OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

MANAGEMENT METRICS

SOCIAL RETURN ON INVESTMENT According to Grassroots Business Fund, social return can be way higher than economic return!

Learn more about SROI (PDF) Peter Burgess COMMENTARY Peter Burgess | ||

|

Social Return on Investment (SROI)

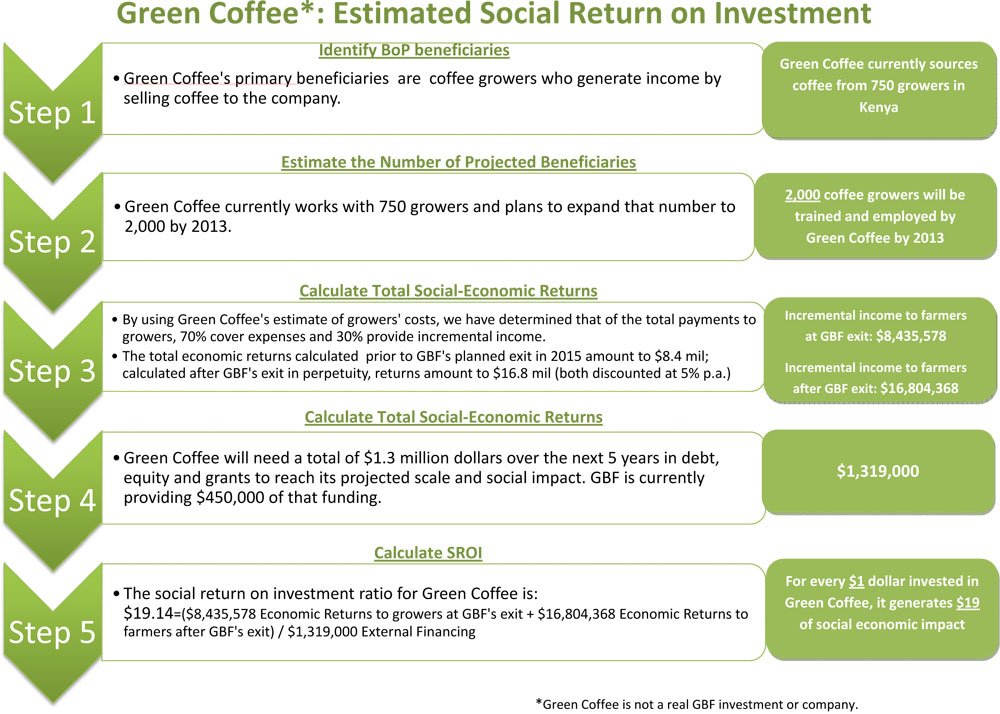

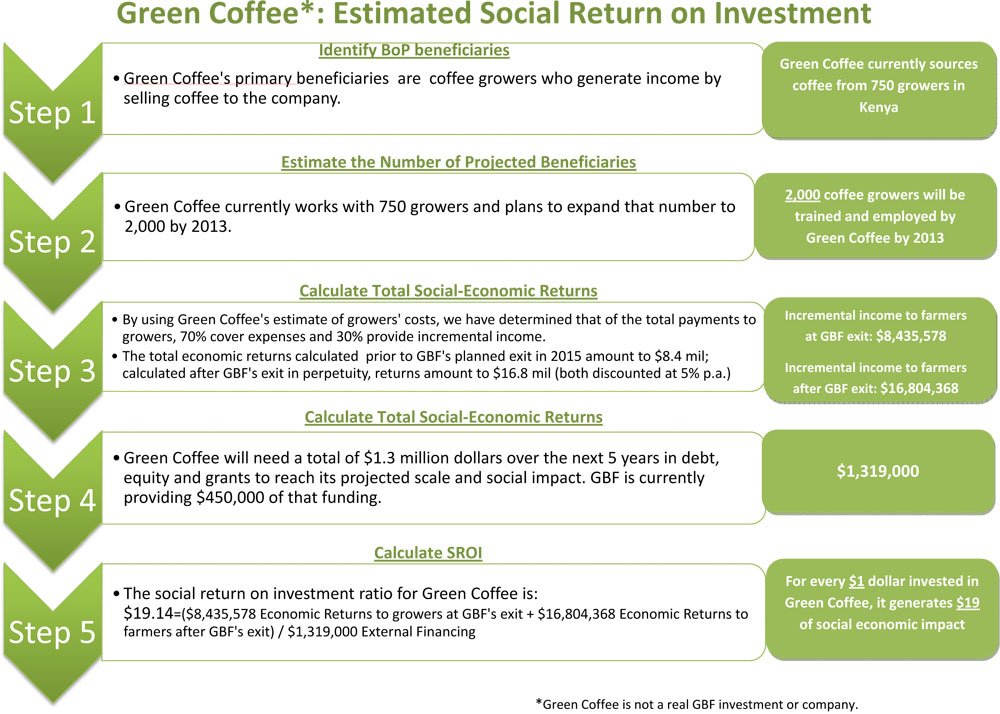

For every $1 invested in portfolio companies, GBF estimates a social return of $17. What is SROI? The Social Return on Investment (SROI) determines the social-economic impact, measured in dollars, that will be generated for every $1 dollar invested into the enterprise. Click here to read about GBF's social-economic impact by sector. Why does GBF use it? The SROI provides guidance to GBF’s investment committee on the potential social-economic impact of an enterprise. While it is by no means the only indicator that GBF uses to determine an investment’s social impact, the SROI is one data point that it considers. The SROI, initially calculated during the due diligence phase of an investment, is recalculated throughout the investment life cycle. Its assumptions are refined according to the financial, operational and social Basic Metrics reported to GBF on a quarterly basis. GBF uses the SROI to estimate the quantifiable social-economic impacts its enterprises will generate and the number of beneficiaries that its enterprises will reach. The SROI allows GBF to measure the social impact an enterprise generates as it relates to the financial capital needed to run the enterprise. In addition, once GBF has been able to calculate SROIs for several investments in a specific sector, GBF will be able to determine sector benchmarks by which to assess future potential investments. All figures are as of November 2010. Learn more about Social Return on Investment Learn more about SROI ... View as a pdf or see text below For every $1 dollar invested in the organization, dollars of social‐economic impact are generated The Purpose of a SROI Estimate The Grassroots Business Fund (GBF) uses a Social Return on Investment (SROI) calculation to estimate the quantifiable social‐economic impact that a high‐impact social enterprise will generate and the projected number of beneficiaries it will reach. The SROI estimate tries to determine for every $1 dollar invested in the enterprise how much social‐economic impact (in real dollars) will be generated. This SROI estimate allows GBF to measure and compare the social impact an enterprise generates versus the financial returns. The SROI estimate is generated based off of conservative assumptions which are verified on a periodic basis, ensuring that the SROI estimate is reasonable. How we use it The SROI estimate provides guidance to GBF and its investment committee on the potential social‐economic impact an enterprise may generate. The SROI estimate is by no means the only indicator that GBF uses to determine an investment’s social impact, but it is one data point that it considers. The SROI estimate, which is initially calculated during due diligence, is recalculated throughout the investment life cycle based off of actuals from the 1st dimension of iPAL on Basic Metrics of Activities and Outputs. This recalculation allows GBF and the enterprise to determine how the social‐economic impact has changed to it beneficiaries. Furthermore, once GBF has been able to calculate and verify several investments in a specific sector, GBF will be eventually be able to determine on average what should the expected SROI of an investment be, given adjustments to the type of impact, the beneficiaries’ poverty level and the country the enterprise is working in. How We Calculate the SROI Estimate There are generally five steps that are taken to calculate the SROI estimate. These steps ensure that GBF follows the same methodology in determining the estimated social impact. Beneficiary Groups and Impact | Steps through STEPS INVOLVED The steps as outlined above begin by identifying the social‐ economic impact that will occur to the Base of the Pyramid (BoP) beneficiaries. This type of impact although varies across sectors, only captures impact data that can be easily quantifiable and eventually verifiable. Therefore, GBF avoids trying to capture any dollar amount that is hard to quantify such as, on social mobility, empowerment or other factors that will only be realized in 20 years or more from now. Because of LabourNet, Kumar no longer has to deal with clients who exploit him financially The second step is to actually determine the number of beneficiaries that the enterprise will reach. This calculation is correlated to how well the enterprise is doing financially and therefore is generated from the financial model. Estimating the total social‐economic returns and the external financing | Steps through Step three and four are also derived from the financial model that GBF builds using conservative assumptions. The numerator in the SROI calculation is the total estimated social‐economic return (including terminal value). This is determined by quantify the dollar amount generated per beneficiary because of the enterprise’s existence and then multiplied by the number of beneficiaries that are projected to exist. The denominator is the total external financing capital that the enterprise will need to generate that social‐economic impact. Both figures mentioned above are both discounted at 5%. Calculating the SROI | Steps The numerator and the denominator are then divided to arrive at the SROI estimate. This estimate informs GBF that for every $1 that is invested in the enterprise, the enterprise generates X dollars of social economic impact for its beneficiaries. SROI esimate = Total estimated quantifiable social economic return / Total estimated external financingThe Human Element Although SROI captures the social economic impact the enterprise generated it is important to note that the end of the day the enterprise is providing sustainable livelihoods to beneficiaries like Kumar. A. Kumar, 42, is a rainwater harvesting mason for LabourNet in India. He decided to become a mason himself after spending 15 years working with no formal training under a supervisor. Today, Kumar supervises up to 30‐50 construction workers at a time. He joined LabourNet 3 years ago, and is currently working on 3 separate projects. In total he has about 6 various contracts, usually 50% of which are sourced through LabourNet. All of his workers, who receive the same daily rate, are LabourNet members. Since joining LabourNet, Kumar has been provided with a sense of security, in that he can work with reliable and transparent transactions. He no longer has to deal with clients who exploit him financially. He has loyal workers who stay with him because they, also, benefit from accommodation and training services. Kumar is looking to increase his earnings in the future, and continue increasing the size of the jobs he is obtaining. SROI Estimate Example

The following image is an example of an SROI calculation for a sample investment called Green Coffee.

The model estimates the social economic impact that Green Coffee will generate to its farmers, agents, and employees. SROI Estimate ൌ = Total estimated quantifiable social economic returns / Total estimated external financing

| The text being discussed is available at | and |