OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

US POLITICS

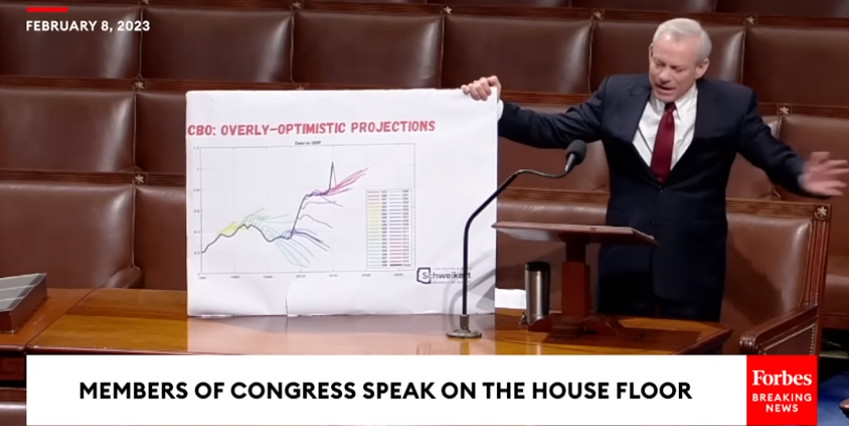

GOP REP SCHWEIKERT OPPINES ON ECONOMICS Forbes Breaking News: 'I Was Just So Angry At The President's Speech Last Night': Schweikert Reacts To State Of The Union Original article: https://www.youtube.com/watch?v=C08x7IrDkOc Peter Burgess COMMENTARY About 25 years ago I was at a conference in Washington DC. At a breakout session attended by several of the staff of the Congressional Budget Office we had a lively discussion about the use of GDP as a critical metric about national economic performance. I learned my economics at Cambridge in the late 1950s. At the time there was a lively debate about the use of GDP in its existing form as a useful measure, and the general conclusion by the top economists of the time that it GDP needed to be revised in order to have utility. This has never happened and there are many reasons for this ... none of them good. At the meeting I referenced, staff from the CBO made the argument that changing a time series was a difficult job, and expensive becuase there would have to be duplicate data collection and calculations for a number of years ... and that precluded change unless there was more money allocated by Congress. But there is another more worrisome issue. GDP is a terrible measure of almost everything associated with the modern economy, and especially the costs of 'bad things' and the costs of 'good things' are both treated in the same way in the GDP computation. This is nonsense ... but it suits investors who tend to see stock market increases when the GDP number goes up, even if the reason for the increase is mainly negative. A far better metric has been developed, but it rarely gets on the news ... it is something called the Genuine Progress Indicator (GPI). Though it is far more rigorous, it has not been widely adopted by the financial community and is rarely featured by the media. It is worth mentioning that one of the great strengths of conventional financial accountancy is the idea of 'double entry' and the idea that almost all transactions have both a debit (cost) and credit (revenue) component and that both of these should be accounted for. Conventional GDP essentially puts any activity ... good or bad ... in the same column which makes no sense, but is super convenient when an economy and a society are in trouble. Peter Burgess | ||

|

'I Was Just So Angry At The President's Speech Last Night': Schweikert Reacts To State Of The Union

Forbes Breaking News Feb 8, 2023 1.47M subscribers ... 278,318 views ... 10K likes On the House floor, Rep. David Schweikert (R-AZ) speaks about government spending and responds to President Biden's State of the Union. Fuel your success with Forbes. Gain unlimited access to premium journalism, including breaking news, groundbreaking in-depth reported stories, daily digests and more. Plus, members get a front-row seat at members-only events with leading thinkers and doers, access to premium video that can help you get ahead, an ad-light experience, early access to select products including NFT drops and more:

| The text being discussed is available at | https://www.youtube.com/watch?v=C08x7IrDkOc and |