Date: 2026-03-03 Page is: DBtxt003.php txt00016727

People ... Ultra Rich

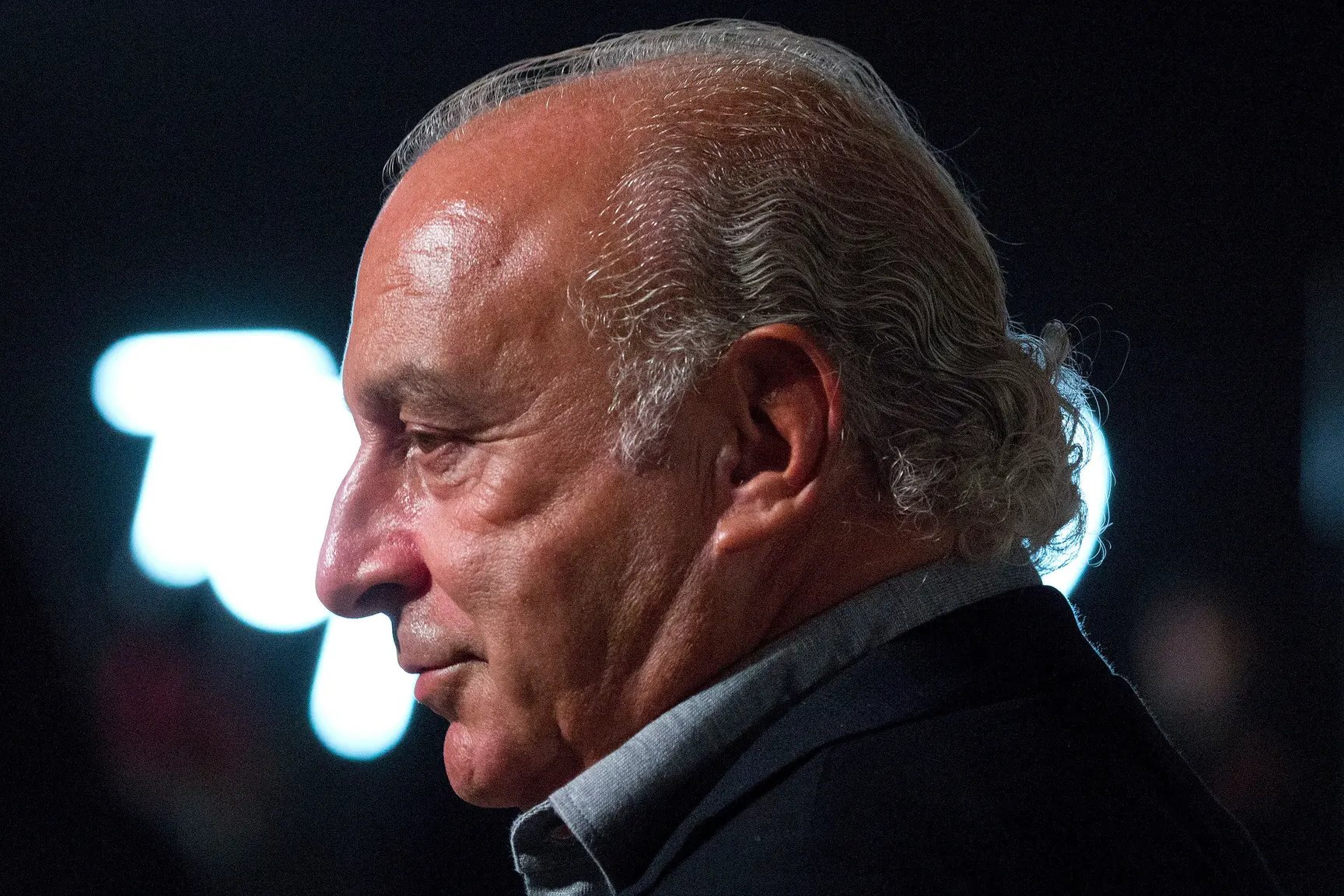

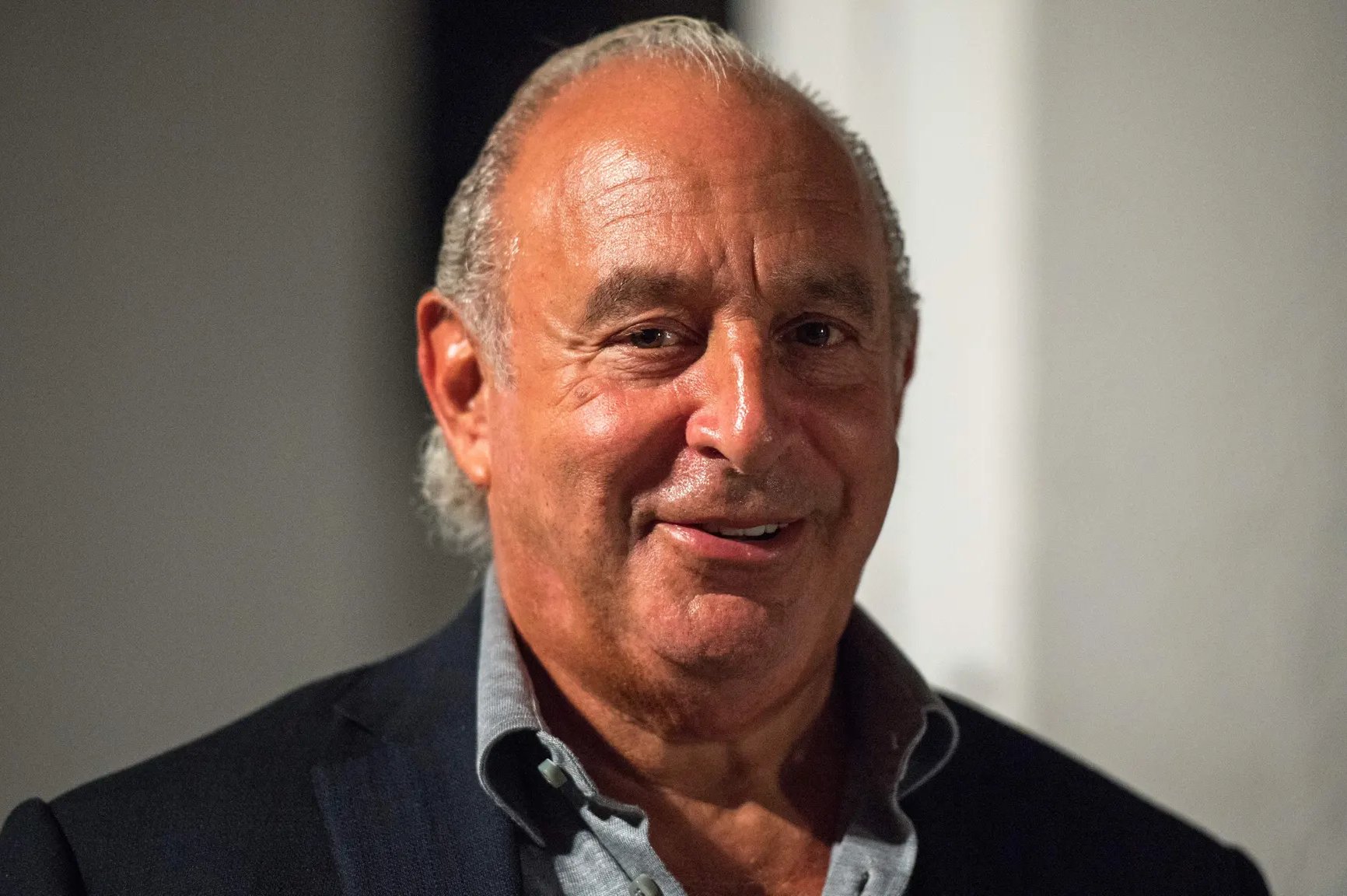

Philip Green

Sir Philip Green ... Topshop owner Philip Green plans to close 23 stores in Arcadia rescue ... Group, which has 566 UK and Irish stores, is asking for rent cuts to help save the business

Peter Burgess

A Topman store

Arcadia, which employs about 19,000 people, could face administration if a rescue plan is not agreed. Photograph: Luke MacGregor/Bloomberg Sir Philip Green plans to close 23 UK stores with the loss of 520 jobs as part of a financial rescue plan for his retail empire, which takes in Topshop, Dorothy Perkins, Miss Selfridge, Wallis, Evans and Burton. The company is also asking landlords to accept rent cuts on up to 194 of its 566 UK and Irish stores in a rescue package that will involve the closure of all Topshop’s 11 US stores. If a deal is not approved, Green’s Arcadia Group, which employs about 19,000 people, could face administration. Philip Green offers landlords 20% stake in Arcadia rescue plan Read more Ian Grabiner, the Arcadia chief executive, said the restructure was a “tough but necessary decision for the business”. He added: “We have in place a well-developed turnaround plan for the group, which includes driving cost efficiencies and managing the refreshed retail store estate and investing in the continued development of our multi-channel proposition and logistics.” The former billionaire Green’s business needs the support of landlordsto cut costs before its next rental payment in late June. The deal is controversial as Green’s family have taken more than £1.5bn in dividends and other payments out of Arcadia since buying it for £850m 17 years ago. The company’s sales and profits have plummeted as it faces increasing competition from online specialists such as Asos and Boohoo, as well as Zara, H&M and Primark on the high street. Green, who has not been in the UK since October, is said to be keen to wrap up an exit from the group. With his reputation in tatters after the collapse of BHS in 2016, only a year after Green sold it for £1 to a former bankrupt, and accusations of inappropriate behaviour, the entrepreneur has lost his appetite for the British high street. Nick Bubb, an independent retail analyst, said landlords would be asking themselves whether they really wanted a probably worthless stake in a business that was likely to be lossmaking and had fallen out of favour with shoppers. “It’s probably not got much of a future,” he said, suggesting landlords would think twice about backing the restructure plan. “Any option for [landlords] is bad. Maybe the least bad option is to establish the principle that retailers can’t just walk away from their legal liabilities.” To persuade them to accept the deal, Arcadia is offering landlords a 20% share in the proceeds from any sale of the business and has promised to invest £50m in revamping and improving stores, as first reported by the Guardian. They will also have access to £40m in compensation. Arcadia also wants to halve payments to its pension fund, which has a deficit of at least £537m, to £25m a year for three years. But Green’s wife Christina, who is the formal owner of the business, has agreed to top up payments to the pension fund with £100m of additional cash over the next three years. It is not clear whether the pensions regulator has approved that deal. But John Ralfe, an independent pensions consultant, said: “This is a good deal for the Arcadia pension schemes. If Sir Philip had chosen to put £100m into the BHS pension scheme before selling it in 2015, it wouldn’t have come back to bite him so ferociously.” Arcadia will seek agreement from landlords for the restructure at a meeting on 5 June. They must approve seven separate insolvency procedures (CVAs) in order for the plan to go ahead. Each require the backing of at least 75% of landlords.

-----------------------------------------------------------------------

Philip Green offers landlords 20% stake in Arcadia rescue plan If plan cannot be agreed, the retail magnate’s firm may face administration

Sarah Butler @whatbutlersaw

Wed 22 May 2019 10.53 EDT Last modified on Wed 22 May 2019 11.12 EDT

Philip Green, who hopes to announce a financial rescue plan for his firm. Photograph: Isabel Infantes/PA

Sir Philip Green’s retail empire has offered landlords a 20% stake in the business as he aims to finalise a rescue restructure of his Topshop to Dororthy Perkins group as soon as Wednesday.

In talks intended to clear a path for the closure of about 60 of the group’s 570 stores and rent cuts on dozens more, Green has also offered a £50m cash investment for updating stores and online sales infrastructure at his Arcadia Group.

He had previously offered a £50m loan for the business and to give landlords a 10% share in the proceeds from any future sale of the business.

The latest offer comes as Green hopes to announce the financial rescue plan – which involves an insolvency process known as a company voluntary arrangement (CVA) – within days.

He is battling to secure backing from landlords and those acting on behalf of pensioners for a deal well ahead of the Arcadia’s next rental payment in late June.

As part of the rescue deal, Arcadia also wants to halve payments to its pension fund to £25m a year, only two years after agreeing to increase them to £50m.

Arcadia’s pension trustees, backed by the pensions regulator, are thought to want a £400m cash injection in order to agree to a cut in annual payments.

The scheme has a deficit of more than £537m based on the company continuing to operate. But that would rise to as much as £750m if Arcadia were to go bust.

The company has offered to hand over the freehold of Topshop’s flagship store, which is worth about £400m. That offer is not seen as sufficient as the property has a mortgage worth about £300m.

If a plan cannot be agreed, then Arcadia, which employs about 19,000 people, could face administration.

Landlords have been able to put pressure on the Arcadia Group as the company’s complex structure gives them more voting power than in the vast majority of CVA deals completed by retailers in recent years.

The firm may have to complete up to eight CVAs of property companies linked to Arcadia’s brands which include Miss Selfridge, Wallis, Evans, Burton and Outfit as well as Topshop, Topman and Dorothy Perkins.

Each require the backing of 75% of landlords. In most CVAs, suppliers and other trade creditors usually hold more sway in the voting process.

Some major landlords, including British Land and Hammerson, have been pushing for a stake worth up to 40%. They also want to see significantly more than £50m investment in the business and a more detailed plan of how the group can be turned around after years of under-investment.

While many high street fashion chains have suffered from a downturn in spending on the high street, Arcadia’s brands are being battered by rising competition from Asos, Zara, H&M and other brands.

One landlord said: “We have not got everything we need yet but things are moving in the right direction.”

Green, who has not been in the UK since October, is said to be keen to wrap up an exit from the group he bought for £850m 17 years ago.

With his reputation in tatters after the collapse of BHS and accusations of inappropriate behaviour, the entrepreneur has lost his appetite for the British high street.

-----------------------------------------------------------------------

Philip Green could close overseas stores as part of Arcadia rescue Retail empire needs to secure deal with landlords to avoid going into administration

by Sarah Butler @whatbutlersaw

Sun 19 May 2019 11.37 EDT Last modified on Sun 19 May 2019 14.35 EDT

Philip Green.

Philip Green has been urged to pump more money into Arcadia and its pension fund. Photograph: AFP Contributor/AFP/Getty Images

Sir Philip Green is considering closing down overseas stores as part of a rescue restructure for his retail empire, which could be announced as early as this week.

Arcadia, the group led by Green that owns several ailing high street fashion brands including Topshop, Miss Selfridge and Wallis, said it needs to secure a deal involving about 50 UK store closures, rent cuts and a reduction in pension fund payments.

If a deal cannot be agreed well before the group’s next rental payment in late June, Arcadia could face administration.

As part of the rescue efforts, it is understood the group is attempting to refinance a £300m mortgage on Topshop’s £400m Oxford Circus building in central London, which also houses Nike. The remortgage could potentially release cash needed to satisfy the group’s landlords and pension trustees, who want Green to pump more money into the business and its pension fund before they will agree to back a rescue deal.

Arcadia had offered to hand over the Topshop building to the pension fund trustees as part of a deal under which it wants to slash annual payments into the scheme to £25m from £50m. But the hefty mortgage and difficult property market mean the store is not seen as the gold-standard asset it once was and trustees have held out for a better offer.

Landlords have also told Arcadia they want significantly more investment in stores than the £100m in loans Green has offered before agreeing to closures and rent cuts of an average of 30% on hundreds of sites. Some also want a larger share in the proceeds from any sale than the 10% initially put on the table.

While not all landlords agree on these demands, Green and his advisers have been locked in talks for weeks in an effort to win over enough backers to secure a deal.

The complex structure of the Arcadia business means it has to implement up to eight separate insolvency procedures known as company voluntary arrangements (CVAs). Each of these must be approved by 75% of creditors, which means landlords have more power over the outcome than in almost any other similar deal attempted by retailers in recent years.

Several industry experts said landlords were becoming more likely to vote against CVAs after a series of similar procedures by Debenhams, New Look, Mothercare and Carpetright had left them out of pocket.

“There is a lot of animosity around,” said one. Another said Green faced particular problems in winning over landlords because his family had taken more than £1.5bn out of Arcadia’s parent company, Taveta, over the years, including a £1.2bn dividend in 2005, and nearly £220m in interest and loan repayments relating to the now collapsed BHS chain since 2009.

“Green’s name is toxic at the moment,” the property source said. “I think Arcadia is easily going to be the most controversial [CVA deal] because of the scale of the business, the behaviour of the owner and the impact on local communities.”

Green, who has not been in the UK since October, is keen to stabilise and potentially offload his empire, which he bought for £850m 17 years ago. The business is struggling as shoppers have reined in spending on clothing and turned to rivals such as Asos, Zara and H&M. Arcadia’s group sales fell 10.5% to £1.7bn in the year to August, according to the Sunday Times, which first reported Green’s offer to close his overseas business.

The group’s overseas businesses could be put up for sale but more than half the 1,000-plus overseas stores are franchise operations. Only Topshop outlets in Ireland, France, Germany, the Netherlands, the US and Australia are run directly by the company.

In Australia there are only two stores and in the US only 11 standalone stores, alongside concessions in the Nordstrom department store chain. The overseas businesses are unlikely to attract a buyer because the stores are leased and many markets are thought to be loss-making.

Philip Green.

Philip Green has been urged to pump more money into Arcadia and its pension fund. Photograph: AFP Contributor/AFP/Getty Images

Sir Philip Green is considering closing down overseas stores as part of a rescue restructure for his retail empire, which could be announced as early as this week.

Arcadia, the group led by Green that owns several ailing high street fashion brands including Topshop, Miss Selfridge and Wallis, said it needs to secure a deal involving about 50 UK store closures, rent cuts and a reduction in pension fund payments.

If a deal cannot be agreed well before the group’s next rental payment in late June, Arcadia could face administration.

As part of the rescue efforts, it is understood the group is attempting to refinance a £300m mortgage on Topshop’s £400m Oxford Circus building in central London, which also houses Nike. The remortgage could potentially release cash needed to satisfy the group’s landlords and pension trustees, who want Green to pump more money into the business and its pension fund before they will agree to back a rescue deal.

Arcadia had offered to hand over the Topshop building to the pension fund trustees as part of a deal under which it wants to slash annual payments into the scheme to £25m from £50m. But the hefty mortgage and difficult property market mean the store is not seen as the gold-standard asset it once was and trustees have held out for a better offer.

Landlords have also told Arcadia they want significantly more investment in stores than the £100m in loans Green has offered before agreeing to closures and rent cuts of an average of 30% on hundreds of sites. Some also want a larger share in the proceeds from any sale than the 10% initially put on the table.

While not all landlords agree on these demands, Green and his advisers have been locked in talks for weeks in an effort to win over enough backers to secure a deal.

The complex structure of the Arcadia business means it has to implement up to eight separate insolvency procedures known as company voluntary arrangements (CVAs). Each of these must be approved by 75% of creditors, which means landlords have more power over the outcome than in almost any other similar deal attempted by retailers in recent years.

Several industry experts said landlords were becoming more likely to vote against CVAs after a series of similar procedures by Debenhams, New Look, Mothercare and Carpetright had left them out of pocket.

“There is a lot of animosity around,” said one. Another said Green faced particular problems in winning over landlords because his family had taken more than £1.5bn out of Arcadia’s parent company, Taveta, over the years, including a £1.2bn dividend in 2005, and nearly £220m in interest and loan repayments relating to the now collapsed BHS chain since 2009.

“Green’s name is toxic at the moment,” the property source said. “I think Arcadia is easily going to be the most controversial [CVA deal] because of the scale of the business, the behaviour of the owner and the impact on local communities.”

Green, who has not been in the UK since October, is keen to stabilise and potentially offload his empire, which he bought for £850m 17 years ago. The business is struggling as shoppers have reined in spending on clothing and turned to rivals such as Asos, Zara and H&M. Arcadia’s group sales fell 10.5% to £1.7bn in the year to August, according to the Sunday Times, which first reported Green’s offer to close his overseas business.

The group’s overseas businesses could be put up for sale but more than half the 1,000-plus overseas stores are franchise operations. Only Topshop outlets in Ireland, France, Germany, the Netherlands, the US and Australia are run directly by the company.

In Australia there are only two stores and in the US only 11 standalone stores, alongside concessions in the Nordstrom department store chain. The overseas businesses are unlikely to attract a buyer because the stores are leased and many markets are thought to be loss-making.

-----------------------------------------------------------------------

The Labour peer Peter Hain, who used parliamentary privilege to accuse Sir Philip Green of being an abusive bully, has said he did so after hearing 'horrible' claims of repeated sexual assaults resulting in hundreds of grievance cases. Hain told the House of Lords on Thursday one alleged victim said the retail tycoon had shouted 'go to psychologists' when staff objected to his behaviour I was told of hundreds of grievance cases against Philip Green, says peer #metoo #timesup Peter Hain describes allegations against Philip Green: 'It was horrible' 2,963 views 26 2 SHARE SAVE Guardian News Published on May 23, 2019 The Labour peer Peter Hain, who used parliamentary privilege to accuse Sir Philip Green of being an abusive bully, has said he did so after hearing 'horrible' claims of repeated sexual assaults resulting in hundreds of grievance cases. Hain told the House of Lords on Thursday one alleged victim said the retail tycoon had shouted 'go to psychologists' when staff objected to his behaviour Subscribe to Guardian News on YouTube ► http://bit.ly/guardianwiressub I was told of hundreds of grievance cases against Philip Green, says peer ► https://www.theguardian.com/business/... Support the Guardian ► https://support.theguardian.com/contr... Today in Focus podcast ► https://www.theguardian.com/news/seri... The Guardian YouTube network: The Guardian ► http://www.youtube.com/theguardian Owen Jones talks ► http://bit.ly/subsowenjones Guardian Football ► http://is.gd/guardianfootball Guardian Sport ► http://bit.ly/GDNsport Guardian Culture ► http://is.gd/guardianculture I was told of hundreds of grievance cases against Philip Green, says peer ► https://www.theguardian.com/business/2019/may/23/philip-green-peter-hain-says-told-of-hundreds-of-grievance-cases-peer LostInPA LostInPA 1 day ago Evidence or unsubstantiated accusations for political purposes? David Edbrooke David Edbrooke 1 day ago GOT.? 42 -42 42 -42 1 day ago And now mr hain will be destroyed by mr green.... They will start calling hain an anti semite...... David Edbrooke David Edbrooke 1 day ago Now back it up or shut up. He dares not say it outside of parliamentary privilege does he? Up next AUTOPLAY 14:54 Sir Philip Green 'sad and very sorry' over BHS collapse ITV News 21K views

-----------------------------------------------------------------------

Why it matters that Philip Green dodged my questions in Monaco – video With Sir Philip Green's Topshop empire Arcadia facing a cash crisis, the Guardian's Rupert Neate wrote to the retail billionaire to ask what reassurances he was offering to the 20,000 people who work for him. There was no reply from his spokesman, so Neate decided to track him down and ask him in person. He found Green in Monaco, preparing to host a grand prix party aboard his superyacht Lionheart. Philip Green's yacht

The front in Monaco

The front in Monaco

Wife lives in Monaco

Wife lives in Monaco

Other wealthy people are based in Monaco

Other wealthy people are based in Monaco