Date: 2024-04-28 Page is: DBtxt003.php txt00018607

Energy

Oil Markets ... January 2020

New Decade, New OPEC Oil Curbs. ... Same Mixed Results

Peter Burgess

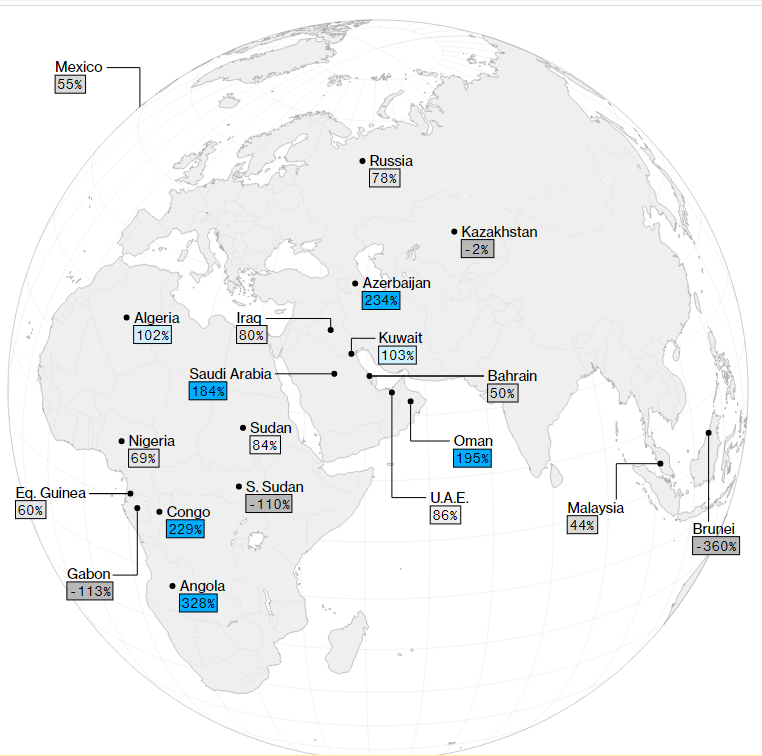

Percentage of cutback target reached

0

20

40

60

80

100

120

140

160

180

U.A.E.

134/156

86%

S. Sudan

-3.289999999999992/3

-110%

Sudan

3.3599999999999994/4

84%

Saudi Arabia

900/489

184%

Oman

66.32000000000005/34

195%

Nigeria

51/74

69%

Malaysia

8.830000000000041/20

44%

Kuwait

144/140

103%

Kazakhstan

-1.1300000000001091/57

-2%

Iraq

152/191

80%

Gabon

-9/8

-113%

Eq. Guinea

3/5

60%

Congo

32/14

229%

Brunei

-14.400000000000006/4

-360%

Bahrain

3.5/7

50%

Azerbaijan

63.299999999999955/27

234%

Angola

154/47

328%

Algeria

45/44

102%

Russia

234.25/300

78%

Mexico

31.720000000000027/58

55%

Note: Positive numbers over 100 indicate full conformity with pledged cuts. A positive number below 100 indicates cuts, but less than pledged. Negative numbers show production actually increased relative to the baseline.

Source: Data compiled by Bloomberg

OPEC+ reset the terms of its agreement as of Jan. 1. Half of the 10 OPEC countries now participating in supply cuts conformed last month, for a rate of 138%, according to Bloomberg calculations from the group’s secondary source data. Non-OPEC adherence was 76%, estimates from preliminary International Energy Agency data on crude supply show. Overall, the OPEC+ coalition had a compliance rate of 119%.

Percentage of cutback target reached

0

20

40

60

80

100

120

140

160

180

U.A.E.

134/156

86%

S. Sudan

-3.289999999999992/3

-110%

Sudan

3.3599999999999994/4

84%

Saudi Arabia

900/489

184%

Oman

66.32000000000005/34

195%

Nigeria

51/74

69%

Malaysia

8.830000000000041/20

44%

Kuwait

144/140

103%

Kazakhstan

-1.1300000000001091/57

-2%

Iraq

152/191

80%

Gabon

-9/8

-113%

Eq. Guinea

3/5

60%

Congo

32/14

229%

Brunei

-14.400000000000006/4

-360%

Bahrain

3.5/7

50%

Azerbaijan

63.299999999999955/27

234%

Angola

154/47

328%

Algeria

45/44

102%

Russia

234.25/300

78%

Mexico

31.720000000000027/58

55%

Note: Positive numbers over 100 indicate full conformity with pledged cuts. A positive number below 100 indicates cuts, but less than pledged. Negative numbers show production actually increased relative to the baseline.

Source: Data compiled by Bloomberg

OPEC+ reset the terms of its agreement as of Jan. 1. Half of the 10 OPEC countries now participating in supply cuts conformed last month, for a rate of 138%, according to Bloomberg calculations from the group’s secondary source data. Non-OPEC adherence was 76%, estimates from preliminary International Energy Agency data on crude supply show. Overall, the OPEC+ coalition had a compliance rate of 119%.

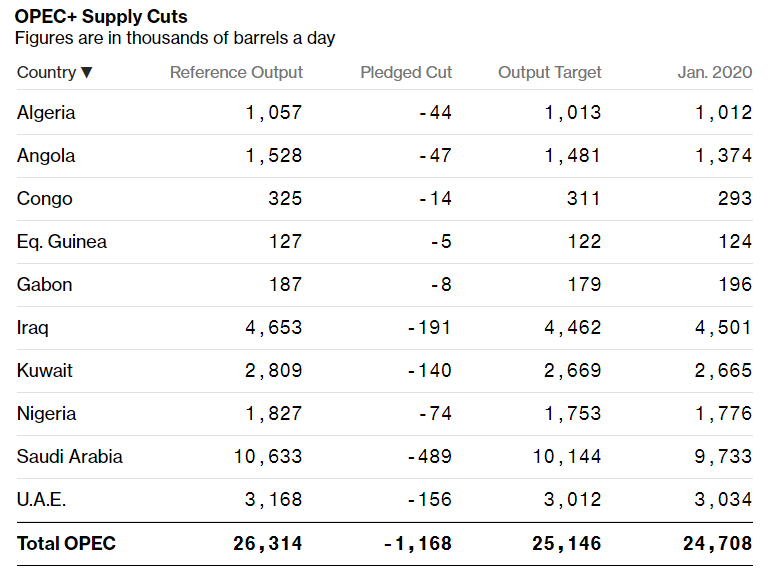

OPEC+ Supply Cuts

Figures are in thousands of barrels a day

OPEC+ Supply Cuts

Figures are in thousands of barrels a day

Country

Reference Output

Pledged Cut

Output Target

Jan. 2020

Algeria

1,057

-44

1,013

1,012

Angola

1,528

-47

1,481

1,374

Congo

325

-14

311

293

Eq. Guinea

127

-5

122

124

Gabon

187

-8

179

196

Iraq

4,653

-191

4,462

4,501

Kuwait

2,809

-140

2,669

2,665

Nigeria

1,827

-74

1,753

1,776

Saudi Arabia

10,633

-489

10,144

9,733

U.A.E.

3,168

-156

3,012

3,034

Total OPEC

26,314

-1,168

25,146

24,708

Azerbaijan

725

-27

698

662

Bahrain

206

-7

199

202

Brunei

103

-4

99

117

Kazakhstan

1,689

-57

1,632

1,690

Malaysia

570

-20

550

561

Mexico

1,744

-58

1,686

1,712

Oman

883

-34

849

816

Russia

10,623

-300

10,323

10,389

South Sudan

132

-3

129

135

Sudan

74

-4

70

71

Total Non-OPEC

16,748

-514

16,234

16,356

Total OPEC+

43,062

-1,682

41,380

41,064

Notes: OPEC and non-OPEC compliance measures crude output. For OPEC supply, Bloomberg uses secondary source data published in the organization’s latest Monthly Oil Market Report. Non-OPEC calculations are based on preliminary data from the International Energy Agency. Reference output levels are primarily from OPEC figures published Jan. 18, 2019. New quotas and targets were established at OPEC+ meetings in December 2019. Output figures and compliance rates may not add up due to rounding.

Sources: OPEC, IEA

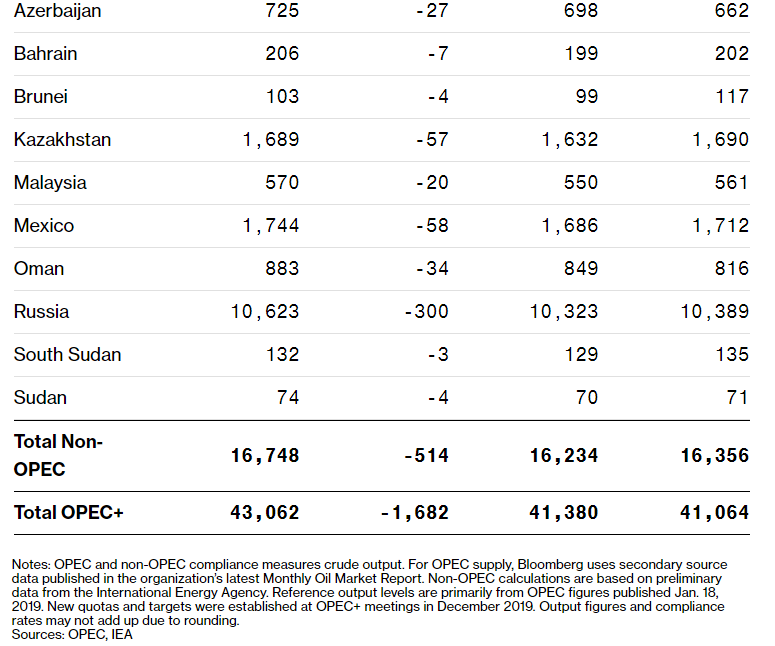

While the cuts have been in place for more than three years, changes were made in January. The alliance pledged to cut by an additional 500,000 barrels a day at a minimum. In addition, Ecuador left the Organization of Petroleum Exporting Countries, and Russia was able to exclude condensate from its crude production, ostensibly making it easier to meet its target.

Even though a few major OPEC producers failed to comply, Saudi Arabia, Kuwait and Angola helped push the organization safely into full conformity with the revised agreement. Russia, responsible for more than half of the non-OPEC curbs, missed its target for the sixth month in a row. In fact, just two non-OPEC producers conformed: Azerbaijan and Oman. OPEC members Libya, Iran and Venezuela are exempt. Bloomberg estimates for OPEC+ compliance in 2020 include crude production only.

January 2020 Oil Production

Thousands of barrels a day

Country

Reference Output

Pledged Cut

Output Target

Jan. 2020

Algeria

1,057

-44

1,013

1,012

Angola

1,528

-47

1,481

1,374

Congo

325

-14

311

293

Eq. Guinea

127

-5

122

124

Gabon

187

-8

179

196

Iraq

4,653

-191

4,462

4,501

Kuwait

2,809

-140

2,669

2,665

Nigeria

1,827

-74

1,753

1,776

Saudi Arabia

10,633

-489

10,144

9,733

U.A.E.

3,168

-156

3,012

3,034

Total OPEC

26,314

-1,168

25,146

24,708

Azerbaijan

725

-27

698

662

Bahrain

206

-7

199

202

Brunei

103

-4

99

117

Kazakhstan

1,689

-57

1,632

1,690

Malaysia

570

-20

550

561

Mexico

1,744

-58

1,686

1,712

Oman

883

-34

849

816

Russia

10,623

-300

10,323

10,389

South Sudan

132

-3

129

135

Sudan

74

-4

70

71

Total Non-OPEC

16,748

-514

16,234

16,356

Total OPEC+

43,062

-1,682

41,380

41,064

Notes: OPEC and non-OPEC compliance measures crude output. For OPEC supply, Bloomberg uses secondary source data published in the organization’s latest Monthly Oil Market Report. Non-OPEC calculations are based on preliminary data from the International Energy Agency. Reference output levels are primarily from OPEC figures published Jan. 18, 2019. New quotas and targets were established at OPEC+ meetings in December 2019. Output figures and compliance rates may not add up due to rounding.

Sources: OPEC, IEA

While the cuts have been in place for more than three years, changes were made in January. The alliance pledged to cut by an additional 500,000 barrels a day at a minimum. In addition, Ecuador left the Organization of Petroleum Exporting Countries, and Russia was able to exclude condensate from its crude production, ostensibly making it easier to meet its target.

Even though a few major OPEC producers failed to comply, Saudi Arabia, Kuwait and Angola helped push the organization safely into full conformity with the revised agreement. Russia, responsible for more than half of the non-OPEC curbs, missed its target for the sixth month in a row. In fact, just two non-OPEC producers conformed: Azerbaijan and Oman. OPEC members Libya, Iran and Venezuela are exempt. Bloomberg estimates for OPEC+ compliance in 2020 include crude production only.

January 2020 Oil Production

Thousands of barrels a day

Cutback reached target Cutback did not reach target

OPEC nations

9,733

Saudi Arabia

4,501

Iraq

3,034

U.A.E.

2,665

Kuwait

1,776

Nigeria

1,374

Angola

1,012

Algeria

293

Congo

196

Gabon

124

Eq. Guinea

Non-OPEC nations

10,389

Russia

1,712

Mexico

1,690

Kazakhstan

816

Oman

662

Azerbaijan

561

Malaysia

202

Bahrain

135

S. Sudan

117

Brunei

71

Sudan

Sources: OPEC secondary-source estimates of crude output for organization’s members. IEA preliminary estimates of crude supply, excluding condensates, for non-OPEC members.

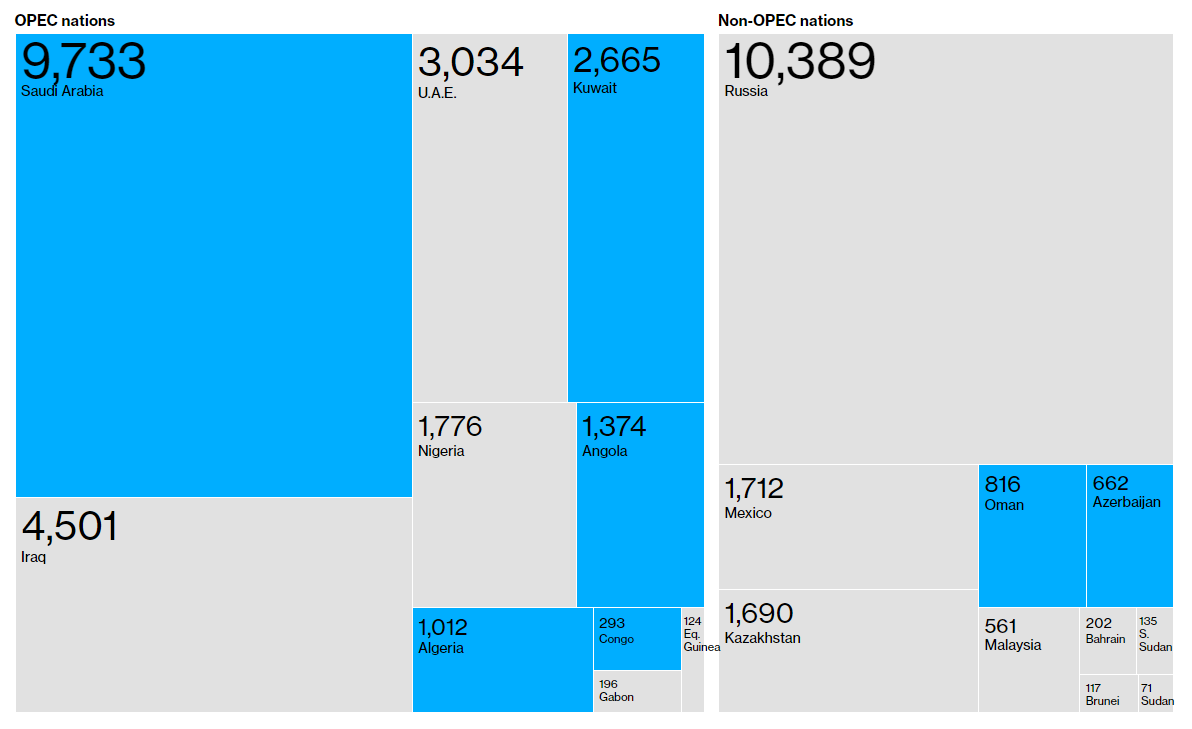

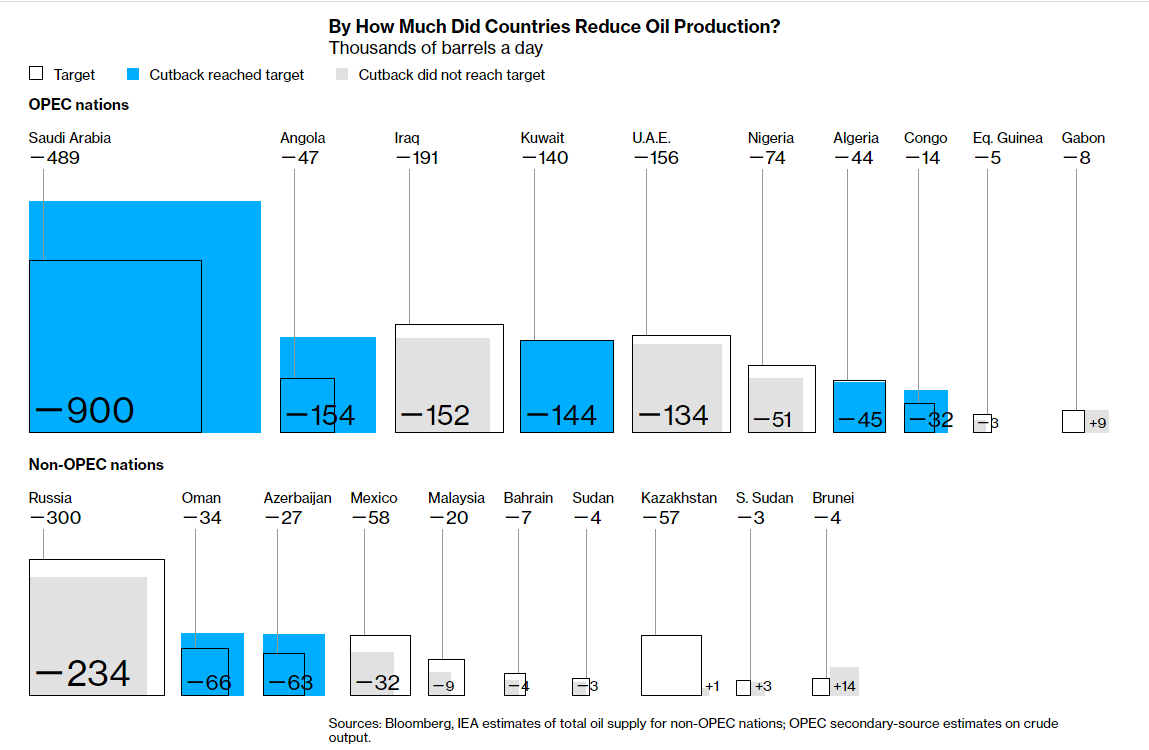

Saudi Arabia agreed to curb by an extra 400,000 barrels a day beyond its pledged cut of 489,000 if others—notably Iraq—also deepened their curbs. In January, the kingdom slashed supply by an average 900,000 barrels daily, though Iraq still failed to reach its target. However, the extra Saudi effort is hardly new: the country exceeded its required cut by at least 400,000 barrels a day in all but three months last year. Bloomberg measures OPEC compliance without the voluntary Saudi curb.

By How Much Did Countries Reduce Oil Production?

Thousands of barrels a day

Target Cutback reached target Cutback did not reach target

OPEC nations

Saudi Arabia

−489

−900

Angola

−47

−154

Iraq

−191

−152

Kuwait

−140

−144

U.A.E.

−156

−134

Nigeria

−74

−51

Algeria

−44

−45

Congo

−14

−32

Eq. Guinea

−5

−3

Gabon

−8

+9

Non-OPEC nations

Russia

−300

−234

Oman

−34

−66

Azerbaijan

−27

−63

Mexico

−58

−32

Malaysia

−20

−9

Bahrain

−7

−4

Sudan

−4

−3

Kazakhstan

−57

+1

S. Sudan

−3

+3

Brunei

−4

+14

Sources: Bloomberg, IEA estimates of total oil supply for non-OPEC nations; OPEC secondary-source estimates on crude output.

In recent years, OPEC+ has been forced to contend with rising American production and a trade war between the U.S. and China, both of which weighed on crude prices. Now there’s a third threat: the coronavirus outbreak, which has killed thousands in China while bringing the country to a halt. Chinese demand for oil products is likely to plunge by more than 35% year-on-year in the first quarter, Morgan Stanley said in a recent report, citing data from researchers at China oil giant CNPC.

Cutback reached target Cutback did not reach target

OPEC nations

9,733

Saudi Arabia

4,501

Iraq

3,034

U.A.E.

2,665

Kuwait

1,776

Nigeria

1,374

Angola

1,012

Algeria

293

Congo

196

Gabon

124

Eq. Guinea

Non-OPEC nations

10,389

Russia

1,712

Mexico

1,690

Kazakhstan

816

Oman

662

Azerbaijan

561

Malaysia

202

Bahrain

135

S. Sudan

117

Brunei

71

Sudan

Sources: OPEC secondary-source estimates of crude output for organization’s members. IEA preliminary estimates of crude supply, excluding condensates, for non-OPEC members.

Saudi Arabia agreed to curb by an extra 400,000 barrels a day beyond its pledged cut of 489,000 if others—notably Iraq—also deepened their curbs. In January, the kingdom slashed supply by an average 900,000 barrels daily, though Iraq still failed to reach its target. However, the extra Saudi effort is hardly new: the country exceeded its required cut by at least 400,000 barrels a day in all but three months last year. Bloomberg measures OPEC compliance without the voluntary Saudi curb.

By How Much Did Countries Reduce Oil Production?

Thousands of barrels a day

Target Cutback reached target Cutback did not reach target

OPEC nations

Saudi Arabia

−489

−900

Angola

−47

−154

Iraq

−191

−152

Kuwait

−140

−144

U.A.E.

−156

−134

Nigeria

−74

−51

Algeria

−44

−45

Congo

−14

−32

Eq. Guinea

−5

−3

Gabon

−8

+9

Non-OPEC nations

Russia

−300

−234

Oman

−34

−66

Azerbaijan

−27

−63

Mexico

−58

−32

Malaysia

−20

−9

Bahrain

−7

−4

Sudan

−4

−3

Kazakhstan

−57

+1

S. Sudan

−3

+3

Brunei

−4

+14

Sources: Bloomberg, IEA estimates of total oil supply for non-OPEC nations; OPEC secondary-source estimates on crude output.

In recent years, OPEC+ has been forced to contend with rising American production and a trade war between the U.S. and China, both of which weighed on crude prices. Now there’s a third threat: the coronavirus outbreak, which has killed thousands in China while bringing the country to a halt. Chinese demand for oil products is likely to plunge by more than 35% year-on-year in the first quarter, Morgan Stanley said in a recent report, citing data from researchers at China oil giant CNPC.

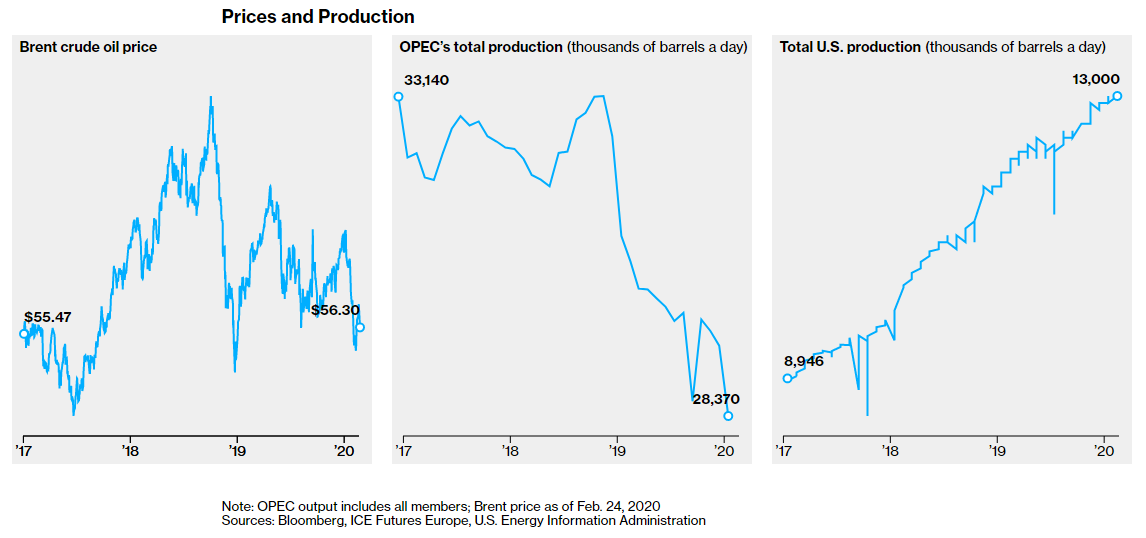

Note: OPEC output includes all members; Brent price as of Feb. 24, 2020

Sources: Bloomberg, ICE Futures Europe, U.S. Energy Information Administration

The next OPEC+ gathering, on March 5-6 in Vienna, is among the most anticipated in years. For weeks, there was speculation that the coalition’s ministers would hold an emergency meeting to address the coronavirus threat. Such a gathering never happened. In addition, Russia, one of the two powerhouses behind the pact, has increasingly seemed to distance itself from the group—if compliance is anything to judge by.

Source: Data compiled by Bloomberg

With assistance from: Ronan Martin and Grant Smith

Additional work by: Brittany Harris

Editor: Alaric Nightingale

Note: OPEC output includes all members; Brent price as of Feb. 24, 2020

Sources: Bloomberg, ICE Futures Europe, U.S. Energy Information Administration

The next OPEC+ gathering, on March 5-6 in Vienna, is among the most anticipated in years. For weeks, there was speculation that the coalition’s ministers would hold an emergency meeting to address the coronavirus threat. Such a gathering never happened. In addition, Russia, one of the two powerhouses behind the pact, has increasingly seemed to distance itself from the group—if compliance is anything to judge by.

Source: Data compiled by Bloomberg

With assistance from: Ronan Martin and Grant Smith

Additional work by: Brittany Harris

Editor: Alaric Nightingale