Date: 2026-03-03 Page is: DBtxt003.php txt00025079

FINANCIALIZATION

ALL ABOUT MONEY (??) ACCUMULATION

Java Discover: Finance Documentary

The REAL Truth Behind our Money: Corruption, Crisis & Credit

ALL ABOUT MONEY (??) ACCUMULATION

Java Discover: Finance Documentary

The REAL Truth Behind our Money: Corruption, Crisis & Credit

Original article: https://www.youtube.com/watch?v=ABFI2YZvL_8

May 4, 2023

263K subscribers ... 58,709 views ... 1.3K likes

When money drives almost all activity on the planet, it’s essential that we understand it. Yet simple questions often get overlooked – questions like:

- Where does money come from?

- Who creates it?

- Who decides how it gets used? And what does that mean for the millions of ordinary people who suffer when money and finance break down?

Referring to the 97% of the world’s money supply that is represented by credit this thought-provoking film presents serious research and verifiable evidence on our economic and financial system and is the first documentary to tackle this issue from a UK-perspective

Featuring frank interviews and commentary from economists, campaigners and former bankers, it exposes the privatised, debt-based monetary system that gives banks the power to create money, shape the economy, cause crises and push house prices out of reach.

Fact-based and clearly explained, 97% Owned demonstrates how the power to create money is the piece of the puzzle that economists were missing when they failed to predict the crisis.

Peter Burgess COMMENTARY

This is an excellent compilation of material about the operation of the money, banking and finance segment of the economy. It makes the case that the actors in this sector have organized in such a way as to enable them to accumulate a huge amount of wealth without much wealth finding its way to everyone else.

I am left hanging in so far as it seems that we are 'stuck' with this situation ... which is a reasonable conclusion given that there has been little or no effective oversight of the money, banking and finance sector for a very long time.

I studied engineering followed by economics at Cambridge in the late 50's early 60's. Amazing things were happening in science and engineering, and Cambridge economics with people like Joan Robinson and Nicholas Kaldor was also quite exciting as it moved from a more classical approach to one that was more 'activist' and Keynesian. In my adult career I have been disappointed at the way progress has been 'manipulated' in ways that have been exceptionally creative and mostly morally reprehensible.

The way money, banking and finance has been managed ... the subject of this 2 hour long video ... is at the center of my own deep annoyance with respect to those with power and influcence in the several decades since the OPEC oil crisis of 1973.

I call the problem 'financialization' ... and it is the driver to a great extent of the TVM initiative that is being documented on this website.

Peter Burgess

Simon Dixon, Founder: Bank to the Future

Ben Dyson, Founder: Positive Money

Ben Dyson, Founder: Positive Money

Noel Longhurst, University of East Anglia

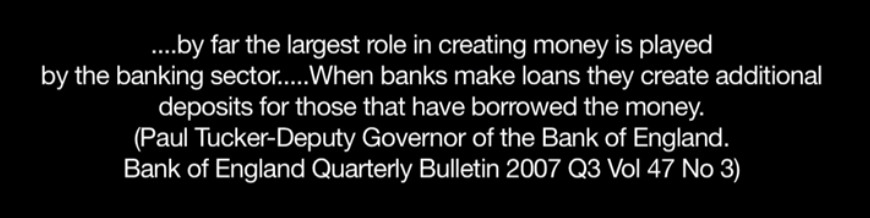

Quote: Paul Tucker ... Deputy Governor, Bank of England

Ann Pettifor, Author and Think Tank Director

Ben Bernanke, Former Chair, US Federal Reserve

Anne Belsey, Monetary Reform Party

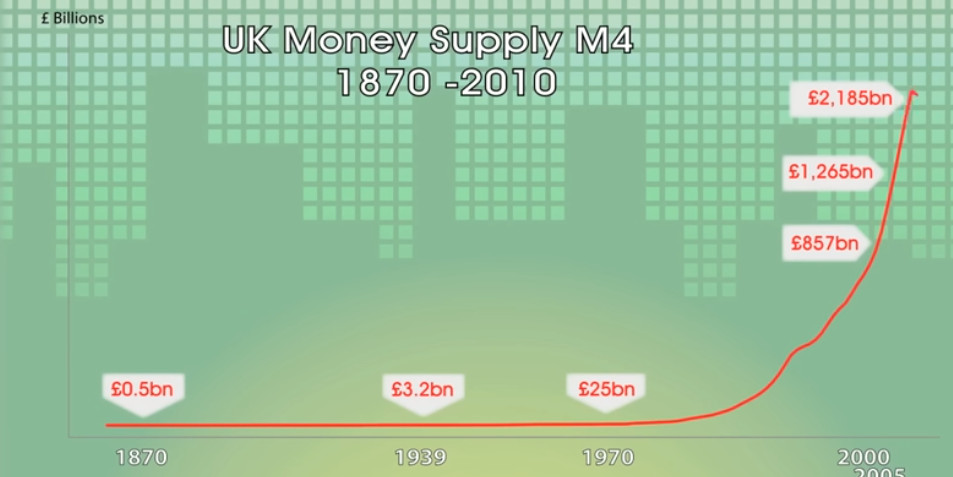

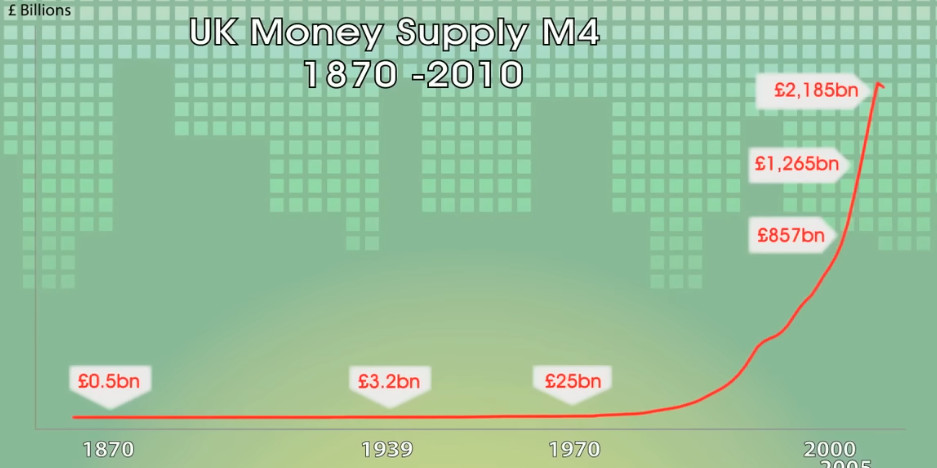

UK Money Supply M4

Bank logo ... HSBC

Sargon Nissan ... former equity trader and economics researcher

New York financial center

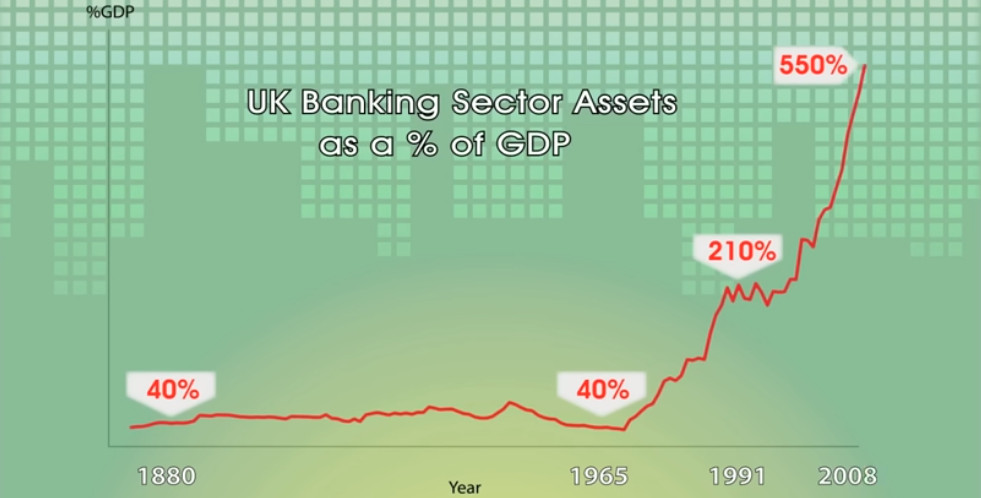

UK Banking Sector Assets as a % of GDP

Nick Dearden, Director: Jubilee Debt Campaign

Paul Moore, HBOS whistleblower

Housing

New York Financial Center ... Wall Street

Activism ... People before Profit

Lloyds Bank logo

Barclays logo

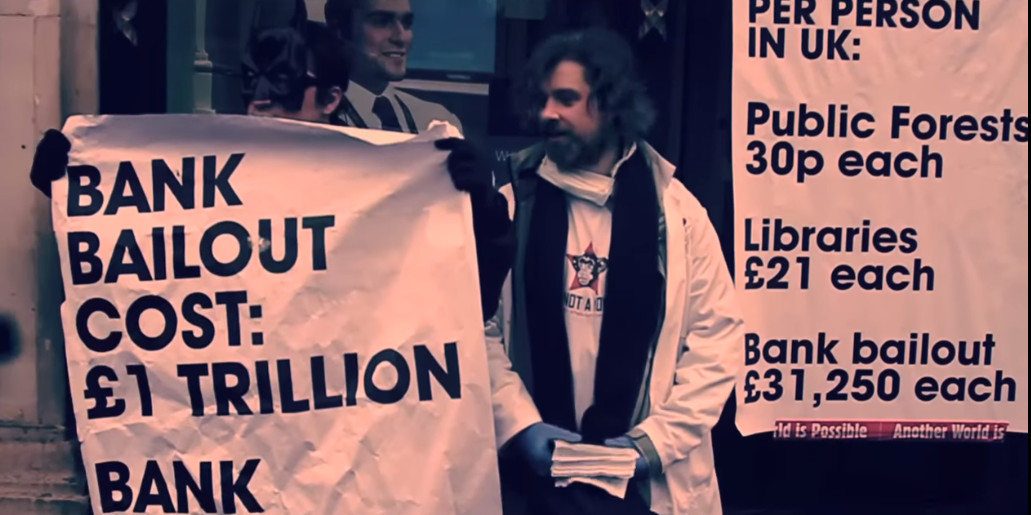

Activism ... huge cost of bank bailout

NatWest logo

Bank of England

Total Reserves of the Bnak of England

Northern Rock

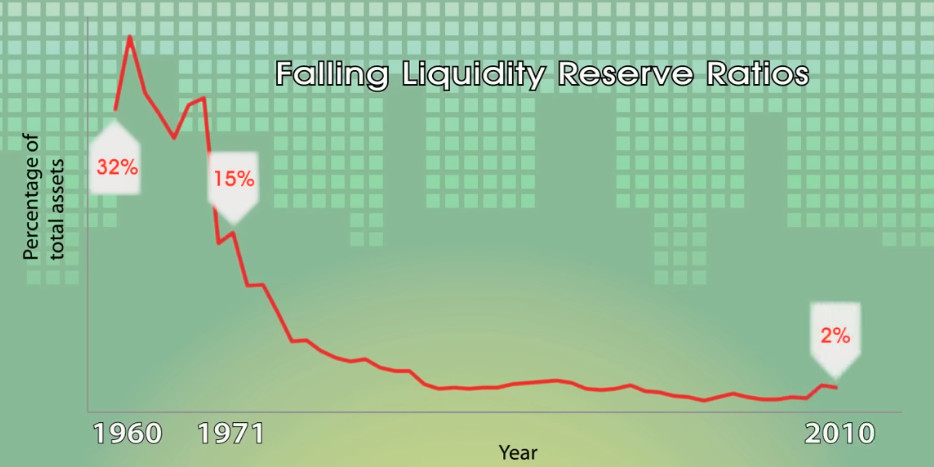

Falling liquidity reserve ratios

James Meadway

UK Money Supply M4

Claran Mundy, Director Transition Bristol

Josh Ruan-Collins, Book: Where does money come from?

Housing ...sub-prime financing!

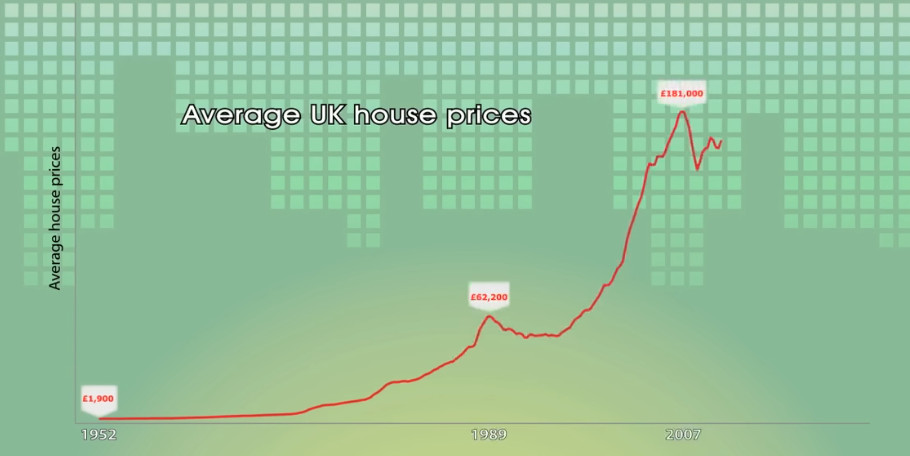

Average UK house prices

Ann Pettifor

Natural Capital ... Forest

UK Money Supply M4

//////////////////////////////////

Videos

About

GPS: How Does the US Satellite System Run the World? The Global Race to Geolocate (Documentary) by Java Discover | Free Global Documentaries & Clips 25K views · 3 months ago

The Real Cost of IKEAs Cheap Wood: Secrets of the Wood Industry | Investigative Documentary by Java Discover | Free Global Documentaries & Clips 43K views · 3 months ago

Are We Living Life on Overdrive? Escaping the Speed of Modern Civilisation | Lifestyle Documentary by Java Discover | Free Global Documentaries & Clips 4.4K views · 4 months ago

HSBC: Tax Evasion, Money Laundering for the Mafia & Currency Manipulation | HSBC Scandal Documentary by Java Discover | Free Global Documentaries & Clips 923K views · 1 year ago

African Witchcraft in London? Mysterious Muti Murders | True Crime & Occult Documentary by Java Discover | Free Global Documentaries & Clips 9.2K views · 2 months ago

Transcript

- 0:02

- how is money created where does it come from who benefits and what purpose does it

- serve D what is a money system what is the

- money behind the money system for centuries the mechanics of the monetary system have remained hidden

- prying eyes of the populace yet its impact both on a national and

- international level is perhaps unsurpassed

- for it is the monetary system that provides the foundations for international dominance and National

- control

- today as these very foundations are being shaken by crises the need for open

- and honest Dialogue on the future of the monetary system has never been greater

- this economic crisis is like a cancer if you just wait and wait thinking this is going to go away just like a cancer is

- 1:02

- going to grow and it's going to be too late what I would say to everybody is get prepared

- 1:07

- there's another time right now to wishful thinking the government is going to sort things out the governments don't

- 1:13

- rule the world Goldman Sachs rules the world we're on the verge of The Perfect Storm

- 1:21

- lie corrupt and entrenched interests that lurk in the corridors of power

- 1:27

- for whom there are no reasons to relinquish privileges they feel are justly deserved

- 1:32

- is he got on plan for the NHS [Applause]

- 1:40

- and the deficit [Applause]

- 1:50

- do you trust the government [Applause]

- 1:55

- try to calm down and behave like an adult and if you can't if it's beyond

- 2:02

- you leave the chamber get out we'll manage without you yeah

- 2:09

- there's no coincidence that booman boss started to become a real cyclical issue around about the 1700s when William

- 2:17

- Patterson founded the bank of England

- 2:24

- this is intolerable Behavior as far as the public no it's not funny

- 2:32

- only in your mind is it funny it's not funny at all it's disgraceful

- 2:44

- the system is inherently unstable as a result of the international power it provides to the dominant parties

- 2:51

- we're at the heart of it lies the idea of how can I get something for nothing

- 2:57

- statistical analysis has found that every time an Empire begins to near its

- 3:02

- own demise you'll find that its currency will be debased there is no guide to how

- 3:08

- this whole system operates to give you an example a researcher at the BBC working on your older person documentary

- 3:14

- went to the bank of England and so can you give me a you know a guide to how money is created and they just said no

- 3:22

- this documentary will investigate and explain this ever-changing system and the impact it has both on a national

- 3:29

- and international level [Music]

- 3:44

- thank you

- 3:50

- foreign

- 4:07

- the total UK money supply stood at 2.15 trillion pounds 2.6 percent of this total was physical

- 4:15

- cash 53.5 billion the rest 2.1 trillion or 97.4 percent of

- 4:23

- the total money supply was Commercial Bank money the three percent of money is created

- 4:31

- through the central bank and that money essentially if you created a 10 pound

- 4:37

- note you could sell that to a bank to put into their ATM and the bank would

- 4:42

- have to repay that 10 pound or buy it for 10 pounds there'd be no interest charged on that money but that money is

- 4:49

- then essentially transferred to the treasury and it's a it's a it's a form of fundraising for the government it's

- 4:57

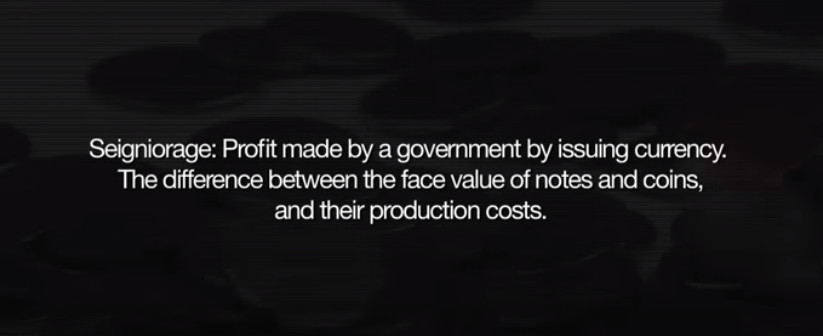

- called synerg

- 5:04

- [Music] when the bank of England creates a 10 pound note it costed about three or four

- 5:12

- Pence to actually print that note and it sells it to the High Street banks at face value so at 10 pounds and

- 5:21

- The Profit the difference between painting the note and actually selling it for 10 pounds

- 5:26

- goes directly to the treasury so in effect all the profit that we get on

- 5:31

- creating physical money uh banknotes goes to the treasury and it reduces how much taxes

- 5:38

- we have to pay over the last 10 years that's raised about 18 billion pounds

- 5:45

- in 1948 notes and coins constituted 17 of the total money supply

- 5:51

- this was one contributing factor in the government's ability to finance post-war reconstruction

- 5:57

- this included the establishment of the NHS in only 60 years notes and coins have

- 6:04

- shrunk to less than three percent

- 6:12

- prior to 1844 banknotes were created by private Banks and the government did not

- 6:17

- profit from their creation pre-industrialization there was multiple

- 6:24

- forms of money coexisting and so the kind of Rise of kind of of government sponsored Fiat money is a relatively

- 6:31

- recent um phenomenon in the 1840s there was no law to stop Banks from creating their

- 6:38

- own banknotes so they used to issue paper notes as as kind of a

- 6:44

- representative of what you had in the bank account instead of you taking your heavy metal coins out of the bank and

- 6:50

- they're going and paying somebody with them you could get your paper which said how much money you had in the bank you

- 6:56

- could give that to somebody and they could use that to go and get the heavy metal coins from the bank now over time these paper notes became

- 7:03

- as good as money people would use the paper notes instead of going and getting the real money from the bank and

- 7:10

- obviously as soon as the banks realized that what they were creating had become you

- 7:15

- know the dominant type of money in the economy they realized that by by creating more of it they could generate

- 7:20

- profits you know they can just print up some new notes lend it and get the interest on top of that and they did

- 7:27

- that you know up until the 1840s in the 1840s they pushed it just a little bit too far and that caused inflation it

- 7:33

- destabilize the economy so in 1844 the conservative government of Robert peel

- 7:40

- actually passed a law that took the power to create money away from the commercial Banks and brought it

- 7:47

- back to the state so since then the bank of England has been the only organization authorized to to create

- 7:54

- paper notes since then everything's gone digital and

- 8:01

- what we now use is money is the digital numbers that commercial Banks can create out of nothing

- 8:06

- [Music] the problem was that they did not include in that in

- 8:13

- that legislation the deposits the demand deposits held in banks by individuals or

- 8:22

- electronic forms of money which essentially what those demand deposits are today most of the money in

- 8:29

- circulation is is electronic money and it's bank it's Bank demand deposits that

- 8:36

- just that set in our in our account so in a way the legislation has got needs to catch up

- 8:42

- with developments in in electronic money and the way that Banks actually operate

- 8:49

- money held in bank accounts are called demand deposits this is an accounting term the banks use

- 8:55

- when they create credit Banks follow the same process when they create loans

- 9:02

- all money held in bank accounts is an accounting entry

- 9:09

- [Music] the reality is now without most money is

- 9:16

- not paper and it's not metal coins it's digital it's just numbers in the compute system you know it's your Visa debit

- 9:23

- card it's your electronic you know ATM card um it's this it's plastic you know it's

- 9:29

- numbers in a computer system you move money from one computer system to another it's all a big database and this

- 9:37

- digital money is what we're now using to make payments with it's what we actually use to run the economy I think a lot of

- 9:44

- people in the UK probably think that the government or the central bank is is in control of most most money in

- 9:52

- circulation and Issues new money into circulation but that's not the case it's

- 9:58

- private banks that create the vast majority of new money in circulation and also decide how it's allocated

- 10:09

- the official terminology for this accounting entry is Commercial Bank money

- 10:15

- when Banks issue loans to the public they create new Commercial Bank money

- 10:21

- when a customer repays a loan Commercial Bank money is destroyed the banks keep the interest as profit

- 10:30

- there's a lot of misconceptions about the way Banks work there is a a poll done by the Cobden Center where they

- 10:37

- asked people you know how how they thought Banks actually operated around 30 percent of the public think that when

- 10:44

- you put your money into the bank it just stays there and it's safe and you can understand why because you know every

- 10:49

- every child has a piggy bank where you keep putting money in and then when it's a rainy day you smash it and you take

- 10:55

- that money out and you spend it so a lot of people keep this this idea of banking

- 11:01

- you know it's somewhere safe to keep your money so that it's there for whenever you need it um another the other 60 of people assume

- 11:09

- that when you put your money in that money is then being moved across to somebody who wants to borrow it so you

- 11:15

- have a pensioner who keeps saving money on her entire life and then her life savings have been lent to some you know

- 11:21

- young people who want to buy a house but actually Banks don't work like that

- 11:44

- at the moment in the UK money creation and control is is largely in the hands

- 11:51

- of private Banks about 97 to 98 of money um that's that's created is is created

- 11:58

- um as Bank Bank debt money you could call it um when Banks issue money into

- 12:04

- circulation as as loans essentially this is very poorly understood fact

- 12:11

- it's not a conspiracy theory it's not a um it's not a crackpot Theory it's the

- 12:16

- way the bank of England describes the process when Banks make loans they create new money

- 12:34

- a few economists will realize the way the money system works but if you don't if you don't realize the way that money

- 12:40

- works and you think that you know everybody's saving is going to work well for the economy what really happens once

- 12:47

- you understand the way the money system works is that if everybody starts saving uh the amount of money in the economy

- 12:52

- strengths and we have a recession so most economists don't have this this full picture they don't understand all

- 12:59

- elements of the system they rely on assumptions on you know receive

- 13:05

- knowledge without actually going into the details and you know money is money

- 13:10

- is the center of the economy if you don't understand where it comes from who it creates who creates it and when it

- 13:16

- gets created then how can you understand the entire economy

- 13:25

- when the vast majority of money that we use now is not cash but it's electronic

- 13:31

- money then whoever's creating the electronic money is getting the proceeds of creating that money and obviously

- 13:36

- creating electronic money is much more profitable than creating cash because you don't have any production costs at

- 13:42

- all so while we've got 18 billion over the course of a decade

- 13:47

- in profit from creating cash the banks have actually created 1.2 trillion pounds

- 13:53

- between 1998 and 2007 the UK money supply tripled

- 13:59

- 1.2 trillion pounds was created by Banks whilst 18 billion pounds was created by

- 14:05

- the treasury a lot of people think when I say this or

- 14:11

- when you say this or when positive money say this that we're all just a bunch of Nutters but on the 9th of March in 2009

- 14:17

- the government of the Federal Reserve Ben Bernanke gave the first ever broadcast interview the governor of the

- 14:25

- Central Bank of the United States of America never given and the day before that he'd bailed out AIG

- 14:33

- um which is a insurance company not even a bank actually to the tune of about 160

- 14:38

- billion dollars so the journalist system now Mr Bernanke where did you get 160

- 14:44

- billion dollars to bailout AIG is that tax money the fed is spending it's not tax money the banks have accounts with

- 14:53

- the fed my Bank lend to a bank we

- 15:00

- computer to mark up the accounts they have with that for Akin

- 15:08

- Mr burrowing [Music] Banks create new money

- 15:14

- whenever they extend credit buy existing assets or make payments on their own

- 15:19

- account which mostly involves expanding their assets

- 15:24

- when a bank buys Securities such as a corporate or Government Bond it adds the

- 15:30

- bond to its assets and increases the company's Bank deposits by the corresponding amount

- 15:35

- [Music] new Commercial Bank money enter circulation when people spend the credit

- 15:42

- that has been granted to them by Banks I found that talking on the doorstep

- 15:48

- from August last year round to August 2009 round two

- 15:54

- the general election or eight nine eight nine months I suppose knocking on doors is that when you try to explain how the

- 16:01

- money system works there's an almost inbuilt refusal of

- 16:07

- people to accept that such a bizarre situation could actually exist

- 16:13

- no you can't possibly you know what do you mean it can't Banks can't thanks

- 16:19

- don't create money out of thin air that's ridiculous they can't do that they lend out their deposit his money

- 16:24

- most people have an idea of how money is they're used to their own way of handling money

- 16:30

- and they try and Implement their own idea of how how their small household

- 16:36

- economy works into the national economy and of course it just doesn't work out it just doesn't

- 16:41

- work out at all by 2008 the outstanding loan portfolio of Bank created credit also known as

- 16:49

- Commercial Bank money stood at over two trillion pounds as recently as 1982 the ratio of notes

- 16:57

- and coins to bank deposits was 1 to 12. by 2010 the ratio had risen to 1 to 37.

- 17:06

- that is for every pound of Treasury created money there was 37 pounds of Bank created

- 17:12

- money in the 10 years prior to the 2007 crisis

- 17:18

- the UK Commercial Bank money supply expanded by between seven to ten percent every year

- 17:25

- a growth rate of seven percent is the equivalent of doubling the money supply every 10 years

- 17:32

- the amount of money they're creating out of nothing is just incredible 1.2 trillion in the last 10 years and

- 17:39

- there's that money has been distributed according to the priorities of the banking sector you know not the

- 17:45

- priorities of society Bank sector itself grew from 1980 2.5 trillion

- 17:54

- dollars to 40 trillion dollars by assets in 1980

- 17:59

- global bank assets were worth 20 times the then global economy by 2006 they were worth 75 times

- 18:07

- according to the U.N as the following chart shows total Bank

- 18:13

- assets of UK Banks as a percentage of GDP remain relatively stable at 50 to 60

- 18:19

- percent up to the end of the 1960s after that they shot up dramatically and

- 18:26

- the real money in in the world to be made today is not by producing anything at all it's simply by forms of

- 18:33

- speculating basically making money from money that's the most profitable and and by far in a way

- 18:40

- um the the biggest form of of activity of economic activity that exists in the world today

- 18:46

- today banks are no longer restricted by how much they can lend

- 18:51

- and as such how much new credit they can create out of nothing

- 18:57

- they are restricted solely by their own willingness to lend

- 19:03

- the issue with allowing Banks to create money there's two main issues firstly the fact that they create this money

- 19:09

- when they make loans so it guarantees that you know we have to borrow all our

- 19:14

- money for the economy from the banks as such

- 19:20

- economy the government needs magnesities to allow for ever increasing

- 19:25

- debt the only way the government can create additional purchasing power is by

- 19:31

- getting itself and us into more depth the second big issue with allowing Banks

- 19:37

- to create money is that they have the incentive to always create more you know they create

- 19:43

- more money if they issue a loan they get the bonuses and the commissions and the incentives to create you know to lend as

- 19:49

- much as possible you have to develop a sales culture what did they do they recruited an amazing guy lovely guy Andy

- 19:56

- Hornby who came from Asda to turn the bank into a supermarket retailing

- 20:02

- operation if you trust Bankers to control the money supply the money supply will just grow and grow and grow

- 20:09

- as will the level of debt until the point where it crashes you know when some people can't repay the debt and

- 20:15

- then they'll stop Lending you hear politicians and journalists saying you know we've we've been living

- 20:21

- beyond our means we've become dependent on debt we need to reign in our spending and live within our means

- 20:28

- it's not possible in the current system you know the reason why I've released in debt now

- 20:34

- is not because they've been recklessly borrowing um we haven't borrowed all this money from you know an army of pensioners

- 20:40

- who've been saving up their whole whole lives money in the current system is there you know it's created when Banks

- 20:46

- make loans so the only way in the current system that we can have any money in the economy you know the only

- 20:52

- way we can have money for business to trade is if we borrowed it all from the banks

- 20:59

- and it's the very opposite of what the Tory party is arguing today which is

- 21:05

- that you have to create savings before you can help the National Health Service and it's because economists have

- 21:11

- completely confused those things both in mandatory policy terms but also in economic thinking and

- 21:17

- because most people still Harbor the old-fashioned view that you need savings before you can invest

- 21:24

- that we have the mess that we're in today now one of the reasons why we find

- 21:29

- it difficult to understand the banking system and credit creation is that we leave school without any money

- 21:36

- and we go and get a job working as an apprentice to a plumber we work really hard all month at the end of the month

- 21:43

- somebody puts money in our bank and so for us the logic is you work and then

- 21:48

- you get money you get Savings in reality you would never have got that job if

- 21:54

- credit hadn't been created in the first instance it's a really important

- 22:00

- um conceptual misunderstanding and it isn't something that the public

- 22:05

- just are guilty of economists don't understand this stuff money doesn't come out of economic activity

- 22:11

- a lot of people have come across as kind of assume that if you've got people if you've got businesses and you've got

- 22:16

- people doing things that somehow money somehow emerges out of the process of people

- 22:22

- doing things doing economic making things and growing things and selling things and producing things that somehow

- 22:28

- money just emerges it's not it's like oil in the car you have to put it in when I see David

- 22:34

- Cameron talking about how we need an economy not based on debt but we need an

- 22:39

- Economy based on savings he just doesn't know what he's saying it's ridiculous it's absolutely absurd and it shows his

- 22:46

- complete lack of understanding of how our money system actually works what he's essentially saying is that we need

- 22:54

- an economy with no money if everyone was saving we'd have mass disappearing of

- 23:00

- money which is essentially what a bank write-off is essentially is people defaulting on their debt which which

- 23:06

- essentially is just money disappearing but if people weren't taking on the debt then it's just it's just such a joke

- 23:13

- it's such a a amateur understanding of how our economy works and how the

- 23:18

- monetary system works and how money is actually created so I really do get a laugh out of watching what people are

- 23:24

- actually saying and they're all just regurgitating what they've learned off each other and you just hear the same things and it just makes me it it really

- 23:32

- gets on my nerves when I hear people talking about um yeah we need more regulations we need

- 23:38

- to regulate the way banks are actually and the bonus it's all just one big smoke screen and working on all the

- 23:45

- symptoms of a greater disease which is really you need to look at the the money system the way money is created and I if

- 23:53

- we don't want any debt then we're essentially saying we don't want any money and we want a moneyless economy with the exception of the three percent

- 23:59

- that's created debt free you know it's a paradox under the current system if you if we as the

- 24:06

- public go into further debt then that's going to put more money into the economy and we're going to have a boom when you

- 24:11

- have a boom it's easier to borrow so people get into even more debt and eventually you know this this cycle

- 24:16

- continues it gets easier and easier to get into debt until some people get over in debt and then you know they default

- 24:23

- they can't repay their mortgage that's what happened then you know it happened first in subprime America

- 24:30

- um and then you know that just brings through a wave of defaults which will Ripple across the entire economy

- 24:36

- the banks go insolvement then we're into a financial crisis and then the bank stopped landing and

- 24:42

- you know they were excessively Landing in the boom and then they stopped landing and then that Court makes the

- 24:48

- recession even worse people lose their jobs and then they become even more dependent on debt just to survive

- 24:54

- basically you know we have a system where we have to borrow in order to have

- 25:00

- an economy we have to be in doubt to the banks and that that guarantees you know a

- 25:05

- massive profit for the banks

- 25:11

- [Music] speaker no return to boom and boss

- 25:20

- [Music] netbank lending must forever increase

- 25:28

- we're paying interest on every single pound even if even if you think the money belongs to you

- 25:34

- somebody somewhere is paying interest on that money the banking system has such a huge impact on the world

- 25:40

- but only because it supplies our nation's money supply we have to protect them we have to

- 25:46

- subsidize them we have to allow them to continue because the the disaster of of

- 25:51

- a bank collapse affects us all in a huge way and anyone that says that we shouldn't have bailed out the banks

- 25:57

- doesn't quite understand the the nature of our monetary system that's like eliminating a huge chunk of our money

- 26:05

- but also bailing out the banks is perpetuating a system which is never going to work anyway so whatever we do

- 26:13

- we're always going to have this cycle until we separate how money is created and the activities are banking then the

- 26:19

- banks can do as they wish they're a normal business like everyone else there's a major Democratic issue here as

- 26:25

- well I mean you have these private profit-seeking Banks creating up to 200

- 26:30

- billion pounds a year and pumping that into the economy wherever they want basically wherever it suits them whether

- 26:37

- they're pumping it into you know these toxic derivatives or putting money into

- 26:42

- housing bubbles just making housing more expensive 200 billion pounds in 2007 of

- 26:48

- new money coming into the economy created out of nothing and where that gets spent determines you know the shape

- 26:54

- of our economy effectively so if we're going to allow anybody to create new money out of nothing and we should at

- 27:01

- least have some democratic control over how that money is used I mean it would we rather have had that money used for

- 27:07

- health care you know to deal with some of the environmental issues to reduce poverty or would you rather have it to

- 27:13

- make houses more expensive so that none of us can afford to to live in a house

- 27:21

- you can see it as a subsidy a special super subsidy to the banks for the right

- 27:29

- to create money which should be for the benefit of the public and spend through a democratic

- 27:35

- process

- 27:43

- there's also another form of money which is effectively an electronic version of

- 27:48

- cash and it's a type of money that the commercial Banks use themselves to make

- 27:53

- payments between each other the High Street Banks don't want to be carrying around huge quantities of money because

- 27:59

- it's dangerous and it's inconvenient and it's you know expensive you have to hire security guards for that type of money

- 28:05

- so what they do is they pay each other in what is an electronic version of cash

- 28:11

- which in the industry is known as Central Bank Reserves they keep this electronic cash in

- 28:19

- accounts at the bank of England but as a member of the public you can't access this electronic cash you can't

- 28:25

- get an account with the bank of England what they do is they they effectively sell the central bank money to the banks

- 28:33

- and they do this by creating it out of nothing and using this money to pay for

- 28:39

- bonds to buy bonds from The High Street Banks so the High Street bank will come along

- 28:45

- with a bond which is you know effectively government debt and it will give it to the bank of England and then

- 28:50

- return the bank of England will type some new numbers into the bank's account at the bank of England so effectively

- 28:56

- they're creating Central Bank Reserves out of nothing the bank of England

- 29:02

- by increasing the available credit in the settlement bank's account with the bank of England

- 29:08

- the settlement Bank in return post bonds or sales assets as collateral for the

- 29:13

- reserves a total of 46 Banks hold Central Reserve

- 29:20

- Accounts at the bank of England smaller or foreign Banks hold accounts

- 29:25

- with one of these 46 Banks to allow them to accept or make payments in pounds sterling

- 29:32

- prior to March 2009 the bank of England would ask each of the major settlement Banks how much Reserve currency they

- 29:39

- needed the settlement Banks would then swap a bond for the reserve currency

- 29:45

- and agree to repurchase the bond for a specific amount at a specified future date

- 29:52

- the settlement Banks would then receive interest at base or policy rate for the Central Bank Reserves they held

- 30:01

- since the crisis settlement Bank Central reserves have shot up dramatically

- 30:19

- when Bank customers transfer funds from their account to another person's account

- 30:25

- a process called intraday clearing occurs the amount of central Reserve Currency

- 30:30

- Bank a has at the bank of England is reduced by the corresponding amount

- 30:35

- that bank B receives this is the importance of central Reserve currency to Banks

- 30:42

- before the credit crisis if a bank was short of central Reserves at the bank of England to meet its

- 30:49

- obligations then the bank would have to loan reserves from other banks with interest

- 30:59

- foreign

- 31:05

- if you sell something on eBay you know that that deal is not complete until you get some money put into your account you

- 31:11

- know most people actually want to see the money in their account before they're happy to close on a deal now the

- 31:16

- banks are pretty much the same but they want to see the money in their account at the bank of England before they

- 31:22

- consider a deal complete so for example if you if you're buying a house from somebody who banks with a different bank

- 31:28

- then what what will happen after you spent a quarter of a million on a house is you'll tell your bank to transfer

- 31:34

- some money to the house sellers bank and what the bank will do is actually

- 31:40

- instruct the bank of England to move 250 000 from their account at the bank

- 31:45

- of England to the bank of the house seller and that money will actually move

- 31:51

- across between the accounts at the bank of England um when that money's moved across and the banks will consider that that

- 31:57

- payment has been made you know it's been settled They Don't Really deal in the kind of

- 32:03

- money that we have in our accounts they deal in this special money that's can only be used at the central bank

- 32:12

- there are millions of people across the country all transferring money to each other using only a few major Banks

- 32:19

- these Banks can keep a tally on their computer systems and usually many of the movements cancel

- 32:25

- each other out at the end of the day the five major Banks RBS Lloyds

- 32:32

- HSBC Barclays and Santander hold over 85 percent of all deposits

- 32:42

- as there are a limited number of banks in the system the central Reserve money can only be moved around them in a

- 32:49

- closed loop the money is just circulating through the system over and over again and if

- 32:55

- you think about it a one pound coin could be used to make a billion pounds of payments if it was circulated a

- 33:01

- billion times and that's effectively the system that you have now is you have a small pool of real money that's just

- 33:06

- going round and round the system and it's being used to make a huge quantity of payments on our behalf just before

- 33:13

- the crisis there was only 20 billion pounds in the accounts at the central bank

- 33:20

- if they don't have enough of this central bank money then effectively they can't make payments and if that happens

- 33:27

- then pretty quickly the entire system sees us up so the bank of England has the responsibility of making sure

- 33:33

- there's enough of this money in the system the requirements for banks to hold a

- 33:40

- specific amount of reserves has changed many times since 1947.

- 33:45

- at that time Banks needed to hold a minimum ratio of 32 percent of reserves cash or treasury bonds to deposits

- 33:54

- in 2006 the corridor system was introduced in which banks could set their own

- 34:00

- Reserve targets each month [Music]

- 34:05

- the rules changed again in March 2009 when the bank of England introduced

- 34:10

- quantitative easing quantitative easing in effect gives settlement Banks the central Reserve

- 34:16

- currency for free the central Reserve currency is what is

- 34:23

- referred to as the real money in the fractional Reserve model but the fact is Banks can have as much

- 34:30

- of this as they want and Central Reserve currency itself is a form of Fiat money which is backed by

- 34:36

- nothing as a consequence there is no longer a meaningful fractional Reserve

- 34:45

- foreign

- 34:50

- [Music]

- 34:58

- with the development of a gold standard that really comes before in the 1880s 1890s where essentially countries pegged

- 35:05

- themselves to a particular defined value of gold and then they have an agreement to fix that value to hold that value

- 35:12

- into trade gold amongst themselves to make sure the balances are all there and also to try and restrict or expand or

- 35:19

- contract activity in their own economies to make sure that the balance that

- 35:24

- particular fixed prices is maintained that disintegrates in after the first World War I mean this is where the whole

- 35:31

- thing breaks apart very major dislocation in the international monetary system at that point not really

- 35:36

- resolved until you get Bretton Woods agreements at the end of the second world war in which everything is pegged

- 35:43

- to the dollar and the dollar is pegged to the gold so you kind of want to remove from gold backing or saying that

- 35:48

- there is a definite you know so solid commodity money behind the paper money

- 35:53

- and the credit money that we're all using over here you're kind of one removed from it after Hiroshima Tokyo wondered when the

- 36:00

- next atom bomb would fall they did not wander long

- 36:06

- [Music] in 1944

- 36:12

- at Bretton Woods the U.S and the UK began to negotiate how to govern the world economy the

- 36:19

- world monetary system and came up with the World Bank and the IMF in a series of other institutions designed to manage

- 36:27

- the Global Currency and there was still a gold standard but this gold standard was going to be tied to the dollar all

- 36:33

- of the world's gold had moved from London to Fort Knox

- 36:38

- and all of the world's currencies were tied to the dollar this system was designed to manage the

- 36:46

- sorts of imbalances to avoid credit crunches or for countries but credit crunches are known as balance of Trades

- 36:52

- deficits I.E when they can't pay their bills and their currency collapses the

- 36:58

- currencies were managed and the system was stable as long as the

- 37:03

- Americans played the role of oversight now who knows the great story about how

- 37:10

- that all came to an end so the quantity of money that was needed to pay for the Vietnam War

- 37:16

- that's exactly what I was trying to get at oil shocks was another one that meant that the Americans were no longer

- 37:22

- respecting their role or playing their role governing the monetary system they were inflating the value of their own

- 37:27

- currency but ostensibly it was meant to be tied tied to Gold into every other currency

- 37:33

- so what did the French do the French were a little bit worried that President Nixon wasn't entirely honest

- 37:41

- and they were worried that they were that precisely what we described that Nixon was printing money when he

- 37:49

- shouldn't have been what's going on and they were worried there wasn't enough gold to honor the exchange rate of the

- 37:55

- French franc so they sent a gun boat to New York Harbor to

- 38:00

- ever so politely ask for our gold back please did they get their gold back

- 38:06

- go and guess they didn't and the Bretton Woods system came to an end

- 38:13

- and this is the point in which we enter the modern era of the financial system

- 38:26

- historically money creation was pegged to a commodity often gold but today it

- 38:33

- is pegged to nothing which means there is nothing backing our

- 38:38

- money this piece of paper is just a piece of paper

- 38:46

- where does this leave us if money is based on nothing why do we think it has any value

- 38:55

- sorry because we can still go and exchange it what somebody else is going to shout

- 39:01

- great little Latin fact the word for credit comes from

- 39:06

- belief correct

- 39:16

- since the collapse of the dollar gold standard in 1971 and the deregulation of

- 39:21

- the financial system money creation has grown exponentially

- 39:27

- the world economic Forum meeting in in Davos at the present time have called on a

- 39:34

- need for the credit within the

- 39:39

- economy the global economy to be expanded by 100 trillion dollars 100 trillion US

- 39:48

- Dollars uh trillion is 12 notes so 100 trillion if

- 39:54

- you want to imagine is a one that followed by 40 knots they believe this credit expansion will

- 40:01

- create a boom because there is now more money in the economy with which to make investments

- 40:06

- it's fascinating that this the emergence of digital currencies how it's transformed everything really because it

- 40:13

- just completely Unleashed private Banks to dominate and create the money system

- 40:19

- that works for them and works for the people who run private Banks

- 40:26

- if you want a growing economy onto the current sale we have to have growing debt you can't

- 40:33

- you know this is something that very very few people really understand especially not the politicians who are

- 40:39

- managing the economy which is a scary thought [Music]

- 40:48

- as the money supply grows more money is available which can be invested in

- 40:54

- productive Avenues however it can also be used to gamble and drive up asset

- 40:59

- prices [Music]

- 41:15

- inflation is a rise in the general level of prices of goods and services in an

- 41:20

- economy over a period of time when the general price level rises each

- 41:26

- unit of currency buys fewer goods and services as the money supply grows and there is

- 41:32

- more currency available more money is available for investment which can lead to growth

- 41:37

- but more money is also available for purchases of goods and speculation which

- 41:43

- leads to inflation essentially inflation is what happens

- 41:49

- when too much money is chasing too few goods and services

- 41:56

- so there's too much money for the the actual output of the economy

- 42:05

- in the seven years between 2000 and 2007 the money supply doubled and the banks

- 42:12

- you know the Central Bank the bank of England in this time was under the impression that they had it under control because they were saying you

- 42:18

- know prices aren't going up that much of course they were only looking at prices in you know in your local Corner

- 42:25

- Shop they weren't looking at the price of Housing and housing is you know the biggest expenditure that most people

- 42:30

- will make

- 42:38

- increasing house prices it may may make you feel like you're

- 42:44

- you're becoming wealthier but as your wealth increases the effect is that your

- 42:51

- children's wealth is actually decreasing so in fact there's no Nets gain in wealth because your children are going

- 42:58

- to have to pay even more when they want to buy a house so in

- 43:03

- effect there's no there's no kind of net increase they're gonna have to earn even more they're gonna have to go into even

- 43:08

- more debt so the rising house prices do not create

- 43:14

- additional net GDP value to the economy it they actually what they do is they

- 43:21

- redistribute wealth uh towards those people who already have houses are you wealthier people and

- 43:26

- remove it from poor people who can't afford to get on the housing ladder so it's another example of a very

- 43:33

- regressive policy actually to allow house prices to Simply inflate it makes

- 43:39

- everybody feel kind of like things are going well and people spend more money on other stuff they take Equity out of

- 43:45

- their houses but it it's not creating new jobs it's not enhancing the quality

- 43:51

- of the economy it's not helping our balance of trade it's not helping the public deficit it's a it's a zero-sun

- 43:57

- game as of August 2011

- 44:03

- 85.5 of consumer Bank lending was secured as mortgages on dwellings

- 44:09

- if you have somebody creating money that can only be spent on one thing which is housing then the price of that thing is

- 44:15

- going to go up between 2000 and 2010 they created over a trillion pounds of

- 44:21

- new money 500 billion pounds just in the three years before the crisis that's why

- 44:26

- house prices went up the way they were there's nothing you know special about houses it was just all this funny money

- 44:32

- being pumped into that market if money is spent into the economy into into a lot of money goes into

- 44:39

- houses for example into mortgages that's an increase in the amount of

- 44:44

- money in the economy without a corresponding increase in activity in output in GDP it's non-gdp based

- 44:53

- spending that's what causes inflation and and in

- 44:59

- the UK we've we've had it in Spades we've had you know this massive housing boom

- 45:05

- and that the main cause for the housing boom in my opinion is the huge amount of

- 45:10

- speculative credit created by the Banks to go into houses if houses were cheaper

- 45:17

- they would be easier to build more they'll be more of them would be built there would be less huge houses with

- 45:25

- hardly any people in them London would not be the center of a kind of very rich

- 45:31

- speculative orgy where all the richest people in the world wants want to get a property in London because it's seen as

- 45:37

- a great asset you know houses would be seen as places to live primarily rather than places to invest

- 45:44

- important thing to think about is if you're a bank and you've got to make a loan

- 45:50

- you have choices you can you can give that lane to a small business

- 45:55

- and you'll know that the risk to you of that loan failing defaulting is actually

- 46:01

- quite High because that small business the owners of that business have limited liability which means if the business

- 46:08

- goes bust you as a bank are getting nothing back essentially you know that that's it so

- 46:14

- that's kind of high risk compared to loaning your money to somebody with some

- 46:19

- collateral with a house behind them like a mortgage so there's a there's a kind of simple incentive for banks to prefer

- 46:25

- putting money into housing then into a small business now that's a real problem

- 46:31

- or if you if you if you widen that out across a whole economy because it means

- 46:36

- there's an incentive you know to put money into speculative rather than productive Investments so again we have

- 46:43

- to think about how we create a monetary system that is more balanced between those two kinds of speculative and

- 46:50

- productive investment the government's showing very little uh enormous reluctance to regulate the housing

- 46:56

- market and to again regulate the amount of money that that Banks put into houses

- 47:02

- we don't decide who creates credit for what no we leave that to a couple of chaps in a bank to decide basically

- 47:08

- foreign

- 47:16

- occurs when there is very high inflation in the price of a specific good or service over a short period of time

- 47:25

- the idea of the Tulips and their relevance is that we saw the first ever Financial bubble and crash

- 47:33

- The Craze for tulips black tulips being a mythical ideal of what somebody could

- 47:40

- genetically engineer through cultivation after many generations became a Mania in

- 47:47

- the Netherlands in the 1630s what they didn't realize was that many of the very very rare patterns on tulips

- 47:53

- were caused by a virus and weren't genetic at all but they traded them to the extent that

- 47:59

- tulip bulbs got to the point where they were worth 10 times the average annual salary of a person working in the Netherlands

- 48:07

- there was a Futures Market in tulip bulbs because obviously you plant them now but you don't know what's going to come out the ground so we see already

- 48:13

- 400 years ago that a money system or a financial system is not something that

- 48:18

- exists in the abstract Somewhere Out There In The Ether but something that was to do with States power trade and

- 48:28

- how they interact with each other unlike tulips which are a disposable

- 48:34

- luxury houses are both a necessity and a luxury and as such they are ideal as a vehicle

- 48:42

- for money and bubble creation a dwelling is perhaps the most prized

- 48:48

- possession of value most people aspire to

- 48:54

- inflating house prices in this way allows a nation to expand its money supply without affecting inflation data

- 49:02

- the additional purchasing power created increases the perceived wealth in relation to other nations

- 49:09

- and thus it creates relative power it is a way of increasing monetary power

- 49:15

- without investing in the productive growth of Industry

- 49:20

- but certainly if you look Britain and America has outstanding examples of this these are countries with very high rates

- 49:26

- of private home ownership so you've got a good base to try and perform this sort of policy off the back of I think it was

- 49:32

- quite deliberate in the case of the US always explicit zaling Greenspan as head of the Federal Reserve when confronted

- 49:39

- by a stock market crash at the end of the 1990s quite deliberately slashed

- 49:46

- interest rates to almost zero everyone can borrow very very cheaply in

- 49:51

- particular it's very easy to borrow against a house because this is an asset and it's potentially something that a

- 49:57

- bank can say well okay we're not just lending you money unsecured you actually do have a house and that's great because we can repossess it they won't tell you

- 50:03

- this when you take the mortgage but they can do this and that bubble is in what fuels expansion such as it is inside the

- 50:10

- US and inside the UK where something similar takes place for the next decade or so I think it's also a reflection of

- 50:16

- an underlying weakness of these governments that they they simply like the will and possibly the ability but I

- 50:24

- think it more comes down to a will to challenge financial markets to challenge big capital and say we're going to do

- 50:30

- something different now and you're going to have to go along with it because we've been democratically elected and

- 50:35

- new law frankly happened and we have mandates to do this and we're going to make this happen you guys remember it's all part of the plan

- 50:42

- what are you yapping about you voted for it

- 50:48

- in Holland or in the Netherlands what we had over a period of trying to get

- 50:54

- independence initially from Spain and trying to raise money to get an army to free themselves was Financial Innovation

- 51:00

- they innovated public lotteries to get money together they had public subscription this was the idea that led

- 51:07

- to the idea of public shares a piece of the action that anybody could invest in that meant that something like two-thirds of the population was

- 51:14

- investing in tulip bulbs by the 1630s after Independence these these

- 51:19

- instruments were applied to financing expansion why was such a small country able to hold its own against so much

- 51:26

- bigger countries for example Spain and Portugal that had the benefits of their Empires for over a century

- 51:33

- in respect of the Netherlands why could they compete on what resource basis well

- 51:39

- they had a more efficient a more involved and a broader based Financial

- 51:44

- system with these instruments that they'd innovated that allowed them to bring more money to bear at one point

- 51:50

- than anybody else more quickly incredible

- 51:57

- but true

- 52:05

- now inflation can be avoided if the amount of money that goes into the

- 52:10

- economy is regulated in a way that it doesn't exceed the actual activity that's

- 52:18

- happening in the economy now the best way to do that in my opinion is to make

- 52:24

- sure that money is issued into the economy only for productive investment

- 52:30

- for productive goods and services so money goes in to help a small business

- 52:37

- start up which creates jobs which creates additional purchasing power

- 52:43

- which means there's no inflation during their history almost all central

- 52:48

- banks have employed forms of direct credit regulation the central bank would determine desired

- 52:54

- nominal GDP growth then calculate the necessary amount of credit creation to achieve this

- 53:01

- and then allocate this credit creation both across the various Banks and type of Banks and across industrial sectors

- 53:09

- unproductive credit was suppressed thus it was difficult or impossible to

- 53:16

- obtain Bank credit for large-scale purely speculative transactions such as

- 53:21

- today's large-scale Bank funding to hedge funds the World Bank recognized in a 1993

- 53:27

- study that this mechanism of intervention in credit allocation was at the core of the East Asian economic

- 53:34

- miracle there's all sorts of things that governments have done in the past very successfully in a number of cases and

- 53:40

- are not often not unsuccessfully in this country but you know the examples that spring to mind like South Korea Japan

- 53:45

- often any stage where government's been quite targeted about how they're going to rebalance the economy and picking

- 53:51

- sectors and deciding where the investment should take place I think that has to start happening in the UK because we're in a demand side recession

- 53:58

- rather than looking at crisis of Supply you have to have a system where credit

- 54:04

- is put into productive Avenues where credit is put into building High-Speed Rail links where

- 54:11

- credit is put into building houses rather than giving people money to inflate the price of of houses so it's

- 54:19

- it's quite simple really in that way and the current system is simply set up

- 54:26

- not to do that basically the creation of money by private banks

- 54:31

- for non-productive usage causes real inflation and as such it is a tax on the

- 54:36

- purchasing power of the medium of Exchange

- 54:46

- the figures for the UK are quite Stark actually that average median real incomes for so

- 54:54

- that's you know what bit in the middle uh for most people declined over the last eight years or so they're now in

- 54:59

- quite sharp decliners as we go into the recession I mean the sharpness really since it looks like since about the 1930s but that way so real incomes are

- 55:06

- declining Bank created fiat currency allows the private Banks to suck wealth from the

- 55:13

- economy and over time results in a gradual decrease in the standard of living

- 55:19

- as people become poorer they become even more dependent on debt

- 55:24

- and this at a time when efficiency and machination have improved dramatically

- 55:29

- if you know you could go back to the 1960s and we were expected to to we're looking forward to an age of leisure

- 55:36

- what would be what they were talking television programs saying what's people can do with all their spare time

- 55:41

- you know and now we've got more people working harder than ever

- 55:47

- spending more than ever which looks great you know when spending more everyone says oh yeah you know but

- 55:54

- if you're not actually benefiting from what you're spending if you're having to spend the money on child care costs on

- 56:00

- commuting costs you know and so forth uh just you know the cost that people

- 56:05

- didn't in the past used to have to pay because you know you could walk to work and you know one member of the family

- 56:12

- remain was able to stay at home and be a permanent Homemaker then you're not actually make sure you're not actually

- 56:17

- any better off you know everyone's under and everyone's under such enormous pressures nowadays

- 56:23

- you know I am conscious that say my four nephews and nieces

- 56:28

- are facing difficult times she's going to find themselves having to work

- 56:35

- you know um very hard just to to keep just to keep a

- 56:40

- roof over them just to get a roof over there just keep a roof over their head people are getting poorer in real terms

- 56:46

- it's because prices always going up because all this new funny money has been pumped into the system by the Banks

- 56:53

- and they're creating it all as debt so at the same time as prices are going up and things are getting more expensive

- 56:58

- we're getting further and further into debt and you know our our wealth and the

- 57:04

- return that we get from actually working is getting less and less all the time when you can't deal with poverty when

- 57:09

- you have a financial system and a money system that distributes money from the poor to the very rich

- 57:15

- any distribution that you try and do in the opposite direction is um you know it's effectively pressing in

- 57:21

- the wind if you look at issues like you know increasing inequality one obvious

- 57:27

- way to tackle inequality is to have say for example a redistributed tax system you know you tax the rich you give some

- 57:34

- money to the poor you move a bit of money down down the scale um that's all very well but if you

- 57:41

- completely Overlook the fact that there's another redistributive system which is taking money from the poor and

- 57:46

- giving it to the rich then you're not really going to tackle this inequality and

- 57:52

- um the way a debt-based money system works it guarantees that for every pound of money there's going to be a pound of

- 57:58

- debt now that debt is typically going to end up with you know the poor uh the sort of lower middle classes those

- 58:05

- people end up with the debt and they end up paying interest on that money which then goes back to the banking sector and

- 58:10

- gets distributed to the people working in the city or in Wall Street

- 58:15

- um and what this what this system does overall is it distributes money from from the poor to the rich essentially

- 58:22

- distributes money from you know the poorer regions of the UK back to the

- 58:27

- city of London and it also distributes money from all the small businesses you know all the little factories around the

- 58:35

- UK and distributes that money back into the bank financial sector we have a system whereby the activity of actually

- 58:43

- supplying occurs under the very same roof as the same organization that's

- 58:48

- responsible for profiting from putting together borrowers and lenders are you back so a bank

- 58:55

- creates our nation's money supply as well as making loans for profit the

- 59:02

- government cannot allow the banking system to fail because if it did over 97 percent of all money would

- 59:09

- disappear this is why in the event of a crisis the risk is transferred to the taxpayer

- 59:16

- but even during normal times Banks receive numerous guarantees and benefits beyond the right to create money Bill by

- 59:23

- the way I know the Bank of America is a very big bank it happens I've got 32 there myself and just between us what

- 59:30

- Assurance do I have that this money is safe well all deposits up to ten thousand

- 59:35

- dollars are assured or insured by the federal government in Washington that's my guarantee yes have you heard that the

- 59:42

- federal government is about 280 billion dollars in the whole [Music] [Applause]

- 59:49

- Banks receive large safety nets from the government the taxpayer guarantees 85 000 pounds as

- 59:56

- Deposit Insurance and the bank of England provides liquidity Insurance in case a bank runs

- 1:00:02

- out of Reserve currency

- 1:00:09

- someone wrote that a big Investment Bank is like a giant vampire squid wrapped

- 1:00:16

- around the face of humanity hypnotizing politicians who throw money

- 1:00:21

- at the banks no strings attached no matter what damage is done

- 1:00:28

- trashing the planet forcing cuts to things that make life better

- 1:00:34

- by schools goodbye playgrounds goodbye jobs

- 1:00:40

- the bankers that we bailed out then gave themselves bonuses that were bigger than

- 1:00:47

- the first wave of public spending cuts Britain alone gave the banks more money

- 1:00:53

- than it cost to put a man on the moon six times over

- 1:01:00

- where did our money go who let the banks get away with it why

- 1:01:06

- can vampire squids ever be useful no government yet is brave enough to

- 1:01:13

- tame them perhaps they need a plan

- 1:01:36

- the spending cuts agenda is an attempt by the government to shift debt from its account to that of the public

- 1:01:44

- this is the government's response to the bank bailouts and is necessary in a debt-based monetary system

- 1:01:50

- where increased purchasing power is the result of growing debt and where a diversification of debt

- 1:01:56

- provides overall stability and Market confidence policies such as student fee increases

- 1:02:03

- and the privatization of Public Services assets and Industry follow the same model

- 1:02:09

- the problem we're facing I think is that uh there's been there's this transference from the public debt to the

- 1:02:15

- private debt which is a which is essentially a way of transferring risk actually away from sort of UK PLC and

- 1:02:23

- the government on to the the heads of individuals and it's going to be the most vulnerable individuals who are

- 1:02:29

- going to have the most debt thus it's a very unprogressive regressive uh policy

- 1:02:35

- framework that the government's embarking on where the risk is moved on to those who are most vulnerable and if

- 1:02:42

- there is another Financial shock if there's an oil shock for example the people who will pay the penalty or those

- 1:02:47

- are the poorest people in society or homeowners for example who will fall into negative equity if interest rates

- 1:02:54

- go up even one or two percent uh they'll be real really big problems so I don't

- 1:03:00

- think it's a sensible Way Forward at the moment at all and it's it's regressive and it's certainly not fair in the terms

- 1:03:07

- that um that the government's talk about and it's certainly not a case of we're in this together

- 1:03:13

- as more of a country's resources and industries are privatized the private sector takes on more debt

- 1:03:19

- as a result more money is created and there is a boom

- 1:03:25

- some private Equity companies have taken this Theory to the extreme engaging in a practice known as a

- 1:03:32

- leveraged buyout where a company is purchased at an often inflated price and the purchase price is

- 1:03:39

- transferred to the business as a debt the company becomes responsible for the

- 1:03:45

- funding of its own purchase these debts are often so great that the company needs to reduce staff salaries

- 1:03:53

- and research activities when you have to factor interest as a

- 1:03:58

- business if you have to factor interest repayment into your goods and services then you have to charge a perpetually

- 1:04:04

- higher price as you take on more and more debt an increase in the diversification of

- 1:04:10

- debt results in an increase in the money supply when the money supply increases more

- 1:04:16

- money is available for productive activities and consumption which is the condition for a boom

- 1:04:24

- it's questionable whether we're going to get out of this recession or whether we'll just keep ticking along the way that we are now

- 1:04:31

- um however if we do then when we come out of this recession when growth starts again look at what happens to debt it

- 1:04:38

- will rise and it will keep rising and the faster the economy is growing the faster the debt will rise and then give

- 1:04:44

- it another three to five years we'll be back where we were you know the debt will become too much people start

- 1:04:50

- defaulting again um it's kind of the system that we're locked into now is we can't we can't

- 1:04:55

- grow the economy without growing the debt and the debt is a very thing that will bring down the economy the only

- 1:05:01

- option going forwards is to reform it to stop Banks from creating money as debt

- 1:05:06

- by fixing the monetary system we can prevent the banks from ever causing another financial crisis and we can also

- 1:05:13

- make the the current you know Public Service cuts and the tax Rises and the increase in national debt are necessary

- 1:05:26

- whilst providing nothing productive in return I mean why is it that we've got all this

- 1:05:32

- technology um you know all this new efficiency and yeah it now requires two people to

- 1:05:39

- finance a household whereas in the 50s it only needed one person working and

- 1:05:44

- the reason for that is not because you know these washing machines and everything are more expensive it's

- 1:05:49

- because of all of that and it's because you know effectively the banking sector is creaming It Off from everybody else

- 1:05:55

- so a growing banking sector isn't a sign you know it's not a good thing if the banking sector is growing it's either

- 1:06:01

- that it's becoming less efficient or it's becoming a parasite on the rest of the economy and that's you know we can

- 1:06:07

- talk about the banking sector becoming four percent five percent six percent of GDP what's happening to the rest of the

- 1:06:13

- economy it's becoming 96 95 94 of GDP we've got to get switched on to this now

- 1:06:18

- you know if we want to if we want to have a chance of tackling any of the other big social issues you've got to

- 1:06:24

- figure out the money issue the poorest in the world pay for crises even when they've not benefited from the

- 1:06:31

- um the the often Reckless and speculative booms like the housing boom in in Ireland that preceded

- 1:06:38

- um that crisis you know over the last 30 years we've seen income differentials increase so that the rich have got much

- 1:06:45

- much richer and Ordinary People haven't they've stayed the same or they've they've got poorer and one of the ways

- 1:06:52

- that the economy was kept going was by providing cheap credit was provide providing debt to those very people who

- 1:06:57

- couldn't really afford things anymore and so they kept buying and when it collapses it's those same people that

- 1:07:04

- they have to pay once again even though in in many ways they were the victims the first time around

- 1:07:10

- as a result of the crises the bank of England has bought corporate debt and repackaged it at lower rates of Interest

- 1:07:18

- yet the average person is being asked to pay more than ever to borrow on overdrafts and credit cards

- 1:07:25

- depths between the very wealthy um or between governments can always be

- 1:07:30

- renegotiated and always have been throughout world history there are not anything set in stone it's generally

- 1:07:36

- speaking when you have debts owed by the poor to the Rifts that suddenly deaths become a sacred obligation more

- 1:07:42

- important than anything else the idea of renegotiating them becomes unthinkable

- 1:07:47

- can you pin down exactly what would keep investors happy make them feel more

- 1:07:53

- confident and that's a tough one personally uh it doesn't matter that

- 1:08:00

- that's it I'm a Trader I don't really care about that [Music]

- 1:08:06

- if I see an opportunity to make money I go with that so for most Traders we don't really care that much how they're

- 1:08:13

- going to fix the how they're going to fix the economy and how they're going to fix the uh the whole situation our job

- 1:08:18

- is to make money from it and personally I'd be in dreaming of this one for three years

- 1:08:23

- if you know what to do you can make a lot of money from this I I had a confession which is I go to bed every

- 1:08:30

- night I dream of another recession I dream of another Moment Like This I dream of another recession I dream of

- 1:08:36

- another Moment Like This you can make a lot of money from it [Applause]

- 1:08:49

- [Music] the way in which you can look across Europe now and see that the new prime

- 1:08:56

- minister Greece Not Elected essentially imposed papademost former employee of Goldman Sachs the new prime minister and

- 1:09:02

- Finance Minister of Italy Mario Monty former employee of Goldman Sykes the new president of the European Central Bank

- 1:09:08

- former employee of Goldman Sachs it's quite you know you kind of see these people popping up absolutely everywhere that's the way to change what we have

- 1:09:15

- take all power and all freedoms away from the people and collect everything into the hands of one small group with

- 1:09:21

- absolute power from the people without the people

- 1:09:28

- against the people what's been interesting out of all this I suppose is the question of democracy that's been

- 1:09:34

- opened up very starkly in Europe that you have a government bank has essentially imposed on you it's Bankers

- 1:09:40

- who more or less got us into this mess to put it rather crude me but that's a good first approximation to it and then

- 1:09:46

- you say okay Bankers are the people who therefore going to get us out of it and incidentally they're going to run your country now there's a serious question

- 1:09:52

- democracy that's opened up here by the way the banking crisis drove more than a

- 1:09:58

- hundred million people back into poverty the mortality statistics of people who

- 1:10:06

- go into poverty rise hugely for a whole range of reasons so the banking crisis

- 1:10:12

- isn't just about becoming poor it was about killing people as well and guess what

- 1:10:19

- we haven't really got to the bottom of it we never held anybody to account and we haven't done the radical reforming

- 1:10:25

- job that we really needed to do because we mistakenly thought

- 1:10:30

- if we destabilize the position any further it'll make matters worse and guess you took the decisions all the

- 1:10:37

- people who were there in the first place I think you ought to know that the

- 1:10:43

- business of one of these businessmen is murder

- 1:10:52

- their weapons are modern they are thinking 2

- 1:10:57

- 000 years out of date

- 1:11:03

- look I was there when the secretary and the chairman of the Federal Reserve came those days and talked with members of

- 1:11:09

- Congress about what was going on it was about September 15th here's the facts

- 1:11:15

- and we don't even need to talk about these things on Thursday at about 11 o'clock in the morning the Federal

- 1:11:22

- Reserve noticed a tremendous drawdown of uh uh

- 1:11:28

- money market accounts in the United States to the tune of 550 billion dollars was being drawn out

- 1:11:37

- in a matter of an hour or two the treasury opened up its uh uh a window to

- 1:11:43

- help they pumped 105 billion dollars in the system and quickly realized that

- 1:11:49

- they could not stem the tide we were having an electronic run on the banks they decided to close the operation

- 1:11:56

- close down the money accounts and announce a guarantee of 250 000 per

- 1:12:03

- account so there wouldn't be further Panic out there and that's what actually happened if they had not done that their

- 1:12:09

- estimation was that by two o'clock that afternoon five and a half trillion

- 1:12:15

- dollars would have been drawn out of the money market system of the United States would have collapsed the entire economy

- 1:12:22

- of the United States and within 24 hours the world economy would have collapsed

- 1:12:28

- [Music] when money is withdrawn internationally from one currency to another

- 1:12:35

- the reserve currency shifts from the National Bank of one country to the reserve account of the foreign

- 1:12:41