Date: 2026-03-06 Page is: DBtxt003.php txt00004673

Energy ... Renewables

Solar

Eric Wesoff ... Solar Summit Slideshow: The PV Module Market

Burgess COMMENTARY

Peter Burgess

Solar Summit Slideshow: The PV Module Market

GTM Research Senior Analyst Shyam Mehta provides actionable intelligence for the solar module manufacturing industry.

GTM Research Senior Analyst Shyam Mehta spoke at this week's Solar Summit in Arizona on solar module manufacturing. Rather than preaching 'big ideas [and] grand narratives [that] don't always give you actionable intelligence,' Mehta tried to provide real-world data points and tried to 'start from the ground.'

Here are a few of his points and the accompanying data.

The performance gap between p-type mono-crystalline silicon and multi-crystalline silicon is narrowing

Efficiency gains in conventional multi c-Si have accelerated and the gains have come 'without significant increase in capex or material cost,' according to Mehta. Yet mono crystalline still commands a 4 cent to 8 cent per watt premium in sales price. Mehta suggests that the value proposition for p-type mono continues to deteriorate.

P-type might make sense in highly real estate-constrained Japan, but in the long term, Mehta sees n-type mono as a key to maintaining the efficiency advantage of mono. Panasonic, SunPower and Yingli are working on n-type cells.

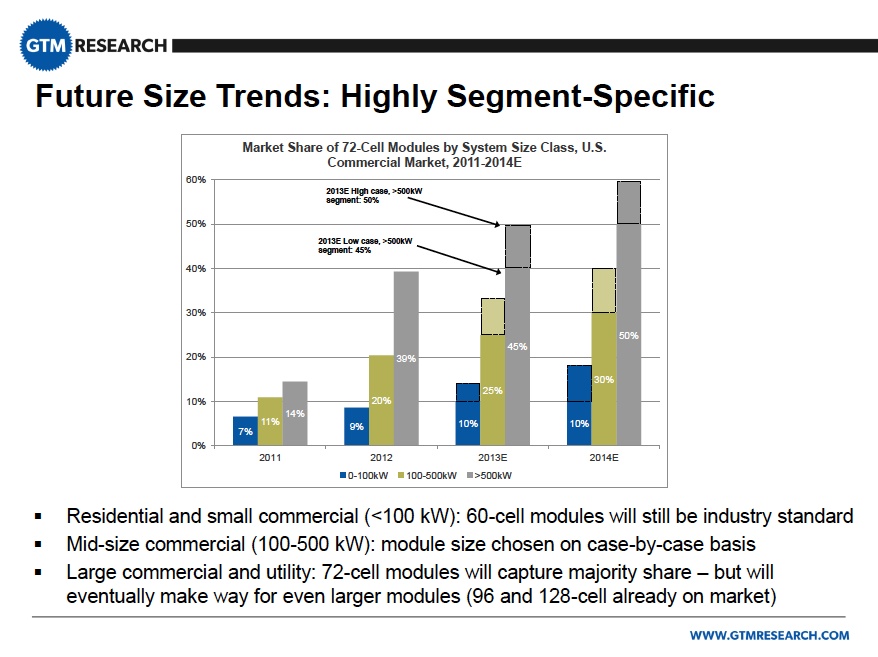

Are 72-cell modules the future?

Are 72-cell modules the future?

Mehta noted that 60-cell modules are the current standard but there are 72-cell, 96-cell, and 128-cell modules available. He said that 72-cell modules have gained significant market share because large modules can reduce balance-of-system costs by up to 7 cents per watt.

The 60-cell modules still have an advantage over larger modules in that they are more rigid, can be carried by one person, and more modules can be fit onto complicated rooftops.

Mehta suggests we will start to see increasing numbers of larger and different sized modules that are 'highly segment-specific.'

Will module prices just keep dropping?

Spot pricing for polysilicon, as well as for cells and modules, has actually risen 5 percent to 15 percent this year. Is this an indication of a sustained price increase? Mehta points to some salient data from GTM research -- 81 percent of ASP reduction over the last two years has come from margin evaporation and polysilicon. He notes that non-silicon materials such as glass and encapsulants have little cost-reduction potential remaining.

Long Short-term risks to module pricing include the EU anti-dumping decision set for late May or early June, a Chinese tariff on U.S. polysilicon, and the uncertainty of consumables pricing.

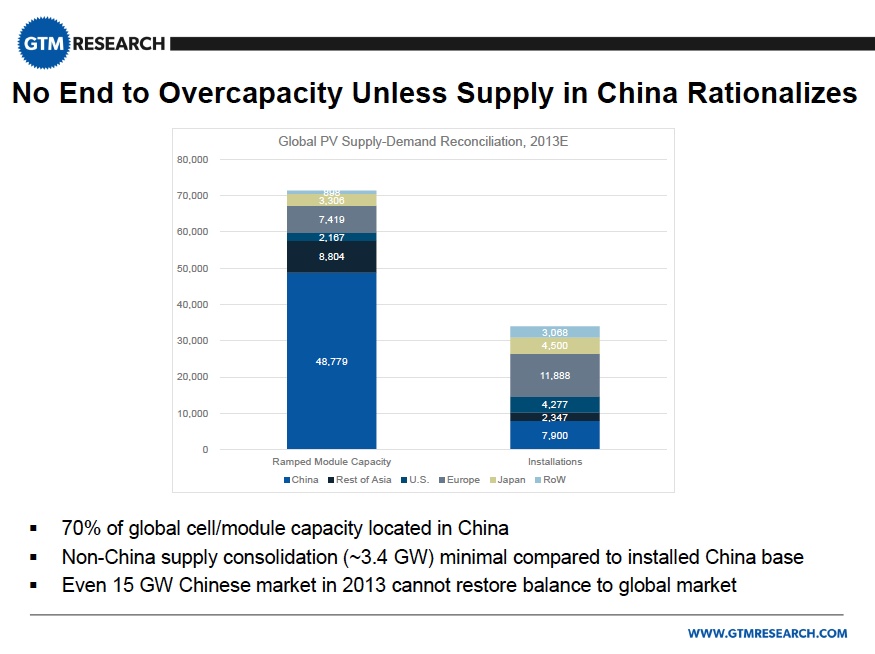

How will supply in China rationalize?

Larger firms will retire older uncompetitive capacity. 'We've already seen this at JA Solar and Suntech,' said Mehta. The analyst added that if China eliminated all non-Chinese capacity was to disappear -- there would still be an oversupply in the rest of the world.

Mehta notes that a bankrupt and insolvent Suntech Wuxi continuing to operate while propped up by city government is not consolidation. And because of this 'messy roadmap' to rationalization, 'There is no end to overcapacity in the next twelve to eighteen months.'

Central lenders will keep backing 'winners,' said Mehta, as will city and district governments.

All of the live-streamed sessions from the GTM Solar Summit can be found here.

Watch GTM Research Senior Analyst Shyam Mehta discuss strategies for success in emerging markets with industry experts at Solar Summit: