|

Value adding and value destruction

The amount of money that gets spent and the amount of good that gets done seems to be more and more

unrelated. Five decades or more of teaching MBA students about ways to maximize profit without

teaching much about society has created a very large community of experts in profit maximization and

hardly anyone that has a deep understanding of the social costs and value destruction associated with this

economic paradigm. The problem, however, is worse, because the relief and development industry has

many people well trained in various other disciplines, but with rather little training in this dimension of

economics ... and even less trained in accountancy..

Cost, price and value are the critical metrics of socio-economic activity. In corporate market based

economic thinking cost and price are the dominant metrics because they determine profit which in turns

determines market valuation ... but in society there needs to be attention paid to the relationship also

between cost and value.

This is approx ... not the correct image

Cost is a determinant of productivity ... or is it productivity that determines cost. This is more than

semantics and goes to the heart of the management of society and the effective use of science and

technology for the benefit of society rather than only being used for proprietary wealth gain. A strategy

that optimizes the former may well be different from one that maximizes the latter.

Negative multiplier

The multiplier should be positive. The Keynesian multiplier is the economic mechanism whereby money

spent by one person becomes money earned by another ... cost for one is income for another.

The multiplier effect is perhaps the most important mechanism in economic theory ... yet it is rarely

talked about by development experts. But the The ultiplier effect makes it easier to understand the failure

of community progress in the face of all the local and external economic activities. The multiplier is one

of the tools for economic optimization that has been sidelined by the experts of the international

development assistance community.

TVM Value Accountancy takes into consideration the impact of the Keynesian multiplier in relating costs

to value for the community. The multiplier effect changes the development dynamic and makes

compounding community progress possible.

The multiplier effect helps to explain how many of the big initiatives over the past 40 years have had

limited benefit. Big projects with foreign contractors and experts get only $1 of value for each $1

disbursed ... at best ... while small community activities get a dollars worth of value over and over again

... multiple times ... one loses count! Much better! The big projects should have had great impact, but

often did very little.

I learned about the multiplier is a college class ... I have observed it working all over the world. However,

rarely where development experts were involved. This is not a theoretical construct. In my experience

modest fund flows into a community produce all sorts of favorable impact.

Lesson ... get a community started and it will never stop! Another lesson ... there is as much multiplier

power as things get small are when things get bigger.

Where do benefits emerge?

Where is the funding coming from? Where are the beneficiaries?

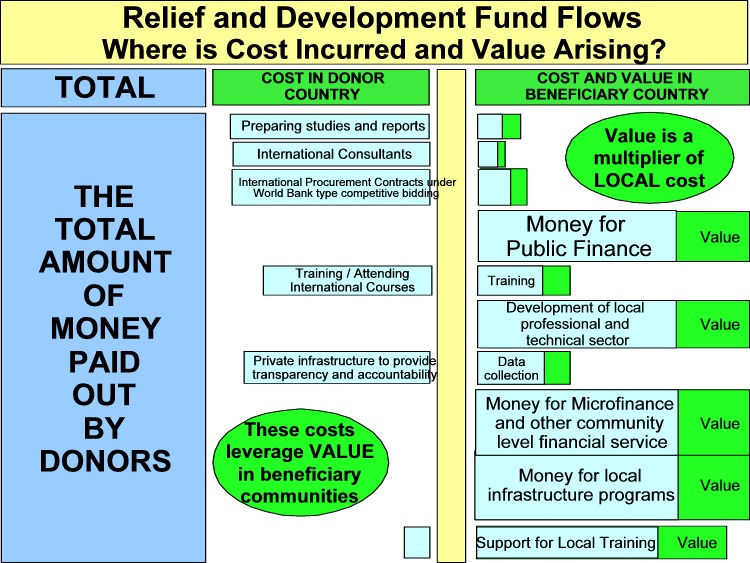

Over the past decades a very large proportion of the international official development assistance has

been disbursed in the north, with the idea that it was going to beneficiaries in the south. But mostly this

did not happen Most funds have been disbursed in the north where there is benefit for the contracting

organizations and rather little left that is of benefit for the south.

A much better way is to disburse more directly in the south where there are direct benefits and associated

multiplier effects. When funds are disbursed in the south, the impact of international official development

assistance is very good. Local disbursement in beneficiary communities not only has a direct benefit, but

delivers other economic improvement through the multiplier effect.

The success of relief and development depends more than anything else on whether it is economic value

adding or economic value destruction that is dominant. In economic value adding the value increment

exceeds the cost. In economic value destruction the value increment is lower than the cost.

In the corporate environment the price of goods and services and the market serves to control cost and

ensure that the clients get value for their money. No similar mechanism exists in the relief and

development sector. Decisions are made based on a process that has no independent (market) checks and

balances and it is easy to commit to make expenditures without the activities and outputs have much

meaningful tangible value.

External funding ... external benefit

While the international relief and development industry and international investors talk about the benefits

of external funding, it might not be as beneficial when everything is taken into consideration. The

following shows something of how external funding impacts net local benefit.

The simple graphic presented above is only a bit of the sad story. The damage that external funding does

to the local economy and to the local communities is obscene ... not that it needs to be ... but is because

the rules and the contract terms are very much in favor of the lenders and unfavorable to the borrowers.

While this is common knowledge ... it has been not negotiable for the past 30 years or more ... while

forcing failure on “beneficiaries”.

When will the World Bank address the big issues for its projects and their financing?

Nigeria borrows $100 million from the World Bank with an official exchange rate $/Naira of

$1.50 --> One Naira and gets the equivalent of Naira 67 million. Decades later Nigeria is

repaying the loan and the exchange rate is now more than Naira 100 to $1.00 ... and must

repay the equivalent of Naira 10,000 million ... that is Naira 10 billion.

Please explain how this is a good way to fund development ... when the borrower gets Naira

67 million of value at the outset and then has to repay Naira 10 billion. Is it any wonder that

development does not work!

Big projects with high risk and low return

The timeline of a typical “development” project shows changes in value starting with value consumption

as the project is prepared and starts implementation, followed by value benefits as the project continues.

For big World Bank type projects the length of time is significant and the scale substantial ... with the

costs of value consumption certain and the benefits much less certain. When the benefits do not

materialize, the project creates massive value destruction ... and for many if not most World Bank

projects this is the sad reality.

This is alternate

TVM Value Accountancy looks at any and all economic activities from the perspective of value creation

and value consumption. The problem with the WB project cycle is that there is substantial value

consumption that is sure, and long term benefit that is uncertain. The following graphic is a simple

depiction of the costs incurred over a long time before a project is funded and implemented. When a

World Bank project does not generate benefits there is a long term loan repayment cash flow that keeps

the project in a value consuming mode for many years.

While this is obviously terribly bad for the community and the economy that serves the citizenry, this is

less bad for those that have enriched themselves at various stages of the project ... no matter that the

project is an economic disaster over the long term.

Planning performance disconnect

How do you measure?

In the introduction it was stated that it is very easy to know what to measure if the goals or objectives are

known. A lot of times the goals and objectives are stated ... and from this there is immediately a lot to

learn.

What Alma-Ata and the MDGs have in common

Bluntly put, it is wasting time working on the way out future while ignoring the

many big things that are causing problems today ... but that is what world leadership

loves to do.

The 1978 Alma Ata International Conference on Primary Health Care in the Soviet

Union produced a declaration that set forth some key targets to be accomplished by

the year 2000 ... some 20 years into the future.

And in 2000 the UN worked up another set of goals to be accomplished by 2015 ...

some 15 years into the future.

If the international relief and development industry has its way ... there will be more

and more long term goals and objectives that cover anything and everything and go

off into the future while there will be the minimum of attention paid to why it is that

there has been such poor past performance and what has to be fixed now.

Focus on disbursement ... on activity

Metrics ought to serve the needs of society ... but the easy metric that has been important in the Breton

Woods institutions and their development clones has been disbursement. While there are cases where

disbursement is a useful proxy for results, this is not so when it is used to the exclusion of almost

anything else. Disbursement serves as a fairly good proxy for activity ... but neither can stand in for result

other than in a very controlled and stable environment. Development, when it is successful, is not stable,

but progressing ... and the only metric worth having is a measure of the results.

Little data ... a lot of statistics

The measurement methodology that now dominates the global economy is based on statistical

mathematics on top of very little data. There is a place for this ... but it needs to be balanced by a

0solid foundation of accounting data and the related data organization and reports. Statistics have

no capacity to provide control and accounting of resources ... something that is essential for an

effective society ... and yet statistics has been used to replace strong data almost everywhere in

the relief and development industry for the past several decades.

//////////////////////////

Sovereignty ... anything goes

The idea of sovereignty that embraces the independence of a people from a foreign power is good ... but it

is not good for sovereignty to be used to protect leadership that has no respect for human rights and

fairness ... to protect a regime where “anything goes” to maintain wealth and power. People are being

treated abominably by governments and elite leaderships ... and external initiatives are constrained by the

idea of sovereignty. At what point does doing right become the dominant driver of meaningful action?

|