Date: 2026-01-17 Page is: DBtxt003.php txt00007345

Metrics

Elements of measurement

PwC ... elements of measurement ... What would you do? The great trade-off

What would you do? The great trade-off

Business faces complex decisions everyday. But how do they evaluate the optimal approach? Or understand which of their stakeholders are affected by their choices?

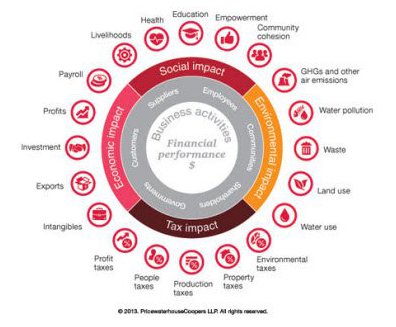

PwC’s TIMM framework puts a value (positive or negative) on twenty impacts across society, tax, economics, and the environment. And gives business the ability to compare strategies and investment choices, evaluating the total impact of each. But it’s best shown in an example.

Environment Impact

GHGs and other air emissions

Water pollution

Waste

Land use

Water use

Tax Impact

Environmental taxes

Property taxes

Production taxes

People taxes

Profit taxes

Economic Impact

Intangibles

Exports

Investment

Profits

Payroll

Social Impact

Livelihoods

Health

Education

Empowerment

Community cohesion

(c) 2013. PricewaterhouseCoopers LLP. All rights reserved.

NB. The size of the bars is the relative impact, green being positive and red negative.

The center of TIMM are the following:

Business Activities ... Financial Performance

Suppliers

Employees

Communities

Shareholders

Governments

Customers

A quick look, and the TIMM model looks suprisingly similar to the MDIA model ... but they are, in fact, significantly different.

PwC with TIMM, not suprisingly, has the corporate business as the central focus of the analysis, just as Porter and Kramer have the idea of Creating Shared Value centered on op[timizing the performance of a for-profit enterprise.

MDIA has people as the purpose of economic activity, with a for profit enterprise simply as the best way of implementing economic activity. But MDIA goes a lot further in order to handle the problem of the massive amount of investment needed to enable improved economic performance that will benefit almost 50% of the people of the planet ... people who will never be served using the conventional for profit business model and for profit financing.

It is my understanding that all of the major accounting firms are working on models similar to TIMM ... but as far as I know none of them have the multi-dimension multi perspective architecture that is central to the MDIA model.