OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

HEADLINES

BLOOMBERG Bloomberg New Economy Daily newsletter ... October 12th 2022 Original article: Peter Burgess COMMENTARY Peter Burgess | ||

Removing the Crutches

By Malcolm Scott

October 12, 2022 at 7:00 AM EDT

You're reading the New Economy Daily newsletter.

By submitting my information, I agree to the Privacy Policy and Terms of Service and to receive offers and promotions from Bloomberg.

Hello. Today we look at global market shockwaves stemming from central banker comments in Washington, how Italy’s incoming government faces a grim first year, and a study asking what would have happened if the Federal Reserve had hiked interest rates earlier.

A Painful Reminder

As policymakers gather in Washington for the fall IMF meetings, one of them just issued a painful reminder that the kind of central-bank support markets have been accustomed to for so long can’t be relied on anymore.

Bank of England Governor Andrew Bailey warned fund managers they have until the end of this week to wind up positions that they can’t maintain before the central bank halts its market support. That triggered a selloff in the pound that soon spread to US and then global stocks.

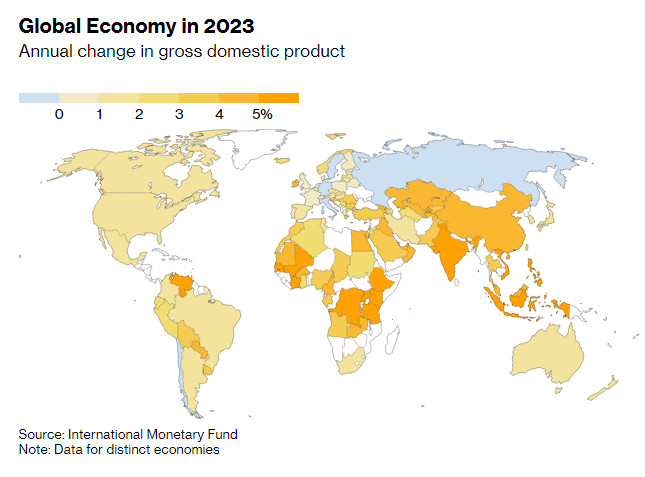

Global Economy in 2023

Annual change in gross domestic product

Source: International Monetary Fund Note: Data for distinct economies Coming on the heels of a gloomy global outlook from the IMF, Bailey’s blast shot the UK to the top of markets’ long worry list. And don’t expect the US Federal Reserve to change its plans just because markets don’t like them either. Cleveland Fed President Loretta Mester said the central bank should stick with its approach to shrinking its massive balance sheet, notwithstanding ongoing volatility in financial markets. “I don’t see any need at the moment to adjust that plan. I think there is a lot of benefit to leaving that plan in place,” Mester said Tuesday during an interview with Kathleen Hays on Bloomberg Television. “Markets have understood the plan. They see it. They understand it.” The Bailey and Mester comments are a double reminder that in this age of inflation, squashing prices trumps the need to keep investors happy. Data on Thursday may show a key US inflation measure is set to return to a four-decade high. Inflation Remains Too High Core consumer price index seen returning to peak as headline CPI eases

Source: Bureau of Labor Statistics, Bloomberg survey Note: Sept. figures reflect median estimates in a Bloomberg survey of economists There’s other subplots bubbling away to keep officials in DC busy too. One is on the currency front, where there were starkly different views expressed relating to the dollar’s strength at unrelated events on Tuesday. In an interview with CNBC, US Treasury Secretary Janet Yellen said the strength of the dollar is the “logical outcome” of different monetary policy stances globally and that its value should be set by the market. “A market determined value of the dollar is in America’s interest,” Yellen said, sticking to a stance that seems to rule out coordinated efforts to weaken the greenback. By contrast, European Central Bank policymaker Francois Villeroy de Galhau said in a speech at Columbia University that Group of Seven foreign-exchange interventions can be effective if they’re coordinated. It was all very qualified: While the Bank of France chief reiterated the G-7 doctrine that central banks don’t target exchange rates, he said they can become “fundamentally misaligned” and “under such circumstances, there were G-7 interventions in the past.” “Several of them were effective, which we shouldn’t forget,” Villeroy said. A coded reminder to his US peers? —Malcolm Scott Got tips or feedback? Email us at ecodaily@bloomberg.net The Economic Scene The IMF’s projections of a grim global outlook are presenting Italy’s winner of the Sept. 25 election with an abrupt reality check. Giorgia Meloni is likely to preside over a contracting economy in her first year in office, the forecasts show. That adds to the challenges faced by the leader of Italy’s rightwing alliance, who is also struggling to find a finance minister. Euro-Area Economy in 2023 Annual change in gross domestic product

Source: International Monetary Fund Note: Data for distinct economies. Croatia joins the currency bloc in January As Alessandra Migliaccio and Craig Stirling explain here, the euro zone’s third-biggest economy is expected to shrink by 0.2% next year. It’s one of only two members facing a contraction in output, alongside Germany, which has also long been dependent on Russian fossil fuel. Read more here. Today’s Must Reads

relates to Removing the Crutches The study also points to policy’s lags in affecting the economy. It takes at least one year for policy changes to impact inflation, Barnichon found. The analysis didn’t look at how an earlier ending of the Fed’s massive bond-purchase campaign would have impacted inflation and unemployment. The Fed in September 2021 announced its intention to start scaling back bond buying but it only completed that process in March, when it began to raise rates.

On #EconTwitter Central banks have been eager to shift part of the blame for inflation to other issues like supply chains or energy. New research raises questions over such assertions:

relates to Removing the Crutches

| The text being discussed is available at | and |