|

|

THE FINANCIAL DIMENSION OF ECONOMIC CAPITAL

IT HAS BEEN THE DRIVER OF PROGRESS SINCE THE BEGINNING OF THE INDUSTRIAL ERA

|

|

|

PROFITS ... THE DOMINANT GOAL IN THE MODERN ECONOMY

|

|

Profits are the dominant goal in the modern economy. Everything in the corporate organization has been managed for a very long time, simply to improve profit performance. Worse, there is a legal theory that anything other than this would be illegal. Not surprisingly profits have improved while social responsibility and environmental responsibility is ignored.

|

|

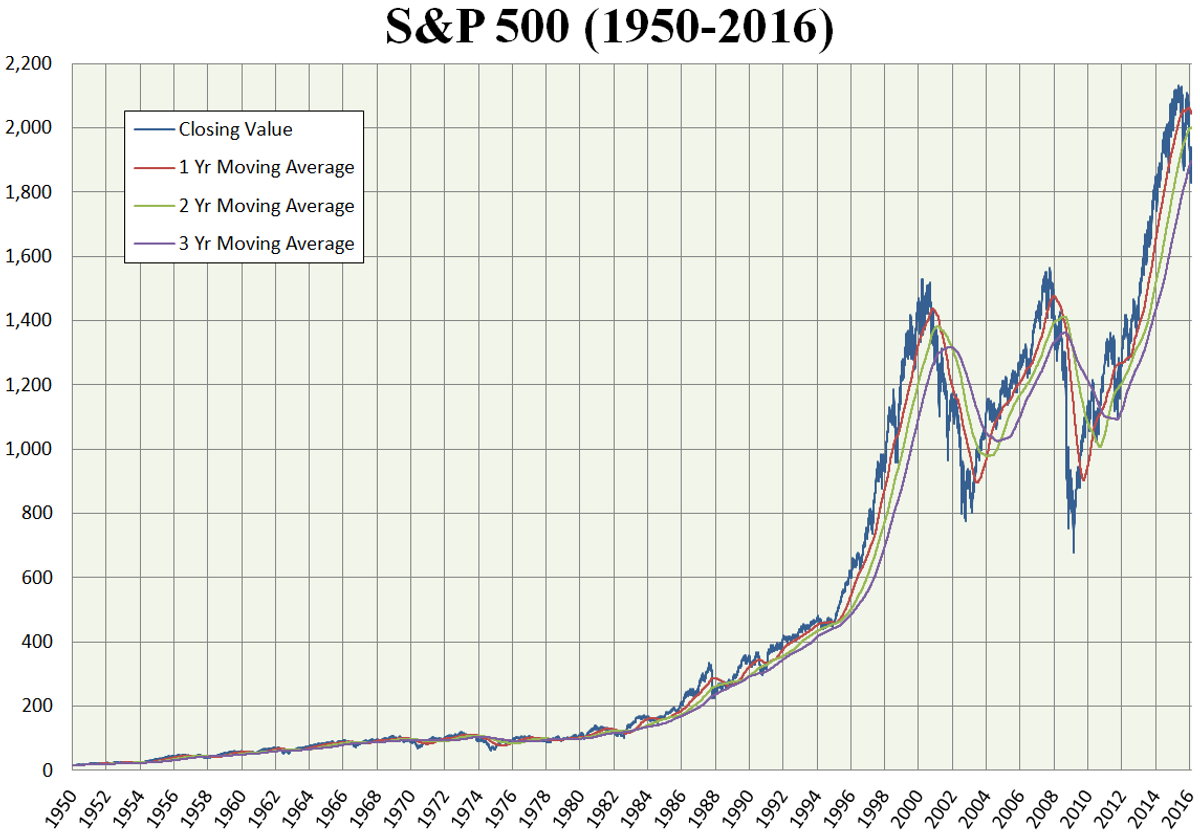

STOCKMARKET HAS GONE UP SPECTACULARLY

|

|

Capital markets are widely seen as a proxy for economic performance. They are monitored minute by minute round the clock and reported on by all the mainstream media. What they measure is not well understood, but that does not seem to matter. Worse, key issues related to social and environmental performance are not reflected well at all!

|

|

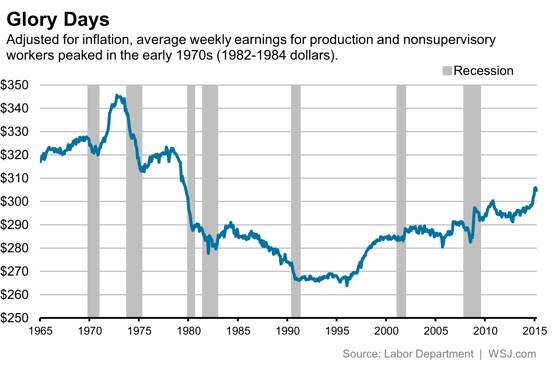

US WAGES MUCH LOWER IN 2015 THAN IN THE 1960s/1970s

|

|

There is a lot of dissatisfaction among workers in the USA, because wages have either flatlined or gon down over the oast 40 years, or two generations. In the 1960s American workers were well paid and worked hard. For the past 40 years workers have been paid substantially less even while companies have increased their profits and owners have increased their wealth.

|

|

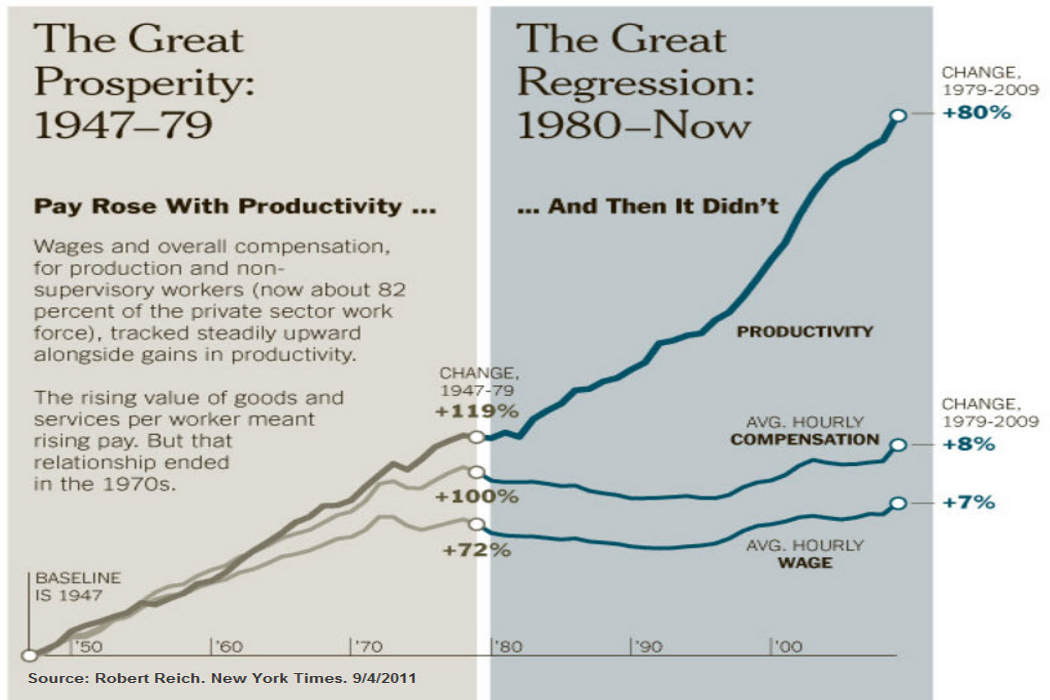

PRODUCTIVITY UP BUT US WAGES FLATLINE

|

|

Economic productivity has been improving since the end of WWII. Until around 1975 the value add from productivity was share reasonably fairly with workers, but from around 1980 to the present time, owners (that is investors) have done very well, but wage earners have flatlined. Over time inequality has increased to record levels.

|

|

|

|

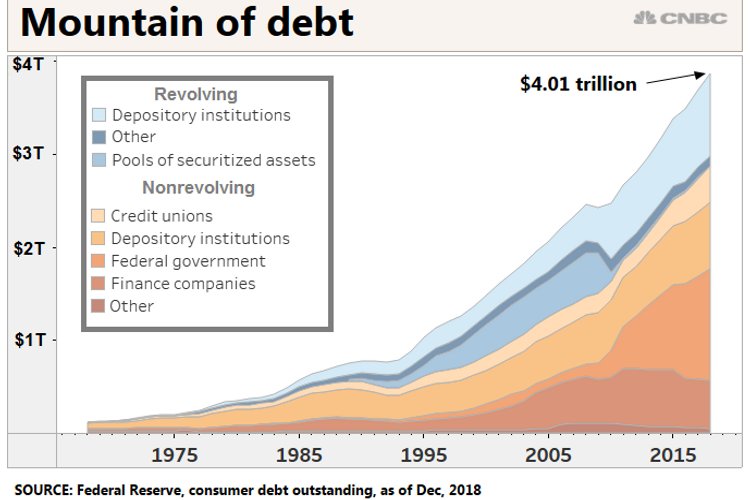

GROWTH OF US HOUSEHOLD DEBT

|

|

This is one of the most obscene trends in finance and rarely discussed. Consumption, which is a key component of the GDP calculation and an important driver of corporate profit has been sustained by ruining the balance sheet of wage earning housholds. The loss of household wealth over the past 50 years is never talked about, but is very important to understand.

|

|

GDP ... NOT ONLY A STUPID METRIC, BUT ALSO DANGEROUS

|

|

GDP was a breakthrough metric when economists introduced it better to understand the Great Depression of the 1930s. Post WWII, both Keynes and Kuznets wanted it to be upgraded, as did Bobby Kennedy in the 1960s. The problem with GDP is that it is largely based on consumption and economic activity with bad things as important as good things.

|

|

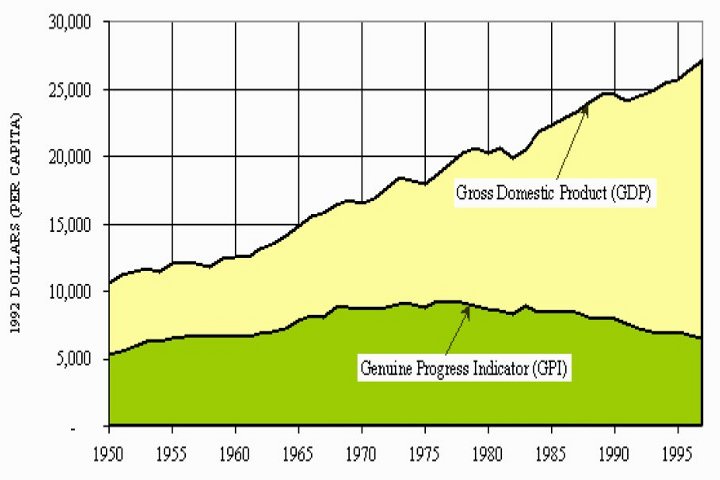

GDP GROWING ... GPI FLAT

|

|

There are many alternatives to GDP as an economic indicator. They all attempt to improve on GDP. The General Progress Indicator (GPI) shows that while GDP progress in the USA has improved over the past 50 years, the GPI has been flat or declining. The GPI seems to reflect the reality of the USA much better than the GDP.

|

|

DECLINE IN THE VALUE OF US MONEY

|

|

Some people say that it is money that makes the world go round. A better way to understand money is that it is more a lubricant than a fuel. There was a time when money was a 'store of wealth', but that time is long past. Now it is something entirely different, and has massively degraded in value over time. It is still an important aid to transaction efficiency, but not much more.

|

|

|

|