OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

MONEY

THE GOLD STANDARD June 05, 1933 ... FDR takes United States off gold standard

Original article: https://www.history.com/this-day-in-history/fdr-takes-united-states-off-gold-standard Original article: https://www.history.com/news/how-did-the-gold-standard-contribute-to-the-great-depression Peter Burgess COMMENTARY Peter Burgess | ||

|

June 05, 1933 ... FDR takes United States off gold standard

On June 5, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

Soon after taking office in March 1933, President Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. And increasing the amount of gold held by the Federal Reserve would in turn increase its power to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931, and Roosevelt had taken note.

READ MORE: How Did the Gold Standard Contribute to the Great Depression?

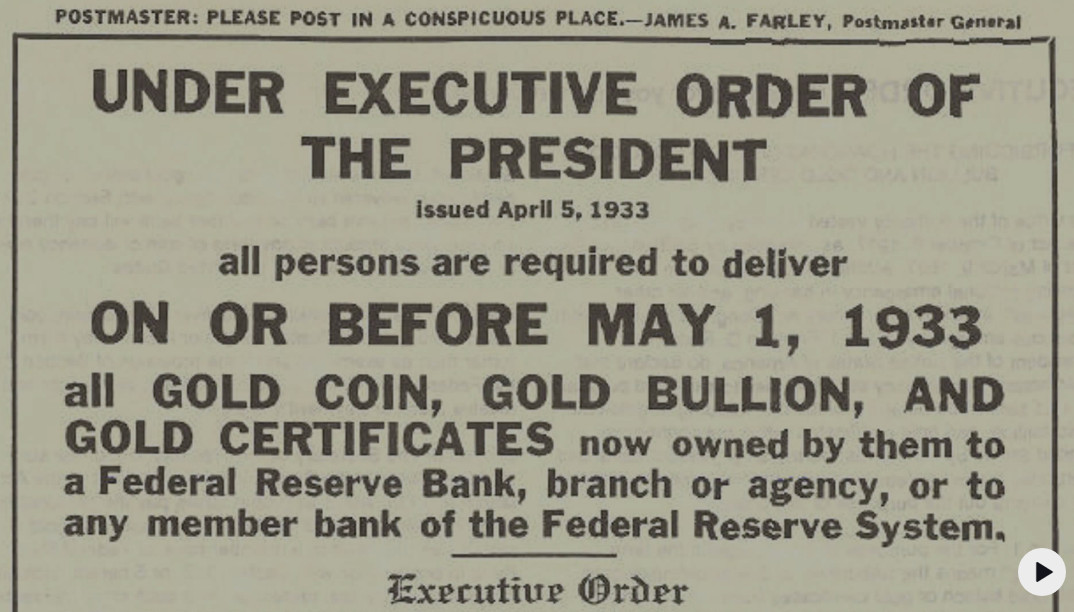

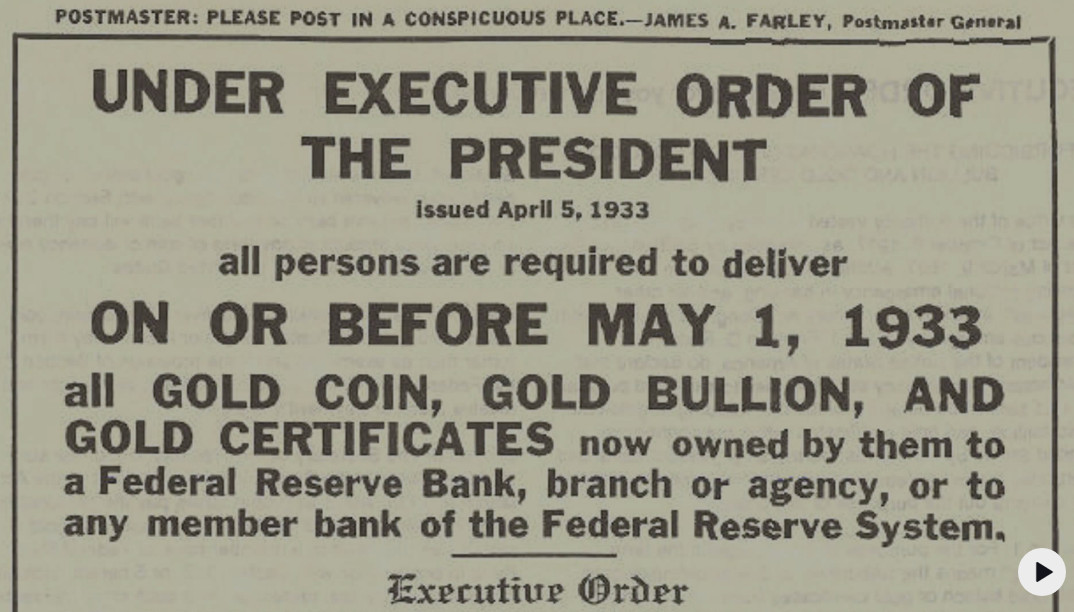

On April 5, 1933, Roosevelt ordered all gold coins and gold certificates in denominations of more than $100 turned in for other money. It required all persons to deliver all gold coin, gold bullion and gold certificates owned by them to the Federal Reserve by May 1 for the set price of $20.67 per ounce. By May 10, the government had taken in $300 million of gold coin and $470 million of gold certificates. Two months later, a joint resolution of Congress abrogated the gold clauses in many public and private obligations that required the debtor to repay the creditor in gold dollars of the same weight and fineness as those borrowed. In 1934, the government price of gold was increased to $35 per ounce, effectively increasing the gold on the Federal Reserve’s balance sheets by 69 percent. This increase in assets allowed the Federal Reserve to further inflate the money supply.

ADVERTISING

The government held the $35 per ounce price until August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. In 1974, President Gerald Ford signed legislation that permitted Americans again to own gold bullion.

Citation Information

Article Title

FDR takes United States off gold standard

Author

History.com Editors

Website Name

HISTORY

URL

https://www.history.com/this-day-in-history/fdr-takes-united-states-off-gold-standard

Access Date

August 5, 2022

Publisher

A&E Television Networks

Last Updated

June 17, 2020

Original Published Date

November 24, 2009

https://www.history.com/news/how-did-the-gold-standard-contribute-to-the-great-depression How Did the Gold Standard Contribute to the Great Depression? A number of complex factors helped to create the conditions necessary for the Great Depression—adherence to the gold standard was just one of those factors. LINDSEY KONKEL ORIGINAL:MAY 8, 2018 ... UPDATED:MAR 18, 2020 The causes of the Great Depression were numerous, and after the stock market crash of 1929, a number of complex factors helped to create the conditions necessary for the longest and deepest economic downturn in modern history. President Franklin D. Roosevelt’s decision to take the United States off the gold standard may have helped to ease the worst effects of the Depression. What is the gold standard? The gold standard is a monetary system in which a nation’s currency is pegged to the value of gold. In a gold standard system, a given amount of paper money can be converted into a fixed amount of gold. Countries on the gold standard can’t increase the amount of paper money in circulation without also increasing their reserves of gold. From the late 1800s until the 1930s, most countries in the world—including the United States—adhered to an international gold standard. (Many European countries temporarily abandoned the gold standard during World War I so they could print more money to finance war efforts.)

Sacks of gold, exchanged by the American people against currency, being stocked in the vaults of a New Jersey bank, 1933. (Credit: Keystone-France/Gamma-Keystone/Getty Images)

President Franklin D. Roosevelt as he signs the Gold Bill on his 52nd birthday, surrounded by members of the Treasury Department and the Federal Reserve Board. (Credit: Bettmann Archive/Getty Images)

| The text being discussed is available at | and |