OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Economic Performance | ||

Boost supply, not demand, during the pandemic © getty Original article: https://thehill.com/blogs/congress-blog/economy-budget/488373-boost-supply-not-demand-during-the-pandemic and https://thehill.com/blogs/congress-blog/economy-budget/488373-boost-supply-not-demand-during-the-pandemic Burgess COMMENTARY In my view the political and intellectual 'right' are wrong in 2021 just as they have been in many times past. Shocks to the national and global economy are not new and they have been the subject of academic study since long before I was a student (in the late 1950s). The economic shock of 2020 caused by the Covid-19 pandemic, however, was 'off the charts' and I would argue that from a macro-economic perspective the crisis has been handled quite well. It took a lot longer to get economic recovery after the dot-com bust of 2000, and the recovery from the 2008 financial fiasco was stunted when the GOP got in the way of almost all of Obama's stimulus initiatives after the first set of mid-term elections. The Federal Reserve was very pro-active early in the Covid crash of early 2020, and Congress legislated stimulus at scale in late 2020 and then in early 2021. It is not clear yet whether Congress will set the stage for sustainable socio-enviro-economic progress by pass a progressive agenda (Biden's proposed agenda) or whether the economic legislation of late 2021 will get stalled. The GOP agenda together with some (very) few Democrats are (as I see it) at odds with the issues that need to be addressed, and addressed at scale. It irritates me that very few in Washington (legislators and bureaucrats) seem to be thinking clearly about the difference between money that is used for investment and money that is essentially a subsidy. For-profit corporate business understands that sound investment in the business improves profit performance, but legislators do not work on the basis that sound investment in society and everything else that supports society (economic and environmental) will result in better socio-enviro-economic performance. This is not surprising because there are stong managment metrics in support of business profit performance, but very weak management metrics for everything else! Peter Burgess | ||

|

The wrong kind of stimulus

Kelly Evans AS OF FRI, OCT 15, 2021 • 11:04 ET Economists spent the past three decades perfecting the art of Keynesian stimulus. Then Covid hit. As the months drag on, it's increasingly clear that Covid is more of a supply shock than a demand shock to the U.S. economy. Do you remember the endless stories about supply chain problems after the 2007-08 financial crisis? Nope. Neither do I. Because they didn't exist. Did we have soaring prices after 9/11? Nope. Container ship shortages after the dotcom collapse? Of course not. All the recent crises we've dealt with have been negative demand shocks to the U.S. economy. And that has empowered the Keynesian approach of filling demand drops with government stimulus--or consumer spending, as in the case of 9/11, when President Bush famously told families to go about their lives ('fly on airplanes...travel...Get down to Disney World') in order to keep the economy from worsening. So naturally, when Covid hit, and people worried about a second Great Depression, policy makers threw more stimulus at the problem than ever before. But Covid is more and more a supply shock, and one that is actually being worsened by the continual massive efforts to stimulate demand. Some warned about this: 'Demand-side stimulus...would give consumers more cash, but the economy will shrink nonetheless...much stimulus money would end up as personal savings or bid up prices for the products still available in a smaller economy,' wrote the Cato Institute's Chris Edwards for The Hill last March. And sure enough, third-quarter GDP looks weak as consumer prices have surged 6% from a year ago, even with households still sitting on over $2 trillion of excess savings. More stimulus could worsen this situation to the point of crisis, if we haven't reached it already. The supply chain is so fragile that products are routinely, if unpredictably, out of stock, or delayed for so long as to be effectively unavailable. Now the energy supply is being caught up in it. What's more, the stimulus and liquidity-fueled asset price gains have helped to shrink the labor force, already under pressure because of the pandemic, by causing early retirements or removing the incentive to work. What fixes this? In retrospect, things like the PPP program. The entire point of providing emergency loans or grants to businesses was to keep the supply side from shrinking. But as those programs have sunset, while cash from the government and the Fed continues to be injected into households and the financial system, their positive effect is waning, especially as the pandemic drags on. Consumers are obviously unhappy with the way things are going. Sentiment just this morning dropped to its second-lowest reading in a decade. 'Expectations' have dropped in recent months to the point of worrying economists like David Blanchflower that we are heading back into recession. Meanwhile, Democrats are displeased that the President's spending and infrastructure bills have stalled. Perhaps the way to think about it--and pitch it to the public--now is to promote those policies that will increase or fix the supply side of the economy. Incentivizing people to work (expand the labor force). Helping to keep businesses afloat (grow the 'supply'). Lowering the cost of labor. You want an infrastructure bill? How a 'war effort' to get the glut of goods through the Port of Los Angeles right now? That would seem to have broad appeal. Tax breaks for truckers? You get the idea. On the flip side, policies that aren't targeted this way risk worsening the problem and could boomerang as a double-dip downturn, like the U.S. experienced in the early 1980s. Never forget that the point of high prices is to destroy demand, because supply can't keep up. So we face a choice: either increase the supply-side of the U.S. economy, or the demand-side will shrink to meet it. Kelly Evans Twitter: @KellyCNBC Instagram: @realkellyevans ------------------------------------------------ Boost supply, not demand, during the pandemic

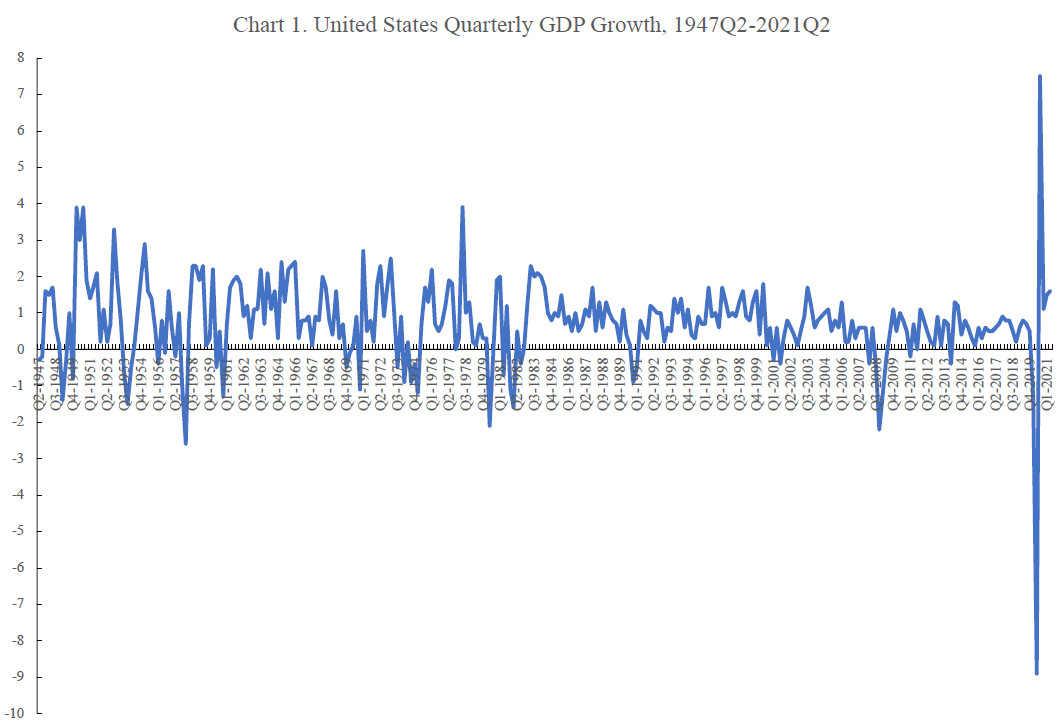

GDP growth by quarter from 1949 t0 2021 Burgess COMMENTARY I rarely agree with economic analysis from writers associated with the Cato Institute and this is no exception. I was trained in an economics department that was heavily influenced by Keynes, but there is one thing about Keynes that is little appreciated. He did not do 'cookie cutter' analysis, but rather looked at the issues and concluded whatever reality required. His thinking during the Great Depression of the 1930s was very different from his recommendations for the Post WWII era because the situations were very different. In the period from 1960 to the present time there have been many changes in the underlying issues, and I ask myself all the time 'What would Keynes do in this circumstance?' knowing full well that the starting point has to be to understand the reality of any situation as well as is possible. What is apparent in the current situation where national level policy makers and business decision makers are navigating the repercussions of the global Covid crisis is that the economic impacts have been huge and fast, with the GDP metric only a very imperfect management metric. The impact on the GDP metric has been off-the-chart and especially the GDP growth dimension of the metric. The economic downturn at the end of the Bush (43) administration precipitated by the housing and mortgage debacle in the financial sector was addressed quite well at the start of the Obama administration but then stalled when the GOP took control of the Senate and Senator Mitch McConnell became the Leader. Prior to this Bush (41) in 1990 had to respond to a serious downturn at the end of the Reagan administration arising in part by financial creativity and the crisis in the Savings and Loan sector. I consider the downturns that started in 1973 and 1979 respectively to have been the most impactful because they were caused by massive structural changes in the balance of economic power in the world with a global energy sector revolution and the rise of OPEC as a major factor in determining global energy prices. In my view, the US socio-enviro-economic system has never recovered from this fundamental change in the balance of economic and social power. But it is worse. Many of those with financial and political power and influence around the world and especially in the USA, have increasingly engaged in financial engineering that has delivered business profits and investor wealth at the expense of society and the broader US population, not to mention degradation of the environment. Peter Burgess https://thehill.com/blogs/congress-blog/economy-budget/488373-boost-supply-not-demand-during-the-pandemic BY CHRIS EDWARDS, OPINION CONTRIBUTOR ... Chris Edwards is editor of DownsizingGovernment.org at the Cato Institute. THE VIEWS EXPRESSED BY CONTRIBUTORS ARE THEIR OWN AND NOT THE VIEW OF THE HILL 03/19/20 10:00 AM EDT (Accessed October 2021) COVID-19 is battering the U.S. economy, causing many businesses to cut back and close down. Policymakers are considering a huge $1 trillion stimulus package with an array of subsidies designed to boost consumption. Pundits often say things like “70 percent of the economy is consumption” and “America has a consumer-driven economy.” That leads them to think that reviving growth rests on inducing people to spend. Consumer spending is 70 percent of aggregate demand, but that is only one side of the economy. The other side is supply—the production of goods and services. The government can stimulate demand all it wants, but it won’t move the needle on GDP if production is halted because of health fears. Instead, governments need to give producers certainty that it’s doing everything it can to help people safely get back to work. The first issue with a stimulus plan is that federal budget deficits already top 1 trillion dollars a year, and deficits will increase further even without such a package as the economy enters recession. Piling on more debt from a stimulus would risk triggering a financial crisis on top of the health care crisis. A fiscal stimulus won’t help the economy, because the Keynesian notion that consumption is the driver of growth is false. President Obama pushed through an $800 billion stimulus after the financial crisis a decade ago and the U.S. suffered the slowest recovery since World War II. The coronavirus is creating both a supply and a demand shock to the economy. The supply shock stems from disrupted supply chains and businesses closing down for safety reasons or due to government mandates. The demand shock stems from individuals cutting back on spending as their income declines and their fears rise. At the same time, businesses are deferring investments as revenues fall. So aggregate demand and supply are both shifting downward and reducing gross domestic product. Policymakers are proposing to stimulate demand to re-inflate GDP. President Trump had proposed zeroing out the federal payroll tax, but now is leaning toward a $1,000 per-person stimulus check. This could start a bidding war for hand-outs because the “money for everyone” approach has bipartisan appeal. However, a demand-side stimulus would accomplish little except moving the government closer to a debt crisis. It would have a hard time boosting GDP because the supply side of the economy is damaged by supply-chain bottlenecks and safety fears. A stimulus would give consumers more cash, but the economy will shrink nonetheless if restaurants, travel, and other goods and services are closed. Rather than raising output, much stimulus money would end up as personal savings or bid up prices for the products still available in a smaller economy. What to do? Governments should help companies resume production safely. They should work to ensure availability of testing kits, sanitizers, gloves, masks and other equipment. South Korea is showing that widespread and rapid testing can empower the private sector with better information and reduced uncertainty. There are plenty of regulations that the federal government, state governments, and local governments should reevaluate to give businesses operational flexibility. In particular, it’s worth modifying regulations that make it more costly or more time-consuming to bring on new workers. Policies such as California’s recently-enacted laws classifying gig economy workers as full-time employees, for example, hamper the kind of flexibility that workers need. And as the pandemic unfolds, local government should do everything they can to preserve public health while looking for ways to allow businesses to safely reopen or resume operations. The more businesses that close, the more that supply chains for other businesses will be disrupted. The more workers who lose incomes, the more government handouts will be demanded that the country cannot afford. To avoid a disastrous downward spiral, we need to employ every strategy to allow businesses to quickly retool for safety and resume operations. Closing businesses harms lower-income workers and brings about fear that shutdowns will be long-term, so it’s critical that policymakers provide assurances that they have a plan in place that will eventually allow business as usual to pick up. News accounts indicate that businesses are doing just that. Companies are equipping workers with gloves and masks, taking worker temperatures, spacing out restaurant tables, reconfiguring factory work stations, sanitizing work areas, adjusting schedules, and allowing employees to work from home. Careful use of these practices could help speed up the process of getting people back to work once public health professionals give the all-clear. Governments can also support production by reducing business costs. The U.S. Treasury is easing income tax payment deadlines, and local governments should do the same with property taxes. The government should also ease rules on the use of income tax losses to support business cashflow, while ensuring access to credit for cash-strapped firms. But policymakers should refrain from imposing costly rules on businesses, such as mandates for paid sick leave, and from pursuing price-gouging cases, which undermine incentives for businesses to supply needed goods. These perhaps well-intentioned interventions don’t work during regular times, and during a public health crisis they will likely have an even more destabilizing effect on markets for goods and services. The federal government can expand the supply of critical health resources. It should repeal protocols that are undermining hospital flexibility in hard-hit areas and repeal restrictions on telemedicine and doctors practicing across state lines. Restrictions on virus testing have been a failure. Thankfully, the government has finally decided to allow companies to sell test kits directly to the public, which will empower the private-sector response. Social distancing and some shutdowns are no-brainers. Schools should be closed because learning can move online, and visitors should be barred from places such as nursing homes. But proposals to shutter major industries, such as automobile manufacturing, are likely counterproductive overall. The economy would collapse with such closures, which would ruin many lives. Treasury Secretary Steven Mnuchin said that a government stimulus is necessary because unemployment could reach 20 percent. But the way to prevent such a disaster is to help American businesses maintain production. Rather than Keynesian subsidies and top-down mandates, policymakers should support the private sector with medical supplies, widespread testing, and allowing flexible responses by businesses and hospitals. Chris Edwards is editor of DownsizingGovernment.org at the Cato Institute.

| The text being discussed is available at | and https://thehill.com/blogs/congress-blog/economy-budget/488373-boost-supply-not-demand-during-the-pandemic |