OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

HEADLINE NEWS

CNBC STOCK MARKET NEWS ... UPDATED FRI, SEP 23 2022 8:18 AM EDT Dow futures tumble by 350 points, head for big losing week on fear the Fed is overdoing it Original article: Peter Burgess COMMENTARY Peter Burgess | ||

STOCK MARKET NEWS

LIVE UPDATES ... UPDATED FRI, SEP 23 2022 8:18 AM EDT

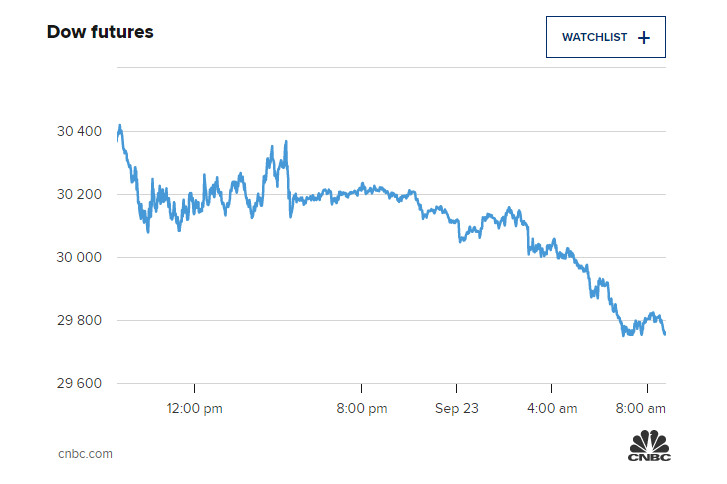

Dow futures tumble by 350 points, head for big losing week on fear the Fed is overdoing it

Alex Harring

Dow futures fall on fear the Fed is overdoing itWATCH NOW

VIDEO00:46

Dow futures fall on fear the Fed is overdoing it

Stock futures were lower on Friday to close out another losing week as investors fear the Federal Reserve’s aggressive hiking campaign to fight inflation will lead to an economic downturn.

Dow Jones Industrial Average futures fell by 395 points, or 1.3%, while S&P 500 futures slid 1.4%. Nasdaq 100 futures lost 1.5%.

Friday is set to be the fourth negative session in a row for the major averages, with the Dow on track to take out its June closing low. The Fed on Wednesday enacted another super-sized rate hike of 75 basis points and indicated it would do another at its November meeting.

Bond yields have soared this week following the Fed’s actions, with the 2-year and 10-year Treasury rates hitting highs not seen in over a decade. Stocks positioned to suffer the most in a recession have led this week’s losses with the Consumer Discretionary Select Sector SPDR Fund off by more than 5%. The Real Estate Select Sectors SPDR Fund is down by 6%.

Goldman Sachs cut its year-end S&P 500 target because of rising rates, predicting at least 4% downside from here.

Analysts and investors on Friday continued to weigh whether the Fed’s recent moves indicate a downturn ahead, with many believing or beginning to accept that a recession is in fact on the horizon.

“At some point, they’ll figure out that recession doesn’t mean the end of the world, and they’ll start getting constructive on stocks again,” said Tim Lesko, a senior wealth advisor at Mariner Wealth Advisors. “But right now, we’re acting as if the sky’s falling.”

Major averages are on pace for their fifth decline in the last six weeks and on track close out the week with losses. The Dow has given up about 2.4% this week, while both the S&P and Nasdaq have fallen 3% and 3.3%, respectively.

Costco was down in premarket trading Friday. Although the retailer posted fiscal fourth-quarter revenue and earnings that topped analysts’ expectations, it is seeing higher freight and labor costs.

11 MIN AGO

Coinbase shares fall with crypto prices in premarket trading

Coinbase shares slipped by about 4% in premarket trading as cryptocurrency prices fell.

Although the cryptocurrency exchange has been diversifying its services and revenue streams, that business still accounts for the majority of its revenue, and trading activity tends to stall when prices are low.

Data is unavailable

Please contact cnbc support to provide details about what went wrong

The crypto market is especially spooked along with the broader markets after the Federal Reserve this week recommitted to an aggressive rate hiking plan.

— Tanaya Macheel

20 MIN AGO

Bleakley’s Boockvar sees ‘biggest financial bubble’ popping as yields surge

Global government bond yields are soaring, a product of recent sharp central bank interest rate increases to control inflation.

For Peter Boockvar, chief investment officer at Bleakley Financial Group, it’s more evidence of a bubble popping in sovereign debt in which real yields had been running at negative level for years. With yields moving opposite price, the capital losses for holders of those bonds are piling up as central bank are no longer able to keep rates low.

“Bottom line, all those years of central bank interest rate suppression, poof, gone.” Boockvar wrote Friday morning. “These bonds are trading like emerging market bonds and the biggest financial bubble in the history of bubbles, that of sovereign bonds, continues to deflate. If the world’s central bankers didn’t decide to play god over the cost of money, we wouldn’t be now going thru the aftermath.”

In the U.S., the 2-year yield, which is most susceptible to Fed rate hikes, was up 9.6 basis points Friday morning to 4.22%, up around 15-year highs. Similar surges are happening elsewhere, with 10-year gilts in the UK at 3.79%, the German 10-year bund around 2.03% and the Swiss 10-year at 2.34%.

In addition to the Fed, the Bank of England, Swiss National Bank and the central banks in the Philippines and Indonesia, among others, also approved sizeable rate hikes this week.

—Jeff Cox

27 MIN AGO

Stocks making the biggest moves premarket: Costco, Boeing, FedEx and more

Here are some of the stocks making the biggest moves in Friday’s premarket trading:

FedEx – FedEx remains on watch this morning after announcing a 6.9% increase in shipping rates and plans to cut another $4 billion in annual costs. FedEx fell 3.2% in the premarket.

Costco – Costco lost 3.3% in the premarket despite reporting better-than-expected profit and sales for its latest quarter after reporting operating margins that were slightly below consensus.

Boeing – Boeing lost 1.8% in the premarket after announcing it will pay $200 million to settle SEC charges that it made misleading claims about the safety risks of its 737 MAX jet after two of the planes were involved in fatal crashes.

Check out the full list of stocks moving in premarket trading here.

— Peter Schacknow, Samantha Subin

1 HOUR AGO

Futures at their lows

Stock futures are at their lows of the session having steadily declined the last four hours.

As for potential catalysts for the rollover, the 2-year Treasury yield has continued its march higher, topping 4.2% in overnight trading. The U.S. dollar is also continuing to climb which could weigh on U.S. multinationals. The dollar move comes as the U.K. unveiled new economic measures to revive its economy. Oil is also falling with WTI futures now off by 3.3%.

Dow futures

| The text being discussed is available at | and |