Date: 2026-02-01 Page is: DBtxt003.php txt00021573

MICROSOFT

STOCK PERFORMANCE

January 2022 ... Microsoft beats on earnings and revenue, delivers upbeat forecast for fiscal third quarter

STOCK PERFORMANCE

January 2022 ... Microsoft beats on earnings and revenue, delivers upbeat forecast for fiscal third quarter

Original article: https://www.cnbc.com/2022/01/25/microsoft-msft-earnings-q2-2022.html

Burgess COMMENTARY

My work with micro-computers or personal computers (PCs) predates Bill Gates and the creation of Microsoft. In its early days Microsoft had one of IBM's success characteristics, it had a relentless program of marketing and promotion on top of technology that was not in the top tier. People invested in IBM main-frame computers even though other computer makes made technologically superior machines. The same went for Microsoft. Word processing using the Wordstar program and a CP/M operating system was way superior to any of the first generation word processing programs running on Microsoft's MS-DOS. Wordstar working on top of MS-DOS had half the performance. When it came to spreadsheets, Lotus became the market leader long before Microsoft introduced Excel. Before that Microsoft sold MultiPlan which had some good features but did not displace Lotus 123. By the early 1990s, Microsoft had come to dominate the software space for PCs.

I was particularly upset when Microsoft acquired FoxPro, the best PC level database software. Microsoft rapidly integrated the FoxPro database engine into the Microsoft Office Suite and within a very short time the FoxPro product disappeared altogether. Sad for users like me ... great for Microsoft.

Market dominance is very good for the company with market dominance ... but for everyone else, not so much. And Microsoft has established an amazing level of market dominance. Whether this is healthy for the overall socio-enviro-economic system is doubtful, but Microsoft and a few other very large tech companies are doing very well for themselves and their owners.

Peter Burgess

PUBLISHED TUE, JAN 25 20223:34 PM ESTUPDATED TUE, JAN 25 20228:23 PM EST

Jordan Novet @JORDANNOVET

KEY POINTS

- Microsoft surpassed estimates on the top and bottom lines, but Azure cloud revenue merely matched analysts’ expectations.

- The company’s gaming business is in the spotlight after Microsoft said it would acquire Call of Duty publisher Activision Blizzard for $68.7 billion.

Microsoft reported better-than-expected earnings and revenue for the fiscal second quarter. The stock initially dropped in extended trading but turned positive after the company issued a sales forecast that also exceeded estimates.

Here’s how the company did:

- Earnings: $2.48 per share, adjusted, vs. $2.31 per share as expected by analysts, according to Refinitiv.

- Revenue: $51.73 billion, vs. $50.88 billion as expected by analysts, according to Refinitiv.

The company had $36.77 billion in unearned revenue at the end of the year, below the StreetAccount consensus of $36.90 billion. Microsoft said it expects to recognize 45% of its $152 billion in remaining performance obligations over the next year, the first time that percentage has slipped below 50% since at least 2017.

We’re buyers of Microsoft, says Wedbush Securities’ Dan Ives

Amy Hood, Microsoft’s finance chief, eased investor concerns on the earnings call, indicating that demand remains strong across much of the business.

Hood said the company expects revenue of $48.5 billion to 49.3 billion in the fiscal third quarter, topping the $48.23 billion Refinitiv consensus. Hood said the company now expects full-year operating margins to widen slightly.

As of the close on Tuesday, the stock is down 14% since the start of 2022, and is on pace for its worst month since 2010. The slump has come alongside a broad selloff in technology stocks as investors brace for rising interest rates.

“We’d be buyers here,” said Christopher Ouimet, a portfolio manager at Logan Capital Management, which owns about $60 million in Microsoft stock. “We think there’s a lot of noise in the marketplace right now. Most of the high-growth stocks are getting washed out here.”

Ouimet said the rise in the yield for the 10-year Treasury note has little to do with whether Microsoft is “going to be able to sell Azure contracts.”

Microsoft’s Intelligent Cloud segment, which contains the Azure public cloud, GitHub and server products such as Windows Server, generated $18.33 billion in revenue. That equals 25.5% growth, and is a bit higher than the $18.3 billion consensus among analysts surveyed by StreetAccount.

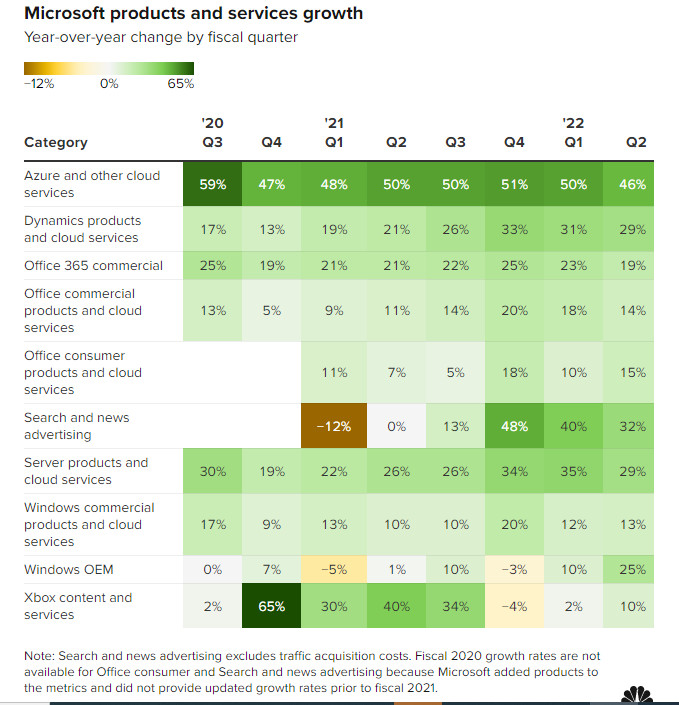

Revenue from Azure and other cloud services grew 46%, ending a streak of four quarters at or above the 50% mark. The expectation was 46%, according to a CNBC survey of 15 analysts, while analysts polled by StreetAccount had been looking for 45.3% Azure growth.

Microsoft doesn’t disclose Azure revenue in dollars. Hood said there will be a sequential growth acceleration in constant currency in the current quarter for Azure.

Revenue from the More Personal Computing segment, which includes Windows, advertising, devices and gaming, totaled $17.47 billion. That’s up 15.5% and above the StreetAccount consensus of $16.56 billion.

Microsoft said sales of Windows licenses increased by 25% in the fourth quarter of 2021. Technology industry research firm Gartner estimated that PC shipments had fallen 5%.

Xbox hardware revenue rose 4% with the passing of the one-year anniversary of Microsoft’s launch of the Xbox Series X and Series S consoles. In the previous quarter, Xbox hardware revenue surged166%.

The gaming component of Microsoft, which now represents almost 11% of total revenue, became more relevant to investors this month, when the company announced plans to acquire Activision Blizzard, the publisher of Call of Duty, for $68.7 billion, the largest deal in Microsoft’s 46-year history.

The Productivity and Business Processes segment that includes Office, Dynamics and LinkedIn posted $15.94 billion in revenue, amounting to 19% growth. Analysts polled by StreetAccount had expected $15.86 billion. The Teams communication app that comes with Office productivity software subscriptions now has over 270 million monthly active users, said Satya Nadella, Microsoft’s CEO.

Nadella said the company generated $15 billion in security revenue in 2021, up nearly 45% from the prior year. In 2020, security revenue increased more than 40%.

During the quarter, Microsoft released Windows 11 as the successor to Windows 10 and introduced the $249 Surface Laptop SE for school use that runs a special version of Windows 11.

“There are now more than 1.4 billion monthly active devices running Windows 10 or Windows 11,” Nadella said. That compares with over 1.3 billion active Windows 10 devices as of April 2021.

We’re buyers of Microsoft, says Wedbush’s Dan Ives