Date: 2026-03-03 Page is: DBtxt003.php txt00019021

TPB Connections ... Metrics Dialog

Richard Betts

Follow up ... I hope Integrated Reporting (IR) is going to be effective.

Peter Burgess

Peter Burgess

Fri, Jun 5, 2:15 PM (10 days ago)

to Richard, bcc: Jerome, bcc: Naomi, bcc: Pamela, bcc: Lynn

Dear Richard

I have to acknowledge that much of my thinking and technical knowledge is most likely somewhat out-of-date. I qualified as a Chartered Accountant in London with Cooper Brothers & Co in 1965 ... but before that had learned some engineering and economics at Cambridge and worked in heavy industry for a short while building equipment (rolling mills and blast furnaces) for the steel industry.

During my accountancy training, I was impressed by its elegance and power. I became a very young CFO soon after migrating to Canada and the United States in the late 60s and was very good at helping companies improve their profit performance ... but also learned more and more about the unfavorable impact optimizing for profit was having on people and the environment. About twenty years later, John Elkington articulated the idea of the triple bottom line, but the quantification or numbering of this concept has not emerged in a very usable form all these many years (more than 25 years) later.

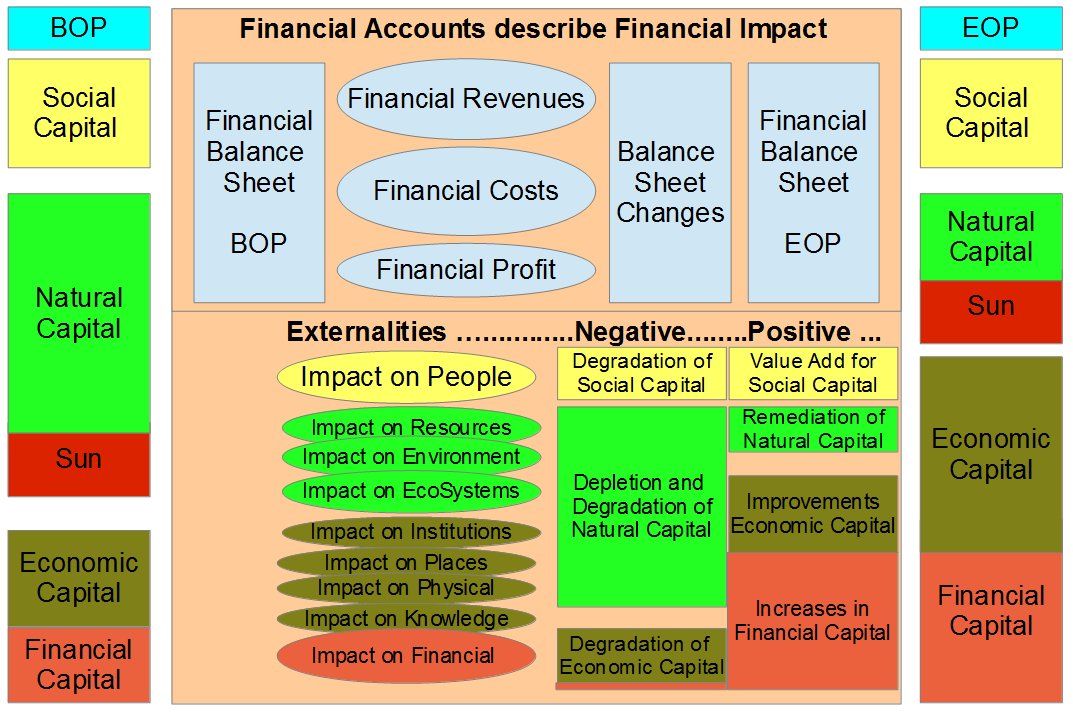

In my view, accountancy has huge value because it is at the center of all corporate profit management systems. There is a widely accepted format (Balance Sheet and P&L Account ) for summarizing the performance and reporting out to stockholders which are pretty quick to read and comprehend. In addition there is all sorts of internal cost and management analysis that drive performance improvement. But when it comes to externalities like social impact and environmental impact ... there are all sorts of words, and to the extent that there are numbers, they are all over the place, and not well organized for management (moving the needle) effectiveness.

Sadly, some of the people who might already have an effective methodology for better management information about social and environmental performance keep this information behind some sort of pay-wall ... which I understand, but it is not helpful in terms of improved socio-enviro-economic performance for society and the world as a whole.

My own feeling is that we all may be at a very important tipping point right now. A lot of people in my generation have become rich and powerful, but they have created a global socio-enviro-economic system that has become dangerously dysfunctional ... very profitable but catastrophically fragile. This has been on display with the global Covid-19 pandemic and its related economic slump, and now in addition intense anger over the death of George Floyd and related social issues.

One of my current agendas is for economic and social statistics in the USA to be segregated into two segments ... one for the top 10% of the population and the other for the bottom 90% of the population. I want to end the talk about the total or average for the whole of the US population because that tells you nothing, and especially hides the deteriorating economic situation for most of the population. The top 1% has a huge amount of power and owns most of the wealth. The next 9% has also progressed quite well during the last several decades. On the other hand the bottom 90% has lost a significant part of their household wealth over the past 40 years, wages have stagnated, but not the cost of living (especially for essential needs). Consumer demand has been financed by more and more personal debt. Pretty much every policy option in the last 40 years ... both from the political left and the political right has maintained this economic status quo pretty much intact ... which explains in large part the intense social anger that exists in many parts of the world and not only in the USA.

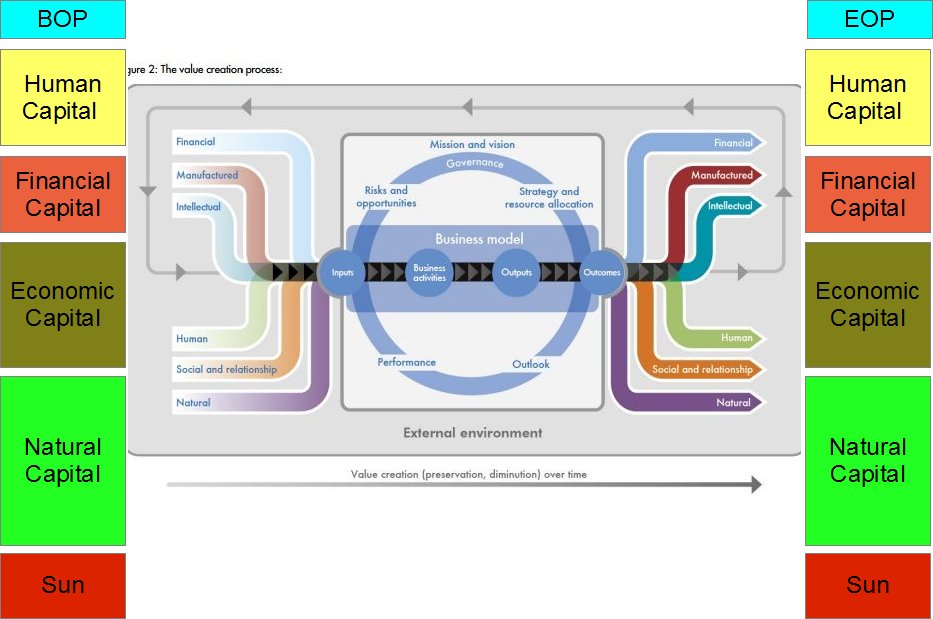

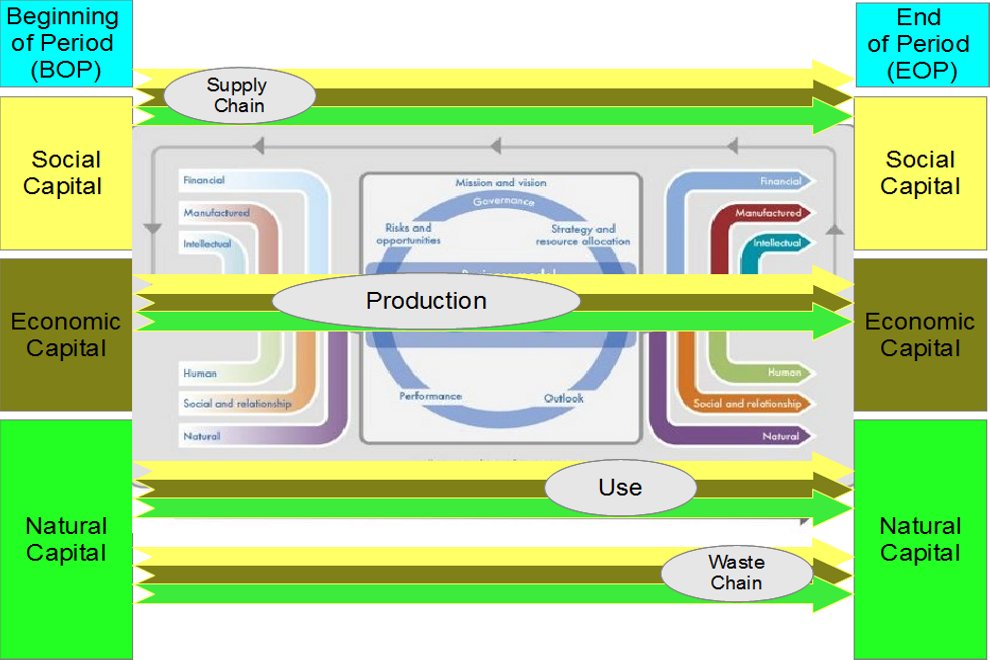

As an old management accountant ... I believe that if we enhance conventional financial accountancy so that it incorporates impact on social capital and impact on natural capital as rigorously as we use money to account for impact on economic capital ... behavior will change for the better.

In my dim and distant past I was involved with quite complex group accounts and the process of consolidation ... and also did work in an organization where our sales and costs were transacted in multiple currencies ... and our reporting had to be in the currency where we were reporting, while our holding company had to report in the currency of its home jurisdiction. I don't want to express social and invironmental performance in terms of $$$ money, but as a different unit of measure that eventually may have an exchange rate relative to $$$ money!

My experience suggests that if decision makers at every level in the system are using the right data for their piece of the system to improve their performance ... then the needle will move. That is where we have to get to ... and we have the means to get there ... and now more than ever perhaps there is the will to get there.

Sorry about the rant ... unloading a bit ... but optimistic that this might be the time for some of this to happen.

Best

PeterB _____________________________ Peter Burgess ... Founder and CEO TrueValueMetrics ... Meaningful Metrics for a Smart Society True Value Impact Accounting ... Multi Dimension for ALL the Capitals http://www.truevaluemetrics.org LinkedIn: www.linkedin.com/in/peterburgess1/ Slideshare: http://www.slideshare.net/PeterBurgess2/ Twitter: @truevaluemetric @peterbnyc Telephone: 570 202 1739 Email: peterbnyc@gmail.com Skype: peterbinbushkill

'Richard Betts'

------------------------------------------

Richard Betts

Fri, Jun 12, 4:08 AM (3 days ago)

to Richard, me

Dear Peter

Many thanks for reaching out and your detailed email. It’s great to hear from you and more on your experiences. Really interesting and excellent.

Like you, I hope that IR will be a success. It is already quite popular globally but has mainly been used just in a few global ‘pockets’ like South Africa and Japan.

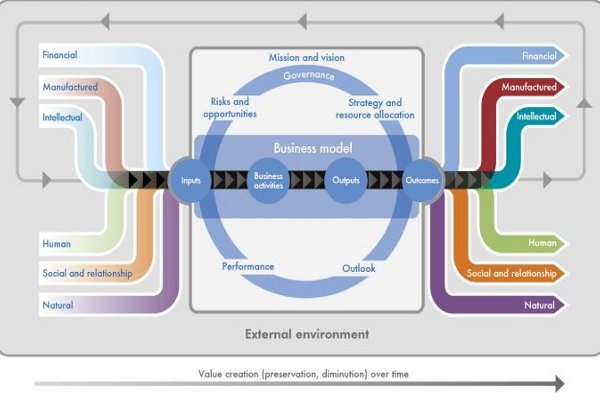

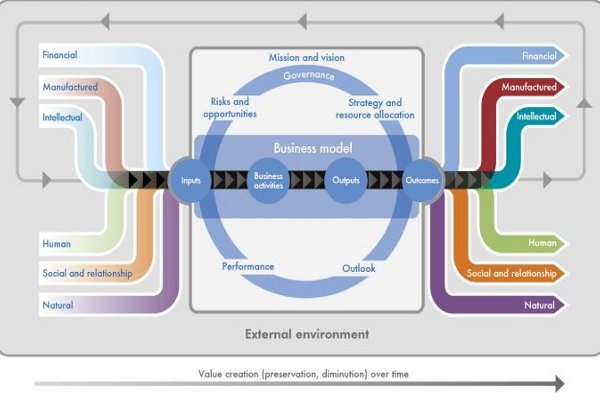

When you look at the detail of the IR framework it becomes clear that, certainly if followed strictly, the focus is on value creation for the organization and providers of financial capital in the first instance and then at a secondary level on ‘others’ (all other stakeholder groups) and arguably only to the extent that value creation/ destruction for these other groups has a direct impact on the entity’s ability to continue creating value for itself and its shareholders.

So arguably it fails to take into account value creation/ destruction for society and is focused on sustainability only insofar as it relates to the company and not to the planet.

Of course the IIRC Framework was developed several years ago and since then there have been many important initiatives. So in my view it won’t work if we stick to the context of several years ago but if a company follows IR principles but with a much broader view of value creation and aligns to the science and global best practice (e.g. SDGs, TCFD, carbon neutrality etc) then it can still be useful.

I am very interested about your true value metrics – and if you have any time to discuss this and any other ideas for collaboration in the coming weeks then please let me know and would be great to talk with you.

Peter Burgess

12:09 PM (4 hours ago)

to Richard

Dear Richard

Thank you for your message ... and YES ... I would be happy to talk / discuss at your convenience.

Though the US talks the talk about being a technologically advanced country ... my phone in rural Pennsylvania has rotten connectivity ... but Google Meet, ZOOM and Skype (PeterBinBushkill) work quite well.

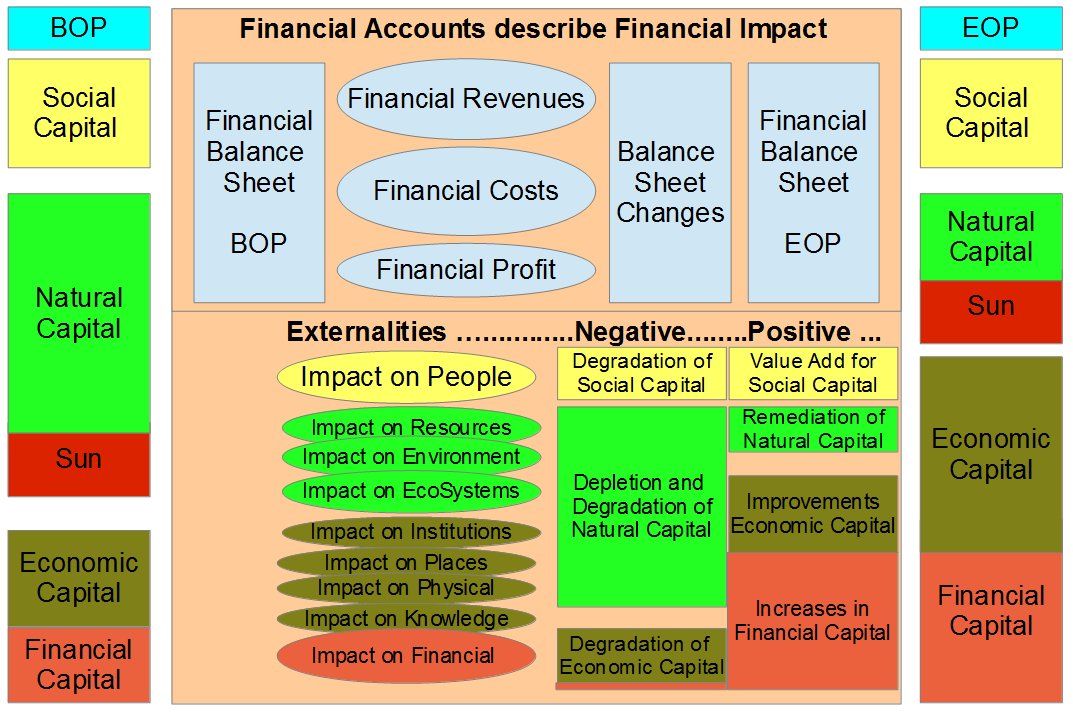

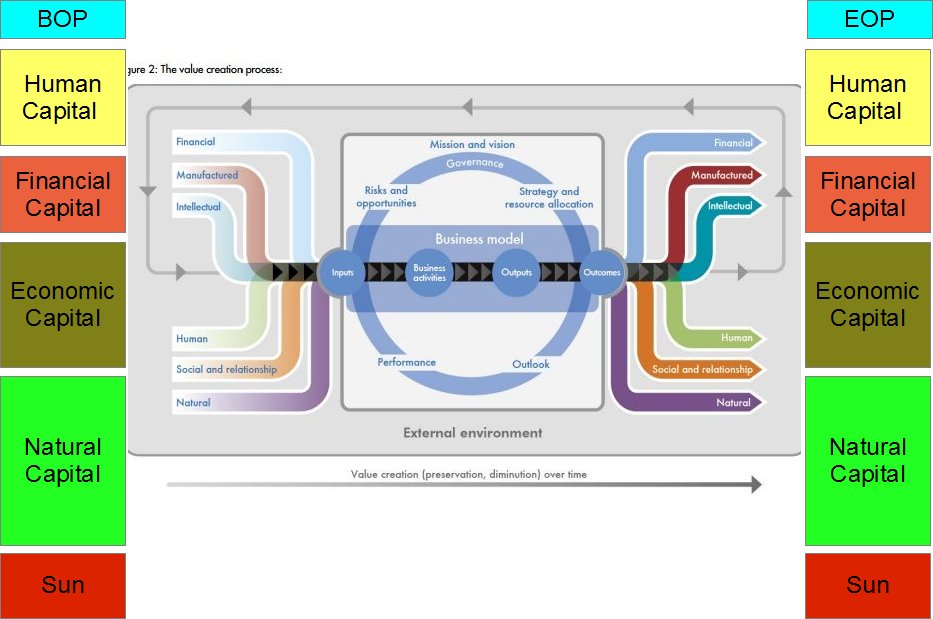

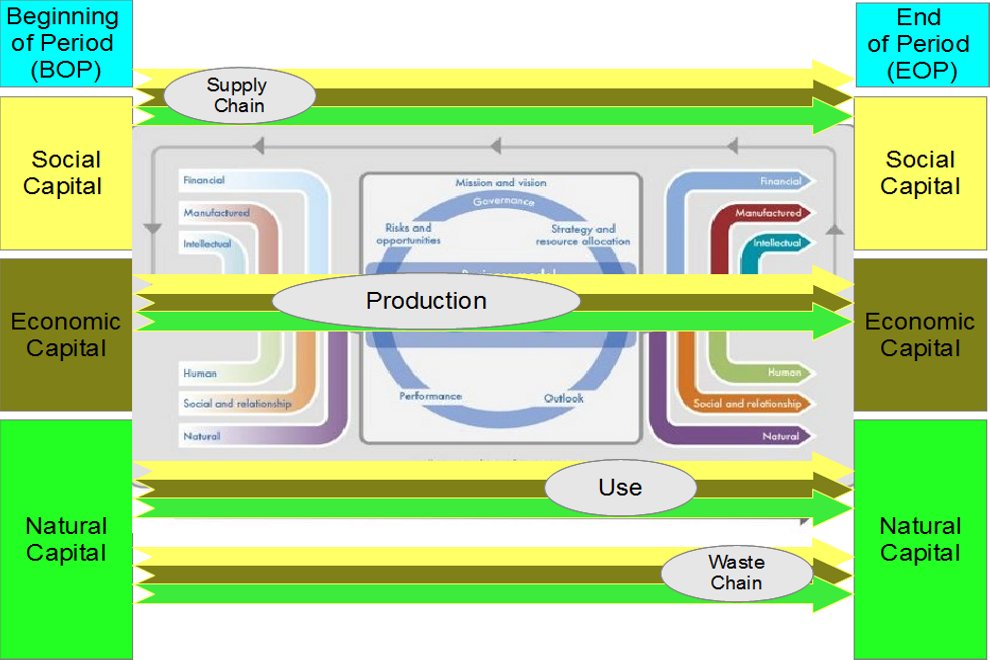

The attached images are an attempt to explain the essential design commonalities and differences related to conventional accountancy, integrated reporting and truevaluemetrics ... I think you will understand what I have tried to do ... though it is far from perfect.

The biggest challenge from my perspective is to actually number or quantify all the states and flows in a coherent manner ... NOT using a money measure as the common metric. The analogy in accounting is somewhat along the lines of multi-currency accounting !!!!!!!!!!

Feel free to reach out at any time that is convenient for you ... hopefully I will see or hear an alert when you reach out.

Best

PeterB _____________________________ Peter Burgess ... Founder and CEO TrueValueMetrics ... Meaningful Metrics for a Smart Society True Value Impact Accounting ... Multi Dimension for ALL the Capitals http://www.truevaluemetrics.org LinkedIn: www.linkedin.com/in/peterburgess1/ Slideshare: http://www.slideshare.net/PeterBurgess2/ Twitter: @truevaluemetric @peterbnyc Telephone: +1 570 202 1739 Email: peterbnyc@gmail.com Skype: peterbinbushkill

4 Attachments