Date: 2026-01-17 Page is: DBtxt003.php txt00011404

Companies

LeEco

Chinese Digital Giant LeEco Expands Into U.S. Market, Eyes Other Global Content Partners

Burgess COMMENTARY

Peter Burgess

Erik Mika

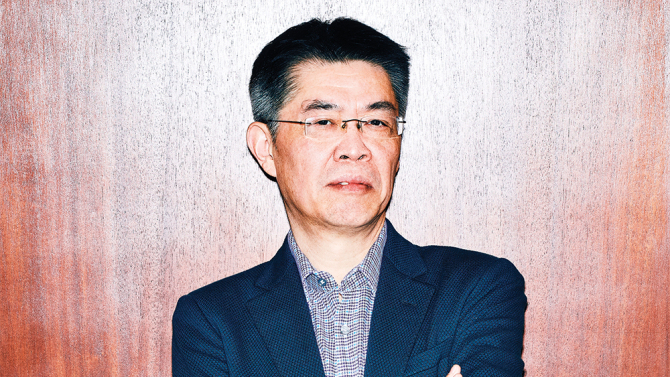

Zhang Zhao LeEco filmTERENCE PATRICK

New year’s celebrations are winding down in China this week, where the whole country has been at a virtual standstill for a little over a week. Lunar New Year is China’s biggest holiday, and the most recent one rang in the Year of the Monkey. “Monkeys are known as great leaders,” says Zhang Zhao, CEO of Beijing-based LeVision Pictures. “Great leadership also (reshapes) what it means to be innovative by breaking down borders.”

Zhang has been trying to break down borders himself ever since he joined LeVision in 2011, co-financing Hollywood movies like “The Expendables 2” and distributing them in China, and also getting into the production business in a big way with the Matt Damon-helmed pic “The Great Wall,” due to be released later this year.

But Zhang and his colleagues aren’t just looking to make a splash with movies during the Year of the Monkey. LeVision’s corporate parent LeEco is getting ready for an ambitious international expansion that will also include taking the first steps into the U.S. market to sell smartphones, TV sets and content services. “We’re big believers that U.S. consumers are hungry (for) the next generation of experiences and devices, and that once they (get them), they’ll accept nothing less,” Zhang says.

LeEco used to be known as LeTV, a brand that still adorns its products. By any name, though, the company is virtually unknown in the U.S., yet it’s been a significant player in China for some time. Originally launched in 2004 — another Year of the Monkey — as an online video service, it quickly became one of the largest video platforms in the country, where it now streams a catalog of some 5,000 movies and 100,000 TV show episodes. Smart TVs and streaming boxes were the logical next step, and last year, LeTV also began selling smartphones in China.

“We’re big believers that U.S. consumers are hungry (for) the next generation of experiences and devices, and that once they (get them), they’ll accept nothing less.” LEVISION PICTURES’ ZHANG ZHAO

The company generated around $1.5 billion in revenue in 2014, and $1.3 billion in the first three months of 2015. It sold four million smartphones in 2015, and is looking to sell 15 million in 2016. To that end, it has started some e-commerce in India, where it sold some 70,000 phones in a limited sale earlier this month. Later this year, it wants to make some of the same devices available to U.S. consumers. And after tackling India and the U.S., LeEco is poised to set its sights on South America.

LeTV executives are cautioning that the company isn’t simply trying to make a big splash in foreign markets. “As we continue to expand globally, we’ll continue to adopt best practices in each market,” Zhang says.

The company is looking to strike strategic partnerships for long-term growth, and isn’t expecting an immediate big return, according to Eric Mika, who began leading LeEco’s U.S. efforts in October after stints at Fidelis Global, Nielsen and Variety. “We are rolling out in a modest way,” Mika says. “Our expectations are realistic.”

Modest talk can’t hide that LeEco has big international ambitions, and is making significant investments, especially Stateside. In addition to offices in Los Angeles, San Diego and New York, the firm also has been hiring numerous developers in Silicon Valley, where it recently signed a lease for a new 86,000-square-foot office, with plans to move in by April.

A LeTV representative didn’t want to comment on the still-unannounced office space, but a source close to the company told Variety it has plans to house as many as 3,500 employees in the facility.

Still, expanding internationally won’t come easy for LeEco, especially in the mobile phone market. Not only is it about to take on much larger competitors like Apple and Samsung, each market also comes with its own challenges, argues Jackdaw Research analyst Jan Dawson. “The biggest difference between the Chinese and U.S. smartphone markets is the degree to which people buy through carriers,” he says. “The big carriers have been really reluctant to stock those phones from relatively unknown brands alongside iPhones and Samsung Galaxies.”

A GREAT LEAP FORWARD

Comparative returns show the extent of LeEco’s growth

76.5% Year-on-year increase in total revenue, January-September, 2015, to $1.32 billion

73.8% Year-on-year increase in net profits for the same time period, to $59.4 million

$54.8% Year-on-year increase in ad growth, to $275 million

101.9% Year-on-year increase in devices business, to $636 million

4m Number of smartphones sold in 2015

3m Number of televisions sold in 2015 (projected)

That’s not at all how LeEco has been doing business in China, where its products are sold exclusively online. What’s more, most of these sales have been so-called flash sales, with LeEco making phones available for a very limited time, and consumers snapping up tens of thousands of devices in minutes, if not seconds.

It’s a model that has worked well for Chinese companies like LeEco and Xiaomi, but it is quite foreign to the U.S., where brands like Apple still get consumers to stand in line for hours whenever a new phone is being released. Mika believes there is room for flash sales in the U.S. “I think it would work,” he says. But he also concedes that LeEco may have to strike some retail partnerships to introduce consumers to the brand.

Such partnerships could further change how LeTV does business. Right now, the company sells phones, TVs and accessories significantly below the price charged by competitors like Apple or Samsung. Its 2015 flagship device, dubbed the Le 1 Superphone, retailed for less than $400 in China, whereas Apple charges Chinese consumers $800 and more for its current-generation iPhones.

LeEco can afford rock-bottom prices in part due to its direct-sales strategy, but the company is also hoping to make up for razor-thin margins with additional services revenue, including movies and TV shows. Each LeTV phone comes with a home screen button that leads straight to the company’s video service, showing off live streams as well as on-demand titles.

For foreign markets, LeEco is looking to strike content partnerships to kick-start those efforts. It already did so in India, where consumers now get to see Bollywood movies supplied by ErosNow, and it’s in talks with U.S. services to strike similar partnerships for a Stateside launch.

LeEco wouldn’t be the first mobile phone manufacturer to bet on content as a competitive advantage. Samsung itself has tried a similar strategy; the company built out its own mobile video service, dubbed “Milk Video” and struck exclusive content deals with the likes of Vice and Funny or Die, but soon after pulled the plug on the effort.

VIDEO:Letv Leader Explains His Company’s Global Mission

Dawson is skeptical that LeEco’s efforts will fare any better. “It’s hard to see how LeTV will be able to put together a package of content that’s really compelling in the U.S. in the face of so many entrenched competitors that have been at this a lot longer, and know the U.S. market much better,” he argues.

Mika counters that companies like Samsung simply don’t have content in their DNA. “ If you are a TV manufacturer, you are a TV manufacturer,” he says.

LeEco wants to be more than just a hardware company. It is betting big on content and services, and hopes that this will not only help to sell phones and TVs, but one day also a whole slew of new devices. In January, it showed off some of those at the Consumer Electronics Show in Las Vegas, including a bike with integrated GPS and anti-theft protection, and an Internet-connected Aston Martin. Think of them as placeholders for its own line of electric cars, which are being manufactured under the Faraday Future brand at a plant in Gardena, Calif.

“We’re bullish on 2016 being the year that LeEco really reveals itself to the world,” says Zhang, jokingly adding — “or should I say monkey-ish?”