Date: 2024-05-15 Page is: DBtxt003.php txt00023372

INFLATION

A BANKER'S EXPLANATION

Prices, policy and your portfolio

Northern Trust Institute — your inflation questions answered

A BANKER'S EXPLANATION

Prices, policy and your portfolio

Northern Trust Institute — your inflation questions answered

Original PDF: https://cdn.northerntrust.com/pws/nt/documents/wealth-management/your-inflation-questions-answered.pdf

TVM archive PDF: Northern-Trust-your-inflation-questions-answered-23372.pdf

Peter Burgess COMMENTARY

Yesterday I responded to this sponsored advertisement

A MESSAGE FROM THE NORTHERN TRUST INSTITUTEMany of the issues that interest me were confirmed when I looked into the material in some detail. It is all about marketing and really rather little about analysis. Because of this, I am not sure whether there are serious economists within the Northern Trust group with a bigger broader understanding of the issues at play, or is this the best that they can do?

Prices, policy and your portfolio — your inflation questions answered

Protect your portfolio against rising inflation with answers to common investor questions on the impact of inflation, like how to fortify your portfolio and wealth plan in the face of uncertainty.

Why it’s important: For investors, the best offense remains a good defense.

Do you have answers to these questions?

- How quickly will supply chains recover?

- Will we see a decline in today’s high energy prices?

- Will upward pressure on wages continue?

- What will be the economic consequences of the Federal Reserve raising interest rates and potentially shrinking its balance sheet?

Q8 below refers to the supply chain issue #1 above and blames COVID for the problems together with some of the changes in consumption patterns that have put the supply chain under stress. The management construct of 'Just in Time' inventory msnagement helps to optimize for profit when everything is working as planned, but when things change in unexpected ways, the costs spiral out of control or costs are constrained and the whole supply chain falls apart. Risk management has been done at a very low level of analysis and exectuive responsibility.

There is little or nothing about the question of high energy prices ... even though this is the most significant global issue that needs to be addressed. This is typical, because the energy companies have generally imposed their policy goals and strategies on both the financial sector and powerful politicians.

The question about 'upward pressure on wages' is laughable if it was not so serious. It is long past due ... like 40 years past due ... that wages in the United States tracked corporate productivity in a reasonable way ... as they did for the period 1945 to around 1970. Investors and owners of saved wealth have become accustomed to profit growth and the related dividend growth and stock price growth that has been driven by incredible improvement in corporate productivity ... but the measure if flawed, because too much of this has come from adverse corporate behavior relative to customers and employeeds and the same for a multitude of issues related to the environment including climate change and all sorts of pollutions.

Q7 refers to a policy misstep specifically by the Federal Reserve. The customer if left hanging on this one because it is clear from the historic record that Central Banks have very limited tools while many politicians, that is legislators have very little understanidng of what legislation is required for the Government to do what it should do. Worse, there are rather few in economics that have a meaningful understanding of how the modern socio-enviro-economic system actually works ... rather they seem to be using very money centric analytical process and data that were deemed inadequate way more the 50 years ago.

The Northern Trust Institute answers to the following questions are in the PDF whose link appears above

Q1: How will inflation affect my portfolio returns?

Q2: How can I protect my portfolio against inflation?

Q3: Should I increase my allocation to Treasury Inflation Protected Securities?

Q4: How do natural resource equities hedge inflation risk?

Q5: Will rising inflation impact my tax bill?

Q6: Should I pay down debt before interest rates go even higher?

Q7: How could a policy misstep impact your outlook for inflation?

Q8: What role do supply chain constraints play in increasing inflation?

Q9: I’m worried about the impact of inflation on my retirement plans. Are there changes retirees should be considering in the current environment?

BURGESS COMMENTARY

INFLATION

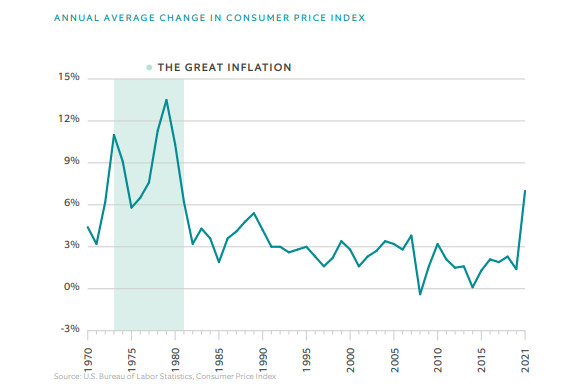

Annual average change in the Consumer Price Index (CPI)

This is an interesting graph showing inflation (Consumer Price Index - CPI ) for the period from early 1970s to the present (2022). Much of the easily accessible news reporting and analysis starts the time series at the start of the 1980s rather than the start of the 1970s.

The inflation in the 1970s was almost totally caused by the increase in the price of crude oil engineered by the OPEC (Organization of Petroleum Exporting Countries) cartel in 1972. Almost everything that happened in the 1970s to the global economy has its origin in the control of crude oil prices by the OPEC cartel and the massive increases in prices.

It should be noted that the OPEC cartel might not have been successful in getting control of the crude oil prices if it were not for many major players staying silent. Firstly there were the major integrated oil giants who were very happy with the OPEC initiative, and, secondly there were a number of countries outside the initial OPEC group. For example, the UK and the Netherlands which had recently developed North Sea oil at a cost many times that of, for example, oil from the Middle East.

Crude oil was around $3.50 a barrel before 1973, when it went to $13.50 and eventually to around $30.00 a barrel by the end of the decade. It has subsequently increase in price to more than $50 a barrel and more than $100 a barrel for periods of time ... and of coures, the Ukraine War is now giving the OPEC group ongoing power to control prices.

The cost of oil ... the cost of energy ... is a component of the cost of everything. It is even more significant as a component of cost in the United States because the US policy of low energy costs to stimulate industry while also serving to stunt technological development and solutions to improve energy efficiency. The cost profile of everything changed in 1973 and it took several years for industry and the business community to get itself organized and optimized for the new reality.

In the immediate aftermath of the OPEC crisis, business in the United States raised prices, giving rise to record levels of price inflation. This was a cost push inflation. By the early 1980s a massive amount of industrial reorganization had taken place including a growing amount of production outsourcing to lower cost economies. This outsourcing was accompanied by the shuttering of US factories and the firing of workers ... significantly enabled by a 'free market' Republican administration in the USA. Workers and unions were significantly weakened and it is only now in 2022, some 40 years later that the value of unions and collective bargaining is being recognised and now once again getting some traction.

I would like to see a graph over the same time period of cost. Costs are a function of productivity and productivity has improved substantially over the past 40 years and it is lilely that aggregate costs have declined substantially. There can be healthy economic improvement as long as there is positive value add and it is allocated between the many economic actors in an equitable manner. The need for the Fed to aim for a 2% inflation rate is because they do most of their analysis based on price without much of an understanding of the underying cost of sales and the key components, especially profit margins and the substantial embedded profit that builds up as embedded cost within the supply chain.

SUPPLY CHAIN / LOGISTICS

The progress in this segment of the global economy has been spectacular ... but !!!

A lot to say about logistics and the management of risk ... TO COME

No comment on this at this stage

WHY WOULD A BANK USE THIS AS AN IMAGE

What are they trying to tell the customer ... it is provocatively bad !!!

This image has me thinking about multiple choice and no easy answer ... and my favorite game as an annoying child which was to run up a down escalator!!!

My grumble with the framing of analysis in the modern world is that it is dominated by short term profit and stock value appreciation for owners of wealth while every other element in the total socio-enviro-economic system is almost totally ignored.

This has to change ... but it must be done in an effective way. This is what TrueValueMetrics is aiming to do.

Peter Burgess