Date: 2024-05-15 Page is: DBtxt003.php txt00004242

Metrics

GIIRS

Global Impact Investment Rating System prepared by B Lab

Burgess COMMENTARY

TVM needs to follow up to see whether there is more information that the BLab GIIRS people will give us to understand better exactly what their system does. From what is below it seems very simplistic and impossible to scale and be useful.

The Contact Information for BLabs who run the GIIRS initiative is

- Address:B Lab. 8 Walnut Avenue, Berwyn, PA 19312

- e-mail at info@giirs.org

- phone at 610-296-8283

Peter Burgess

Read the GIIRS Quarterly Analytics Report for 3rd Quarter 2012 as a pdf

This report does not seem to be very useful for serious analysis. This may be because one needs to be a 'member' of the GIIRS community in order to see meaningful data, or it may be because such data do not exist and are not part of the system.

Some of the methodology used by GIIRS is described on the website ... this URL ... http://www.giirs.org/about-giirs/how-giirs-works/173 This is from the website. The following is the core framework for the GIIRS impact metrics. It seems to be the most detailed description that is available to an 'unregistered' user of the system.

Appendix III: GIIRS and Theory of Change Logic ModelThis is a text version of the above:How does GIIRS impact assessment related to the Theory of Change logic model?

The GIIRS analysis framework comprises:Intent

- Intent

- Inputs

- Activities

- Outputs

- Outcomes

Inputs

- Management letter in GIIRS rating report allows company to communicate impact intent to investors

- Socially and environmentally focused business model section has a gating question to recognize impact models bnase on intent to create impact through a specific model, though these questions are all unweighted. The weighted model questions are around performance.

Activities

- Includes questions related to inputs, like policies and incentives set up to encourage positive social and environmental performance

Outputs

- Assessment includes questions related to practices, includes recycling, worker training, financial controls, etc.

Outcomes

- GIIRS collects and reports metrics or KPIs to track outputs within GIIRS annual rating period

- Assessment also includes questions related to measured outputs, including energy and water use, number of jobs created, number of volunteers hours per worker, etc.

- Assessment also includes questions related to achievements in outcomes, including reductions in carbon emissions and waste production and tracking outcomes over time including income level survey use

- Over time GIIRS will help ocmpanies and funds track outcomes, design m,ore questions focused on outcomes and gather data to set benchmarks on outcome achievements

How this compares with the TrueValueMetrics framework

All of this framework for data collection and analysis contrasts with the core logic that has driven the development of the TrueValueMetrics system

In the TVM framework ... which is derived from accounting ... there are data at the center of everything. In money profit accounting these data are money transactions. In TVM there is equal consideration given to the value transactions.

The following is the same concept presented in a slightly more simple manner:

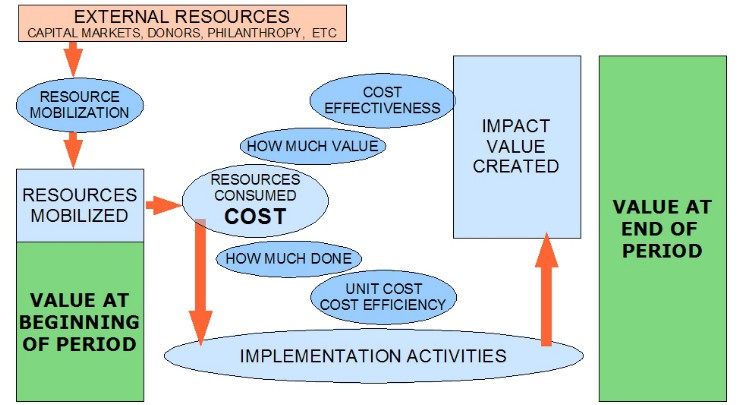

There is an important concept in double entry accounting that is not widely appreciated outside the accounting community, but is core to the power of accountancy for many management purposes. This is the idea that the results of a period may be determined either by 'adding up' all the transactions and preparing the operating or profit and loss account or may be determined by valuing the balance sheet at the beginning of the period and then again at the end of the period, and the results are the net difference between the two. This graphic might help:

The key to this is the change in the 'state' or balance sheet from the beginning of the period (BOP) to the end of the period (EOP). The change in state is caused by something that happened between the BOP and the EOP.

The following shows the key elements of progress and performance:

When one uses this analysis framework as the basis for data collection, it is clear that change in 'state' is the most effective way of measuring impact. Furthermore, the method allows for the value elements to be included in the 'state' as well as the money denominated elements.

There is one last problem that needs to be brought up. Almost all metrics for accounting and accountability are done with an organizational focus, yet impact is outside the organization, and the impact is felt by individual people, by their families, but the community and by society at large.

TVM is therefore designed so that the analysis of an economic activity can be 'rolled up' or consolidated in many different ways. Essentially the same set of data is consolidated as the performance of the organization and is consolidated as the performance of the place ... in other words, a community.

For discussion on how 'change in state' is computed, click here (TO COME)