facility in the USA employing around 1,300 workers and faced with massive material and energy price increases caused by the OPEC oil cartel and ... in my opinion ... enabled to a large extent by the international oil companies and several non-OPEC countries like the Netherlands and the UK. Companies like the one I was working with were forced to increase our prices because all of our costs had gone up and we were operating at a substantial loss.

The inflation that is going on at the moment is very different. Mostly, the biggest element of cost is now the embedded profit in the material and services being purchased at every step in the supply chain through to the final consumer. It is energy that is by far the biggest contributor to this problem of embedded profit, but not at all the only one. The tech industry has a high level of prductivity courtesy of digital technology, but very little of this gets translated into low prices but is used almost exclusively to enrich owners. This has been going on for the several decades since the Reagan administration and massive outsourcing of production from the United States to everywhere and anywhere with lower costs and more potential for profit.

All of this has been aggravated by more and more focus on 'efficiency' often at the expense of resilience. Many of the supply chains for essential parts are efficient but fragile, and in many cases there is only on supplier. It is no wonder that companies have performed rather badly as the Covid pandemic changed everything to do with both sources and markets for almost everything.

I have tried to stay in touch with the academic world as I have grown older and I have to admit to a huge concern over how the issue of 'risk' is being taught. Most of the lecturers seem tp tjinl of 'risk' as being something that is unlikely to happen ... but my longer experience suggests that risk will manifest itself, and perhaps not at all in the way one might have imagined. The financial community and what I refer to as 'financialization' seems to understand risk in a very flimsy way.

Though for most people the last couple of years have been awful because of Covid disruption ... there are many companies that have been able to report record profits ... and financial markets have been at record levels. During 2022, these high stock market valuations have declined considerably, but they are still at high levels compared to pre-pandemic levels. This suggests that the business community is being able to game the system to its advantage even while the overall socio-enviro-economic system is being challenged. How can this be?

And, of course, the answer to that is that only one key metrics is doing well ... and that is the profit metric. Metrics about social progress and environmental progress are in decline, but that does not matter, because to all intents and purposes these metrics are ignored in corporate stock valuations.

This has to change, and the sooner the better.

Meanwhile, central banks including the US Federal Reserve are going to 'fight inflation' because that is what they think is their mandate. It may be the mandate, but does it make any sense? It sounds like interest rates are going to be increased and bank financing toghtened (ending or reducing the level of quantitative easing) in order to reduce the demand for goods and services from consumers. Is this not economic and social madness. Sadly, a big part of demand comes from a very large number of people in the US economy / society who are already having difficulty paying for their reasonable needs because of high prices and low wages. Yes ... the 'average' for all of society may be 'up' but it is 'up' because a few of those at the top outweigh the many at the bottom. I am not sure that many well credentialled economists fully appreciate the danger of using an 'average' without also understanding the make-up of the average.

My dream is that the management metrics that we use for policy determination could be a whole lot better than the ones we seem to be using at this very interesting and dangerous time.

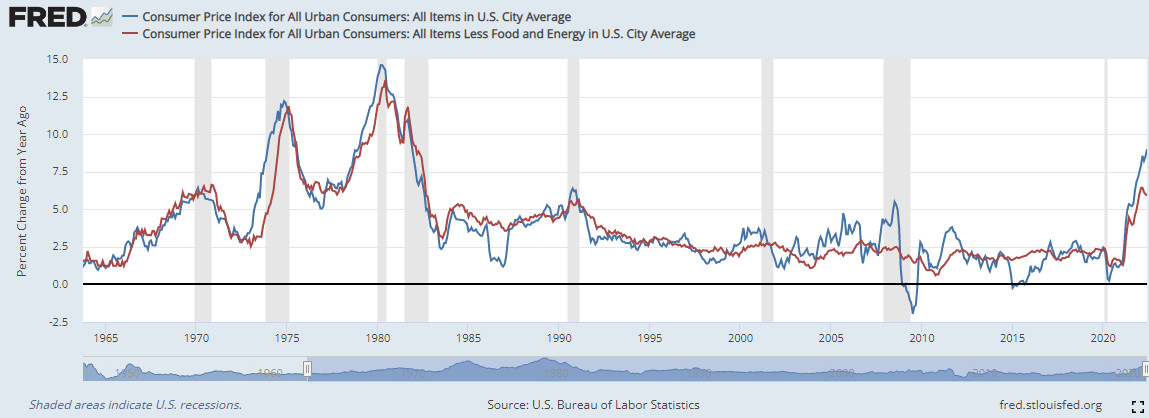

Inflation from 1964 to 2022 ... Federal Reserve

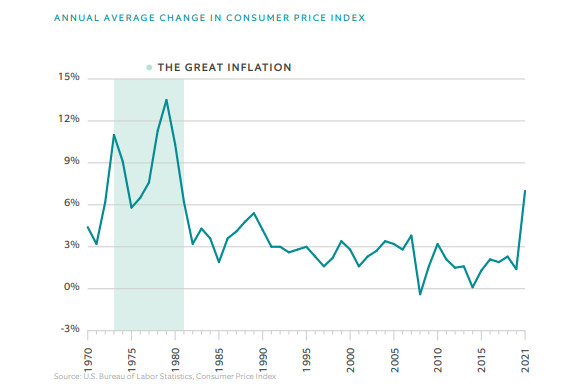

Inflation from 1970 to 2021 ... Northern Trust

And to add insult to injury, a lot of the graphs are unclear about what goods and services are included in the indeces or not. On balance, I am comfortable with the conclusion that energy pricing decisions are at the core of the 1922 inflation difficulties together with a massive level of embedded profit in nearly all the supply chains.

Peter Burgess

|