Date: 2026-02-06 Page is: DBtxt003.php txt00014208

Taxation

GOP's wrong reform

Where the GOP’s Tax Extremism Comes From ... Conservative leaders like Grover Norquist want to basically eliminate taxes and government

Burgess COMMENTARY

Peter Burgess

Dec 2

Where the GOP’s Tax Extremism Comes From

Conservative leaders like Grover Norquist want to basically eliminate taxes and government

IMAGE Life in about 1774

In a party-line vote, Republican Senators have passed a remarkably unpopular tax bill — one that raises taxes on most Americans and lowers them for the very wealthy and corporations. Even with the rosiest projections of supply-side and trickle-down effects, this bill will shrink the size of government revenues by perhaps trillions. And that’s the point.

The religious fervor for cutting government comes in large part from conservative voices who believe that all government is bad. And nobody has made more noise on this topic than Grover Norquist, President of Americans for Tax Reform.

No one enjoys taxes. But Norquist hates them with a passion that makes me wonder if an IRS agent beat him up as a kid. He’s famous for saying, “I don’t want to abolish government. I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.” And he’s the guy who got nearly every national-level GOP politician to sign a pledge to never raise taxes.

Never.

Not even when, say, we wage a multi-trillion-dollar war. But remember, in the past, presidents of both parties both lowered and raised taxes when the need arose, including conservative patron saint Reagan (and of course Bush senior found he couldn’t keep his “Read my lips, no new taxes” pledge). Everyone used to recognize that, sometimes, things come up that require investment — just as they do in our lives. When we send a kid to college, get a new car, or replace a broken boiler, we spend more that year. And when a country grows and has large, complex, shared resources to build and maintain, it takes investment.

But some far right thinkers want to spend almost nothing. How low does Norquist actually want taxes to go? He recently let us know.

Grover Norquist offers an idea on taxes

This inane tweet generated some funny replies, mainly about how different the country was in 1774. Let’s consider a few things we didn’t have then:

... A national system of roads, bridges, and tunnels with 47,000 miles of interstate highways

... An air traffic system moving 2.5 million people across 29 million square miles of airspace…every day.

... A vast energy grid and power system, owned and operated by a complex combination of public and private entities.

... Thousands of public hospitals with MRIs, CT-Scans, and countless treatments and medications that were not even imaginable in the age of bloodletting and leeches.

... A standing military with millions of people and thousands of tanks, aircraft carriers, stealth bombers, and nuclear weapons

... Thousands of local police and fire departments with modern equipment and pensions and benefits for our public safety workers

... Large-scale water and sewage systems

... Regulatory bodies with the stated goal of ensuring the ongoing safety of thousands of drugs, millions of consumer products, and billions of pounds of food (we each eat a literal ton of food every year)

... Health insurance and financial assistance (yes, a safety net) for the poor, elderly, and temporarily out of work to ensure they have some basic level of well-being

The vast majority of Americans expect and want all of these services and more. We could, and should, debate how we best accomplish these goals (i.e., private vs. public provision of services), but it’s not much of a debate that we need them. And, of course, we should demand efficiency and minimize waste. But it’s a fantasy to pretend that (a) these assets are tiny parts of the economy, or (b) privatized solutions would achieve the same goals and optimize our collective well-being (vs. optimizing for lowest cost no matter what — do you want that in air traffic control or your food safety?).

Also consider the way so many Americans talk about government, like it’s some external group. It’s bizarre. We are government — it’s our shared responsibility. Our neighbors, friends, family, and ourselves work in the government keeping our complicated society going. Dismissing them all as “bureaucrats” is insulting and wildly inaccurate. Exact numbers for government employment are not easy to assemble. But, we know there are 3.2 million elementary and secondary school teachers, well over a million people in law enforcement and fire departments, 2 million citizens in the active and reserve military, and on and on. In short, tens of millions of people work in government in some way. Those think tanks that hate all government express shock at these numbers.

But why are they shocked? Take a good look around at how much of our society is shared — our physical infrastructure, our modern communications infrastructure, our public safety and health services, our protection of clean air and water and a stable climate, our system to ensure safe food and drugs, our educational system for pre-K through college, and so much more. It takes a lot of people and investment to look this good (or even not so good at times).

Then consider that we also provide shared resources for the entire country, no matter how remote. For example, the stimulus package of 2009, which fiscal conservatives hated, allocated billions to bring broadband to rural areas (those places that generally dislike big government). Investments like these build a fair, thriving society…and I think it’s worth it.

So, providing and maintaining key elements of society are big endeavors. Thus Norquist’s 1774 benchmark of 1% to 2% for taxes is dumb. But he can’t possibly believe that this level of taxation would support a modern society. No, that’s merely an initial offer in a grand mental game. He’s using the cognitive bias of “anchoring.” When starting a conversation about numbers, the first one you hear greatly influences your thinking. By pegging the number that low, Norquist makes the kinds of numbers we really need seem absolutely insane.

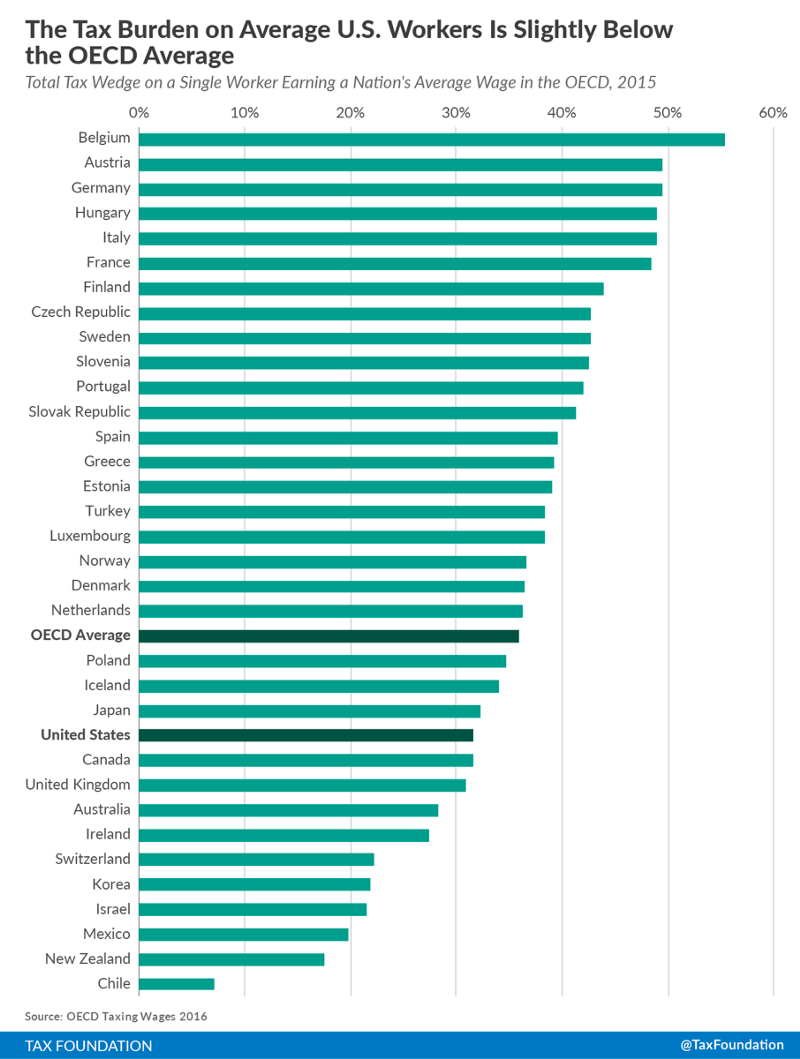

And modern, developed countries collect revenues (yes, taxation) of about 40 to 50% of income. Look at this analysis of tax burden on workers across the OECD (i.e., the developed world) and see the chart below (by the way, consider the framing we use , calling it a “burden” rather than a contribution). The US currently falls below the OECD average.

Modern, developed countries tax about 40 to 50% of income. (← Click to tweet!)

Let me be very clear about something. I don’t pretend to know the exact right amount of taxation. And I’m sure there’s some waste. But going from 40% to 2% is not about getting leaner. It would require eliminating entire, and most, current functions of government. When people demand lower taxes, we should ask, “What will you do without to reduce spending?”

So on to the real debate. Let’s imagine that we believed in investing in common good resources. We should propose a number as absurd as Norquist’s. Here’s my version of his tweet:

The best tax rate? One clue. In 1953, the top tax rate for Americans was 93%. Seems reasonable.

(By the way, I hear from many Americans that around the 1950s, America was really “great.”)

Ok, so now that we’ve established that total taxes should fall somewhere between 2% and 93%, can we have an actual reasonable discussion?

(If you liked this, please press the clap button a bunch so others can find it. To avoid nasty commentary which is unfortunately a staple of all media now, I generally close comments…but we seem to be keeping civil here. Bravo. But you can come yell at me, if you must, on Twitter @AndrewWinston (but I block people who love ad hominem attacks). I like to think that we should start with the assumption that most people want what’s best for their kids, communities, country, and world…and thus deserve respect).

Andrew Winston advises many of the world’s leading companies on how to navigate and profit from solving humanity’s biggest challenges. He is a globally recognized speaker and writer on business strategy and mega-trends. Andrew is the author of The Big Pivot and co-wrote the international bestseller Green to Gold.

One clap, two clap, three clap, forty?

By clapping more or less, you can signal to us which stories really stand out.

Andrew Winston

Adviser, author, speaker on how businesses can (profitably) solve the world's mega-challenges. Author: The Big Pivot & Green to Gold http://www.andrewwinston.com