Date: 2026-03-03 Page is: DBtxt003.php txt00028628

GLOBAL OVERVIEW

JOE BLOGS ... june 8th 2025

RUSSIA's Shock Decision

JOE BLOGS ... june 8th 2025

RUSSIA's Shock Decision

Original article: https://www.youtube.com/watch?v=IKLNZCXgz0M

Peter Burgess COMMENTARY

Peter Burgess

- https://www.buymeacoffee.com/JoeBlogs / joeblogsyt

- YouTube Membership - / @joeblogs

- YouTube Super Thanks (click below)

- 0:00 Intro

- 0:40 INFLATION

- 3:10 INTEREST RATES

- 6:08 RUBLE

- 12:14 SUMMARY & CONCLUSION

Transcript

- ntro

- 0:00

- hi welcome back to Joe Blogs in today's

- episode I want to talk to you about

- what's happening in the economy in

- Russia and specifically to talk about

- the shock decision that the Bank of

- Russia announced that it decided to cut

- interest rates from 21% to 20% and this

- is actually the first interest rate cut

- that Russia has announced since

- September 2022 so that's almost 3 years

- ago it's 2 years and 9 months and the

- reason why this is a surprise to the

- financial markets is because of what's

- happening with inflation because

- inflation has been persistently high in

- Russia for a long period if we have a

- INFLATION

- 0:40

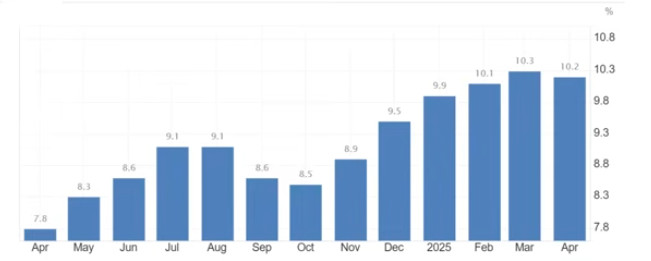

- look at what's been going on over the

- past 12 months with inflation you can

- see that 12 months ago in April 24

- inflation was sitting at 7.8%

- however the most recent data that's been

- published for April 25 shows that it's

- now up to

- 10.2% and if you look at the trend of

- 1:01

- this chart you can see that it has

- clearly been moving in one direction

- upwards and for the past 3 months

- February March and April they're the

- reported figures it's been above 10% and

- 10% inflation is extremely high for a

- developed economy now hang on a minute

- just before we go on a second I just

- wanted to say that a lot of people who

- are watching my videos are not

- subscribing i had a look at the data the

- other day and only around 60% of the

- people who are watching videos are

- subscribed so if you're one of those

- people if you haven't hit that

- subscriber button could you please do so

- now i don't ask this very often but just

- smash that button now because I'd like

- to get the subscribers up as high as

- possible it doesn't cost you anything

- it's not going to make a difference to

- your day but it will make a difference

- to mine and it'll make me a bit happier

- so if you could do that that would be

- really well appreciated but getting back

- to this inflation data what we're seeing

- here is a clear upward trend and if you

- follow the channel you'll be aware of

- 2:01

- the interaction between interest rates

- and inflation traditional theory tells

- us that when you have a situation like

- this in Russia where inflation is rising

- month on month what you should do is to

- increase interest rates because by

- increasing interest rates firstly it

- makes the cost of borrowing more

- expensive so if you're a company or an

- individual thinking about taking out a

- loan maybe you're thinking about

- expanding your company or buying a car

- or going on holiday or refurbishing your

- kitchen or whatever it might be if

- interest rates go up then you're

- probably going to think twice about

- making that decision and currently

- because interest rates are above 20% in

- Russia I think that would deter most

- people because 20% interest per year is

- a lot of interest to be paying but if

- you want to bring inflation down that's

- what you should do as a central bank you

- should be increasing your interest rate

- 3:00

- but as I said right at the start of

- today's video Russia despite the fact

- that inflation is sitting above 10% have

- just announced a reduction in interest

- INTEREST RATES

- 3:10

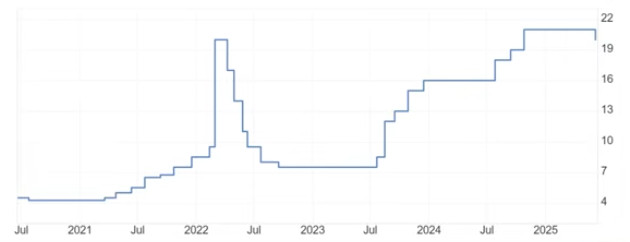

- rates and if we look at what's been

- happening over the past 5 years you can

- see that it's been a really interesting

- movement in interest rates in Russia

- immediately following the invasion of

- Ukraine which started in February

- 2022 interest rates were increased to

- 20% and at that time it was announced

- that that was an emergency rate that was

- being brought in for a short period of

- time to reflect the special war

- situation that was going on in Ukraine

- it wasn't actually referred to as a war

- it was a special economic situation i

- can't even remember what the name of it

- was i'm sure lots of people send me a

- message reminding me what that was but

- the 20% at that point was seen to be a

- short-term measure you can see that

- interest rates did come down rapidly and

- interestingly they actually came down to

- 4:00

- a lower level than they'd been at before

- the war started which was a surprise to

- everybody at the time because if we have

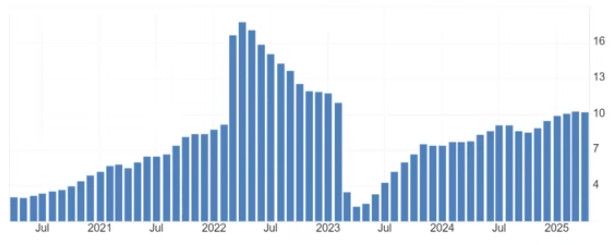

- a look at what was going on with

- inflation at that point you can see that

- at the start of 2022 inflation was

- sitting at around 5 or 6% now

- immediately following the invasion of

- Ukraine it spiked and it rose to above

- 16% but despite the fact that interest

- rates started to come down so did

- inflation and this caused a lot of head

- scratching in the Western world nobody

- could really fathom why inflation was

- going down at the same time as all of

- the sanctions that have been applied

- against Russia were making things much

- more expensive so inflation should have

- been going up for that reason and also

- the value of the ruble collapsed

- following the invasion of Ukraine and

- that should have made the all of imports

- way more expensive because if you're

- having to buy things in the rubble

- equivalent and your currency is falling

- in value that should push up prices but

- 5:02

- remarkably it didn't and inflation came

- down to a low of

- 2.3% by the middle of 2023 which was

- actually a lot lower than inflation was

- in most developed economies at that time

- so um nobody was really quite sure how

- that happened but since the middle of

- 2023 as you can see from this chart

- inflation has been on the rise and is

- now up above 10% as we've just discussed

- and in terms of what has been going on

- with interest rates since 2023 you can

- see that they've also been on the rise

- so this is following the traditional

- pattern that we would have expected we

- expect the Bank of Russia or any central

- bank to increase interest rates at a

- time when you have rising inflation so

- the fact that interest rates have now

- been reduced despite the fact that

- inflation is sitting at its highest

- point since the end of

- 6:01

- 2022 is slightly unusual so raises the

- question as to why this is happening now

- RUBLE

- 6:08

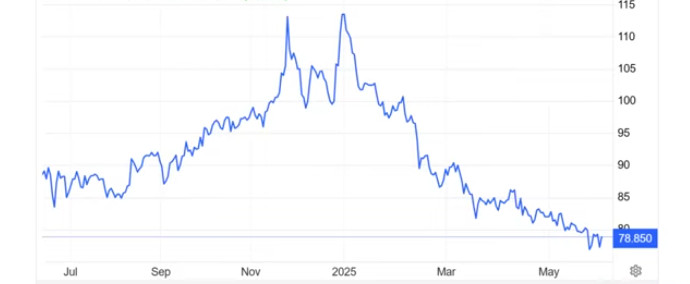

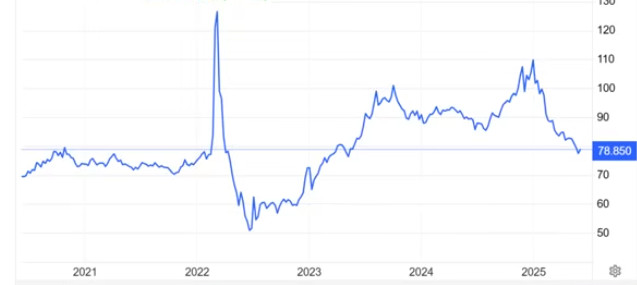

- if we have a look at what's going on

- with the value of the ruble because

- whenever I make a video about Russia

- everybody sends me lots of messages

- about the ruble people who are

- supporting the Russian economy are

- always pointing out that the ruble is

- doing really well now we look at this

- chart that shows the movement over the

- past 12 months you can see that at the

- end of

- 2024 the ruble value had got down to its

- worst position for a long period of time

- against the US dollar it was trading at

- above 110 rubles which is an an absolute

- disaster from Russia's point of view now

- that actually proved to be um the

- turning point and you can see that since

- the start of 2025 the ruble has

- strengthened significantly and is now

- trading for around 80 to1 US scale of

- this chart to show what's been happening

- 7:00

- over the past 5 years you can see that

- the current level is on par with where

- the ruble was trading back in 2021 which

- was before the war in Ukraine started um

- you can see that the invasion of Ukraine

- in February 22 had a disastrous impact

- on the value of the ruble it fell to

- almost 130 to1 US the Bank of Russia

- then stepped in and started buying

- rubles and artificially inflated the

- value and at one point in the middle of

- 2022 it was trading at around 50 to1 US

- which is the strongest it had been at

- for a long period of time but over the

- past 3 years we've seen a deterioration

- in the value of the ruble however that

- has turned around over the past six

- months and there's no real explanation

- for that the only explanation I can give

- you is that the size of the market for

- the ruble is now very very small because

- not many countries are dealing in rubles

- in fact it's pretty much only Russia and

- 8:01

- countries that don't have a choice who

- are dealing with Russia that are

- basically being told to use rubles such

- as Cuba or Venezuela that they've been

- told to use rubles but India and China

- who are the biggest trading partners for

- Russia today have refused to make

- payments in rubles they basically said

- 'We're not doing it.' So China will only

- make payments in its own currency the

- Chinese yuan and India initially wanted

- to make those payments in Indian rupees

- russia said 'Well actually that doesn't

- work for us because nobody else wants to

- accept Indian rupees so we can't use

- that currency for anything else it's

- useless to us.' So they're now dealing

- in a mixture of Chinese yuan and United

- Arab Emirates dirhams so the market for

- the ruble is now really small and what

- that does is enables the Bank of Russia

- to be able to control the price because

- they can buy and sell rubles in the

- small market to keep it at the level

- that they want it to and it's

- interesting that it's now trading at

- 9:00

- that sort of level that it was at in

- 2021 which clearly is a rate that the

- Bank of Russia is comfortable with but

- if we jump back and have a look at the

- last 12 months this strengthening in the

- value of the ruble in theory should have

- actually reduced inflation because if

- the ruble is worth more each month than

- it was previously then that means that

- you have more purchasing power the ruble

- equivalent of whatever the price is in

- the international market for things that

- Russia is importing is going up and

- therefore inflation should have been

- going down but if we look at the

- inflation chart for the past 12 months

- you can see that the opposite has been

- happening inflation has actually been

- going up and what that tells us is that

- the ruble isn't being used to buy

- anything it's not actually got any

- purchasing power in the global market so

- the value of the ruble is now

- disconnected from the Russian economy so

- anybody that's sending me messages

- saying the rubles's doing really well

- therefore Russia's doing really well

- isn't really looking at the data because

- 10:02

- the data isn't telling us that the data

- is telling us that inflation is

- continuing to rise despite the fact that

- the ruble has been strengthening in

- value and if we go back to the interest

- rate chart the fact that Russia has now

- reduced its interest rates despite the

- fact that it's got persistently high

- inflation significantly higher than most

- developed economies around the world

- tells us that there are now problems in

- the Russian economy now we've been

- talking about problems in the Russian

- economy for a long period of time but

- Russia hasn't really been accepting that

- there's been no acknowledgement that

- Russia is struggling but the fact that

- interest rates are now being lowered

- tells us that there is a reduction in

- growth in the Russian economy because

- that's the other reason why you would

- reduce interest rates you'd reduce them

- if inflation was down at the level where

- you wanted it to be or if you're not

- seeing growth because reducing interest

- rates encourages companies and

- individuals to start borrowing again it

- 11:00

- makes it cheaper and therefore it should

- mean that those companies and

- individuals then spend that money and

- when you start spending in the economy

- then hopefully that fuels growth and

- increases GDP so this is the fundamental

- reason why Russia has reduced interest

- rates and the reason why it has been a

- surprise to the markets is because of

- what's going on with inflation because

- as a central bank you always have that

- really difficult dilemma behind either

- controlling inflation or stimulating

- growth and if we talk about what's going

- on in the USA at the moment Donald Trump

- is very keen for the Fed to reduce

- interest rates because he wants to

- stimulate growth he wants to boost GDP

- but Jerome Powell from the Fed isn't

- doing that because he's watching what's

- going on with inflation and Donald

- Trump's tariffs and he's concerned that

- if he reduces interest rates it could

- cause inflation to get out of control so

- you've always got that trade-off between

- what's happening with inflation and

- what's going on with the economy itself

- 12:00

- but what we're seeing in Russia right

- now is that the slowdown in the economy

- is overriding the problems with

- inflation and that's caused the central

- bank to reduce interest rates

- surprisingly so what's the summary and

- SUMMARY & CONCLUSION

- 12:16

- conclusion today well I wanted to post

- this video because this announcement

- that the Bank of Russia has reduced

- interest rates was a surprise to me and

- the markets because of what's been going

- on with inflation because we've been

- expecting interest rates to actually

- rise to maybe 25 or even 30% at some

- point during 2025 if Russia wanted to

- get back to its target inflation rate of

- 4% cuz 10% is a long way above 4% but

- what we've seen is that the Bank of

- Russia which was coming under pressure

- from President Putin to reduce rates in

- exactly the same way as we're seeing in

- the USA where Donald Trump is trying to

- encourage the Fed to reduce interest

- rates despite inflation staying higher

- 13:00

- than it wants it to be the Bank of

- Russia has now agreed with President

- Putin that interest rates do need to

- start coming down they've only come down

- by 1% though from 21% to 20% so I don't

- think that's going to make a material

- difference if I'm offering you a loan

- and I tell you that I could do it at 21%

- and then I come back to you a week later

- and say 'Actually I've looked at my

- numbers again I could do it for 20%.' Is

- that going to make a material difference

- to you i don't think it would i think

- you'd probably say '20% 21% doesn't

- really make any difference i don't want

- to take that loan it's too expensive.'

- But the Bank of Russia have reduced

- interest rates for the first time since

- September 2022 so what this tells us is

- that we're now likely to see a

- succession of interest rate reductions

- that was what we saw back in 2022 when

- interest rates rose to 20% we then saw a

- rapid reduction down to 7 12% and it

- might be that we see a similar thing

- 14:00

- happening now and the big question is

- what's going to happen to inflation if

- the Bank of Russia does decide to do

- that because as we've talked about if

- you reduce interest rates usually you

- would expect inflation to start rising

- again and the last thing that Russia

- needs at the moment is higher inflation

- because it's still operating in a

- wartime economy because a lot of

- companies have been commandeered by the

- state and they're working directly for

- the Kremlin to produce things for the

- war in Ukraine that's driven up wages

- because all of those companies have been

- offering higher wages to attract in more

- staff to make sure that they're fully

- occupied and they can produce as much as

- they can to make the maximum amount of

- money from the Kremlin but that's driven

- up wages across the board and lots of

- companies are now struggling with those

- higher wages the higher wages have

- resulted in more spending in the economy

- which has driven up inflation so it is a

- surprise that the Bank of Russia have

- reduced interest rates as a result of

- the fact that the economy is now slowing

- 15:00

- down because Russia has been

- self-funding itself it's been paying all

- of these higher wages to all of these

- companies which has been growing the

- economy but that growth is now running

- out of steam so the Bank of Russia is

- having to reduce interest rates to try

- to restimulate the economy and what this

- tells us is that the economy is starting

- to fracture in Russia the wartime

- economy can't last forever it won't be

- self- sustainable for the long term

- because Russia has to fund that from

- somewhere it's been funding it from its

- national wealth fund as I've talked

- about in previous videos the National

- Wealth Fund is now depleting it doesn't

- have enough money to carry on with this

- strategy forever and so the Bank of

- Russia is now stepping in trying to get

- the economy back on track to make sure

- that Russia is self-funding but what it

- tells us is that interest rate cuts are

- an indication of a slowdown in the

- economy that slowdown is because Russia

- isn't making the same amount of money

- from its sale of oil and gas and coal

- 16:00

- that it was historically it's running

- short of cash and if this situation

- doesn't sort itself out in the near

- future Russia is going to have a serious

- problem so hopefully you've enjoyed

- today's video you found it useful

- informative and thoughtprovoking if

- you've liked what I've said then please

- give me a thumbs up thank you for

- watching this video all the way through

- to the end and thank you to anyone that

- has subscribed if you haven't please

- smash that subscriber button as I said

- right at the start of today's video and

- thank you so much to everyone that's

- supporting me if you've bought me a

- coffee or sent me a YouTube super thanks

- really appreciate that thank you so much

- and if you're a long-term supporter

- either through Patreon or YouTube

- membership or buy me a coffee membership

- thank you for that support really helps

- keep me motivated and here's something

- to put a smile on your face

Russian Inflation Rate

Russian Interest Rates

Russian Inflation

Value of Russian Rouble (2024-2025)

Value of Russian Rouble (2005-2025)