OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

SOCIO-ENVIRO-ECONOMIC SYSTEM BEHAVIOR

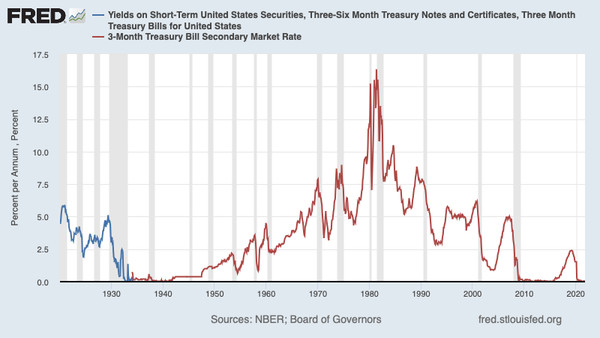

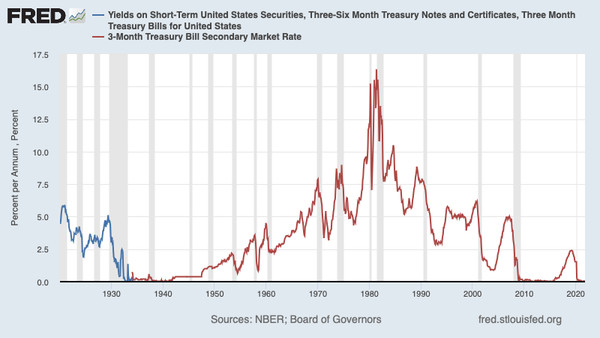

INTEREST RATES Interest rates have been used for economic manipulation for all the wrong reasons during the past 60 years.

Original article: http://www.truevaluemetrics.org/DBadmin/DBtxt003.php?vv1=txt00021308 Burgess COMMENTARY Interest rates have been used as a tool for economic manipulation and for all the wrong reasons during the past 60 years. If I remember correctly, when I was learning about economics and the economy the purpose of an interest rate was to price risk. The interest rate could be low when the risk was low, and would be higher when the risk was higher. And yes ... in the 1970s when it became very difficult in the USA for business to earn good profits, the risk went up and the interest rates also went up. But these high interest rates were also meant to get inflation under control which did not happen until the US business community figured out that they could improve profit performance by outsourcing to low wage countries like China and closing American factories. The wages of American worker have flatlined or worse for more than 40 years in spite amazing improvements in corporate productivity and profits which have increased and increased no matter hat. Even during the COVID pandemic, most sectors have increased their profits and the US stock market has reached record levels thanks to financial engineering that ignores important impacts like socil impact and environmental impact ... the so called externalities in conventional financial accounting! In late 2021 some important changes in society and the economy started to manifest themselves. The COVID pandemic caused many lifestyle changes and people have increasingly questioned how they lived their lives and concluded a better life was possible with a different approach to work. The result has been what commentators are now calling 'A Great Resignation'. At the same time, changes in lifestyle and the associated consumption patterns are causing supply chain dysruption and shortages ... temporary or otherwise ... and enabling opportunistic business prices increases. While some price increases reflect associated underlying cost increases, most simply add to profit ... and in some cases very substantial increases in profit. I first wrote about profit as being a major component of cost (to the consumer) back in the late i980s. I wanted to differentiate the economy of the Reagan years with that of the 1970s when there was massive 'cost-push' inflation which had forced prices to be raised. The 1973 OPEC oil shock was the root cause of the inflation during the 1970s, and little the US business could do to mitigate this situation. On the other hand in the 1980s, business and the Reagan administration enabled wage cost reduction by eliminating much employment security and facilitating production offshoring. At the same time the accelerating introduction of digital technology made it increasingly efficient to manage complex supply chains that optimized for profit. Most of the business mindset that emerged in the Reagan years, together with financialization and financial engineering still dominates in the business segment of the socio-enviro-economic system. Peter Burgess

Interest rates ... monetary policy is like pushing on a piece of string

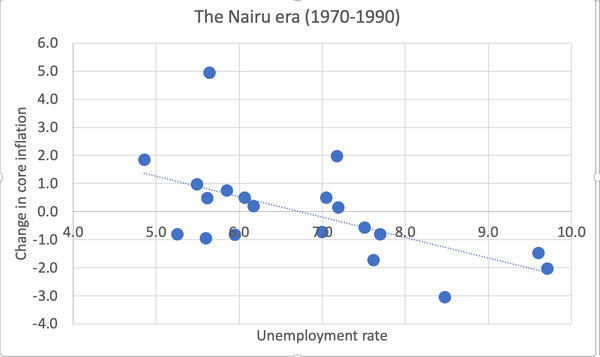

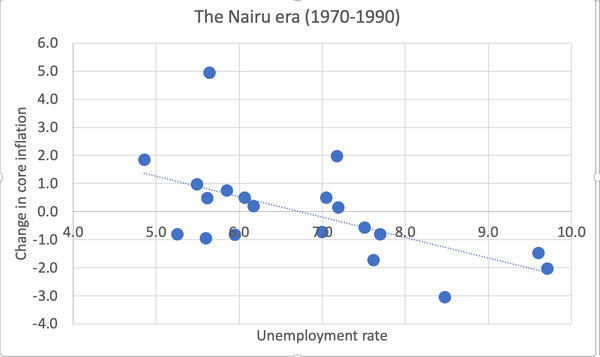

NAIRU, the non-accelerating inflation rate of unemployment, to avoid the implication that unemployment is somehow good

| ||

|

| The text being discussed is available at | and |