OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

COMMENTARY

COMMENTARY BY UMARI HAQUE Why the Economy of the 2020s Is Going to Be a Big Squeeze ...The Economy Is About to Be Hit by a Series of Hammer Blows, And a Lot of People Are Going to Be Ruined

Image Credit: FT Original article: https://eand.co/why-the-economy-of-the-2020s-is-going-to-be-a-big-squeeze-e309e450c31a Peter Burgess COMMENTARY Peter Burgess | ||

|

Why the Economy of the 2020s Is Going to Be a Big Squeeze

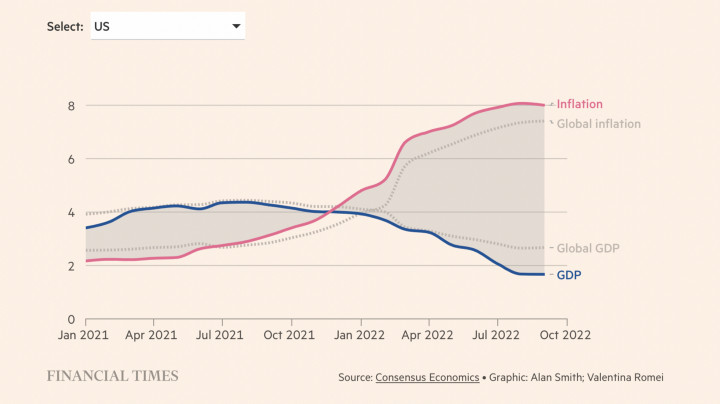

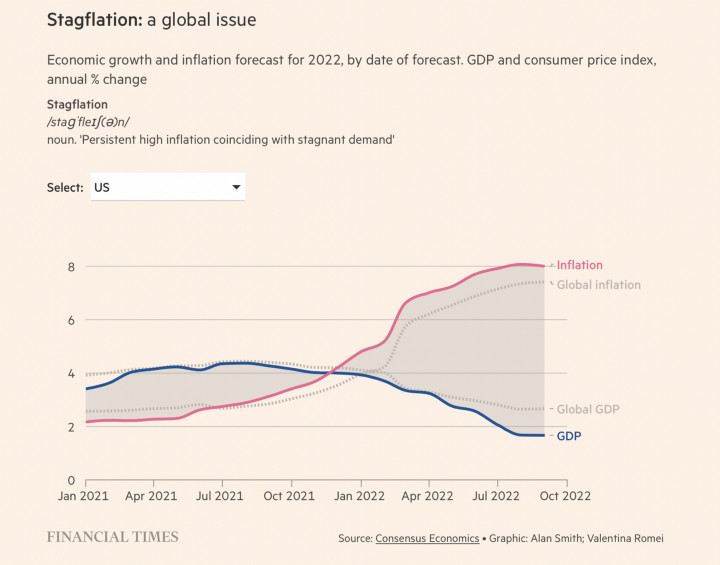

The Economy Is About to Be Hit by a Series of Hammer Blows, And a Lot of People Are Going to Be Ruined Written by Umair Haque October 11th 2022 These days, the single most popular question I get is — it’s asked with an almost teeth-chattering sense of dread — “what’s going on with the economy? Are we headed for a recession?” The answer to that question goes like this. The economy of the 2020s is now in plain sight, and it’s ugly. Welcome to the Big Squeeze. Don’t think of it a recession. Or even a depression. Those terms might mean something to economists — but to the average person? Not so much. Whether or not the economy’s “booming” — a perennial favorite amongst pundits, just like Covid’s always over — the average person’s life is in dire shape. We now have four to five generations and counting — Gen X, Millennials, Zoomers, Alpha — experiencing swift, sharp downward mobility. The average household is living paycheck to paycheck, right on the edge. Household debt levels have exploded around the world, beginning with America, reaching across Europe, even to South Korea and China, precisely because people’s incomes have been stuck for decades now. I could go on with the litany, but I don’t have to tell you — you’re probably living it. The point is that in the context of real life, recession is an almost meaningless term. When people say it, what they really mean something like: is my life going to get even worse, even faster? A better way to think about the economy of this decade is as a Big Squeeze. What do I mean by that? I mean that people are about to be squeezed on both sides: costs are going to rise, sharply, while incomes are going to fall in real terms. And that is going to cause another mega-problem to add to our already long list, from climate change to extinction to inequality to fascism — a worldwide economic crisis, of historic proportions, most likely. Sorry, I’m not trying to scare you, just to talk openly. Let me explain how the Big Squeeze is going to work in concrete terms. Think about the last year or two of your life. If you’re lucky enough to have a stable career and a good job, still, you’ve likely struggled to make ends meet, because prices have been skyrocketing. For everything. From food to energy to cars and electronics and household goods and beyond. We’ll come back to why. The point is that prices are rising, fast. And in response, central banks have begun to raise rates relentlessly, rocking the economy with hammer blow after hammer blow of rate rises. What do those do? Well, you might not feel them quite yet, if you’re lucky enough to have a good job and so on — but you will very shortly. Why is that? Because they’re going to have two further effects. Remember how most people in our societies now live on a perpetual cycle of debt? Even those of think of themselves as relatively prosperous do — it’s rare to vanishing for anyone but the mega rich to own a home or a series of cars or much of anything outright. Most people below the 90% threshold simply live off a revolving door of credit — financing everything from mortgages to cars to household goods and so on. And worse, that debt is already unpayable — in America, people now die in debt, and in South Korea, the personal debt crisis was the inspiration, literally, for Squid Game. So what happens as rates rise? People who are already living on the edge — and that’s most of our societies — get wiped out. Suddenly, they can’t afford all those payments, because now interest has skyrocketed. As rates continue to rise, people are going to go broke. It’s going to take a few months, because for now, people are getting by, just transferring one form of debt to another, sweating, hoping desperately to make ends meet. But for many, many people, there’s no way out: already stretched, they’re not going to be able to afford to pay their bills at all anymore. And that means that banks are going to saddled with bad debts. From mortgages to credit cards to car loans and so forth. What do bad debts do? That’s right, they bring down banks. What happens when banks fail? Unemployment begins to soar, because they lend less to businesses, who have to fire people and lay them off. Added to that already grim picture is what happens on the demand side — as people go broke because now they can’t afford their debts anymore in a new financial era, they stop spending. That makes unemployment rise, too. What happens as unemployment rises? Incomes stall. Because of course now businesses don’t have to bid up wages to employ people. There’s much talk of “growing wages” in places like America, but it’s largely a fiction. Those gains have been concentrated in two sectors, hospitality and retail, and while that’s welcome, you can hardly have a modern economy of cashiers and waiters. And more to the point, in real terms, income is already falling, failing to keep pace with rising prices. Are you beginning to see how the Big Squeeze works? On the one side, people get absolutely hammered by rising prices — relentlessly, for food, energy, household goods, everything, and we’re about to come to why. Then they get hammered again, by the rising price of debt, which is the fundamental resource most people really live on. And then they get hammered yet again, as real incomes flatline and fall, because now multiple economic crises have erupted as people go broke. Which multiple economic crises, precisely? Well, a replay of something like 2008 is on the cards now. As rates skyrocket, a lot of people are going to lose their homes — mortgages becoming unaffordable. As banks foreclose on all those homes, they’re going to fail, too, because all this is likely to trigger a house price crash. So now we have two crises: a housing crisis and a banking crisis. It’s likely that those will become a larger economic crisis, too, crashing stock markets and making national debts go through the roof, because, well, now banks have to be bailed out yet again. And who’s on the hook for that? That’s right, the average taxpayer, who loses things like their retirement funds. Squeeze. When I say Big Squeeze, if anything, I’m understating the economic era we’re now entering. Huge numbers of people are going to be financially ruined by all the above — scarred for life by going broke. And in places like America, going broke can be more or less a death sentence. It’s not just numbers we’re talking about — experiencing financial ruin, losing your home, your retirement, these things are body blows to a good life. They destroy relationships and they crush people mentally, spiritually, socially, emotionally. People are likely to suffer tremendously as a result of the Big Squeeze — for many, it’ll be a death grip, suffocating them. Now. The most foolish part of all this is that it is needless. This is yet another self-made catastrophe, like Trumpism, Brexit, or climate change. It doesn’t need to happen this way. What do I mean by that? Why are prices soaring? It’s not just the war in Ukraine. It’s because our basic systems for everything are failing. When I say everything, I mean everything. Water, food, energy, medicine. We didn’t even manage to vaccinate the planet, rivers are running dry, entire regions go up in flames every summer, climate change is killing crops left and right. Prices are soaring because the planet can’t now provide us with the standard of living we grew used to at peak killing-the-planet. It’s dying, and what it can offer is shrinking fast, from water to crops to livestock to lumber and so on. That’s not going to change. This isn’t a phase or a cycle, it’s a permanent transformation. And there’s only way out, which is to rebuild all our basic systems, so that they can produce the standard of living we’re accustomed to, without destroying the planet and life on it. That means everything from clean energy to closed loop manufacturing to fossil free cement and steel to redesigning our cities not to be massive heat sinks to brining dying ecosystems back to life. That is the only way out, or else it’s just accelerating oblivion for all of us, including the mega-rich, unless you really think you can stockpile enough water in a bunker to last a few generations. Now. What does all that require? Investment. Let me use a simple example I often do. How did the American West come to be, as it is today? Well, during the New Deal, the Hoover Dam was built, which provided water and power. A mega-project — a mega-investment — in basic systems. It was good for a century. And now we’ve reached its limit — the West is running out of water and power. It needs new systems, now, or else there won’t be enough of both shortly. But where are today’s equivalents of the Hoover Dam — meaning society-changing investments in clean energy, in green buildings, in closed-loop manufacturing, in agriculture that doesn’t depend on fossil fuels? We’ve made a small start, as in Biden’s climate bill, but the truth is that while it’s a breakthrough politically, it’s not nearly enough to solve the problem. Now. What do rising interest rates do? They choke off investment. If you were going to invest, say, $50 billion in a mega-project for clean energy, well, now, the price goes up, because of course part of it is probably debt, and even then, there are fewer lenders and so forth. In general, rising interest rates destroy the possibility of investment. Think about what you’d borrow to start a business at 0% versus 10% — and how much faster and higher your hurdle would be to break even. Central banks are doing exactly the wrong thing. Raising rates isn’t stopping inflation. It’s having almost no effect — and you can see it by now. They’ve hammered the economy with rate rises — and inflation’s still at nearly 10%. It’s not working. Because it can’t work. Raising interest rates doesn’t magically grow back failing crops or restore dried up rivers or magically clean the soot from the skies. It doesn’t do anything, except crush people financially — and most of us are already crushed. Because the problem of rising prices is about material shortages caused by planetary ecological limits being reached, raising interest rates is exactly the wrong thing to do. It chokes off all the mega-investment we need at precisely the moment we need it most. As a simple example, imagine you wanted to start a business for any of the stuff I’ve mentioned — clean energy, closed loop manufacturing, sustainable agriculture. How much less possible is it now, with sky high interest rates? When you can barely make ends meet anymore? The economy of the 2020s is turning out to be a needless, self-made catastrophe. Yet another one, to add to the list. It’s a Big Squeeze. It’s going to squeeze people and households, taking them to the brink of financial ruin, and beyond, leaving many literally ruined. Worse, perhaps, though, is that it’s squeezing the life out of what slender possibilities remained for solving the problem of Extinction. What do rising interest rates really mean? They mean that more money flows to capital, in the form of interest. But capital doesn’t need more money. The top .01% already take most of the gains, own most of the stuff, and have more money than they’ll ever know what to do with. What does it benefit anyone that a billionaire earns another million in the next few hours..while the planet dies, and takes our civilization with it? Let me say it again. Capital doesn’t need more money. Who does? Everyone and everything else, from the average person to forests and river and trees to animals at the edge of exintction to shattered ecosystems to the basic systems we all depend on that rely on them. All of that stuff desperately needs more resources, investment, money — or else its lights out for our civilization. That’s what I mean by the Big Squeeze. It’s a goddamned shame. How many self-made calamities does it take to teach a civilization a lesson? We’re finding out the answer the hard way. Umair October 2022

Image Credit: FT

| The text being discussed is available at | https://eand.co/why-the-economy-of-the-2020s-is-going-to-be-a-big-squeeze-e309e450c31a and |