Date: 2026-01-18 Page is: DBtxt003.php txt00020965

Investment

Impact of Inflation

The Fed Wants To Eat Your Money, And Your Cash Is Trash

The iconic Charging Bull statue is not surrounded by the usual crowd because the city is deserted during the state of emergency triggered by the COVID-19 pandemic.

Alex Potemkin/iStock Unreleased via Getty Images

Original article: https://seekingalpha.com/article/4454059-the-fed-wants-to-eat-your-money-and-your-cash-is-trash

Burgess COMMENTARY

This article was written for investors and people with cash, and for this group the article may well resonate. My interest is how the economy impacts the much bigger group that are short of income and short of wealth. That group are short of cash and have been losing household wealth for a very long time with nobody taking much action to address their issues. The section in the article below that talks about labor shortage is important, but rather weak. In my understanding of the situation, there are many people who are not employed AND there are many jobs openings. Why, therefore, is there a problem ... and, of course, the answer is that the available jobs do not match the skills people have, and available jobs are located in one place and available workers are located in another place. Solving this problem will take time and political commitment which is generally lacking. Over a long time, the United States has done a poor job of skills training, putting more and more focus on academics that do not include meaningful skills. In addition, relocation is more difficult than it was a generation ago because of the shortage of affordable housing and the rather low wages that workers are being paid ... certainly relative to profits and stock prices, and also relative to cost of living. It should be observed that there has been much more price inflation for essential goods and services than for all goods and services, another reason for the broad discontent with the general population in the United States.

Peter Burgess

Written by Rida Morwa ... Author of High Dividend Opportunities.

Co-produced with “Hidden Opportunities”

September 9th, 2021

Summary

- Wonder why equity prices, home prices, bond prices, and even junk investment prices are moving all in one direction - up?

- The power of 'Excess Cash in the System' explained.

- The Fed 'wants' to drive inflation higher.

- Cash is trash today and should be put to work!

- Why this market is set to keep soaring.

The markets keep exhibiting signs of great strength and resiliency as the pace of the supercharged U.S. and global recovery accelerates. The S&P 500 index (SPY) already broke well above the 4500 level, which is an extremely bullish signal. This market is supported by strong economic fundamentals, GDP growth, strong corporate earnings, cheap money, and excess liquidity. Furthermore, we're in the midst of the strongest earnings environment in more than a decade, as we have been seeing in the vast majority of our economically sensitive stocks reporting stellar earnings! However, we cannot underestimate the main driver of this bull market, which is cheap money and excess liquidity.

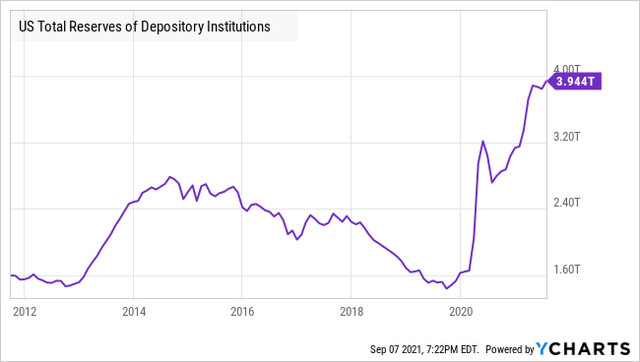

The Power of Excess Cash in the System

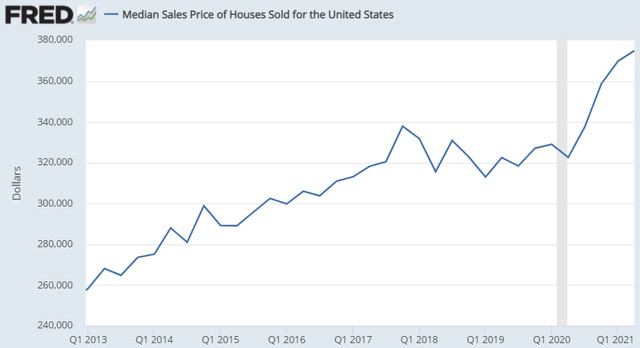

1- Wonder why house prices are soaring?

With mortgage rates at record low levels, everyone wants to fulfill their dream of owning a home. And why not when the cost of borrowing is this cheap. Consumers have been aggressively deploying their excess cash to make down payments on homes. Result - the median house price in the U.S. is $375,000, up 16% YoY after several years of being relatively flat.

Source: fred.stlouisfed.org

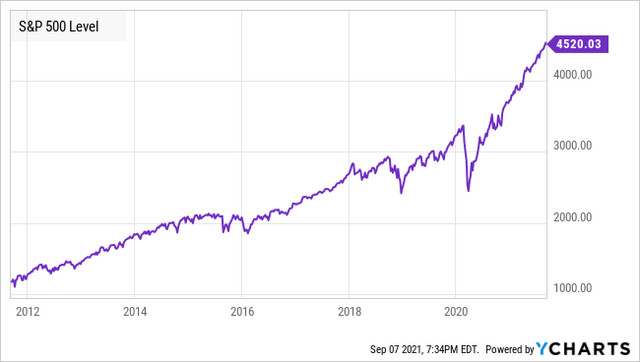

2- Why are the stock markets reaching highs after highs?

Why won't they? Americans are flush with more cash in their bank account than ever before. Since the pandemic's beginning, CD and savings rates have been near zero, so consumers are pursuing other investments. Any asset class you can think of has soared over the past year.

Virtual Currencies: Data from The Harris Poll shows that nearly one in 10 Americans used the stimulus checks to invest in cryptocurrencies, driving their prices up to record levels - Bitcoin is up 381% over the past year.

The stock market: Popular U.S. indices continue to make new highs. The S&P 500 is up 20% YTD and is past the 4500 level. The stock market has clearly benefited from excess cash in investors' pockets.

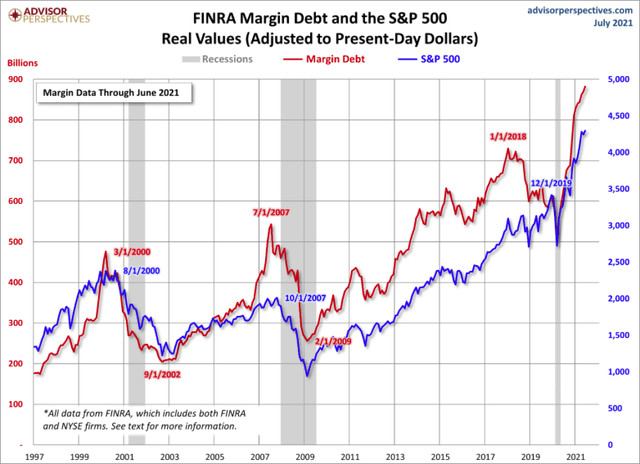

3- Why are 'smart money' investors leveraging up their accounts?

FINRA's measure of margin debt is up about 50% since pre-COVID levels. This metric tells us about the amount of money that investors borrow from their brokers to leverage their accounts and accelerate their returns.

We can clearly see the relationship between the S&P 500 and the margin debt. Higher leverage is a sign of increased market bullishness, and margin debt is typically seen as a leading indicator for the market. Here, it's indicative of new market highs on the horizon.

Source: Advisor Perspectives

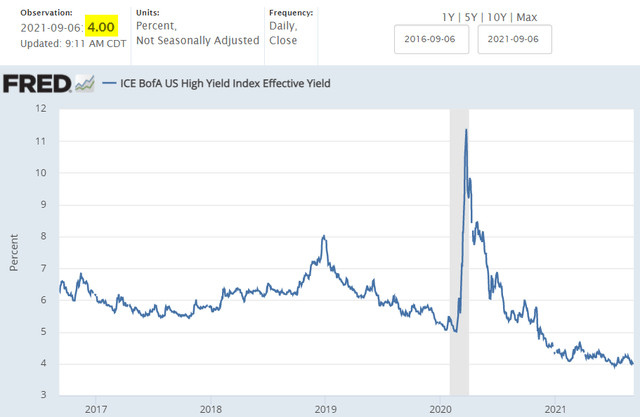

4- Why even Junk Bond Prices are Soaring?

High demand for junk bonds has resulted in negative 'real yields' (inflation adjusted) for the first time in history. The ICE BofA U.S. High Yield Index that is composed of below investment grade corporate debt (commonly referred to as 'junk') currently yields below the inflation rate.

Source: fred.stlouisfed.org

So investors are ready to buy just about anything for 'some kind' of return.

The reason for these higher prices across the board is 'excess liquidity in the system,' and its implications...

- In today's yield-less world, every investor is looking for some kind of return. Cash sitting in the bank, or in CDs or money markets, are generating negative returns, when we adjust for inflation. There are too many dollars in the system looking for returns of any kind, even meager returns. And these dollars are flooding into limited pools of investments! Excess liquidity chasing too few opportunities such as the equity markets is the main driver for this bull market.

- Excess liquidity is inflationary by itself, and reduces your purchasing power. Smart investors are realizing that cash on the sidelines is a losing proposition, and should be put to work. This re-enforces, even more, the value of 'non-cash assets' including the stock markets, real estate, and even the bond markets.

- Inflationary pressures keep increasing, as reported month after month from government data, making cash even less attractive for investors who are seeing their purchasing power evaporate. This is driving more money into the same limited pools of investments.

The bottom line is that inflation expectations are soaring. High liquidity is driving prices up almost everywhere you look. Smart investors are afraid to be left behind with worthless cash, and they are perfectly right!

Inflation? What Inflation?

I think all of us, including me, you know, really weren’t really prepared for this inflation shock.Aug. 27, Core PCE, the preferred inflation measure of the Federal Reserve, came in at 3.6%. Core PCE excludes large, and what most people would consider essential expenses, food, and energy, representing its biggest move since July 1991.

James Bullard, CEO & President of The Federal Reserve Bank of St. Louis

Source: Wall Street Journal

Source: bea.gov

As a reminder, back in December 2020, the Fed projected inflation, as measured by Core PCE, would be 1.8% in 2021. In other words that inflation would be about the same as it was in 2018, the last time the Fed hiked interest rates.

Source: bea.gov

We can call that a swing and a miss. It's also worth noting that we did not see deflation for even a single month. While PCE fell in April 2020, it remained positive. The cost of living did not go down during COVID. What we saw was government stimulus artificially increasing income.

So this spike in inflation is not 'making up' for a year of zero inflation as some have suggested. It's on top of last year's average of 1.4% growth in Core PCE.

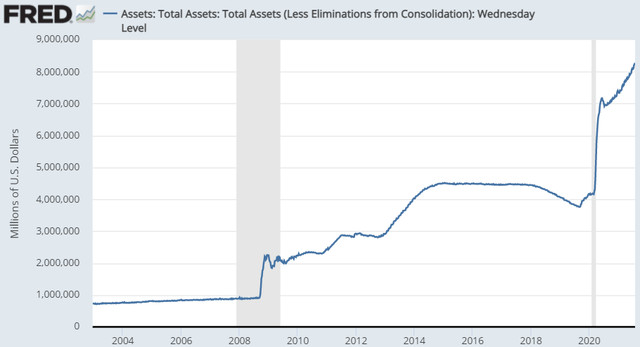

The Fed Wants to 'Eat Your Money' by Driving Inflation Higher

The Fed is pumping more and more liquidity into the system. And they have no intention of stopping. What they did during the Great Financial Crisis pales in comparison to what we see today.

Source: fred.stlouisfed.org

The Fed continues to pump liquidity into the system and maintain a 0% target rate even as inflation pressures continue to mount. Even ignoring their own preferred metrics.

Yet despite signs that inflation is much higher than expected, the Federal Reserve reiterated recently that it will 'hold the line.' Voting to maintain the target rate at 0-0.25%, while also continuing to pump more money into the financial system by continuing to buy Treasuries and agency MBS (mortgage-backed securities).

In fact, I would argue today that the Fed and the government are happy that inflation running high. Why? Because today, if you add the government debt, corporate debt, and consumer debt, the United States is more indebted than it has ever been historically. The total non-financial debt/GDP ratio is nearly 300%. This massive level of debt is a financial time bomb that could explode anytime. When it does, it would collapse the economy into a major recession with widespread defaults, causing the financial and the housing markets to crash, and setting up for major bank failures.

In the face of this major threat, policymakers are not leaving anything to chance. It's becoming increasingly clear that the government is fighting this danger with two different tools:

- Keep pumping liquidity in the system so that debt can be refinanced, and avoid the risk of a financial collapse.

- Printing money and pumping more liquidity to drive inflation even higher. As inflation runs high and the currency devaluates, the level of global debt is reduced.

Source: Getty

As investors, there are a few items we must take into consideration when positioning our portfolios:

- Inflation is happening - as consumers, we're seeing it in our daily lives and feeling its pain.

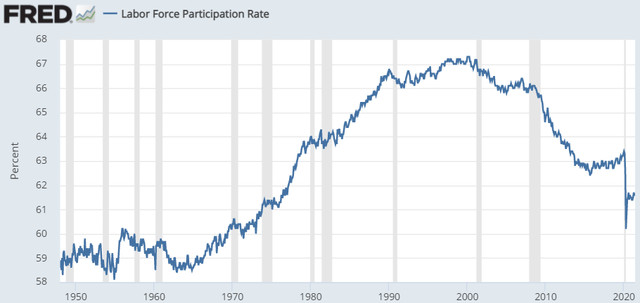

- The flavor of inflation is changing from commodity shortages to labor shortages – this means that inflation will be much more permanent than the Fed expects. The Federal Reserve and many economists are grossly underestimating the long-term ramifications of the labor shortage.

- The 'Bubble of Cash' is going to continue to drive the markets. The Fed has the pedal to the metal and cannot slow down. Note that during the mortgage crisis, the Fed was unable to meaningfully reduce its balance sheet for over a decade. The current Fed has shown even more hesitance to do anything that negatively impacts the markets.

- The Federal Reserve is not only unwilling to do anything about inflation, but it's actually very happy with it. It reduces the risks of a hard economic landing by making debt levels less meaningful, even at the cost of depleting your savings.

Last year, a lot of people were laid off when the businesses they worked for closed down. This year, they are not eager to return to work. The workforce participation rate is the lowest it has been since 1976.

Source: fred.stlouisfed.org

This has occurred, even as the number of job openings is higher than ever. Businesses around the world are being plagued by staffing shortages, many cutting their hours. The impact is especially hard on lower-wage jobs like the food and hospitality industries. Many factories have struggled, especially with positions that require experience.

How are businesses going to encourage employees to come back to work? Money. Economics 101, when demand is higher than supply, prices rise. Right now, the demand for workers is much higher than the supply.

We're not going to get into politics. Some see wages rising as a good thing. We will stop by simply observing that it's happening and that wages are likely to go much higher as potential workers sit on the sidelines even as demand for more labor increases.

Ultimately, what happens when wages go up? Prices go up. And that's called inflation. Unlike commodities, where we often see a lot of volatility in prices, wages are much more 'sticky.' Employers will be forced to offer increasing wages as they compete with others over a smaller workforce.

Source: redbubble

Cash is Trash today and Should be put to Work.

It's becoming increasingly clear that the Fed is more concerned about the risks of the massive U.S. debt rather than the risk of a red-hot economy with soaring prices. They continue to stress that they're not going to change anything. This explains why the current Fed is far more 'dovish' than we have seen in many decades. Put simply, the Fed has two choices to face, a deep recession due to excessive debt, or a high inflation that would reduce the level of debt, but make people poorer by eating away their savings. They chose to avoid recession at any cost, and you cannot blame them. It is their mandate.

For investors like us, today we're faced with a clear path to a red-hot economy financed by the government, and resulting in soaring inflation and asset prices. It has become our urgent priority to keep ahead of inflation to protect both the value of our asset base and the purchasing power of our income stream. This means that we want to be invested in companies that are economically sensitive and will benefit from an economy that is running hot, and will benefit from 0% short-term rates.

Stocks we want to focus on are:

- BDCs (business development companies) (BIZD): These companies invest in small to medium-sized businesses that will expand rapidly in a super-heated economy. Additionally, the access to cheap debt provides fertile ground for expansion.

- Property REITs (VNQ): Real estate directly benefits from cheap debt as buying real estate with 30%-40% debt is common. Interest is usually the largest single expense for most REITs and they're benefiting from refinancing at cheap rates. Additionally, physical real estate appreciates in value during periods of inflation. REITs that are expanding rapidly and those that have leases tied to inflation will outperform.

- Mortgage REITs (REM): Not all mortgage REITs are alike, and we want to be exposed to those solid ones that benefit from low financing costs and can maintain a high interest rate spread in the current environment. These also operate in an economically sensitive sector.

- Commodities (XLB) (PICK): We saw commodities pull back in July, and this was a 'reversion to the mean' caused by an overcrowded trade. Prices never move in a straight line and traders will move in and out of a trade trying to catch short-term price movements. With confirmation that inflation is persistent and is heading higher, inflation-resistant stocks will see new highs again, especially in the commodity sector.

- Collateralized Loan Obligations (or CLO funds): CLOs provide another great opportunity to get exposure to a heating economy with enormous yields. CLOs in booming economies experience low default risk, and great re-investment opportunities, making them prime winners for income seekers.

- Preferred stocks (PFFA): High-yield preferred stocks have historically exhibited minimal correlation to medium-term Treasuries. In this market where equity and bond instruments are soaring together, it is important to have such a diversification for a protected income stream. Moreover, above-average yields of preferred securities are excellent for inflation-beating income.

- Value over Growth: 'Value' stocks have historically outperformed 'growth' stocks when inflation is running high. Why? It's simple. Growth stocks bank on future cash flow, which becomes less valuable when discounted at 'high inflation rates.' Therefore, their growth potential becomes less attractive. Value stocks on the other hand are generally those companies that are valued based on their current cash-flows, rather than their potential ones. These same value stocks tend to be smaller and medium-sized companies that are the most flexible to bank on economic growth, and provide the best hedges against inflation.

- High Yield: By definition, when there's inflation, receiving cash today is better than receiving cash in the future. The main focus of our Income Method is to achieve a high level of immediate income. One great thing about investing in super high dividend stocks is that if you're collecting a 7% yield on your income, you're already beating inflation, without even re-investing a penny. If you re-invest some of your earnings, you are empowering more future income.

Source: Getty

Bottom Line

Do you feel everything is getting more expensive while the purchasing power of the dollars in your bank is shrinking? Many do, and this is why 'asset values' are soaring because smart investors are getting rid of their cash.

Yes, inflation is soaring, and the Fed wants to eat your money to reduce debt levels. Your cash is trash. You need urgently to get your money working for you and fight this trend.

The good news is that the future looks bright if you're invested in the right stocks and sectors. I remain confident that we're set for a multi-year global economic and market expansion financed by the U.S. Government and others across the globe. It's not too late to act now. When inflation is flaring, you don't want to be the last person holding cash.

If you want full access to our Model Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Dividend Opportunities.

We are the largest income investor and retiree community on Seeking Alpha with over 4600 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +7%, you can supercharge your retirement portfolio right away.

This article was written by Rida Morwa, 80.82K Followers ... Author of High Dividend Opportunities

https://seekingalpha.com/checkout?slug=rida-morwa

Contributor Since 2006

About Rida Morwa ... I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row. Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 4500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ('CPA') from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I am also a Certified Mortgage Advisor CEMAP, a UK certification. I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Seeking Alpha, Investing.com, ETFdailynews, and on FXEmpire.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

- 1) Treading Softly

- 2) Beyond Saving

- 3) Philip Mause

- 4) PendragonY

- 5) Preferred Stock Trader

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Disclosure: I/we have a beneficial long position in the shares of VNQ, BIZD, REM, PICK, VNQ, PFFA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, Preferred Stock Trader, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Written by Rida Morwa Marketplace Author of High Dividend Opportunities. The #1 Service for Income Investors and Retirees, 9-10% dividend yield.