OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Country ... USA |

|

COMMENTARY |

|

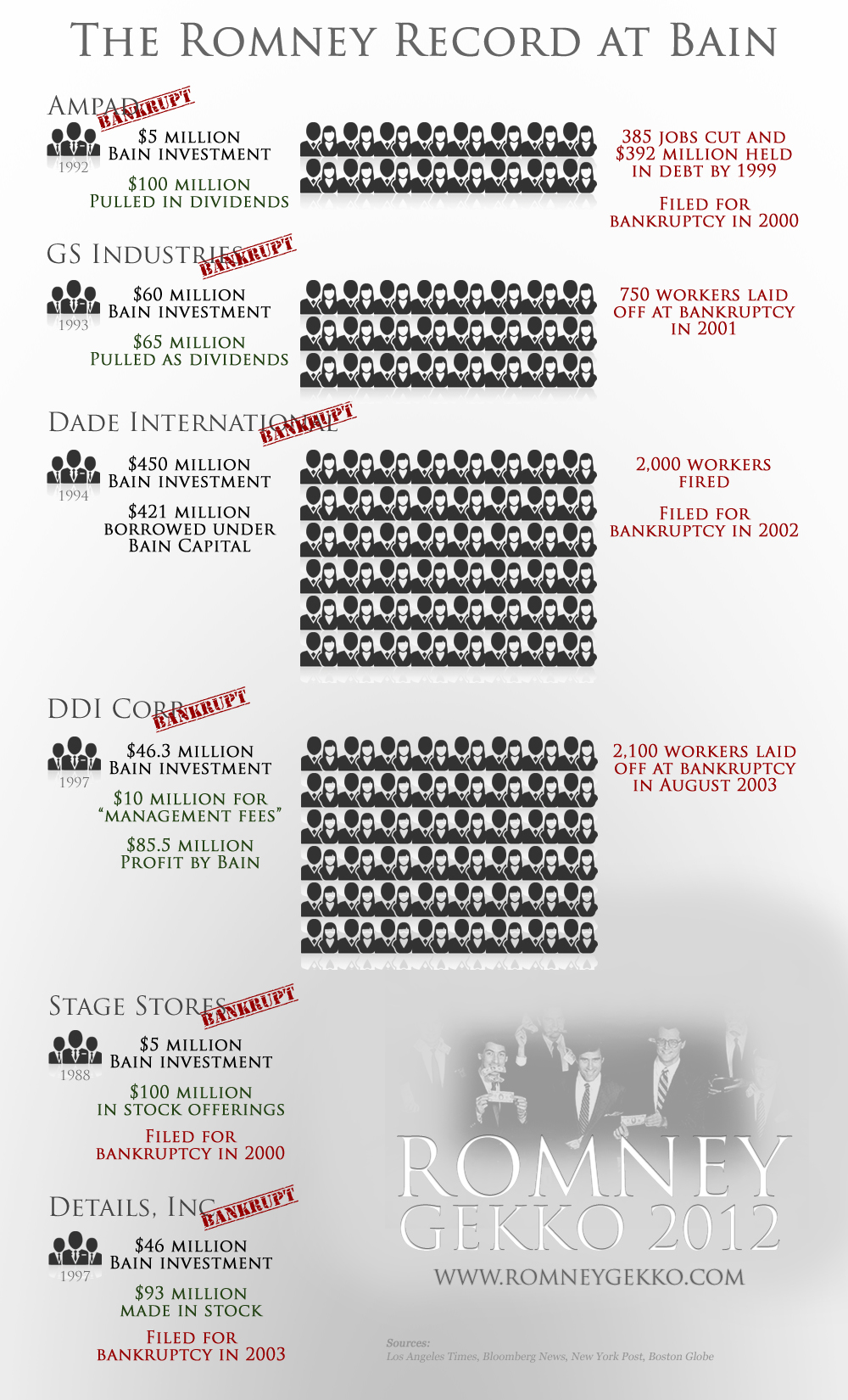

Mitt Romney and Bain Capital A Brief History of Mitt Romney’s Record of Putting Profits Ahead of People as CEO of Bain Capital

What is Bain Capital? Co-founded by Mitt Romney in 1984, Bain Capital is a classic “strip and flip” shop — a private equity firm that made its money buying businesses and sucking profit out of them by any means possible that often resulted in a stack of pink slips for everyday Americans. As the New York Post reported, during his 15 years as head of Bain, Romney “made fortunes by bankrupting five profitable businesses that ended up firing thousands of workers.” Here’s how it often went down. Romney’s Bain would buy a company and increase its short-term earnings through firing workers and shuttering plants in order to borrow enormous amounts of money. The borrowed money was used to pay Bain dividends, however, those businesses needed to maintain that high level of earnings to pay their debts. When they couldn’t, that meant plant closures, more layoffs, bankruptcies, and in many cases, the end of the business. Yet these bankruptcies still meant huge profits for Bain’s investors. Furthermore, Bain continued to collect management fees even as companies failed. Michael Rumbin, a vice president for technology management at Dade told the Los Angeles Times, “My experience at Dade during those Bain Capital years was that it was strictly an investment, not to create jobs.” Rumbin also spoke with Bloomberg in July:

Dade borrowed so much money to make that payment that when sales declined and interest rates rose the company struggled to pay its creditors. Standard & Poor’s downgraded its outlook for Dade Behring to negative from stable. The company later filed for bankruptcy.According to the Boston Globe in 2008: “Romney had chances to fight to save jobs, but didn’t. His ultimate responsibility was to make money for Bain’s investors, former partners said.” One former official who worked on the labor contracts of the Bain-created company GS Industries told the Los Angeles Times that Bain “bled the company.” A recent report from the Los Angeles Times notes Romney’s colleagues admit they were not in the business of creating jobs. And make money he did — Mitt loads of it. For an eight year period starting in 1987, Romney’s Bain invested 22 percent of the money it raised in five businesses that ended up filing for bankruptcy and walked away with a $578 million in profit. Judging by the photos at the time, finding places to stuff all those profits became something of a joke among the Bain cohorts. Such a display of greed and excess that would make Gordon Gekko — the fictional cut-throat corporate raider in Oliver Stone’s Wall Street — blush. Romney left Bain with a staggering $4 billion in assets. It’s no wonder Wall Street lobbyists are lining up to throw campaign money Romney’s way today, by far more than any other presidential candidate. Mitt Romney is the poster child for the greed of Wall Street and excess of the 1%. A guy who made hundreds of millions putting profits ahead of peoples’ jobs is exactly the kind of guy Wall Street would love running things in Washington. Mitt Romney would let the Gekkos of the world go back to same greedy and reckless behavior that wiped out trillions in savings and cost millions of Americans their jobs. Here’s a few examples of “stripping and flipping” companies — sucking cash out of businesses, laying off workers, and eventually hitting bankruptcy all while making investors like Mitt Romney even richer.

A recent report from the Los Angeles Times notes Romney’s colleagues admit they were not in the business of creating jobs. Bain managers said their mission was clear. “I never thought of what I do for a living as job creation,” said Marc B. Walpow, a former managing partner at Bain who worked closely with Romney for nine years before forming his own firm. “The primary goal of private equity is to create wealth for your investors.” And make money he did — Mitt loads of it. For an eight year period starting in 1987, Romney’s Bain invested 22 percent of the money it raised in five businesses that ended up filing for bankruptcy and walked away with a $578 million in profit. Judging by the photos at the time, finding places to stuff all those profits became something of a joke among the Bain cohorts. Such a display of greed and excess that would make Gordon Gekko — the fictional cut-throat corporate raider in Oliver Stone’s Wall Street — blush. Romney left Bain with a staggering $4 billion in assets. It’s no wonder Wall Street lobbyists are lining up to throw campaign money Romney’s way today, by far more than any other presidential candidate. Mitt Romney is the poster child for the greed of Wall Street and excess of the 1%. A guy who made hundreds of millions putting profits ahead of peoples’ jobs is exactly the kind of guy Wall Street would love running things in Washington. Mitt Romney would let the Gekkos of the world go back to same greedy and reckless behavior that wiped out trillions in savings and cost millions of Americans their jobs. Here’s a few examples of “stripping and flipping” companies — sucking cash out of businesses, laying off workers, and eventually hitting bankruptcy all while making investors like Mitt Romney even richer.

Read more about Ampad from the 2008 report in the Boston Globe. [PDF] MSNBC host Rachel Maddow picked up on unaired 1994 campaign ads citing Romney’s record at Bain Capital. In one ad, it cites a Boston Globe report that a company under Romney’s watch collected a $10 million bailout while Bain Capital profited $4 million. Another ad included personal testimonies from former workers who were laid off by Romney’s private equity firm. Watch: Comedy Central comedian Stephen Colbert discussed Mitt Romney’s record at Bain Capital in a segment called, “The Word.” Watch:

Sources

|

|

|

| The text being discussed is available at http://www.romneygekko.com/mitt/ |