|

Wait a Second. Can Crude Oil Really Fall Below $20/bbl?

Dec 29, 201557,924 views772 Likes175 CommentsShare on LinkedInShare on FacebookShare on Twitter

In 2008, many commentators predicted that the sky was the limit for crude oil prices due to the so-called peak oil theory. Seven years later, crude oil is still in bear market territory and WTI crude oil prices are down 77% from their 2008 top. As often, mean reversion, i.e. the process by which prices tend to revert and move towards their long-term average over time, made a comeback with a vengeance (excesses on the upside being compensated by excesses on the downside).

So far, the collapse of oil prices, coupled with the end of historically low interest rates, has engendered the layoff of more than 200,000 employees worldwide as many oil fields appear to no longer be profitable. More than that, 1/3 of the US shale producers are now expected to go bankrupt in the next 36 months (see the recent comment by Bruce Richards, CEO of Marathon Asset Management), which is putting the whole high yield market at risk of a major crash.

As for Goldman Sachs and its commodities research team led by Jeff Currie, they are anticipating WTI crude oil prices below $20/bbl in the next few quarters (Extreme Oil Bears Bet on $25, $20 and Even $15 a Barrel in 2016) resulting from a prolonged global oil glut (let's not forget that Ali Al-Naimi, Saudi Arabia's oil minister, warned a year ago that Saudi Arabia - and OPEC de facto - would not cut its production even though prices fell as low as $20/bbl).

But wait a second, can crude oil prices really fall below $20/bbl?

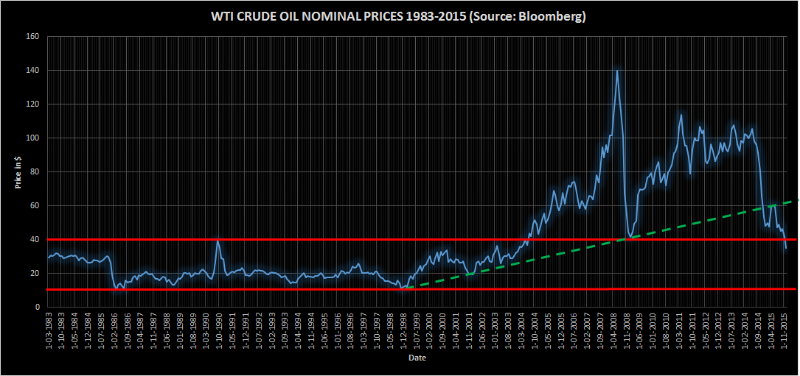

In order to get a rapid idea of where crude oil prices might go in the near future, I collected WTI crude oil monthly prices from Bloomberg (CL1 Comdty) from 1983 to 2015 (note that the data are not available prior to 1983).

Here are a few comments on the raw data:

1) The average WTI crude oil price from 1983 to 2015 is $42/bbl

2) The historical high was made in June 2008 at $140/bbl

3) The historical low was made in March 1986 at $10,42/bbl

4) Over the 393 months (observations) of the time series, WTI crude oil prices fell below $20/bbl 109 times, i.e. 28% of the time

From these raw data, we would be inclined to think that the $20/bbl short-term target might be quite fair. However, we have to bear in mind that we are looking at nominal prices here (not taking inflation into account), which means we are comparing apples with oranges.

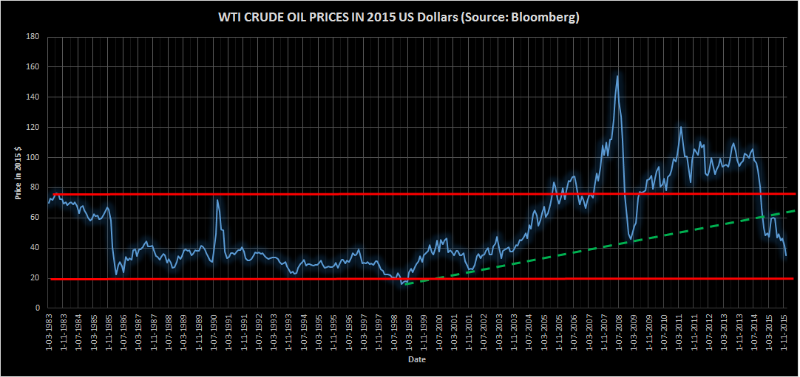

In order to compare apples with apples, I suggest to convert all the monthly WTI crude oil prices (1983-2015) into 2015 US dollars using the latest US government CPI data published in December 2015.

Here are a few comments on the data adjusted for inflation:

1) The average WTI crude oil price from 1983 to 2015 is $54/bbl

2) The historical high was made in June 2008 at $154/bbl

3) The historical low was made in November 1998 at $16,34/bbl

4) Over the 393 months (observations) of the time series, WTI crude oil prices fell below $20/bbl only 5 times (August 1998, November 1998, December 1998, January 1999, February 1999), i.e. 1,3% of the time (also note that these extreme prices were reached at the end of the previous bear market)

The big picture is now quite different. Indeed, when adjusted for inflation, we notice that WTI crude oil prices have, for the last 33 years, been above $20/bbl almost 99% of the time (in 2015 US dollars). We also know that WTI crude oil prices in 1973, before the oil crisis, were floating around $3/bbl, which in 2015 US dollars would represent $16/bbl, i.e. not that far from $20/bbl in today's US dollars. Last but not least, the sample mean is increased when taking inflation into account ($54/bbl in real terms vs $42/bbl in nominal terms), which means average prices are expected to be higher over the long-term that what could be induced from historical nominal prices.

Moreover, we can notice that the collapse of oil prices is accompanied with the collapse of both oil & gas rigs in North America (source: Baker Hughes), pointing to a massive cut in exploration as was the case in the 1990s.

As such, it seems WTI crude oil prices have a tendency not to go (too far) below $20/bbl when adjusted for inflation (at least in 2015 US dollars). I guess it would be interesting to run such a comparison over a longer period of time and on different markets (Brent, OPEC basket, etc) to see if the limited downside is confirmed on other markets. Longer term, it seems WTI crude oil prices are meant to oscillate in a $20-$80 range, but it also seems crude oil prices might eventually not go below $20/bbl in the next few quarters contrary to what many commentators are suggesting.

At this stage, any fall of WTI crude oil prices below $30/bbl could be used to either start taking profit on short positions, enter medium to long-term hedging strategies in the anticipation of future higher prices, or even start building medium to long-term long positions so as to benefit from the mean reversion process towards the long term WTI crude oil price average of $54/bbl (in 2015 US dollars).

Of course, this is only food for thought and all comments are welcome!

------------------------------------------------------------------------------------------

Dislaimer: The views and opinions expressed in this article are those of the author and do not reflect the position of any institution.

|