Date: 2024-04-29 Page is: DBtxt003.php txt00015750

International Finance

US Current Account

Will the US Current Account Explode Soon? ... The U.S. current account deficit has widened to a degree that few had thought possible. Under Trump, it could become an explosive device for the world financial system.

Burgess COMMENTARY

Peter Burgess

Will the US Current Account Explode Soon? ... The U.S. current account deficit has widened to a degree that few had thought possible. Under Trump, it could become an explosive device for the world financial system.

Credit: STILLFX Shutterstock.com

Takeaways

... The US current account deficit has widened to a degree that few had thought possible. Under Trump, it could become an explosive device for the world financial system.

... If the current account were balanced, the US could theoretically produce more than 3% more. Almost 5 million new jobs could be created.

... Capital is being withdrawn from emerging and developing countries and transferred to the US. The ever-rising US current account deficit increases the risk of a global debt crisis.

... The rising US current account deficit is another problem added to the many existing imbalances in the world.

Americans have run a current account deficit seemingly forever. Ten years ago, it was a warning sign before the big financial crisis.

Since then, things calmed down. Because the U.S. current account deficit has widened again recently to a degree that few had thought possible, it could once again become an explosive device for the world financial system. At a minimum, it is the Achilles heel of Trump’s policymaking.

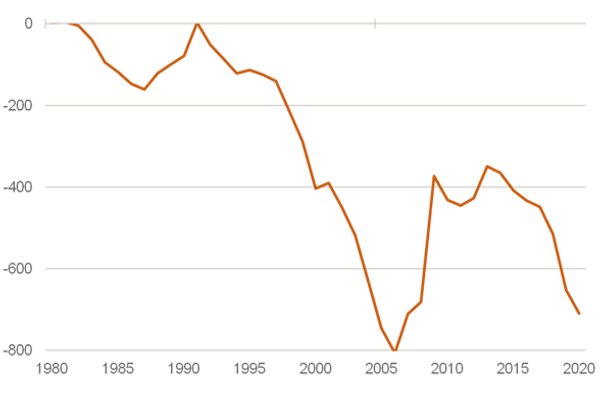

Look at the numbers (see the graph below). The U.S. current account deficit, according to IMF calculations, will increase by 50% from 2016 to 2019 – from $430 billion to $650 billion. There has been no such increase for a long time.

U.S. current account, USD billion

Huefner Graph

Source: IWF

How does this happen?

How does this happen? Very easily. The current account balance is equal to the difference between what a country produces and what the domestic demand is. If businesses and citizens buy more than they produce (as has been the case in the United States for many years, a trend that is now even worse), then it has to acquire the missing goods and services abroad.

Macroeconomic conditions in the United States are far from favorable for a reduction in the current account deficit. The economy is booming. Many companies are producing at capacity and cannot manufacture more.

Nor are they competitive enough so that they could easily take the place of foreign companies providing the goods. Conversely, U.S. consumers are optimistic and buy more and more. The U.S. government, for all the talk about balanced budgets, spends way more than it takes in.

Some people had expected that the tariffs that Trump introduced would ease the situation. Theoretically, that is true. If imports into the United States become more expensive, Americans should actually have to buy fewer goods abroad. Imports should decline. The external balance sheet should therefore no longer have such a large hole.

These assumptions were certainly the underpinning of Donald Trump’s grandiose announcements that nothing was easier than winning a trade war. In reality, things have turned out very differently.

From 2017 to 2019, that is, in the years when tariffs really take effect, the deficit will rise by $200 billion.

Now you can ask what’s so bad about that? Americans have always run a current account deficit. But when it’s that high, it’s very bad. First, U.S. production capabilities are not used as they should be.

How Trump oppresses domestic job creation

If the current account were balanced, the United States could theoretically produce more than 3% more. Almost 5 million new jobs could be created. That’s a staggering number, especially for Trump and his core constituency.

Second, interest rates should not rise so much. The higher interest rates are not due to the supposedly excessive central bank policy, as Trump says. If the United States had a balanced current account, it would not have to go borrowing abroad. The demand for capital would be lower. And with that, the price of capital, that is the interest rate, would be lower.

Third, the debt problem in the world would not increase so much. High debt levels around the globe are now fueled by the growing need for capital in the United States. The country threatens to crowd out smaller debtors and give them even bigger economic and financial problems.

Capital is already being withdrawn from emerging and developing countries to a considerable extent and transferred to the United States. The danger of a global debt crisis, which the IMF so forcefully warned at its annual meeting last week, would be smaller without the ever-rising U.S. current account deficit.

The sword of Damocles

Fourth, U.S. dependence on foreign creditors would not be so great. At present, as much as Americans try to ignore it, the sword of Damocles is hovering over the United States. One day, the Chinese might indeed no longer provide new capital. Worse things are in the offing if the Chinese dump their holdings of U.S. Treasuries on the market.

So far they have not done that, but the possibility certainly always exists. The Chinese are one of the largest creditors of the United States.

Finally, the current account deficit also has an impact on the exchange rate. If the deficit rises further, it tends to weaken the U.S. dollar. While many things play a role in the foreign exchange market, the current account is an important factor.

Conclusion

The rising U.S. current account deficit is another problem added to the many existing imbalances in the world. It weighs on the capital markets and makes the situation even more unstable. This is particularly important when the markets are nervous and uncertain anyway, as they are at the moment.

-----------------------------------------------------

More on this topic

America First — Or Against All?

Buffett: No US-China Trade War

Is There Method to Trump’s Trade Madness?

Tags: current account deficit, Donald Trump, trade war, United States

----------------------------------------------------------

About Martin Hüfner

Martin Hüfner is the former chief economist of Germany's HVB Group.

Bio

Former Chief Economist, HVB Group

Martin Hüfner is economic advisor to various banks and asset managers in Germany, Switzerland and Austria. He is the author of the book “Europe — The Power of Tomorrow” (2006) and is now a Fellow of the Institute for Applied Policy Research at the University of Munich, Germany.

Until 2005, he was the Chief Economist at HypoVereinsbank (HVB), Germany’s second-largest bank headquartered in Munich. In this capacity, he served as the Chairman of the Economic and Monetary Affairs Committee (EMAC) of the European Banking Confederation — as well as Chairman of the Economic and Monetary Affairs Committee of the Association of German Banks.

Before joining HypoVereinsbank, Mr. Hüfner was senior economist at Deutsche Bank, Germany's largest bank.

Prior to entering the banking industry, Mr. Hüfner was trained as a journalist at the Mainzer Allgemeine Zeitung. He holds a doctorate in economics from the University of Munich.

Mr. Hüfner is a frequent commentator on European and global issues. His articles have appeared in the Financial Times, The New York Times, The Wall Street Journal, Frankfurter Allgemeine Zeitung and numerous other publications.