Date: 2024-05-15 Page is: DBtxt003.php txt00019840

Media / Headlines

Washington Post ... The Finance 202

Washington Post ... The Finance 202 ... November 9th 2020 ... Big job ahead for Biden

Peter Burgess

The Washington Post

The Washington Post The Finance 202 Your economic policy briefing

Tory Newmyer By Tory Newmyer with Brent D. Griffiths

Biden faces economic mess as he plots an emergency cleanup Smoldering economic wreckage will greet Joe Biden when takes office in 72 days.

The Democratic president-elect pledged to begin repair work immediately. On a newly launched website — buildbackbetter.com — he said he will move to provide emergency aid to state and local governments, extend unemployment benefits, bail out Main Street businesses, and put people to work in a “Public Health Jobs Corps.”

President-elect Joe Biden gestures to supporters Saturday in Wilmington, Del. (AP Photo/Andrew Harnik)

And he emphasized his focus will be on the middle class — calling it the “backbone of this nation,” in a Saturday speech — as he seeks to more evenly spread the benefits of what he has called a K-shaped recovery. President Trump, by contrast, has insisted the economic rebound has been sharp and V-shaped.

Over the longer term, Biden “plans to incentivize companies to bring manufacturing jobs back to the United States, to raise taxes on corporations and on individuals making more than $400,000 a year, and to fund job-creating infrastructure investments, including in universal broadband,” David J. Lynch writes.

Biden's ability to do so hinges on which party controls the Senate, which will be decided by the outcome of a pair of runoff elections in Georgia on Jan. 5.

But his incoming administration isn't waiting to take office to start pressing its agenda. instead, his transition team will work start working with congressional Democrats immediately to shape a relief package they aim to pass during the upcoming lame-duck session, “with the aim of getting money for their priorities in spending legislation before the end of the year,” Erica Werner, Paul Kane and Yasmeen Abutaleb report.

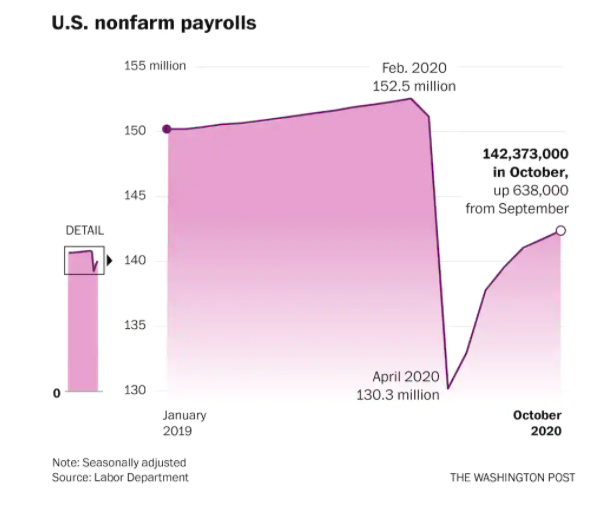

Meanwhile, the scale of the challenge he faces from the economic crisis alone is coming into sharper focus. The headline unemployment number dipped to 6.9 percent as payrolls jumped by 638,000 in October, according to the Friday jobs report — beating most economists earlier expectations.

But the labor force participation rate remains at a roughly 40-year low, and other estimates say joblessness is much higher than the official number suggests.

Via RSM chief economist Joseph Brusuelas:

'The economy’s initial bounceback also is losing steam. On Friday, the Labor Department said the number of new jobs fell for the fourth straight month. More than 21 million Americans are receiving some form of unemployment benefits,” Lynch writes. “Amid signs of softer demand, major employers recently announced fresh layoffs. ExxonMobil is cutting 15,000 jobs and Boeing is trimming its payroll by 7,000 after letting tens of thousands of workers go earlier this year.'

The pain is likely to get worse before it eases.

As coronavirus infections spike to record levels across the country, it is primed to force new shutdown measures that will take a fresh toll on struggling businesses.

Against that backdrop and likely facing stiffer resistance on Capitol Hill to major relief spending, investors expect the Biden administration to preside over a low, slow grind out of the economic ditch.

“Treasury bond yields fell sharply Wednesday, suggesting investors expect less fiscal stimulus, slower growth and easier monetary policy from the Fed than had been envisioned pre-election,” the New York Times’s Neil Irwin writes. “And the stock market soared Wednesday and Thursday, as investors priced in both easier money from the Fed and a Biden administration that will be constrained in its ability to raise taxes and expand regulation on businesses.”

But the chance for an upside surprise remains, Irwin writes — if, for example, Biden convinces Republicans to embrace a scaled-down aid package between $500 billion and $1 trillion then succeeds in bringing the pandemic itself to heel. “The biggest question may turn out to be this one: Has the pandemic fundamentally broken anything about the economy? If not, a speedy recovery may be possible even without a politically aligned Congress. If yes, it might feel like the early 2010s all over again.”

Share The Finance 202

The transition

President-elect Joe Biden. (Robert Deutsch/USA Today/Bloomberg)

Biden plans immediate flurry of executive orders.

He will reverse a number of reversals of Obama policies: “He will rejoin the Paris climate accords … and he will reverse [Trump’s] withdrawal from the World Health Organization. He will repeal the ban on almost all travel from some Muslim-majority countries, and he will reinstate the program allowing'“dreamers,' who were brought to the United States illegally as children, to remain in the country,” Matt Viser, Seung Min Kim and Annie Linskey reported over the weekend.

“Although transitions of power can always include abrupt changes, the shift from Trump to Biden — from one president who sought to undermine established norms and institutions to another who has vowed to restore the established order — will be among the most startling in American history.”

Obama alums are the favorites for top economic posts: “In forming his cabinet, Biden is likely to rely on an inner circle of longtime veterans from the Obama administration, mindful of the possibility Republican-controlled Senate that would almost certainly scuttle nominees for top posts who belong to the progressive wing of the Democratic Party,” Bloomberg News's Max Berley reports.

- Treasury: Federal Reserve Governor Lael Brainard “is the clear favorite.” Former NEC head Jeff Zients, former HHS Secretary Sylvia Mathews Burwell and Sarah Bloom Raskin, a former Fed governor and Treasury official, are also on the list. “Ex-Fed official Roger Ferguson and Atlanta Fed President Raphael Bostic, both Black men, are also possibilities,' per Bloomberg.

- Council of Economic Advisers: 'Jared Bernstein, who was Biden’s chief economic adviser when he was vice president, has seen his name in contention. Economist Heather Boushey is also on the list.

- National Economic Council: Boushey is also being considered for this post.

“At the same time, Biden could face pressure from the Democratic Party’s left wing to pick a more liberal figure, someone who could push for aggressive financial overhauls and prove more adversarial to supporters of free trade. Such a nominee, however, could face difficulty winning Senate confirmation if Republicans retain control after two January runoffs in Georgia.”

Other key transition news:

- Beijing is betting on a detente: “While Biden could ease off Beijing in certain respects after Inauguration Day, many Chinese have adopted a fatalistic view of the post-Trump world: U.S.-China relations are likely to be fraught for four more years, if not a generation,” Gerry Shih and Eva Dou reports.

- Biden likely to maintain some tariffs: “Removing them would be like catching a falling knife: It would alienate voters across the Midwest who helped Biden across the finish line,” Bloomberg News's Joe Deaux reports of current tariffs on some steel and aluminum.

Money on the Hill

Washington on Sunday morning. (J. Scott Applewhite/AP)

Possible government shutdown looms over lame-duck session.

Both sides have also expressed optimism over a possible stimulus deal: “Even before Biden takes office on Jan. 20, Congress must contend with a Dec. 11 government funding deadline. Failure to reach a deal would result in a government shutdown, and Trump has not signaled whether he would sign a new spending bill,” Werner, Kane and Abutaleb report.

“Trump administration officials have indicated they are unlikely to play much of a role in any new round of stimulus talks, instead letting Senate Majority Leader Mitch McConnell take the lead. Meanwhile, Biden allies predicted that Biden and Vice President-elect Kamala D. Harris will press Congress to produce a compromise coronavirus relief bill that has eluded lawmakers and Trump administration officials for months.”

Market movers

Wall Street. (Mark Lennihan/AP)

Divided government won't help you conquer the market.

Wall Street's takeaway from the election lacks historical evidence: “In the long run, though, there is little evidence split governments have an effect on stock returns. Since the 1928 election, there has been virtually no difference in the annual return of the S&P 500 in years when one party controlled Washington versus periods when power was split,' the Wall Street Journal's Paul Vigna reports.

“In fact, the index has slightly outperformed when control of the presidency and Congress has been unified under one party. In the 45 years that the same party controlled Congress and the White House, the average return on the S&P 500 was 7.45 percent, according to Dow Jones Market Data. In the 46 years that power was split, the average return was 7.26 percent.”

CEOs expect a predictable Biden presidency: “Many corporate leaders view Mr. Biden as a centrist on business issues and foresee a quieter, less publicly turbulent relationship with the White House over the next four years—even if they don’t always agree with the administration’s policies,” the WSJ's Chip Cutter reports.

“Executives expect the public scars of the 2020 election to linger for some time. The divisive race, capped by several intense days as the nation awaited results, prompted a number of business leaders to call on Biden to focus his first months in office on bringing the country together … CEOs say additional stimulus to support consumers and businesses hurt by the pandemic, along with measures to stop the spread of the virus, should top Biden’s priority list. Many business leaders also called for increased government spending on infrastructure …'

Key quote: 'Now is a time for unity,” Jamie Dimon, CEO of JPMorgan Chase & Co, told the Journal. “We must respect the results of the U.S. presidential election and, as we have with every election, honor the decision of the voters and support a peaceful transition of power.”

Coronavirus fallout

A Pfizer vaccine trial conducted in Hollywood, Fla. (Eva Marie Uzcategui/Bloomberg)

Pfizer vaccine found to be 90 percent effective in first analysis.

The results offer hope of a breakthrough. “A front-runner coronavirus vaccine developed by drug giant Pfizer and German biotechnology firm BioNTech was more than 90 percent effective at protecting people compared with a placebo saline shot, according to an interim analysis by an independent data monitoring committee that met Sunday,” Carolyn Y. Johnson reports.

'The early look at the ongoing trial provides a decisive initial glimpse of the real-world performance of one of the four coronavirus vaccines in the last stages of testing in the United States. It is the strongest signal yet that the unprecedented quest to develop a vaccine that could help bring the pandemic to an end might succeed, breaking every scientific speed record… In Pfizer’s 44,000-person trial, there have so far been 94 cases of covid-19, the illness caused by the coronavirus, in people who were not previously infected. Fewer than nine of those cases were among people who received two shots of the vaccine, a strong signal of efficacy.”

More evidence of PPP fraud is emerging. The allegations cast a pall over one of the government's largest pandemic-response programs: “Congress and the Trump administration designed the PPP to give small businesses fast and easy access to taxpayer funds, and it worked: About $525 billion in loans were distributed to 5.2 million companies between April 3 and Aug. 8. Many business owners say it was a lifeline in turbulent times,” the WSJ's Ryan Tracy reports.

“The Small Business Administration’s inspector general, an arm of the agency that administers the PPP, said last month there were ‘strong indicators of widespread potential abuse and fraud in the PPP.’ The watchdog counted tens of thousands of companies that received PPP loans for which they appear to have been ineligible, such as corporations created after the pandemic began, businesses that exceeded workforce size limits (generally 500 employees or fewer) or those listed in a federal ‘Do Not Pay’ database because they already owe money to taxpayers.”

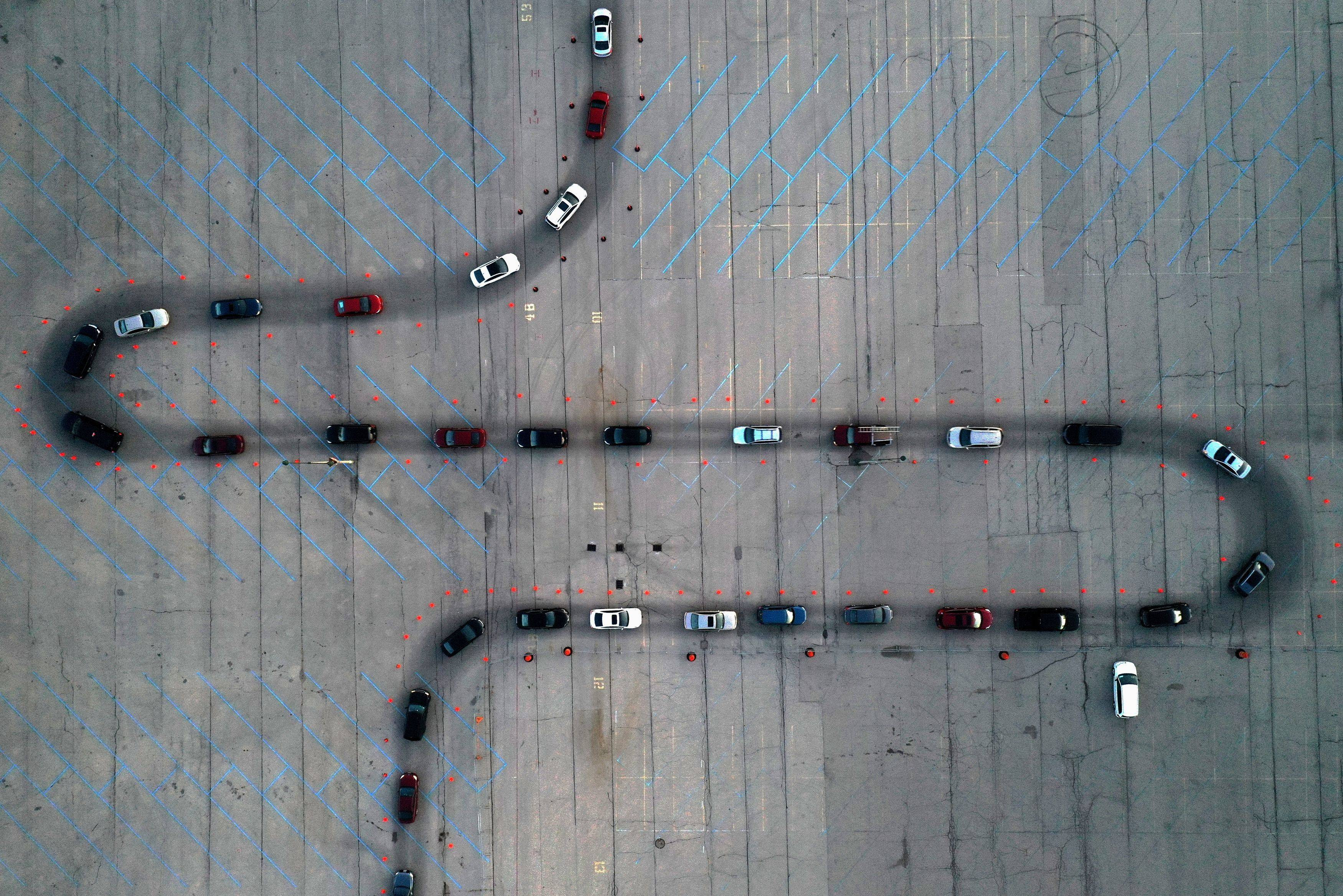

People in vehicles wait at a drive-through coronavirus testing site in Milwaukee. (Bing Guan/Reuters)

More from the U.S.:

Record breaking wave of cases continue: “A surge of cases revealed a snowball effect: It took only 10 days for the country to move from 9 million cases to what is expected to be its 10 millionth case Monday. By comparison, it took more than three months for the country to go from no cases to 1 million in late April,” Robert Barnes reports.

From former FDA commissioner Scott Gottlieb:

Utah issues mask mandate: “The state's rolling seven-day average for new daily coronavirus cases — generally considered a more accurate metric than single-day case counts — hit a new high for the fifth consecutive day on Sunday and grew by nearly 40 percent in the past week, according to data tracked by The Washington Post,” Antonia Farzan reports.

Major Idaho hospital turns away patients for second weekend in a row: “St. Luke’s Magic Valley Medical Center, which is located in the city of Twin Falls, told the Idaho Statesman that it went ‘on diversion’ for a 12 hour period — meaning that four or five patients seeking care were sent elsewhere. Most were sent to the Boise area, roughly two hours away,” Antonia Farzan reports.

From the corporate front:

- Berkshire takes a hit: “Warren Buffett’s Berkshire Hathaway Inc reported lower quarterly operating results on Saturday and said the pandemic may cause further damage, even as gains in stocks such as Apple Inc fueled a more than $30 billion overall profit,” Reuters's Jonathan Stempel reports.

- Restaurants defend dining rooms: “McDonald’s Corp., Starbucks Corp. and other chains are serving customers inside, in line with safety standards they say they have honed during roughly nine months of grappling with the virus. Some executives say they see an immediate boost in sales when dining rooms reopen,” the WSJ's Heather Haddon reports. Neither chain wants to shut down its spaces again, electing to fine tune their plans this time around.

Chart topper

Biden edged Trump in counties experiencing faster economic growth, according to the Economic Innovation Group's John Lettieri:

Daybook

Today:

McDonald's, Norwegian Cruise Line Holdings, Occidental Petroleum and Party City are among the notable companies reporting their earnings, per Kiplinger

Tuesday:

Fed vice chair Randal Quarles and Acting Comptroller of the Currency Brian Brooks are set to testify before the Senate Banking Committee

Thursday:

- The Labor Department reports the latest weekly jobless claims

- Quarles and Brooks are set to testify before the House Financial Services Committee

The funnies

From The Post's Ann Telnaes:

Bull session

We think you’ll like this newsletter Check out Opinions A.M. and P.M. for the best of The Post's opinions and commentary, in your inbox every morning and afternoon. Sign up » The Washington Post Manage my email newsletters and alerts | Unsubscribe from The Finance 202 | Privacy Policy | Help You received this email because you signed up for The Finance 202 or because it is included in your subscription. ©2020 The Washington Post | 1301 K St NW, Washington DC 20071