Quick Picks & Lists | Industrial

China Hurts Boeing

Dec. 5, 2019 6:30 AM ET|38 comments | About: The Boeing Company (BA)

Dhierin Bechai

Dhierin Bechai

The Aerospace Forum

In-depth insights from an expert on the aerospace and airline industries

(8,908 followers)

Summary

Boeing will cut Dreamliner production in late 2020.

Company cites trade tension as a main reason for the cut.

Trade war hasn't affected deliveries as much as it has affected orders.

Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Get started today »

For Boeing, 2019 has been a year that marks the company’s deepest crisis, and for good reason there's a focus on the Boeing 737 MAX. What has remained somewhat unaddressed is the fact Boeing will be reducing production rates on the Boeing 787 program in late 2020. In this report, I want to have a look at Boeing’s reasoning for this rate reduction.

Boeing 787 trade war

Source: scaerospace.com

Back to 12 Dreamliners per month

During the Q3 earnings call Boeing announced that it will be cutting production for the Boeing 787 program in late 2020 from 14 aircraft per month to 12 aircraft per month. Given that lead times for wide body aircraft orders are 12-18 months, in the absence of orders to fill the delivery spots in 2020 and primarily 2021, announcing a rate cut does make sense. Boeing simply had to make a call here, because rate reductions need to be announced roughly a year before the reduction takes effect. Boeing either had to find the orders now or announce the cut and assessing the overall demand for aircraft if they believed they were not going to get those orders to fill the 2020-2021 delivery slots.

Boeing said the following about the rate cut:

In the near term, as we have shared, the U.S.-China trade situation has presented challenges for our widebody production plans, in particular for the 787 program. As part of our practice for a significant market such as China, we have forecasted orders from operators based on the country as part of our skyline assumptions. The lack of orders from China in the past couple of years has put pressure on the production rate.

We are in the planning window on the rate decision due to the production lead times. Therefore, as part of our disciplined rate management process, we believe it is appropriate to make a production rate adjustment to balance the supply and demand. So, beginning in late 2020, we plan to transition the 787 production rate from 14 per month to 12 per month, for approximately two years.

Obviously the “bad news” is that there's a reduction in output, the good news is that Boeing expects it to be temporary.

Orders from China fell

Table 1: Orders China for Boeing aircraft (Source: AeroAnalysis)

Boeing orders China

One thing we are interested in knowing is how much did orders actually fall. Using the AeroAnalysis Data Visualizations tool that members of The Aerospace Forum have access to, we found that indeed the trade tension between the US and China has resulted in reduced order activity from China.

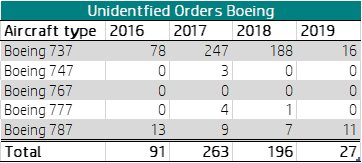

Table 2: Unidentified customer orders for Boeing aircraft (Source: AeroAnalysis)

Unidentified orders Boeing

Now, what should be noted is that the aircraft ordering process in China is almost exclusively regulated via the state. One of the consequences is that orders from Chinese customers do end up in the books as unidentified orders and are often disclosed at a later stage. So, it's also important to have a look at the unidentified orders. Not all these orders will eventually be orders from China, but a big portion is. What we see from the unidentified order overview is that there isn’t much of a trend. Order activity has been slow this year due to the problems with the Boeing 737 MAX. Since, we are mostly interested in trends in wide body orders, it's more helpful to exclude the Boeing 737 orders. This also partially mitigates the impact of the crisis Boeing is currently facing with its single aisle product.

Widebody orders Boeing

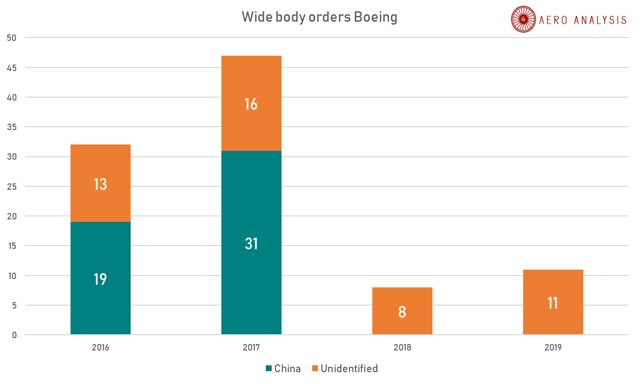

Figure 1: Wide body orders Boeing from China and unidentified customers (Source: AeroAnalysis)

What we see is that the combined order inflow for wide body aircraft did come down indeed. It's partially driven by China simply not ordering aircraft to make a statement, but likely also the economic uncertainty of a trade war does not make a strong case for committing to more aircraft.

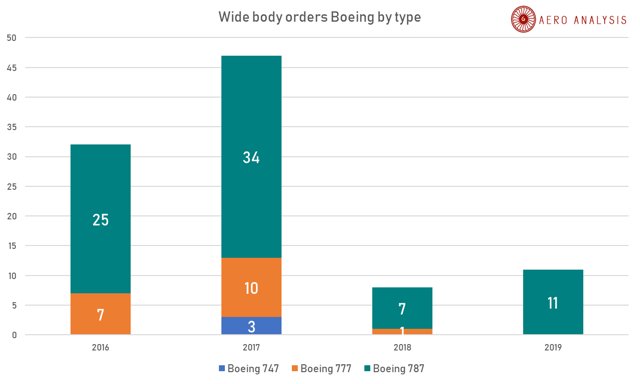

Wide body orders by type

Figure 2: Wide body orders Boeing from China and unidentified customers by type (Source: AeroAnalysis)

Figure 2 most clearly shows why Boeing cut its production rate heading into 2021. Out of all wide body programs, the Boeing 787 program is impacted most with orders falling from 34 units (only Chinese and unidentified customers) to 11 so far this year. You can plug that gap by the rate reduction from 14 to 12 aircraft per month. While not all unidentified orders will eventually be coming from China (some are coming from Saudi Arabia and Qatar for example), the order inflow does seem to be impacted by the trade war.

Chinese customers are often identified upon delivery, so we checked the deliveries attributable to China and what we found is that there were 12 Dreamliner deliveries in 2016, 16 in 2017, 25 in 2018 and with two months of delivery overviews remaining to be published in 2019 there were 15 Dreamliner deliveries this year. So, Dreamliner deliveries to China could fall slightly year-over-year but not by much.

Conclusion

In this report, I wanted to have a look at whether the US-China trade tensions could indeed be a reason for Boeing to temporarily reduce the production rate on the Boeing 787 program. In order to answer that question, we had a look at the order inflow from China and undisclosed customers (which often does include yet to be disclosed Chinese orders) and what we did find is that especially orders for the Dreamliner have been down since 2018, which also happens to be the years in which the dispute between China and the US heated up. Now, what's important to take note of is that recently the market has gained quite a bit on the hopes of a trade deal with China, but for Boeing’s Dreamliner program the absence of a trade deal has resulted in delivery slots reserved for Chinese customers remaining unoccupied as other global carriers als =o are not in a rush to add wide body aircraft. At the same time, while orders remained absent, the deliveries of aircraft has continued. So the trade dispute did not have far reaching implications for the delivery profile at present, but certainly has dented the current order inflow (and thus the future delivery flow) of Dreamliners to the extent that Boeing did not see any other option than to temporarily dial back production.

A trade deal this year or next year will of course be good news for Boeing but it's a good moment to realize that going into 2020 and 2021 Boeing is one of the companies paying a price for the trade war driven by the absence of Dreamliner orders from China. One also should be aware that with a current production rate of 14 aircraft per month, Boeing needs a smooth sales machine to maintain its production rate. In that regard, the Boeing 737 MAX crisis hasn’t helped Boeing and the uncertainty caused by the trade dispute doesn’t help either to collect orders from customers outside of China. Boeing did capture some meaningful orders during the year, but certainly not all for the 2020-2022 timeframe.

---------------------------------------------------------------

The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

Disclosure: I am/we are long BA, EADSF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

| The text being discussed is available at

and

| |