OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Economics | ||

|

Burgess COMMENTARY Peter Burgess | ||

Craving Healthcare: A Beginner's Guide And My 7 Picks

Summary

The Healthcare sector has significantly outperformed the S&P 500 in the last decade and with lower volatility – the only sector to do so. This outperformance should continue, considering multiple tailwinds.

Among the Healthcare subsectors, Medical Devices has led the charge with its continued ability to compound revenue and earnings.

Health insurers is also a safe space, though upcoming elections may provide a better entry point.

The Healthcare tech is also moving fast, and identifying potential winners in the space can generate significant alpha for your portfolio.

Why Healthcare?

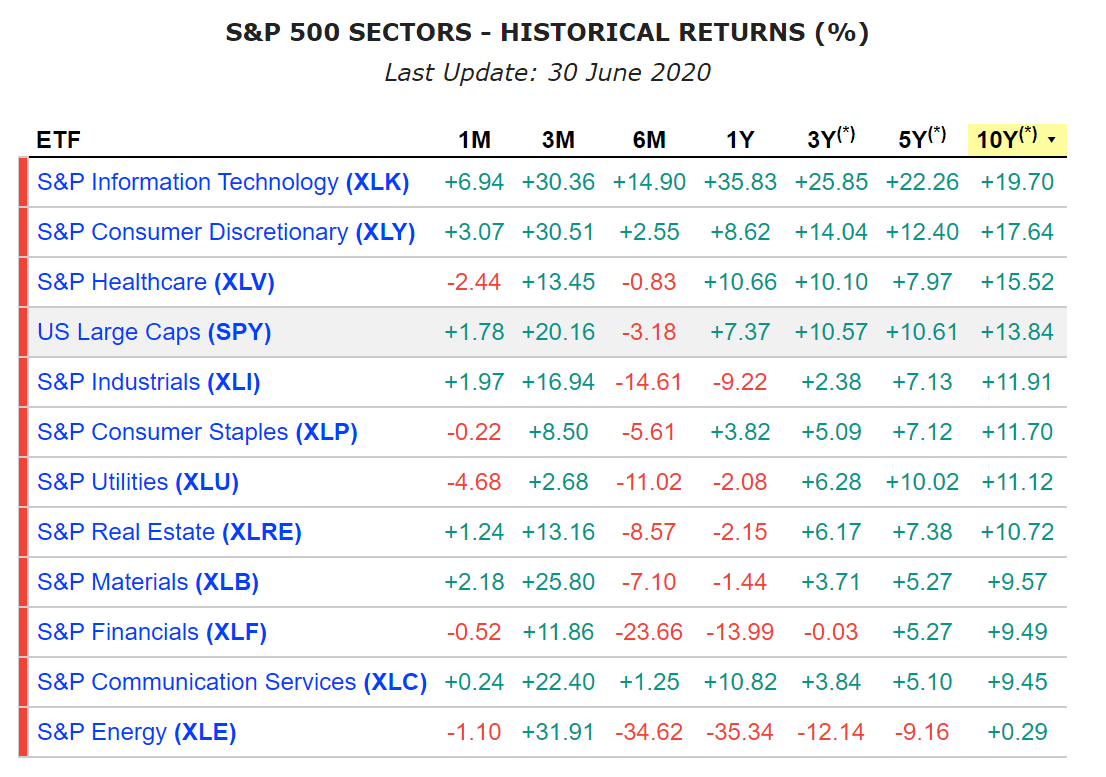

Healthcare has been one of the top-performing sectors of the S&P 500 over the last decade. The table below (last updated June 2020) neatly summarizes the performance of all the key sectors over different periods. Healthcare (XLV) has outperformed the S&P500 (SPY) by ~1.5% annually, and comes right after Technology (XLK) - remember, technology is eating the world - and Consumer Discretionary (XLY) - almost 24% of which is Amazon (NASDAQ:AMZN).

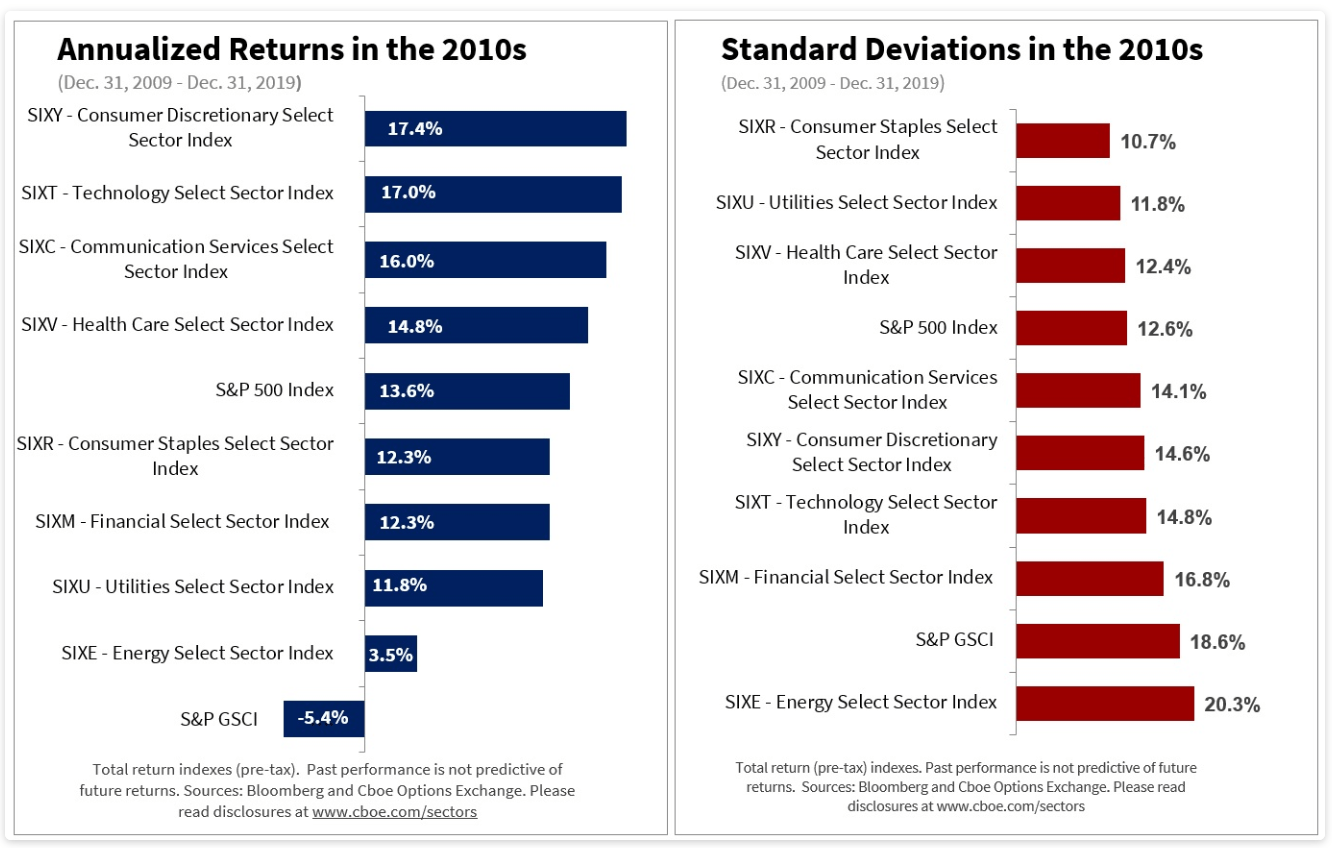

Source So, 10 years ago, if you had invested $10,000 in XLV, it would have grown to $42,300, while the same in SPY would have resulted in $36,500. Almost $6,000 more, and this outperformance hasn't come by accident. Here are the three key reasons why Healthcare has remained one of the top performers, and why it may continue to do so: 1. Consistency: Healthcare sector is known for its ability to perform both during thick and thin. Healthcare is the only sector (see the chart below) that has outperformed the S&P 500 (Annualized returns in the 2010s of 16% vs 14.8%) with lower volatility (standard deviation of 12.4% vs 12.6%). Please note this chart uses slightly different timeframes and indexes than above but conveys the same message.

Source 2. Demographic Demand: We all have heard about how the aging in the developed world is leading to the continuous demand for healthcare. This would serve as a tailwind for the companies in the space. 3. Valuation: After knowing the continued outperformance and lower volatility, you would be thinking that the healthcare stocks must be expensive. And to my surprise, it's not. The excellent chart below from Yardeni research shows that Healthcare forward PE is only 16.7 compared to 22.3 for S&P 500. I believe this may change if healthcare companies continue to outperform, and multiples expansion can further support the stock prices along with earnings growth.

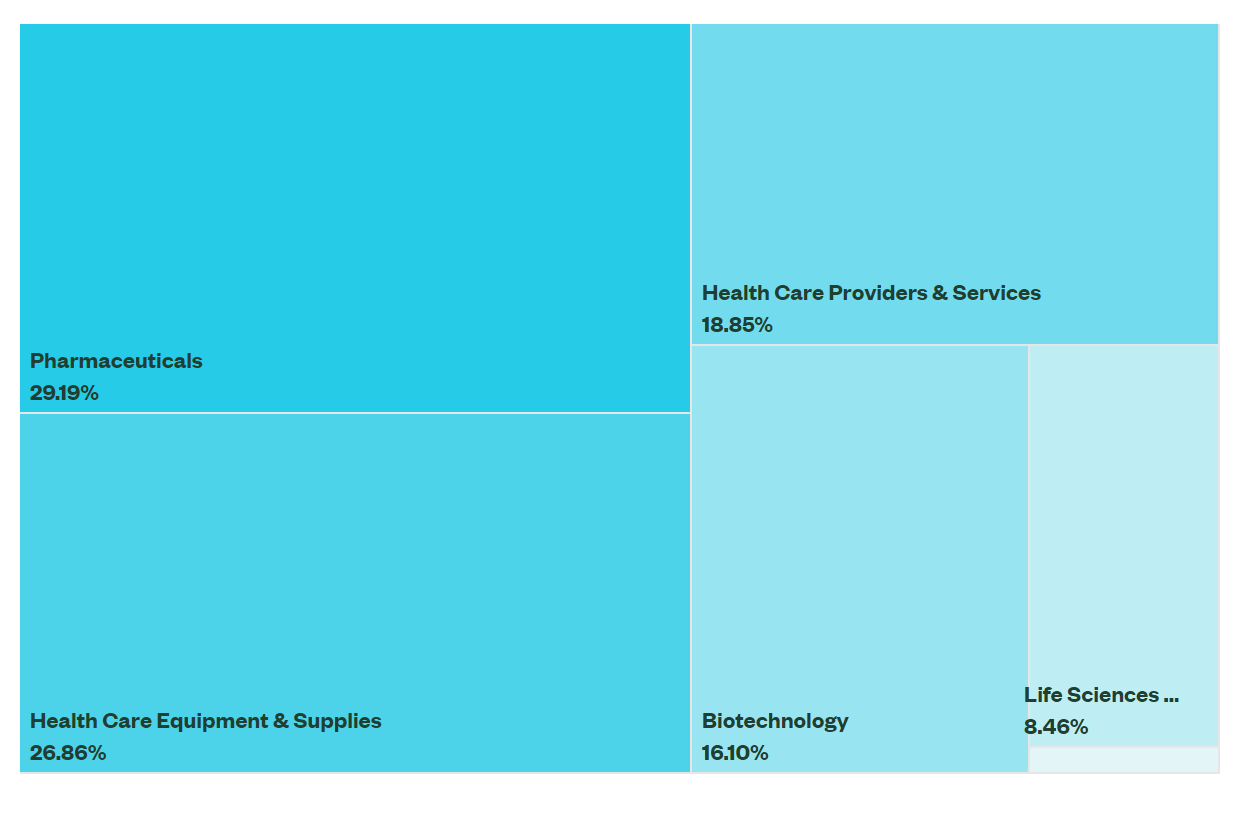

Source So, by now, I am hoping that you are convinced that Healthcare is a must-own sector and are ready to place your order for XLV. Hold on. Let's look under the hood and explore what is leading to this outperformance. Background So, before I get into the details, let me share my investment beliefs: Conviction: I don't invest in anything unless I am convinced about the story. This lets me stick with a stock whether it's sunshine or rain, and it has served me well in the past. Growth: I believe a lot of people misunderstand growth. It's as simple as the power of compounding. Considering my focus on total returns, I always value companies that show their ability to grow revenues profitably. Flexibility: I don't think as a retail investor, we need to marry ourselves to a single investing style (e.g., high dividend, dividend growth). Even if you prefer dividend growth, it shouldn't stop you from picking Google (NASDAQ:GOOGL) (GOOGL) or Facebook (FB), if you believe in their story. My own portfolio is spread across ~40-45 securities, and I divide them into 3 buckets: Consistent Compounders: proven business models, above-average growth rate (Medium Risk, Medium-High Return) - Think of GOOGL, UnitedHealth Group (UNH), Honeywell (HON) High Flyers: growing at a rapid pace, may have little to no profits (Medium-High Risk, High Return) - Think of AMZN, Netflix (NFLX), Peloton (PTON) Special Situations: depressed valuations due to short-to-mid-term challenges such as loss of confidence in management, significant debt, or industry overhangs (Medium-High Risk, Medium-High Return) - Teva (NYSE:TEVA), Simon Property Group (SPG), AT&T (NYSE:T). You can read more about my journey, investment beliefs, and allocations to these buckets here. Now, it would become easier for me to take a deeper dive into the Healthcare sector and help you in developing a strategy that can outperform broad indices. What makes up Healthcare? Here is how State Street breakdown the Healthcare sector. If you consider Pharmaceuticals, Biotechnology and Life Sciences to be cut from the same cloth, we are looking at three broad sub-sectors/industries:

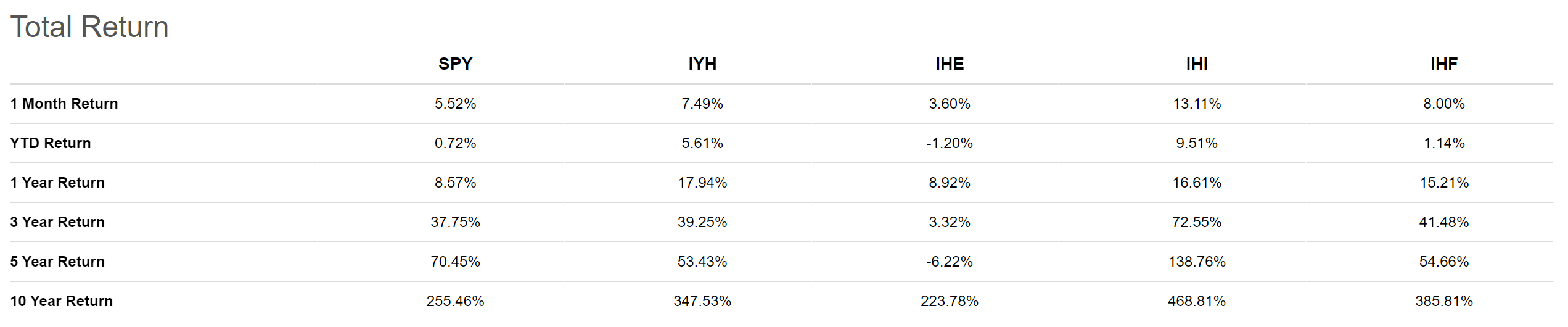

Source Pharmaceuticals, Biotechnology & Life Sciences ~54% (e.g., Pfizer (PFE), Merck & Co (MRK)) Health Care Equipment / Medical Devices ~27% (e.g., Abbott (ABT), Thermo Fisher (TMO)) Health Care Services ~19% (e.g., UnitedHealth Group (UNH), CVS Health (CVS)) Let's look at how these sub-sectors have performed compared to Healthcare as a whole and SPY. Here is an overview of the tickers shown below - S&P 500 (SPY); iShares U.S. Healthcare ETF (IYH); iShares U.S. Pharmaceuticals ETF (IHE); iShares U.S. Healthcare Providers ETF (IHF). I am using the iShares tickers for the comparison and further analysis, as these are slightly more mature with higher AUMs compare to corresponding SPDR ETFs.

Source: Seeking Alpha I want to specifically draw your attention to iShares U.S. Medical Devices ETF (NYSEARCA:IHI). You would notice that IHI has significantly outperformed not only the S&P 500 but also the broader Healthcare ETF (NYSEARCA:IYH) as well as the Pharmaceuticals (IHE) and Services (IHF) ETF. This outperformance is consistent over all the periods, including 10 years, 5 years, 3 years, and 1 year (slightly below the IYH for the 1 year). Again, I don't think this outperformance is by luck. But before we drill down further, let's look into what these ETFs/ sub-sectors consist of:

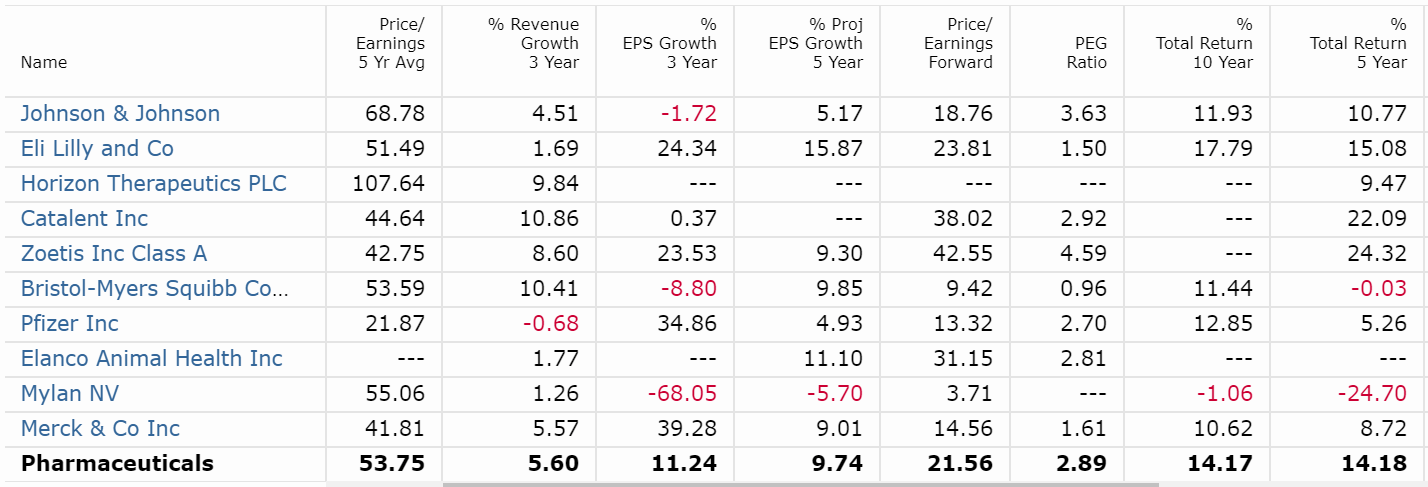

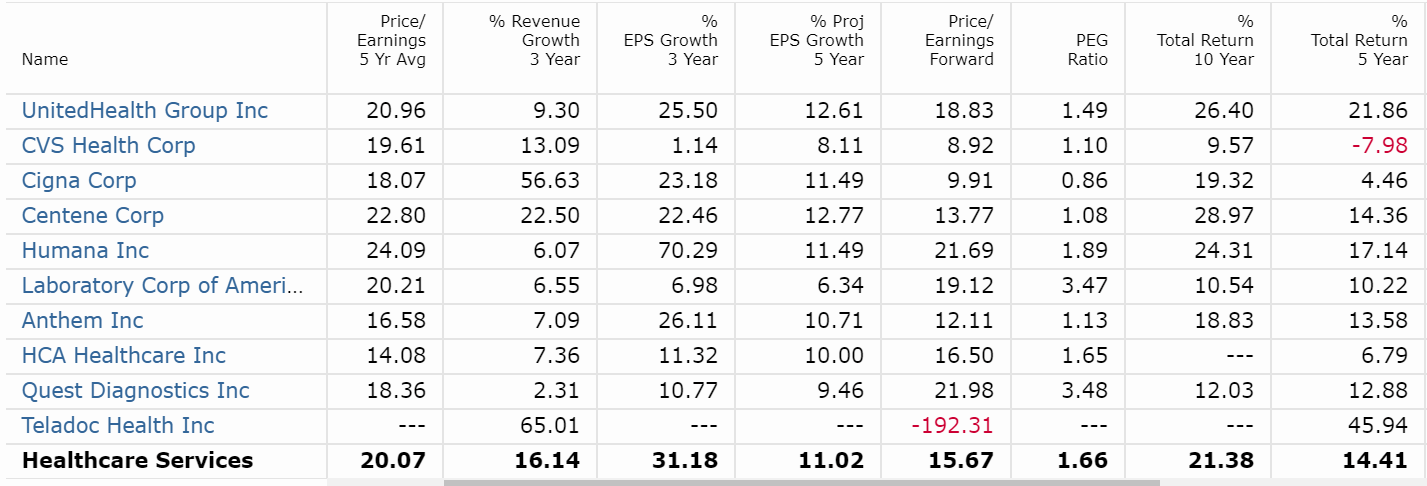

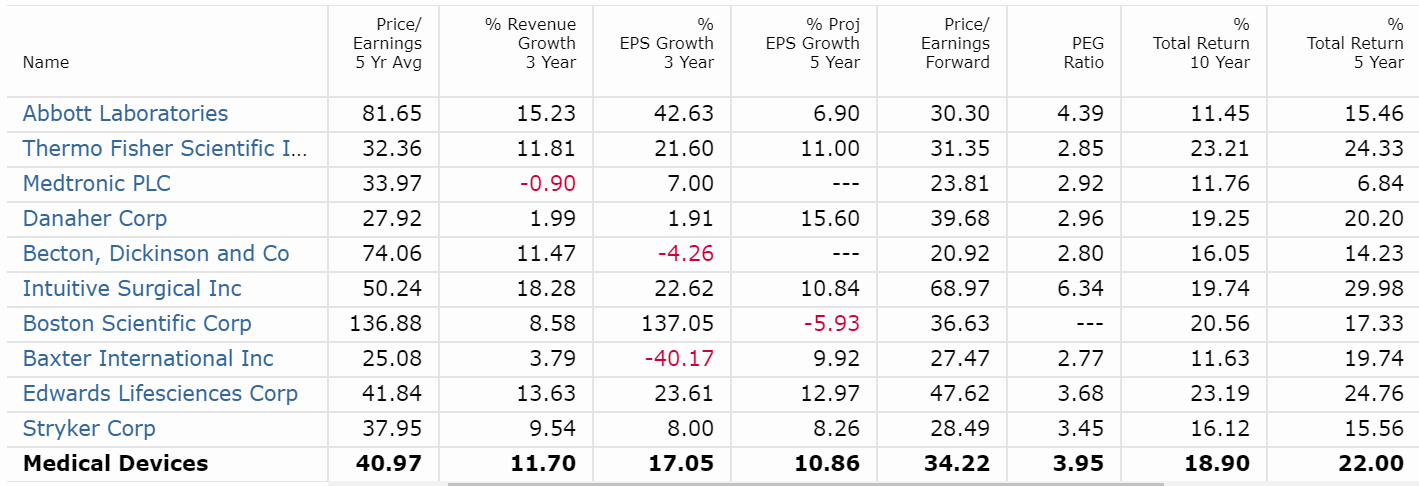

Source: Blackrock.com (IHE, IHI, and IHF, respectively) You would notice that all the three ETFs are fairly concentrated in their top 10 holdings, commanding over 70% of the portfolio, as per June 30, 2020. So, if we understand the fundamentals of these holdings, we should get some perspective on the past as well as the future potential of these subsectors. Here is a snapshot of some key metrics of the top 10 stocks in each of these subsectors: Pharmaceuticals

Source: Morningstar The first thing to notice is the variations in returns between individual stocks (from -25% to +24% for the 5-year period). Further, 4 out of the top 10 stocks in the sub-sector don't even have 10-year returns, meaning they were IPOed during this period. And this has always been my concern with pharmaceuticals. This sector has always been dependent on that star drug that carries the brand forward. So, you can only make good returns if you understand the sector dynamics well and can pick a stock that can be a long-term winner. Considering my limited understanding of the space, the only stock I own is Teva (NYSE:TEVA). TEVA (part of Special Situations bucket): It is a turnaround story, and a bet on Kare Schultz, a pharmaceutical veteran, plus I consider generic manufacturers to be a bit more diversified compare to brand name pharmaceuticals. Healthcare Services

Source: Morningstar This subsector covers a wide variety of organizations including insurance providers (e.g., UNH), drug retailers (e.g., CVS), hospitals (e.g., HCA Healthcare (NYSE:HCA)), diagnostic providers (e.g., Quest Diagnostics (DGX)), and Healthcare technology companies (e.g., Teladoc Health (NYSE:TDOC)). I can go on and on as the landscape is more complex than what I just described here. But the point is that even though this subsector is a bit easier to analyze and a consistent performer compare to pharmaceuticals, these companies may still have very different dynamics, and there could be wide variations in returns. I particularly like the insurance and Healthcare technology space but not a fan of the hospitals and diagnostics companies because their marginal cost is higher, and scalability is limited. Here is a quick overview of my holdings from the subsector: UNH (part of my Consistent Compounders bucket): UNH is one of the largest Healthcare stocks and has been able to consistently beat Wall Street revenue and earnings estimates due to the superiority of its management and continued investment in technology. It trades at close to 19 forward earnings and projected to grow its EPS by ~12.6% for the next five years. Honestly, I wouldn't be surprised if it grows earnings at the clip of 15%. I continue to watch this closely as upcoming elections may lead to some short-term pressure. If it comes down to $225-$250 range, I would add this stock further. CVS (part of Consistent Compounders bucket): CVS is trying to become the next UNH. It trades at less than 9 forward earnings and is expected to grow it by 8-10% over the next few years. I consider the stock to be a great buy at these levels, and I have a limit order @60.10 to increase by holdings by another ~22% Livongo (LVGO) (part of High Flyers bucket): Even though I recently added LVGO to my portfolio, it has already more than doubled. It makes great apps to collect patient data continuously and uses nudges to make patients change their behavior. The beauty is that it directly sells to the organizations (e.g., insurers, pharmacy benefit managers), and that shows its proven ability to add to the bottom line of the insurers and other Healthcare organizations. Keep an eye on this one. Medical Devices

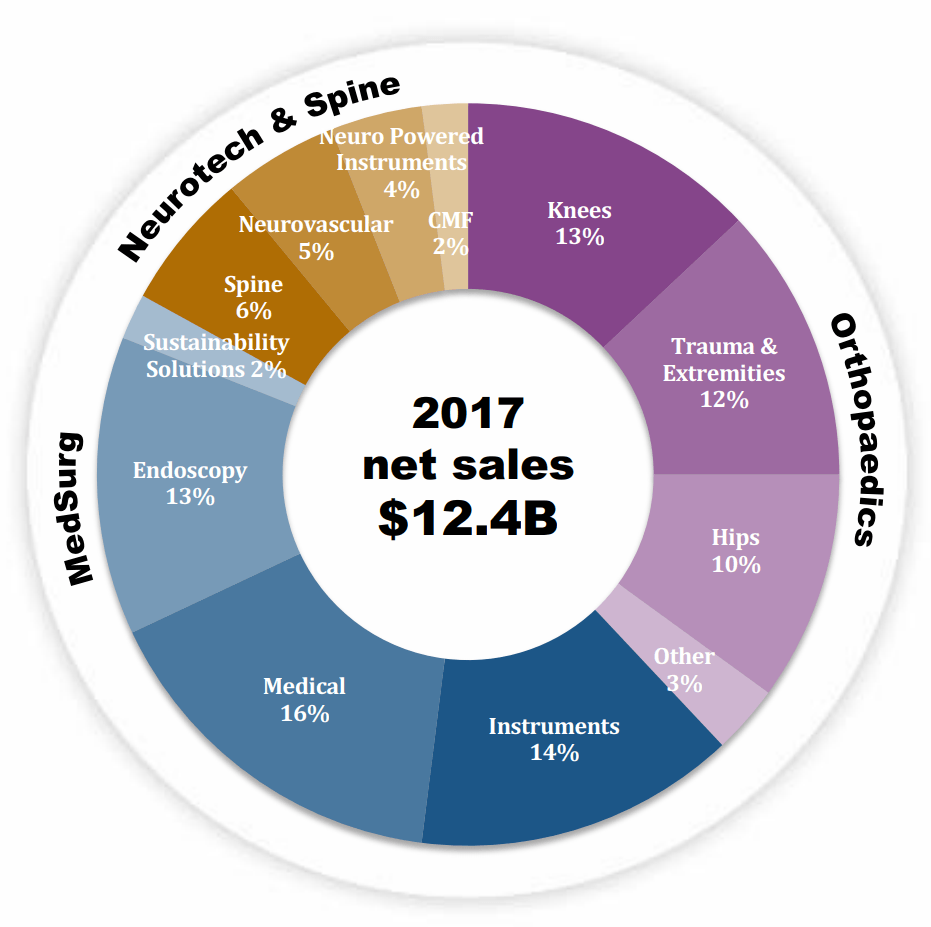

Source: Morningstar This is my favorite subsector and rightly so. Look at the consistency of returns - every stock is a winner. You would notice that over the last 5 years and 10 years almost all the holdings have produced double-digit CAGR (except Medtronic (NYSE:MDT) over the 5-year period), showcasing this sector is not dependent on a couple of star performers. What it means is that for Medical Devices, rather than trying to pick a stock, one can easily buy IHI and do well, while for Pharmaceuticals and Healthcare Services, it may be worthwhile to identify winners considering the variability of returns between holdings. Please note the relatively expensive valuations of the sector due to incredible performance and earnings visibility. Even though the table above shows that these stocks are expected to grow their earning at ~11%, I am confident that the actual numbers might be closer to mid-teens, in line with their past performance. This would also justify their high forward multiples. I own Stryker (NYSE:SYK) in this space, and I am looking to add IHI and TMO. Stryker (part of Consistent Compounders bucket): You can never go wrong with Stryker. It is one of the highest quality buys. Here is an old chart from their presentation but shows how diversified and embedded they are in the medical equipment space, and I don't think that's going to change anytime soon. I am hoping for an earnings miss on 30-July, and any pullbacks to the range of $160-$175 could provide a solid entry point.

Source TMO: Thermo Fisher is an acquisition machine and has outperformed every large-cap medical device stock (at least the top 10 showcased above) over the last 10 years. If you had invested $10,000, 10 years ago in this stock, it would have grown to 80K+. Incredible, isn't it? TMO is an acquisition machine, and the ability to effectively integrate (cultural, cost, and revenue synergies) new businesses is a major strategic advantage that is very difficult to replicate. I don't think this outperformance is going to change, and I am waiting for a pullback to buy this one. IHI: As I mentioned earlier, this sector itself is a winner, and if you don't want to get too deep, buy IHI and look at it 10 years later. You can check my full portfolio here. Final Thoughts Healthcare is going to be a long-term winner with significant tailwinds due to the aging population and continued innovation. Looking within the sector, Medical Devices has outperformed Pharmaceuticals and Healthcare Services by a wide margin, and that has led it to be a bit more expensive. However, the earning visibility and growth potential for this subsector is clearest, and that may limit any multiples correction. If one understands the pharmaceuticals space well and can pick winners - that's great. I hold TEVA. For everyone else, it might be better to either focus their energy on the Medical Devices sector as a whole (IHI) or pick a few winners such as TMO or SYK. One can also add Insurance providers such as UNH, especially if there is a pullback. My sweet spot is anything between $225 and $250. The other way to go is CVS - short-term headwinds but with the potential to double in the next 4-5 years. The Healthcare technology space is also interesting but not for the faint of heart. I particularly like LVGO due to the great story, but you would have to embrace the volatility if you want to go that route. Overall, Healthcare deserves an important place in your portfolio. It's my top priority to add stocks from the sector, and I am continuously looking out for good deals. No matter which way you go (i.e., ETFs vs individual stocks), make sure you have a decent allocation. By the way, you may have noticed that I didn't mention COVID-19 even a single time in the article. As long-term investors, we should not be considering these short-term concerns, unless something has fundamentally changed. And for the Healthcare sector and sub-sectors, I don't think COVID-19 has made any meaningful long-term impact positive or negative for most of the key players. If you like the material and want more, click 'Follow' to receive instant notification when I publish the next one. Also, leave a comment with your thoughts on the analysis. Disclosure: I am/we are long CVS, SYK, UNH, TEVA, LVGO, GOOGL, SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Long-winded ... Growth, long-term horizon, portfolio strategy, large-cap (381 followers)

| Jul. 31, 2020 12:00 PM ET The text being discussed is available at | https://seekingalpha.com/article/4362928-craving-healthcare-beginners-guide-and-7-picks and |