Date: 2026-01-18 Page is: DBtxt003.php txt00015822

Energy

Electricity Generation USA

Report: US on Track for Record Coal Retirements in 2018, With More on the Way ... Research suggests 36.7 gigawatts of coal-fired capacity could retire through 2024—even with a repeal of the Clean Power Plan.

Burgess COMMENTARY

Peter Burgess

FOSSIL FUELS

Report: US on Track for Record Coal Retirements in 2018, With More on the Way

Research suggests 36.7 gigawatts of coal-fired capacity could retire through 2024—even with a repeal of the Clean Power Plan.

More coal closures are coming, driven by the economics for renewables and gas.

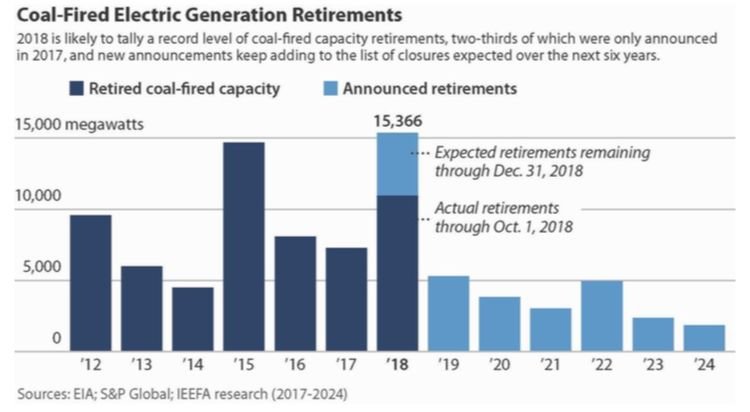

The U.S. is on track this year to “easily exceed” a previous annual record of 14.7 gigawatts in coal retirements, dropping 15.4 gigawatts of capacity, according to a recent report from the Institute for Energy Economics and Financial Analysis.

The research organization expects this retirement trend to continue in coming years, according to data compiled using sources such as corporate announcements, integrated resource plans and news reports. The current U.S. coal fleet still sits at about 246 gigawatts of capacity. But retirements forecasted at 36.7 gigawatts from the beginning of 2018 through 2024 will reduce that capacity by 15 percent.

IEEFA notes that federal or state policy changes, like the Affordable Clean Energy (ACE) rule to replace the Obama-era Clean Power Plan, could influence closures. But the report also reiterates that policy is not the main driver behind retirements. Economics will push “sizable” retirements in 14 states including Indiana, Minnesota, Ohio and West Virginia.

“Some of these closures may shift calendar years,” said Seth Feaster, an IEEFA data analyst and author of the report. “But that won’t affect the overall figures.”

According to Feaster, the 36.7 figure is “very conservative.”

“IEEFA fully expects these numbers to grow — we are aware of a number of coal-fired plants or units already under review for closure, but they have not been announced,” said Feaster in an email. “We are also aware of some other plants and units that are now running at low capacity factors, and are likely to get closed in the next few years.”

As other researchers have noted, cheap natural gas and renewables have made coal increasingly uneconomic. Those trends will fundamentally change the U.S. electricity mix. The Energy Information Administration (EIA) believes that coal-fired electricity will drop from 39 percent of the mix in 2014 to 27 percent in 2019.

EIA expects gas will make up the majority of that capacity, growing to 35 percent of generation in 2018 and 2019. But the agency notes that renewables play an increasingly important role as well; they are forecasted to produce 10 percent of electricity in 2018 and nearing 11 percent in 2019.

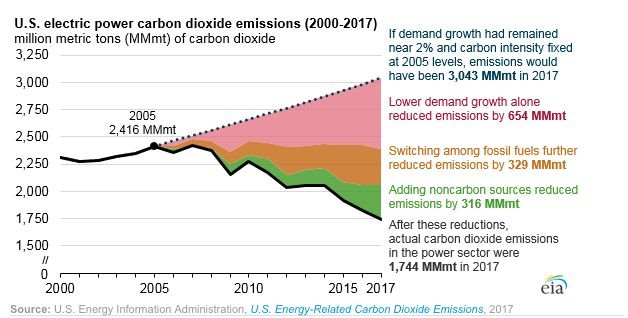

EIA data released after the IEEFA report shows that renewables reduced emissions by a nearly comparable amount as fuel-switching to gas.

Some of the decline in coal, according to IEEFA, has to do with age. Most of the country’s coal plants came online before 1980. Developers built many gas, wind and solar plants after 2000.

But the retirement of younger plants — like Texas’ Sandow Power Plant, which was expanded in 2009 and retired in January — show economics can favor clean energy and gas even against more recent builds.

“The electric-generating industry is well into a fundamental transition,” writes Feaster in the report. “In short, the future of coal-fired generation assets is limited.”

Trump administration attempts to stem retirements

Several of the companies most impacted are those that have reached out to the Trump administration for help.

IEEFA noted closure announcements from FirstEnergy Solutions in Pennsylvania and Ohio. Earlier this year that subsidiary of FirstEnergy Corp. asked the Trump administration for emergency support for its coal and nuclear plants. It then filed for bankruptcy. Murray Energy, which IEEFA said is likely to suffer in part because of a 6.5-million-ton annual delivery contract with FirstEnergy Solutions, also asked the White House for an emergency order to keep coal mines and plants operational.

Until recently, the federal administration was preparing support for coal and nuclear plants using emergency powers generally associated with wartime. The government reportedly shelved that idea in October because of concerns about cost and legal challenges.

But the Trump administration is still moving forward with other attempts to buoy coal, like its ACE rule. That regulation gives states more freedom to control emissions from coal plants. Comments on the proposed rule were due October 31.

A comment submitted by the Edison Electric Institute (EEI), a trade group representing investor-owned electric utilities, indicates the varying perspectives of utilities across the country when it comes to the role of coal regulations.

“EEI’s member companies had — and continue to have — differing views on both the extent of EPA’s legal authority to adopt the final [Clean Power Plan]…and the relative stringency of the goals in the final CPP,” writes EEI, although it acknowledges that “the electric sector is undergoing a transition toward low- and zero-emitting generation that will continue over the next decade and beyond.”

That transition may be accelerating. IEEFA writes that coal plant closures following announcements from FirstEnergy Solutions and American Electric Power are “occurring far sooner than expected.”

----------------------------------------------------------------------------

TOP ARTICLES

MOST POPULAR MOST COMMENTS

Customers really despise Tesla Solar's customer service.

Yelp Reviews of Tesla’s Residential Solar Business Are Not Pretty

Analysts forecast that renewables will account for up to 20 percent of the global power market by 2035.

Energy Transition to Reach ‘Point of No Return’ by 2035

The sun sets on another Saudi Arabian solar megaproject.

Failure of ‘World’s Biggest Solar Project’ in Saudi Arabia Is No Surprise

WHITE PAPERS

Why Residential Solar Must Be Storage Ready

DOWNLOAD >

Enabling the Connected Energy Customer Through Cloud and Voice Services

DOWNLOAD >

Related Reports

U.S. PV System Pricing H1 2018: Forecasts and Breakdowns

GET REPORT NOW >

U.S. Solar Market Insight: Q3 2018

GET REPORT NOW >