OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

RUSSIAN INVASION OF UKRAINE

SANCTIONS Half of Russia’s 20 Richest Billionaires Are Not Sanctioned

Original article: https://www.bloomberg.com/graphics/2022-russian-billionaires-sanctioned-ukraine-war/ Burgess COMMENTARY Peter Burgess | ||

Half of Russia’s 20 Richest Billionaires Are Not Sanctioned

Story by Stephanie Baker and Tom Maloney

Data and graphics by Raeedah Wahid, Mira Rojanasakul, Marion Halftermeyer and Alex McIntyre

March 30, 2022

Half of Russia’s 20 richest people have not been sanctioned over its war in Ukraine, leaving a group of super-rich, powerful billionaires free to operate around the world without legal restriction.

In total, tycoons worth a total of at least $200 billion before the war started have been hit by sanctions. Yet the list of who’s blocked –and who’s not – reveals a patchwork pattern of cross-border penalties that has spared many Russians with business interests in key global markets, a Bloomberg News analysis shows.

The attempt to isolate Russia from international finance and pressure President Vladimir Putin – while minimizing spillover to the global economy – has seen the U.K. sanction 10 of the richest billionaires and the European Union nine. By contrast, the U.S. has sanctioned just four.

SANCTIONED:

EU, UK

SANCTIONED:

EU, UK

SANCTIONED:

EU, UK, US

SANCTIONED:

EU, UK

SANCTIONED:

UK, US

SANCTIONED:

EU, UK, US

#1

VLADIMIR

POTANIN

#2

LEONID MIKHELSON

#3

ALEXEY MORDASHOV

#4

VLADIMIR LISIN

#5

VAGIT ALEKPEROV

#6

ALISHER USMANOV

#7

ANDREY MELNICHENKO

#8

VIKTOR VEKSELBERG

#9

GENNADY TIMCHENKO

#10

ROMAN ABRAMOVICH

SANCTIONED:

EU, UK, US

SANCTIONED:

EU, UK

SANCTIONED:

EU, UK

SANCTIONED:

EU, UK

#12

MIKHAIL PROKHOROV

#13

VICTOR RASHNIKOV

#14

MIKHAIL FRIDMAN

#15

DMITRY RYBOLOVLEV

#16

VYACHESLAV KANTOR

#17

GERMAN KHAN

#18

LEONID

FEDUN

#19

ALEXANDER ABRAMOV

#20

ANDREY GURYEV

#11

SULEIMAN KERIMOV

Only three men feature on all three lists, with four of Russia’s five richest men not sanctioned anywhere. They are led by the country’s richest man, Vladimir Potanin, a metals magnate who was worth $30 billion on Feb. 18, the final day of data before sanctions began rolling out three days later. The richest sanctioned Russian on the list is Alexey Mordashov, the controlling shareholder in Severstal PJSC, Russia’s fourth-largest steelmaker, who had his assets frozen by the EU on Feb. 28 and by the U.K. two weeks later.

Energy executive Leonid Mikhelson, steel tycoon Vladimir Lisin and Vagit Alekperov, chairman of oil giant Lukoil PJSC, are among the other richest Russians who have not been sanctioned. All own significant holdings of publicly traded companies operating in Russia’s highly politicized business environment.

Tracking who’s sanctioned where remains difficult because Washington, Brussels and London issue penalties in a series of unlinked notices. Australia, Canada and Japan have imposed their own restrictions.

Related story: Tracking the Sanctions Imposed on Russia Over Ukraine Invasion

Sanctions experts say that decisions not to censure some of Russia’s richest men is at least partly linked to their critical stakes in vast energy, metals and fertilizer companies.

“There are reasons to go after some oligarchs and there are reasons to hold some in abeyance,” says John Smith, who headed the U.S. Treasury’s sanctions unit, the Office of Foreign Asset Control (OFAC), until May 2018, and is now a partner at law firm Morrison & Foerster in Washington, D.C. “It can either be because they’re not believed to be close to the Kremlin decision-making or that they may be too difficult to sanction at the outset, and governments want to develop a plan before they pull the trigger.”

The U.S. has learned from the experience of 2018, when it sanctioned billionaire Oleg Deripaska, who controlled United Co. Rusal International PJSC, the world’s largest aluminum company outside China. That caused global prices to soar, only stabilizing after Deripaska agreed to relinquish control of Rusal in 2019.

How Have Sanctions Impacted Russian Billionaires?

Some Russians were targeted because of their clear links to state-owned companies, regardless of their net worth: Igor Shuvalov, a former first deputy prime minister, is now chair of state-owned bank VEB, while Sergey Ivanov is CEO of state-controlled diamond company Alrosa PJSC and a board member at Gazprombank.

The unprecedented sanctions are rippling across continents, with wealthy Russians moving assets and unwinding holdings as authorities in Italy, France, Spain and elsewhere have moved to seize yachts and ground private jets.

Roman Abramovich, the biggest shareholder in Russia’s second-largest steel producer Evraz Plc, is selling Chelsea Football Club after being sanctioned by the U.K. and E.U.

Alisher Usmanov, who owns 49% of USM, which controls steel and iron ore producer Metalloinvest, was sanctioned by the U.S., U.K. and the EU. He had already transferred most of his real estate and other property into irrevocable trusts of which he is no longer a beneficiary, a spokesperson said. That move has complicated government efforts to block his property, including his 156-meter-long yacht Dilbar, now languishing in Hamburg, Germany. Concerns about possible market fallout quickly became clear, even though Usmanov is believed to own just under 50%, the threshold at which sanctions kick in on his companies. After the U.S. sanctioned Usmanov on March 3, blocking his personal assets, the U.S. Treasury turned around the same day and issued licenses allowing any companies majority owned by him, directly or indirectly, to continue operating.

The Richest Sanctioned Russians 👆

10 billionaires own or have been linked to a host of yachts, planes, helicopters and homes

💼 Corporate ⌂ Real Estate ⚓ Yacht 🛪 Plane ● Sports team ■ Art

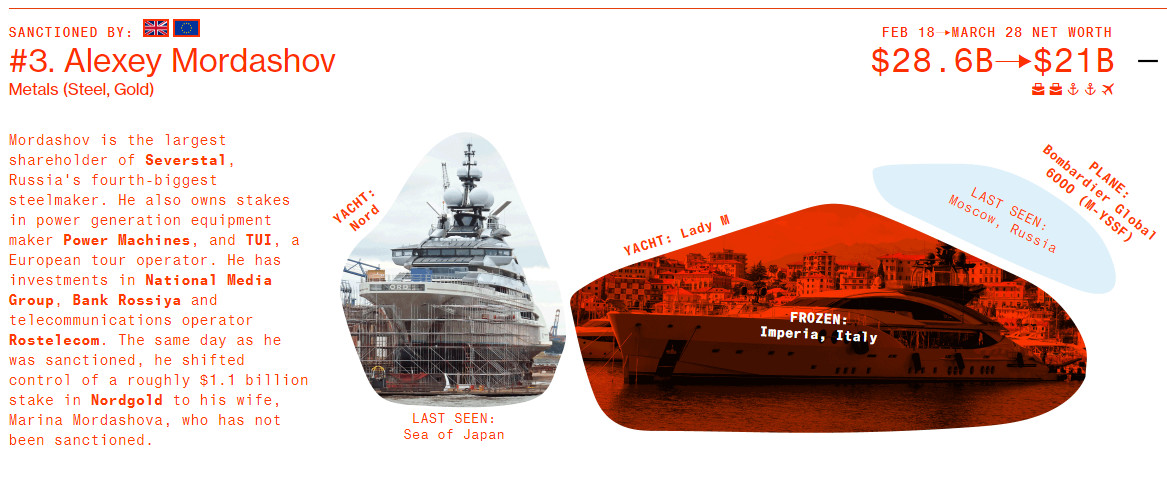

SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #3. Alexey Mordashov $28.6B⭢$21B Metals (Steel, Gold) 💼💼⚓⚓🛪 PLANE: Bombardier Global 6000 (M-YSSF) Mordashov is the largest shareholder of Severstal, Russia's fourth-biggest steelmaker. He also owns stakes in power generation equipment maker Power Machines, and TUI, a European tour operator. He has investments in National Media Group, Bank Rossiya and telecommunications operator Rostelecom. The same day as he was sanctioned, he shifted control of a roughly $1.1 billion stake in Nordgold to his wife, Marina Mordashova, who has not been sanctioned. LAST SEEN: Moscow, Russia YACHT: Nord YACHT: Lady M FROZEN: Imperia, Italy LAST SEEN: Sea of Japan

SANCTIONED BY: us flag uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #6. Alisher Usmanov $21.6B⭢$18.9B Metals (Iron), Telecom 💼💼⌂⌂⌂⚓🛪🛪🛪 REAL ESTATE: Sutton Place, Surrey, UK Usmanov owns 49% of USM, a Russia-based investment group that controls Metalloinvest, Russia's largest iron ore producer, and MegaFon, a telecommunications company. He also has stakes in AliExpress Russia Holding and Akkermann Cement, and controls Kommersant, a Russian newspaper. HELICOPTER: Airbus H155 (M-DLBA) REAL ESTATE: Beechwood DEREGISTERED: Isle of Man House, London, UK HELICOPTER: Airbus H175 (M-DLBA) YACHT: Dilbar FROZEN: Hamburg, Germany DEREGISTERED: Isle of Man PLANE: Airbus A340 (M-IABU) FROZEN: Italy REAL ESTATE Golfo del Pevero, Sardinia, Italy DEREGISTERED: Isle of Man SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #7. Andrey Melnichenko $18.9B⭢$18.3B Agriculture 💼💼⌂⌂⌂⚓⚓ SANCTIONED BY: us flag uk flag FEB 18⭢MARCH 28 NET WORTH #8. Viktor Vekselberg $18.3B⭢$16.7B Metals (Aluminum), Equipment 💼💼⚓🛪 SANCTIONED BY: us flag uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #9. Gennady Timchenko $18.1B⭢$13.8B Energy (Natural Gas) 💼💼⚓ SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #10. Roman Abramovich $16.4B⭢$13.7B Metals (Steel, Nickel) 💼⌂⌂⌂⌂⚓⚓🛪🛪🛪🛪🛪🛪🛪● SANCTIONED BY: us flag uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #11. Suleiman Kerimov $15.1B⭢$12.7B Metals (Gold) 💼⌂⚓ SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #13. Victor Rashnikov $13.5B⭢$10.1B Steel 💼⚓⌂ SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #14. Mikhail Fridman $13.2B⭢$10.4B Diversified 💼💼⌂ SANCTIONED BY: uk flag eu flag FEB 18⭢MARCH 28 NET WORTH #17. German Khan $9.0B⭢$7.1B Diversified 💼💼⌂ Note: Feb. 18 was the last trading day before Russia’s invasion began Sources: Bloomberg Billionaires Index, Bloomberg reporting, Organized Crime and Corruption Reporting Project, media reports Action has not been unanimous. Any major business operating in Russia does so only with Putin’s blessing; the billionaires must stay on the right side of the government. Still, proximity to Putin isn’t easy to measure and wealth by itself doesn’t always translate into influence over the Kremlin, as some sanctioned billionaires have argued. Related story: Broke Oligarch Says Sanctioning Billionaires Won’t Sway Putin Sanctioning Mordashov, the EU cited his “links with Russian decision-makers” and his stakes in National Media Group, controlling television channels, and in Bank Rossiya, which opened several branches across Crimea after it was annexed in 2014. “I have never been close to politics,” Mordashov said in a statement. “I fail to understand how these sanctions against me will contribute to the settlement of the dreadful conflict in Ukraine.” Severstal was the first Russian company to miss a coupon payment on foreign-currency debt after Citigroup Inc. declined to process a payment after EU and U.K. sanctions on Mordashov. In a sign of how complex global systems mean sanctions in one jurisdiction can impact another, U.S. investors can’t get paid even though the U.S. hasn’t sanctioned Mordashov. “Companies are evaluating the risks not only legally, but reputationally,” Smith says. “They don’t want shareholders questioning why they’re dealing with Russia.” Will Sanctions on Russians Work? One month after the invasion, Russia is now the most sanctioned country in the world. Freezing central bank reserves and kicking some banks out of the international payments system has battered the ruble and caused the country to teeter on the verge of a default. However, Bloomberg’s analysis of thousands of sanctions records shows there are striking differences between the penalties imposed by the U.S., U.K. and EU. Overall, the U.S. has frozen the assets of 852 people, the European Union 775 and the U.K. 982. But many of those sanctions do not overlap. While almost 550 people have been sanctioned by both the U.K. and EU, common ground with the U.S. is more elusive. 452 in common U.K. U.S. 294 in common 547 in common 417 in common EU Even experts are having a hard time untangling the threads, saying the divergences could undermine the effectiveness of sanctions. “I definitely don’t see a single pattern anywhere,” says George Voloshin, a sanctions expert who tracks Russia as director of Paris-based Aperio Intelligence. “I still don’t think policymakers are on the same page in terms of strategy, although they claim to have some coordination.” Why Some Billionaires Haven’t Been Sanctioned Many leading unsanctioned billionaires are active in vital global commodity sectors and own significant stakes in major companies that supply Western nations. “A primary objective of sanctions has to be that we hurt the sanctions target more than we hurt ourselves,” Smith says. “When you talk about gas, Europe still needs Russia. The U.S. and its allies will be looking very carefully to see what products from Russia may be nearly essential to us and third country companies and seek to avoid those impacts.” Potanin, who made his fortune in the 1990s, is one of Russia’s original oligarchs and remains unsanctioned. He is one of several tycoons who’s played hockey with Putin and helped the Kremlin stage the Sochi Olympics in 2014. In the wake of the invasion he lost coveted positions at U.S. cultural institutions, and surprised many by criticizing Kremlin plans to seize assets of foreign companies pulling out of Russia. Potanin owns 36% of MMC Norilsk Nickel PJSC, making him the largest shareholder in a company that accounts for about 10% of refined nickel and 40% of global palladium output – crucial for the manufacture of semiconductors, already in short supply before the war. The Richest Unsanctioned Russians 👆 Key assets owned by or linked to billionaires who mostly operate in key global markets 💼 Corporate ⌂ Real Estate ⚓ Yacht 🛪 Plane ● Sports team ■ Art

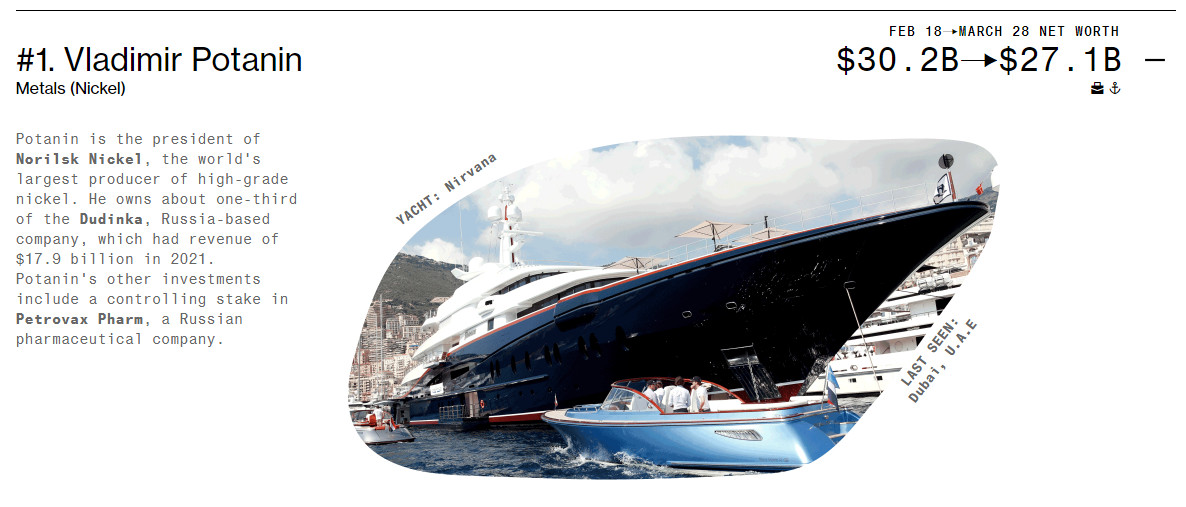

FEB 18⭢MARCH 28 NET WORTH #1. Vladimir Potanin $30.2B⭢$27.1B Metals (Nickel) 💼⚓ Potanin is the president of Norilsk Nickel, the world's largest producer of high-grade nickel. He owns about one-third of the Dudinka, Russia-based company, which had revenue of $17.9 billion in 2021. Potanin's other investments include a controlling stake in Petrovax Pharm, a Russian pharmaceutical company. YACHT: Nirvana LAST SEEN: Dubai, U.A.E FEB 18⭢MARCH 28 NET WORTH #2. Leonid Mikhelson $29.2B⭢$24.7B Oil & Gas 💼💼⚓ FEB 18⭢MARCH 28 NET WORTH #4. Vladimir Lisin $28.0B⭢$21B Metals (Steel) 💼⌂ FEB 18⭢MARCH 28 NET WORTH #5. Vagit Alekperov $22.5B⭢$5.3B Oil & Gas 💼⚓● FEB 18⭢MARCH 28 NET WORTH #12. Mikhail Prokhorov $13.8B⭢$13.8B Diversified ⚓ FEB 18⭢MARCH 28 NET WORTH #15. Dmitry Rybolovlev $10.8B⭢$10.7B Diversified ⌂⌂⚓🛪● FEB 18⭢MARCH 28 NET WORTH #16. Vyacheslav Kantor $10.6B⭢$10.7B Agriculture 💼■■ FEB 18⭢MARCH 28 NET WORTH #18. Leonid Fedun $8.5B⭢$1.7B Oil & Gas 💼⌂⌂● FEB 18⭢MARCH 28 NET WORTH #19. Alexander Abramov $8.3B⭢$7.1B Metals (Steel, Nickel), Telecom, Timber 💼⌂⚓ FEB 18⭢MARCH 28 NET WORTH #20. Andrey Guryev $7.9B⭢$8.7B Agriculture 💼⌂⚓ Note: Feb. 18 was the last trading day before Russia’s invasion began Sources: Bloomberg Billionaires Index, Bloomberg reporting, Organized Crime and Corruption Reporting Project, media reports Mikhelson, the second-richest Russian, is also unsanctioned, though he has extensive business ties to Gennady Timchenko, a billionaire so close to Putin that he was among the first to be sanctioned by the U.S. back in 2014. Related story: Who Are Russia’s Oligarchs and Can They Influence Putin? Mikhelson owns about a quarter of Novatek PJSC, the largest non state-owned gas producer in Russia and a major supplier to Europe, while Timchenko owns 23.5%. He and Timchenko’s combined stakes are close to the 50% threshold that the U.S. uses to trigger formal sanctions on companies. In practice, fear of running foul of sanctions has led some companies to go beyond official rules and steer clear of doing business with entities tied to sanctioned people. Banks and corporations “will be very wary of conducting transactions with any entity that has significant ownership by a sanctioned individual,” Voloshin says. Several steel tycoons have escaped sanctions even as the EU imposed a ban on imports of certain Russian steel products, a move that’s expected to cost Russia 3.3 billion euros ($3.6 billion) in lost export revenue. Lisin, chairman of Novolipetsk Steel PJSC, the country’s largest, was worth $28 billion before the invasion and remains unsanctioned. He came out against the war on March 8, saying it was a “tragedy that was hard to justify.” Abramovich, the Chelsea owner, has escaped U.S. sanctions after President Voldymyr Zelenskiy asked Washington to spare him because he was helping with peace talks, according to a person familiar with the situation. Alexander Abramov, Abramovich’s long-time business partner who owns 19.3% of Evraz, is not sanctioned anywhere. Their combined stakes are close to the 50% threshold. Evraz has extensive operations in North America and has worked with lobbyists in Washington. Soaring prices for fertilizer supplies may have dissuaded the West from sanctioning some other key billionaires. Among the most prominent is Andrey G. Guryev, the largest shareholder of PhosAgro PJSC, Europe’s biggest manufacturer of phosphate fertilizers. He’s the beneficiary of a company that reportedly owns Witanhurst House in London, worth about $350 million, the second-largest private residence in London after Buckingham Palace. He has not been sanctioned but the EU and U.K. sanctioned his son, Andrey A. Guryev, forcing him to step down as PhosAgro’s CEO. “I really don’t know why they sanctioned him because he’s just an executive of the company,” Voloshin says. “It doesn’t have any impact on the company itself.” One Kremlin connection stems from PhosAgro’s former chairman Vladimir Litvinenko, the head of St. Petersburg’s mining institute, who oversaw Putin’s PhD in 1996 and now holds 21% of PhosAgro, worth $1.8 billion before the invasion. Will There Be More Sanctions? The invasion of Ukraine changed U.S., U.K. and EU sanctions policy. Historically Brussels has followed Washington’s lead and struggled for consensus among its 27 members. This time around it was far more aggressive. The U.K. then rushed through a legislative change to enable mass updates to its sanctions lists. Only the addition of 347 names on March 24 brought the U.S. close to parity.

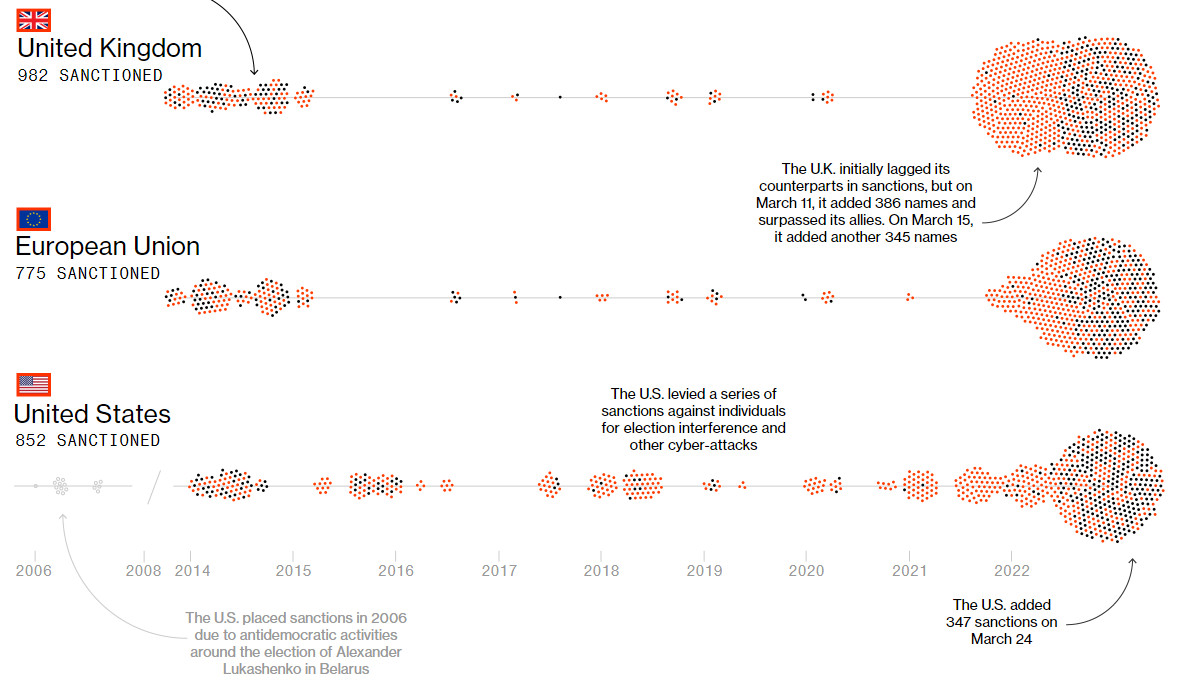

Invasion of Ukraine Supercharged Sanction Programs Sanctioned individual Sanction shared by western allies Many individuals recently sanctioned were already under lesser sanctions imposed in 2014 over Russia’s annexation of Crimea United Kingdom 982 SANCTIONED The U.K. initially lagged its counterparts in sanctions, but on March 11, it added 386 names and surpassed its allies. On March 15, it added another 345 names European Union 775 SANCTIONED The U.S. levied a series of sanctions against individuals for election interference and other cyber-attacks United States 852 SANCTIONED 2006 2008 2014 2016 2017 2018 2019 2020 2021 2022 2015 The U.S. added 347 sanctions on March 24 The U.S. placed sanctions in 2006 due to antidemocratic activities around the election of Alexander Lukashenko in Belarus Sources: U.S. Department of Treasury, Official Journal of the European Union, and HM Treasury “The EU has war on its doorstep,” Smith says. Concerns over the risks from close ties with Russia mean EU nations have moved on sanctions “faster than anyone would have expected.” As a result, a string of prominent billionaires have been sanctioned by the EU and the U.K. but not by the U.S. They include Andrey Melnichenko, founder of EuroChem, a producer of mineral fertilizer and agricultural products based in Zug, Switzerland. “He has no relation to the tragic events in Ukraine,” a spokesperson for Melnichenko says. “There is no justification whatsoever for placing him on any sanctions lists.” Victor Rashnikov, the controlling shareholder of Magnitogorsk Iron & Steel Works PJSC, was sanctioned by the EU and the U.K. but not the U.S. Likewise for the Alfa Group billionaires – Fridman, Petr Aven, German Khan and Alexei Kuzmichev. None of them is involved in Russian exports considered critical to global markets. Beyond the billionaires, there are other lesser-known but politically connected figures who haven’t been affected at all. “We’re not at the end of it,” Voloshin says. “When you look at further potential targets, I wouldn’t look at who’s close to the Kremlin but rather the impact the sanctions will have on the global market.” Editors: Adam Blenford, Alex Tribou Photo editor: Eugene Reznik With assistance from: Daniel Flatley, Brittany Harris, Ben Stupples, Devon Pendleton and Nick Wadhams Photo credits: Top 20 Richest: Mikhelson, Mordashov, Lisin, Usmanov, Melnichenko, Prokhorov, Rashnikov, Khan: Andrey Rudakov/Bloomberg; Alekperov, Kerimov, Fedun: Simon Dawson/Bloomberg; Fridman, Abramov, Guryev: Mikhail Svetlov/Getty Images; Potanin: Chris J. Ratcliffe/Bloomberg; Vekselberg: Sefa Karacan/Anadolu Agency via Getty Images; Timchenko: Sergei Karpukhin/AFP via Getty Images; Abramovich: Peter Macdiarmid/Getty Images; Rybolovlev: Valery Hache/AFP via Getty Images; Kantor: Mikhail Fomichev/AP/RIA-Novosti; Assets of sanctioned: Yacht Nord: Wolfgang Fricke/Wikimedia Commons; Yacht Lady M: Giuliano Berti/Bloomberg; Yacht Dilbar: Clive Brunskill/Getty Images; Yacht A: Leon Neal/Getty Images; Yacht SY A: Dan Istitene/Getty Images; Airbus A319 (P4-MIS): Anna Zvereva/Flickr; Yacht Lena: Giuliano Berti/Bloomberg; Yacht Eclipse: Valery Hache/AFP via Getty Images; Yacht Solaris: Savo Prelevic/AFP via Getty Images; Yacht Amadea: Osman Uras/Anadolu Agency via Getty Images; Yacht Ocean Victory: Ali Balli/Anadolu Agency via Getty Images; Real estate: Google Earth (12) Assets of unsanctioned: Yacht Nirvana: Valery Hache/AFP via Getty Images; Yacht Pacific: Anadolu Agency/Anadolu via Getty Images; Yacht The Palladium: Moshi Anahory/Flickr; Airbus 319-133: James Lloyds/Flickr; Yacht Anna: Pablo Tomasello/AFP via Getty Images; Yacht Titan: An-d/Wikimedia Commons; Real estate: Google Earth (7) Methodology Bloomberg News compiled and analyzed financial sanctions data from the U.S. Department of Treasury, Official Journal of the European Union and HM Treasury through March 24, 2022. Data was filtered for sanctions related to Russia’s invasion of Ukraine. Financial sanctions imposed against individuals tied to Russia since 2014 were included in the dataset, with the exception of Belarus (imposed by the U.S. since 2006). Spellings of names were standardized to American spelling in order to merge the U.K., EU and U.S. datasets for common sanctioned individuals. Sanctions may have been extended or updated with additional information pertaining to an individual (i.e. alternate names, additional nationalities, passport numbers, etc.), but only the initial sanction listing dates were used in the dataset to avoid duplicates. The U.K., EU and U.S. datasets do not share a unique identifier; therefore, data was merged on last name and date of birth wherever possible, and again on last name and first name. Data was manually reviewed for any duplicates. Bloomberg analyzed the 20 richest Russians according to their ranking on the Bloomberg Billionaires Index on Feb. 18, 2022, the last business day before the first new sanctions relating to Russia’s actions in Ukraine were implemented.

| The text being discussed is available at | https://www.bloomberg.com/graphics/2022-russian-billionaires-sanctioned-ukraine-war/ and |