Date: 2026-03-07 Page is: DBtxt003.php txt00018455

Media / News

The Finance 202 / Washington Post

The Finance 202 ... March 13, 2020 ... Your economic policy briefing ... Stocks lose most of their gains under Trump as coronavirus fear takes hold

Peter Burgess

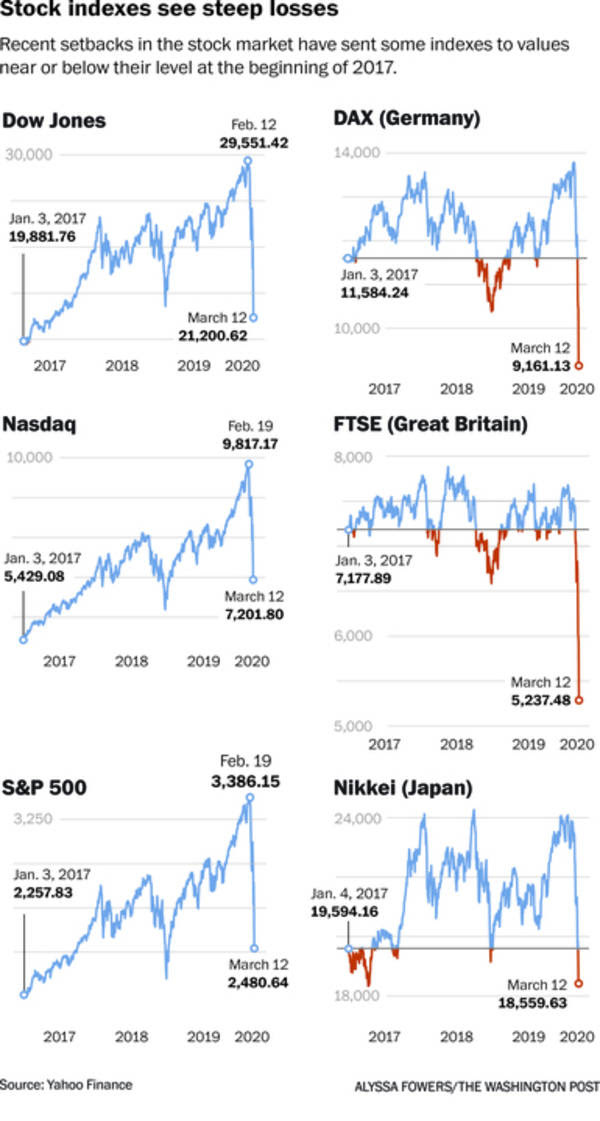

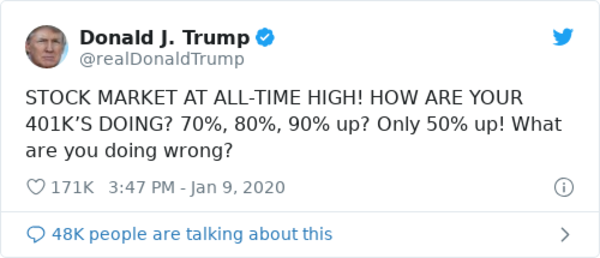

A board on the floor of the New York Stock Exchange on March 12, 2020 in New York City. The Dow Jones Industrial Average dropped 2,352 points, an almost 10 percent decline and biggest since 1987. (Photo by Jeenah Moon/Getty Images) THE TICKER President Trump loves to brag about how much the stock market has gone up since he took office. But the growing fear of the economic fallout from coronavirus has already erased almost all those gains. And there is reason to think the worst is yet to come as coronavirus begins to strangle economic activity, sending businesses closing and sparking layoffs. The cratering market is flashing a signal from investors that they think a recession could be imminent — if not unfolding now. After diving 10 percent on Thursday — the Dow Jones industrial average’s steepest one-day sell-off since Black Monday in 1987, and its fourth-worst day ever in percentage terms — that index is up only 7.4 percent since Trump’s inauguration a little over three years ago. The broader-based S&P 500 isn’t faring much better. It officially joined the Dow in bear market territory Thursday by dropping 9.5 percent and now has shed 27 percent since hitting fresh highs less than a month ago, its fastest ever skid of such magnitude. “Since Trump took office, it’s up only 9 percent, about what it gained in the last seven months of Barack Obama’s presidency,” my colleague Philip Bump notes. Put another way, if those indexes tank as badly again today, they will actually have lost value over the course of Trump’s presidency. Stock futures remain volatile, erasing earlier indications of steep losses to point to solid gains at today's open. “Sell-offs this violent generally have some big bounces along the way,” Bloomberg Opinion's John Authers writes. “Having embarked on such a descent, we can expect to fall further.”

The president, who has remained glued to the market’s performance as the coronavirus has borne down on the U.S., offered some nothing-to-see-here spin denying the plain facts of the Wall Street carnage. “We have a lot of things that we’re working on with the financial markets, and it’s going to work out fine,” Trump told reporters at the White House. “You have to remember the stock market, as an example, is still much higher than when I got here.” Here’s how it compares to the market under President Barack Obama at the same point in his first term:

(via Reuters) The collapse in share prices threatens to vaporize one of the president’s most potent arguments for reelection. The Trump team’s rough framing has essentially been: Love him or hate him, you would be hard-pressed to argue he hadn’t at least preserved the economic momentum he inherited, leaving most Americans in stronger personal financial shape. From two months ago:

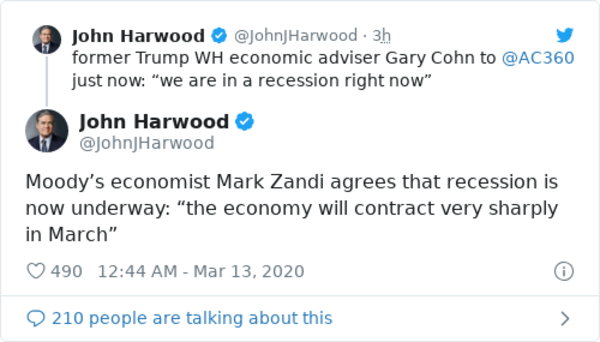

To be sure, roughly half of Americans don’t own stocks, even through a retirement fund. But share prices in part reflect investors’ expectations of future corporate earnings. And that's where the fears of a recession come in: As LPL Financial points out in a note, the S&P 500 has dropped 37% on average in bear markets during a recession, while losing 24 percent on average in bear markets that avoid a recession. Gary Cohn, Trump’s former top economic advisor, said the economy has stepped across the threshold for a recession already. Moody’s Analytics chief economist Mark Zandi agrees. From CNN’s John Harwood:

To be sure, roughly half of Americans don’t own stocks, even through a retirement fund. But share prices in part reflect investors’ expectations of future corporate earnings. Ditto Claudia Sahm, a former Federal Reserve economist specializing in identifying recessions:

Other economists say a recession is now all but certain, contrary to Trump’s campaign-trail refrain that the “best is yet to come.” From my colleague Heather Long:

And ominously for the president, investors so far have judged Washington policymakers, and Trump in particular, as part of the problem. They briefly reversed their stock-dumping spree to acknowledge an extraordinary move by the Federal Reserve. The central bank said it would pump $1.5 trillion into short-term lending markets while also buying $60 billion worth of Treasury bonds to help stabilize the plumbing of the financial system. But after recovering some of their losses following that early afternoon announcement, stocks ended the day at session lows. Trump’s attempts to promote calm have backfired. In his nationally televised address Wednesday night, he incorrectly said that the U.S. would impose trade restrictions on Europe. He made a rare acknowledgment of error to aides in the Oval Office after the speech, according to my colleagues Philip Rucker, Ashley Parker and Josh Dawsey, and sent a tweet correcting himself. But that and other faulty claims in the ten-minute talk — plus the lack of a call for specific, large-scale spending to help stanch the economic bleeding — sent stock futures into a tailspin whose momentum carried through the trading session. Trump spent Thursday in “an unusually foul mood” and sounded “apoplectic” about the stock sell-off, former senior administration official briefed on his private conversations told The Post. Some relief may be on the way. The administration and House Democrats are close to an agreement on a spending package that aims to buoy Americans swamped by the fallout of the pandemic. “Speaker Nancy Pelosi (D-Calif.) said she expected a vote Friday ‘one way or another’ to approve the package, which is expected to amount to several tens of billions of dollars,” my colleagues Mike DeBonis, Erica Werner, and Jeff Stein report. Pelosi indicated the measure is only a first legislative swipe at the emergency. “There will obviously be other bills,” she told reporters. “The legislation will include measures to boost paid family leave and unemployment insurance, ensure free coronavirus testing, and strengthen nutritional aid like food stamps,” The Post team reports. “Trump is advancing costly ideas of his own — including a payroll-tax holiday that could drain tens of billions of dollars from Social Security. That idea has gotten limited traction among both parties on Capitol Hill, and congressional leaders decided to pursue a narrower package that could win GOP support, leaving broader measures, such as the payroll-tax cut, for another day.'

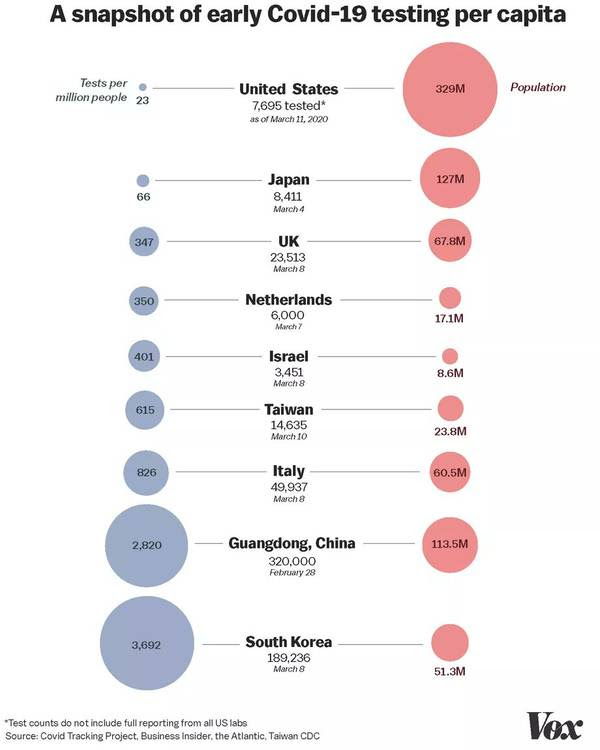

Coronavirus response in the United States: Trump potentially exposed but won't be tested. “A Brazilian official who met [Trump] and Vice President Pence at Mar-a-Lago on Saturday has tested positive for coronavirus, though Trump said Thursday he ‘isn’t concerned’,” per the Post. The White House says he doesn't need to be tested. An Australian official tested positive just days after meeting with Ivanka Trump. Meanwhile, “Sophie Trudeau, the wife of the Canadian prime minister, said she tested positive for the virus as her husband said he is self-isolating.” Closings pile up: “Disneyland and Walt Disney World are closing. Kentucky, Maryland, Michigan, New Mexico and Ohio announced statewide school closures to slow the rate of infections. And the Church of Jesus Christ of Latter-day Saints announced it is indefinitely suspending all public gatherings, including worship services, worldwide,” my Post colleagues report. Plus, 'The White House, U.S. Capitol and Pentagon have closed to tours.' Virtually the entire sports calendar is bare now: All four major sports leagues currently in season are on hiatus, my colleague Jacob Bogage reports. That news came as the NHL, MLS and MLB followed the NBA in postponing scheduled games along with those announcements the NCAA canceled its beloved March Madness tournament and all remaining winter and spring championships. The anger over the lacking of testing is rising: “The issue dominated separate briefings for members of the House and Senate, emerged in the presidential race and became a flash point at a House Oversight and Reform Committee hearing, where the country’s top public health officials struggled to explain why more Americans could not get tested for a global pandemic,” my colleagues Mike DeBonis, Erica Werner and Seung Min Kim report. Corporate fallout: Global airlines call for aid: Airlines “appealed for urgent government financial support as U.S. carriers rushed to cut flights to Europe in the wake of new U.S. travel restrictions aimed at combating the coronavirus outbreak, while United Airlines warned of U.S. travel disruption as the virus spreads domestically,” Reuters's Tracy Rucinski and Laurence Frost report. The cruise industry's clout is being tested: The industry has “long-standing connections to Trump, including through Carnival Corp. chairman Micky Arison, a friend whose company helped sponsor Trump’s reality show franchise ‘The Apprentice’ over the years,” my colleagues Josh Dawsey, Jonathan O'Connell, Ashley Parker and Beth Reinhard report. 'The cruise lines have raced to get ahead of further government action, voluntarily suspending a small number of voyages this week and pitching to the White House a plan to safeguard passengers. But stock value of cruise companies has plummeted.' ESPN, TNT face lost revenue: “The networks that carry NBA games will take a substantial hit to advertising revenue and could potentially be on the hook for big rights-fees payments, according to analysts and people familiar with sports-rights deals … Comcast also is the NHL’s major broadcast partner. Meanwhile, ESPN, Turner and Fox Corp.’s Fox all have MLB rights,” the Wall Street Journal's Benjamin Mullin and Lillian Rizzo report. International fallout: Norwegian central bank cuts rates: Norway's central bank cut its key interest rate to 1 percent from 1.5 percent in a surprise announcement, CNBC reports. European Central Bank declines to cut rates, “despite market expectations for a reduction amid the ongoing coronavirus outbreak,” CNBC reports. “However, the central bank did announce measures to support bank lending and expanded its asset purchase program by 120 billion euros ($135.28 billion).” Hospitals in Italy are running out of beds: “Within a few days, doctors and health experts say, even those hospitals will be filled up. The region at the center of Italy’s coronavirus outbreak, they say, is on the verge of running out of room for its most critical patients,” my colleagues Chico Harlan and Stefano Pitrelli report of the outbreak in the northern Italian region of Lombardy. POCKET CHANGE

President Trump, left, and Microsoft CEO Satya Nadella, center, listen to Amazon CEO Jeff Bezos during a roundtable at the White House in 2017. (Nicholas Kamm/AFP/Getty Images) — Pentagon asks to reconsider parts of JEDI contract: “The Pentagon has asked a federal court to give it 120 days to ‘reconsider certain aspects’ of its decision to award an important cloud computing contract known as JEDI to Microsoft, according to a court document made public Thursday,” my colleague Aaron Gregg reports. “Amazon is suing the Defense Department over the decision, which it claims fell in Microsoft’s favor because of improper meddling by President Trump. The decision comes just days after U.S. Court of Federal Claims Judge Patricia Campbell-Smith sided with Amazon on a motion to halt contract performance. (Amazon founder and chief executive Jeff Bezos owns The Washington Post.)” — Juul co-founder steps down: “James Monsees launched the startup, then known as Ploom Inc., in 2007 with Adam Bowen. It catapulted to the top of the e-cigarette market but was blamed for a surge in teen vaping. It has been buffeted by regulatory crackdowns, lawsuits and investigations into whether its marketing targeted underage users,” the Wall Street Journal's Jennifer Maloney reports. “Monsees and Bowen in October stepped down from their jobs as chief product officer and chief technology officer and moved into advisory roles assisting the company’s new chief executive, K.C. Crosthwaite.” — Verizon raises 2020 capital expenditure: “The company said it expects to spend $17.5 billion to 18.5 billion in 2020, up from its prior forecast of $17 billion to $18 billion,” Reuters's Amal S reports. “The carrier also said it has not seen any measurable increase in data use since the coronavirus outbreak.” — Jobless claims drop, but layoffs loom: “The number of Americans filing for unemployment benefits unexpectedly fell last week as employers continued to hold on to their workers, but the coronavirus pandemic is expected to lead to an increase in layoffs as companies battle supply chain disruptions and sagging demand for some goods and services,” Reuters's Lucia Mutikani reports. “Some businesses are already cutting jobs and demand is weakening, at least at the factory level. Other reports … showed companies announced more than 600 layoffs through March 12 tied to the outbreak, while producer prices fell by the most in five years in February as prices for energy products and services such as hotel accommodation, shipping and air travel dropped.” MONEY ON THE HILL — Rep. Porter secures administration commitment on covering testing costs. CNN's Caroline Kelly: 'Democratic Rep. Katie Porter successfully pressed the Centers for Disease Control and Prevention chief during a congressional hearing on Thursday to agree that the agency will pay for testing for the novel coronavirus. “The exchange came after [Trump], while addressing the nation on Wednesday night, incorrectly implied that coronavirus patients could access free treatment. Many insurers have said they will pick up the cost of coronavirus testing for some policyholders, but not the treatment -- and a test or treatment that is covered is not necessarily free.” Porter's tweet of the exchange went viral. See it here: OPINIONS The $1 trillion plan to save the economy when the coronavirus forces everyone to quarantine Massive federal support will be needed once the coronavirus shuts down large parts of the U.S. economy, as is happening in Italy now. Dennis Kelleher, in MarketWatch Read more » CHART TOPPER The U.S. is badly lagging the developed world in coronavirus testing, via Vox:

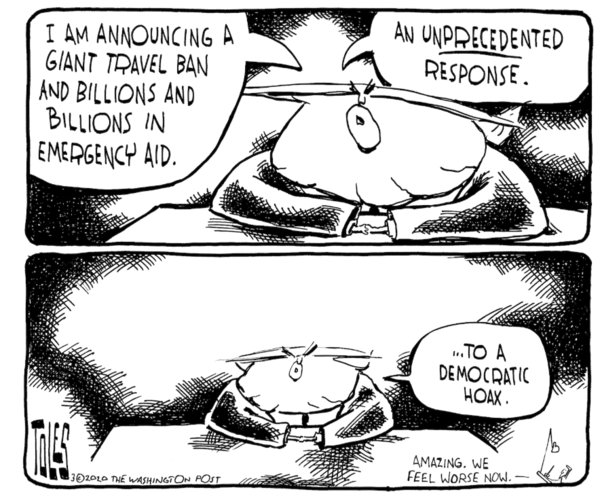

DAYBOOK Today: The University of Michigan releases a preliminary report on consumer sentiment for March THE FUNNIES From The Post's Tom Toles:

BULL SESSION Share The Finance 202: Twitter Facebook Trouble reading? Click here to view in your browser. You received this email because you signed up for The Finance 202 or because it is included in your subscription. Manage my email newsletters and alerts | Unsubscribe from The Finance 202 Privacy Policy | Help ©2020 The Washington Post | 1301 K St NW, Washington DC 20071 The Washington Post Democracy Dies in Darkness ...