OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Household Debt | ||

|

Burgess COMMENTARY Peter Burgess | ||

|

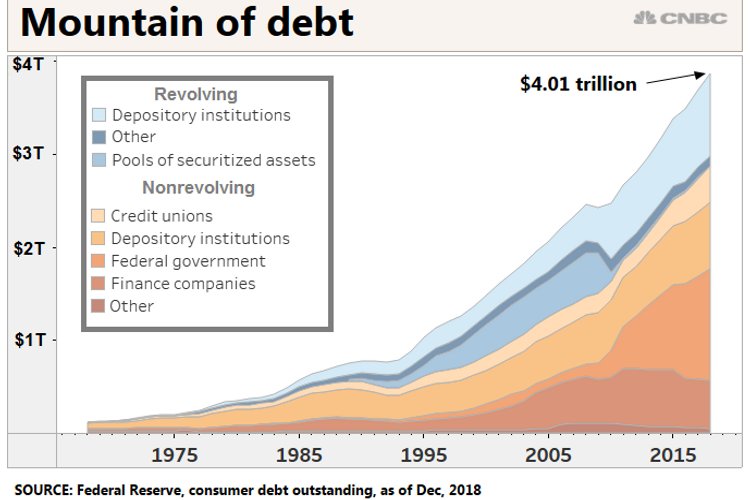

PERSONAL FINANCE ... Consumer debt hits $4 trillion

KEY POINTS

GS: Consumer spending, retail sales, Lord & Taylor Shoppers carrying bags walk up Fifth Avenue in New York City. David Goldman | Getty Images

GS: Consumer spending, retail sales, Lord & Taylor Shoppers carrying bags walk up Fifth Avenue in New York City. David Goldman | Getty Images

Americans are diving deeper and deeper into the red. As of this month, outstanding consumer debt exceeded $4 trillion for the first time, according to the Federal Reserve. Relatively strong holiday spending, particularly in November, and increasing credit card debt added more than $41 billion in outstanding balances at the end of 2018, according to LendingTree, a loan comparison website, which analyzed the data from the Fed. In addition, a steady rise in student loan balances, as well as an increase in the cost of automobile financing in the fourth quarter, contributed another $80 billion.

At these levels, consumers are spending about 10 percent of their disposable income on nonmortgage debts, including credit cards and auto, personal and student loans, said LendingTree chief economist Tendayi Kapfidze. Ahead of the Great Recession, that averaged about 13 percent, he added. “It’s a level of debt that’s pretty manageable overall,” Kapfidze said. “Of course, for any one individual, you have to make sure you are not taking on more debt than you can handle.” The average American has a credit card balance of $4,293, according to the latest Experian data. Total credit card debt is also at its highest point ever, surpassing $1 trillion, the Federal Reserve found. Now, more than 1 in 3 people — or 86 million Americans — said they’re afraid they’ll max out their credit card when making a large purchase, according to a WalletHub credit cards survey. (Most of those polled considered a large purchase as anything over $100.) At the same time, credit card interest rates have never been higher. The average card interest rate is currently 17.41 percent, according to CreditCards.com’s latest report. That’s up from 16.15 percent one year earlier and 15.22 percent two years ago. And still, credit card delinquency rates, or late payments over 90 days past due, remain relatively low even though rates have been slowly rising in the last few years. Meanwhile, outstanding student loan debt has tripled in the last decade and is now $1.5 trillion. A college education is now the second-largest expense an individual is likely to make in a lifetime — right after purchasing a home. More from Personal Finance: This simple banking move can multiply your money Here’s how to figure out your net worth Got debt? Your boss wants to help with that Subscribe to CNBC on YouTube. WATCH NOW VIDEO02:23 “Don’t start out behind the eight ball”

Jessica Dickler @JDICKLER

| PUBLISHED THU, FEB 21 2019 8:28 AM EST / UPDATED THU, FEB 21 2019 11:37 AM EST The text being discussed is available at | https://www.cnbc.com/2019/02/21/consumer-debt-hits-4-trillion.html and |