|

|

MONEY / LIQUIDITY

CRYPTOCURRENCIES

A new (2017) Medium of Exchange and Store of Value ... but also a likely locus for financial gambling

|

|

TO DO ... update images to be more relevant to the subject matter

|

|

|

|

|

|

|

|

|

|

WHAT IS A CRYPTOCURRENCY?

More confusion than clarity

|

GO TOP

|

WHAT IS A CRYPTOCURRENCY?

From Wikipedia: A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional units, and to verify the transfer of assets.[1][2][3] Cryptocurrencies are classified as a subset of digital currencies and are also classified as a subset of alternative currencies and virtual currencies.

TVM/TPB Note: This definition / description does not make reference to it being a store of value, rather it is merely a description of an asset that cannot be changed without the authority of the owner / owners (i.e. key holders)

Most ICOs are not 'investments' but something more like 'crowdfunding' or worse ... simply gambling.

https://en.wikipedia.org/wiki/Cryptocurrency

|

Open Wikipedia link

|

|

|

SCALE AND GROWTH OF THE CRYTOCURRENCY SECTOR

|

|

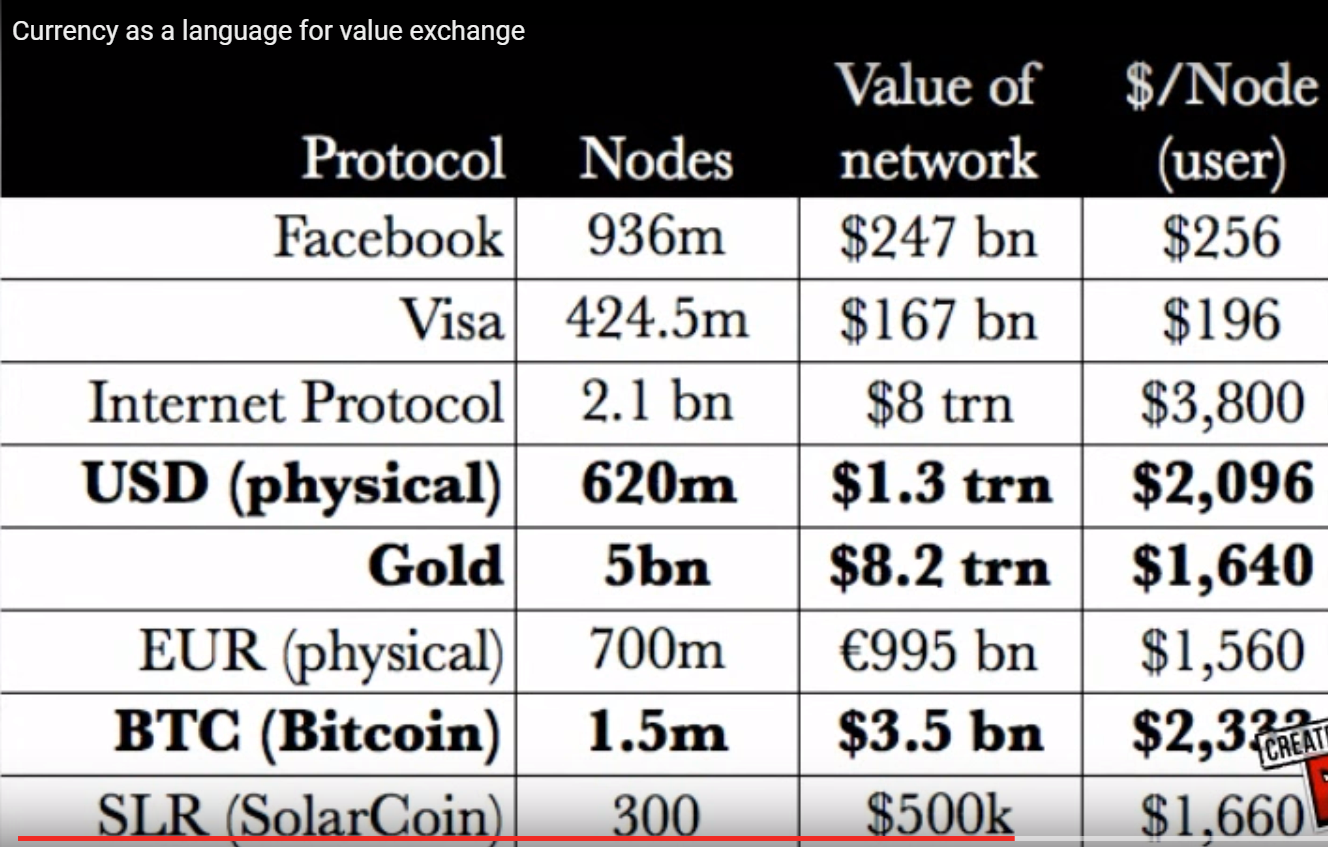

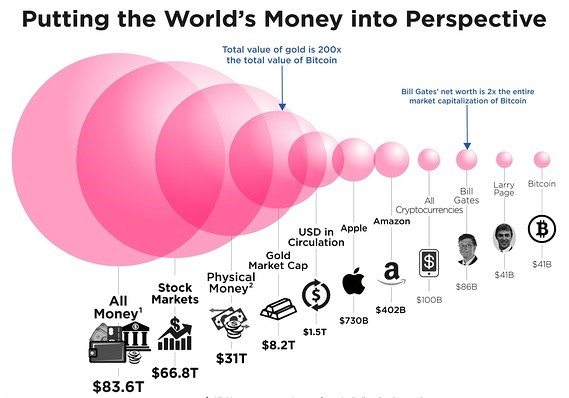

THE RELATIVE SIZE OF CRYPTOCURRENCIES -V- OTHER ECONOMIC COMPONENTS

|

|

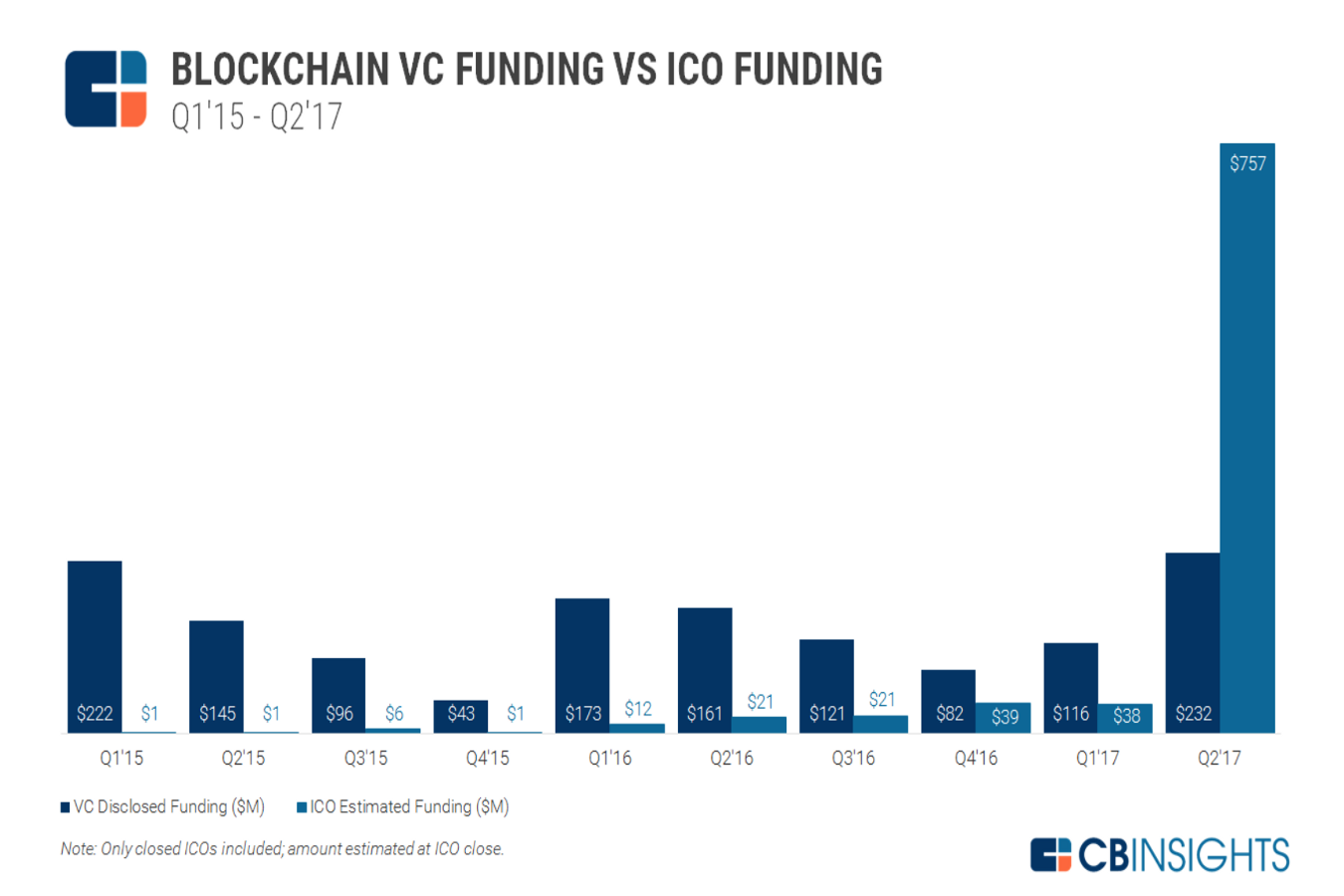

Growing number and value of ICOs in the crytocurrency economy

|

The scale of Initial Coin Offerings (ICOs) in the second quarter of 2017 has been at a record level

In the second quarter of 2017 the amount of ICO related financing has boomed (ICI = Initial Coin Offering). These were negligable in 2015 and 2016 and started to grow very rapidly in the early part of 2017. This reflects the growing understanding of what blockchain technology can be used for, and an increasing acceptance of its use. It also reflects the willingness of a certain class of investor to embrace the idea that 'if BitCoin can be a vehicle for wealth creation, then maybe another blockchain based coin or token might do the same ... and make me rich!'

|

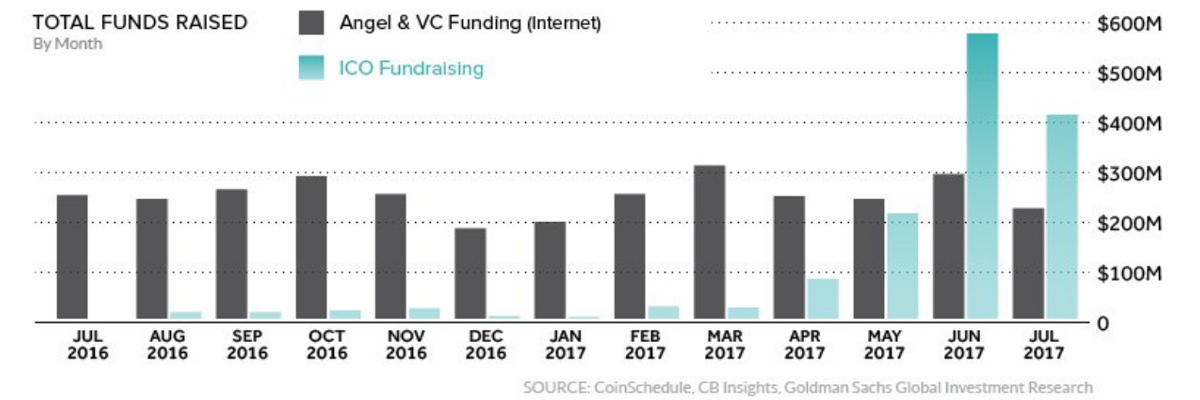

Trend: VC -v- ICO fund raising during 2017

|

The explosive growth in the use of ICOs for fund raising in June and July of 2017 has shocked the world of traditional establishment finance and given rise to a massive amount of thought about what this is going to mean for the future of finance.

Many jurisdictions are concerned by the complete lack of regulation related to cryptocurrencies and initial coin offerings (ICOs). In late August 2017, the Chinese government banned the use of ICOs and called for the giveback of the funds raised through recent ICOs.

It is thought that this ban will be removed as soon as a regulatory framwork in China has been established.

|

Bitcoin in comparison to other economic components (mid year 2017)

|

|

|

|

EXAMPLES OF CRYPTOCURRENCIES

Little regulation ... a mix of great ideas and outright scams

|

GO TOP

|

|

|

BitCoin

The Biggest Crytocurrency in Circulation (2017)

|

GO TOP

|

|

|

CityCoins

A coin / token based on PLACE

|

GO TOP

|

Alfonso-Govela-City-Coins-White-Paper-v1-170904

The basis for SolarCoin ... that is the potential of solar PV to produce electricity up to around 2050.

'../../DBpdfs/Thinkers/Alfonso-Govela/Alfonso-Govela-City-Coins-White-Paper-v1-170904.pdf'

|

Open PDF ...

Alfonso-Govela-City-Coins-White-Paper-v1-170904

|

|

|

INS

Blockchain for Retail Grocery

|

GO TOP

|

INS-ICO-Whitepaper-171002

INS believes Bitcoin, Ethereum and other blockchain ecosystems will usurp traditional industries, including retail. Blockchain offers a compelling solution to the problem of combining accessibility with privacy and security ... [TPB: huge potential for disruption ... technology driver from Russia!]

'../../DBpdfs/BlockChain/ICOs/INS-ICO-Whitepaper-171002.pdf'

|

Open PDF ...

INS-ICO-Whitepaper-171002

|

|

|

Kidcoin

Blockchain Ecosystem for Families

|

GO TOP

|

Kidcoin-Whitepaper-v1-7-8-May-2018

Kidcoin Ecosystem and Digital Economy ... Kidcoin will improve kid and family-centric financial interactions by creating self-sustaining, communityowned ecosystems. “Self-sustaining” means the wealth in the community grows as a whole, and “community-owned” means participants in the existing community take on most of the key roles within the ecosystem. As more and more users discover the benefits of Kidcoin’s secure ecosystem and digital economy, we see the currency evolving into a highly sought after earning and payment method.

'http://truevaluemetrics.org/DBpdfs/BlockChain/Kidcoin-Whitepaper-v1-7-8-May-2018.pdf'

|

Open PDF ...

Kidcoin-Whitepaper-v1-7-8-May-2018

|

Quantor-White-Paper-2018

Quantor (Quant Accelerator, quantor.co) is an international ecosystem that combines an online training platform and a marketplace of investment algorithms and solutions for the cryptocurrency and fiat markets, which allows the knowledge and skills of investment industry experts and developers of investment algorithms and applications to be effectively introduced into the economic turn over.

'http://truevaluemetrics.org/DBpdfs/Cryptocurrencies/Quantor-White-Paper-2018.pdf'

|

Open PDF ...

Quantor-White-Paper-2018

|

|

|

SERATIO

SOCIAL EXCHANGE RATIO

|

GO TOP

|

|

|

SolarCoin

A coin / token based on potential

|

GO TOP

|

SolarCoin ... Frequently asked questions

SolarCoin is a blockchain-based digital currency distributed to solar producers at a rate of one coin per megawatt-hour of solar energy produced, based on verified meter readings. The organization maintains a public ledger which records each SolarCoin given out to solar electricity generators.

https://solarcoin.org/en/faq-frequently-asked-questions/

|

Open external link

|

SolarCoin ... accountability / transparency

https://solarcoin.org/en/solarcoin-oca-accounting-transparency/

|

Open external link

|

Cryptocurrency / SolarCoin

Enterprise Times News article: SolarCoin blockchain: earn your reward

The SolarCoin Foundation, based in Greenwich, Connecticut, seeks to incentivise solar production one megawatt-hour at a time. It uses blockchain technology as its foundation. Founded in 2014 by a group of solar experts and macro-economists, the SolarCoin Foundation is an international network of volunteers and a community. Its purpose is to oversee the distribution of SolarCoins (cryptoexchange symbol: SLR).

|

Open file 13744

|

SolarCoin-PV-roadmap-foldout

The basis for SolarCoin ... that is the potential of solar PV to produce electricity up to around 2050.

|

Open PDF ...

SolarCoin-PV-roadmap-foldout

|

|

|

STK

Blockchain / Cryptocurrency for Global Payments

|

GO TOP

|

STK-whitepaper-171002

STK Global Payment’s vision is to create a globally accessible alternative to traditional banking, allowing you to store your money safely, access it instantly and transact with it anywhere, in any currency including crypto by using the STK token, right from your smartphone, using the STACK app. Creating a digital wallet as a companion to a traditional card solution, the STACK app enables you to use any of your currencies at point of sale, anywhere in the world.

'../../DBpdfs/BlockChain/ICOs/STK-whitepaper-171002.pdf'

|

Open PDF ...

STK-whitepaper-171002

|

|

|

THE ENERGY ISSUE FOR BLOCKCHAIN IMPLEMENTATION

|

GO TOP

|

|

Bitcoin miners fall for Iceland’s clean energy

|

Credit: Simon Allerdice/CC-BY-2.0

|

Bitcoin miners have descended on Iceland, and their operations are growing so fast that more of the country’s energy is expected to go into mining virtual currencies this year than into powering Iceland’s homes, the Associated Press reports. The process of mining bitcoin uses massive amount of energy, as AP explains, and the miners have discovered Iceland’s abundance of renewable energy from geothermal and hydroelectric power plants, as well as its climate, which allows for natural cooling of computer servers. One lawmaker has proposed taxing bitcoin mining profits.

KEY QUOTE: 'Under normal circumstances, companies that are creating value in Iceland pay a certain amount of tax to the government. These companies are not doing that, and we might want to ask ourselves whether they should.' —Iceland Parliament Member Smári McCarthy

|

|

|

|